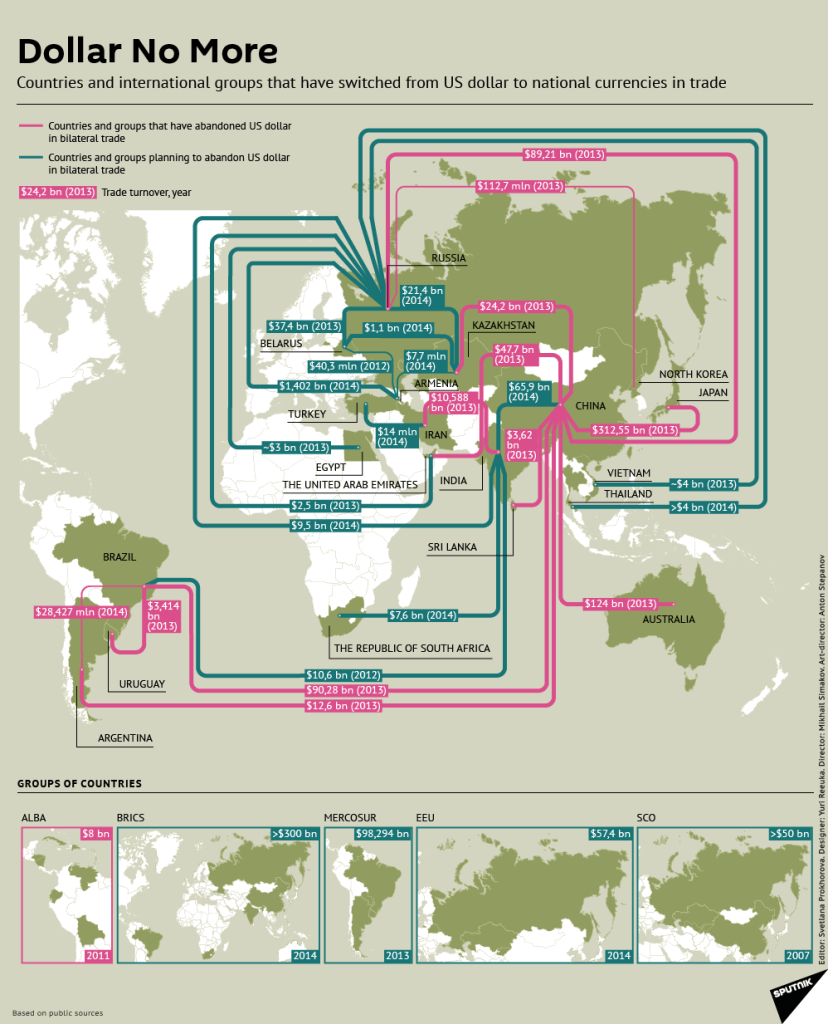

We’ve posted this article chiefly for the infographic contained within it showing just how much the global monetary system has changed in recent years. Read on and you’