This Week:

- A Change in Recent Trend – Gold Down But Silver Up

- Why the RBNZ Will Cut Rates Further Yet

- Our 5 Most Popular Articles of the Past Year

- Put Yourself on Your Own Gold Standard

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1874.44 | – $13.04 | – 0.69% |

| USD Gold | $1260 | +$6.90 | + 0.55% |

| NZD Silver | $23.21 | + $0.16 | + 0.69% |

| USD Silver | $15.60 | + $0.30 | + 1.96% |

| NZD/USD | 0.6722 | +0.0083 | + 1.25% |

A Change in Recent Trend – Gold Down But Silver Up

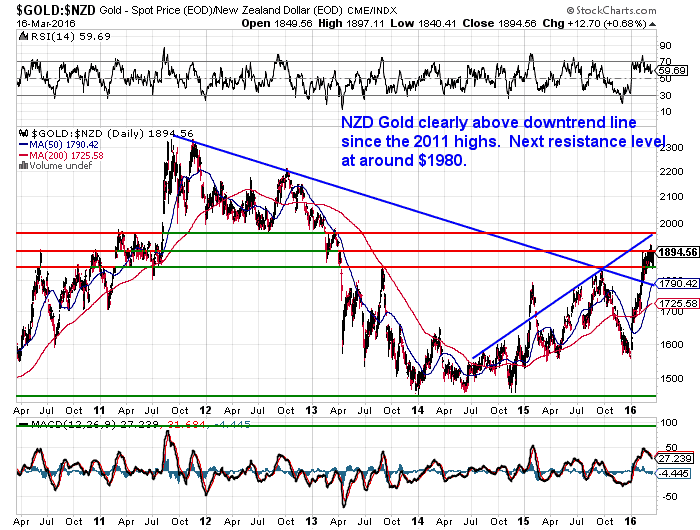

Gold in NZ Dollars is down slightly on last week. Although it did break through the $1900 level and set a new almost 3 year high. It has pulled back under $1900 since then, but looks to be building for an approach of the upper trendline.

In US Dollar terms gold (bottom of the above chart) jumped up sharply this morning

with the US Federal Reserve announcing they were keeping interest rates on hold.

This also spiked the NZ dollar much higher, so hence only a very small rise in NZ Dollar terms. The Kiwi dollar looks to be carving out a bottom currently. But there is tough resistance for it around the 68 cent mark.

Below is a longer term view taken from our daily price alerts which is quite revealing (you can sign up for that here if you are thinking of buying and want to keep a close eye on prices). The rise this year has clearly taken gold above the downtrend line since the 2011 high.

The next horizontal resistance line is at $1980, which also coincides with the current uptrend line. So that level could be quite tough to crack and may require more than one attack to be breached.

Overall though it’s hard to deny that the trend in NZ dollar gold is up. But very few people have yet noticed.

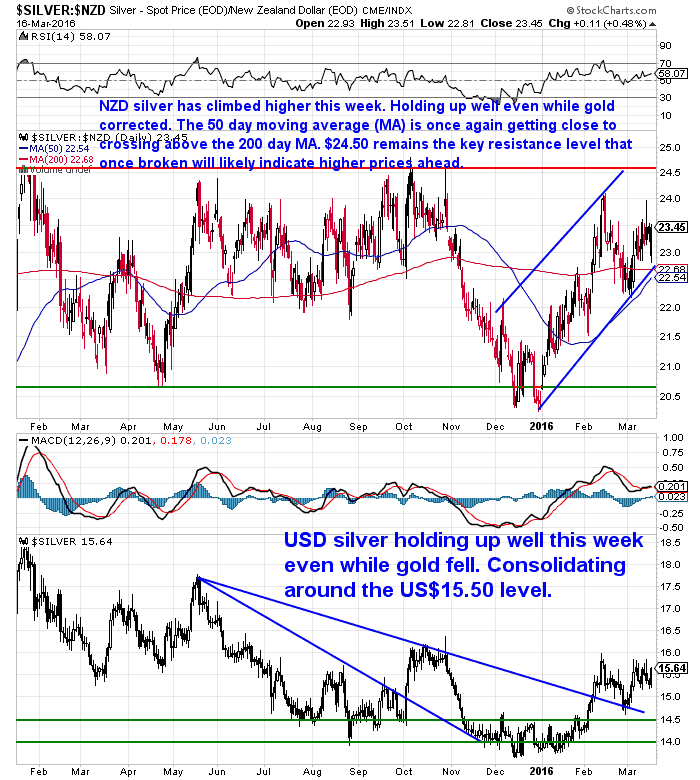

Silver might have surprised a few people this week. While gold corrected down early in the week, silver actually held up pretty well. In fact silver is actually up on last week while gold is down.

Perhaps the beginnings of something more significant for silver? Too early to say. We’ll need to see it breach the $24.50 level to show that higher prices are ahead.

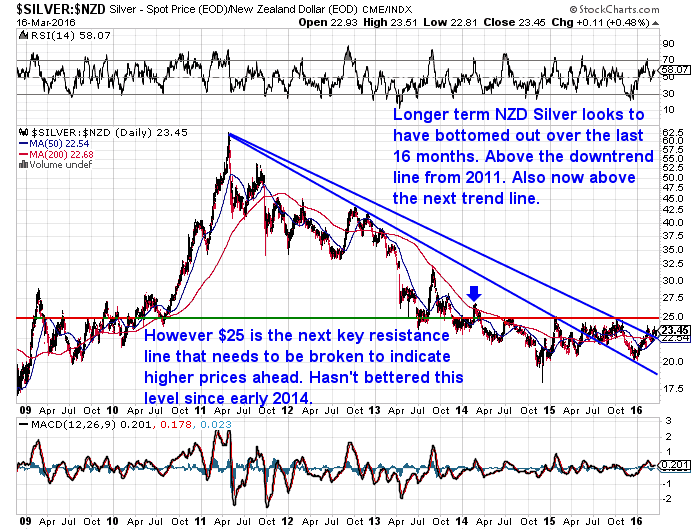

The long term silver chart below is also quite instructive. Silver in NZ dollars looks to have bottomed out over the past 16 months. Bouncing around between $20 and $25. It has also broken above the downtrend line from the 2011 highs. Now also nudging above the next trendline too.

So potentially this could be a good low risk entry point to get some financial insurance, that also has plenty of upside potential.

Why the RBNZ Will Cut Rates Further Yet

You’ll recall the RBNZ surprised with a rate cut last week. Well, here’s a good reason why the RBNZ will cut rates much further yet. Our rates are still higher than inflation by a larger margin than many nations.

See how NZ compares worldwide with interest rates versus the pace of inflation right now. There are a lot of countries with inflation rates close to or lower than the rate of inflation. So it shouldn’t surprise that gold has headed higher this year.

Malaysia holds rate at 3.25% (inflation 3.5%), Canada holds rate at 0.5% (inflation 2.0%), Georgia holds at 8% (inflation 5.6%), New Zealand surprises with cut to 2.25% (deflation of 0.5% in Q4 2015), South Korea holds rate at 1.5% for 9th month (inflation 1.3%), European Central Bank fires its bazooka, cuts key rate to 0.00% (deflation of 0.2% per year in Feb), Peru holds at 4.25% after 4 hikes (inflation 4.5%), Poland holds at record-low 1.5% for 12th month running (deflation of 0.7% per year in January)…Central banks this week

Monday sees Kazakhstan (currently at 17.0% with inflation at 15.2%) and Mozambique (10.75% vs 12.2%); Tuesday sees Japan (now negative 0.1% rate on commercial banks’ excess reserves, still 0.3% discount rate since 2008, facing inflation of 0.0% in January); Wednesday sees Iceland (last held at 5.75% with inflation at 2.2%) and United States Federal Reserve (raised to 0.5% ceiling in December, inflation last seen at 1.4%); Thursday brings Indonesia (7.0% vs 4.4%), UK’s Bank of England (0.5% vs 0.3%), Norway (0.75% vs 3.1%), Serbia (4.5% vs 1.5%), Switzerland (-0.75% vs -0.8%), South Africa (6.75% vs 6.2%), Egypt (9.25% vs 9.1%) and Chile (3.5% vs 4.7%); Friday brings Russia (11.0% vs 8.1%) and Mexico (3.25% vs 2.9%)…Via Adrian Ash Bullionvault.

Of course New Zealand as a lessor economy must have higher rates than the major nations in order to attract the capital needed to fund our debt based economy. You can see the same thing amongst many developing nations in the stats above too. That is their interest rates are higher than inflation rates.

But that said we still have some room to go lower. Especially if more nations “go negative”.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

Our 5 Most Popular Articles of the Past Year

We thought you might be interested to see what other people have found interesting on the website this past year.

Here are our top 5 most read articles over the last 12 months:

How Much Gold Does the Reserve Bank of New Zealand Have?

We’ve had the odd query from other New Zealanders asking “With all the recent reports of various Central Banks of the world buying gold, just how much gold does the Reserve Bank of New Zealand (RBNZ) actually have?”

We’ve had the odd query from other New Zealanders asking “With all the recent reports of various Central Banks of the world buying gold, just how much gold does the Reserve Bank of New Zealand (RBNZ) actually have?”

So we thought we should publish the specifics. See what they are here

PAMP Suisse Gold / Silver vs Local NZ Gold / Silver: Which should I buy?

From the first time buyer of gold or silver, a question we often get is “How do I choose between buying PAMP Suisse gold and silver bars versus local New Zealand refined gold and silver bars?”

From the first time buyer of gold or silver, a question we often get is “How do I choose between buying PAMP Suisse gold and silver bars versus local New Zealand refined gold and silver bars?”

Here’s 3 factors to consider in making your decision. Read More

RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

Here’s a quick video summary of the Reserve Bank Of New Zealand’s Open Bank Resolution (OBR) scheme. Implemented in June 2013 as an alternative to a government (i.e. tax payer) bail out of any failed bank in New Zealand, this rather innocuous sounding name actually means a Cyprus like bank “bail in” or depositor “Hair cut” as a means of getting sufficient capital to keep a failing bank operating. Watch

Here’s a quick video summary of the Reserve Bank Of New Zealand’s Open Bank Resolution (OBR) scheme. Implemented in June 2013 as an alternative to a government (i.e. tax payer) bail out of any failed bank in New Zealand, this rather innocuous sounding name actually means a Cyprus like bank “bail in” or depositor “Hair cut” as a means of getting sufficient capital to keep a failing bank operating. Watch

Dubai – City of Gold: A Visit to Dubai “Gold Souk”

A brief visit to Dubai gave us the chance to check out their famous Gold Souk or Gold Market.

A brief visit to Dubai gave us the chance to check out their famous Gold Souk or Gold Market.

Like much of the east gold maintains an important role in society here. It is still a common form of saving – particularly in jewellery form much like in India, (who also happens to be Dubai’s largest customer when it comes to gold).

The scale of this attachment to gold in the East was borne out by the sheer size of the Gold Souk. Read more

NZ Gold Coins (and Silver Coins) or NZ Gold Bars (and Silver Bars): Which Should I Buy?

Should I buy gold coins or should I buy gold bars?

Should I buy gold coins or should I buy gold bars?

It’s a very common question for new gold buyers. And one we hear a lot.

Same goes for silver coins versus silver bars. Confusion often reigns for the novice gold and silver investor.

Just to complicate things even further there’s the question of buying locally produced gold and silver coins and bars versus those from overseas. Some common overseas coins include South African Krugerrands, American Gold and Silver Eagles, Canadian Maples, Austrian Philharmonics. Closer to home we have the Australian Gold Nugget, Gold Kangaroo, and Silver Koala. Read more

Jim Rickards: Put Yourself on Your Own Gold Standard

We’re waiting on an advance copy that we were offered from the publisher of Jim Rickards new book due out next month “The New Case for Gold”. So keep an eye out for our review of that in coming weeks.

Rickards had a great explanation this week that even if central banks won’t do

it, why you should put yourself on your own gold standard.

“As long as you can own gold, you can put yourself on your own gold standard by converting paper money to gold. I recommend you do that to some extent. Not all in, but I recommend having 10% of your investable assets in gold for the conservative investor, and maybe 20% for the aggressive investor — no more than that.

Those are pretty high allocations relative to what people have. Most people own no gold, and all the institutions combined have only a limited allocation to gold. So even if you take the low end of this range, you’re still nowhere near 10%. In fact, institutions could not raise their gold allocation even to a few percent. There’s not enough gold in the world — at current prices — to satisfy that demand. So it’s got this huge upside associated with it.

Still, central banks don’t want to go to a gold standard. But if gold is a barbarous relic, if gold has no role in the monetary system, if gold is a “stupid” investment, then why do the Chinese keep buying it? Are they stupid?

Gold has already rallied about 20% since the start of the year. If some scenarios play out, you are going to see the price of gold go up… a lot more. And it may go up a lot in a very short period of time. It’s not going to go up 10% per year for seven years and the price doubles. It could have a kind of a steady upward movement… and then a spike… and then another spike… and then a super-spike. The whole thing could happen in a matter of 90 days — six months at the most.

When that happens, you’re going to have two Americas. You’re going to have an America that was not prepared. Paper savings will be wiped out; 401(k)s will be devalued; pensions, insurance and annuities will be devalued through inflation… Because remember, it’s not just the price of gold going up.”

If you want to go on your own gold standard you know where to come to do it!

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,465 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

Unsubscribe | Report Abuse

|

Pingback: Coming: NZ's own form of "helicopter money"? - Gold Survival Guide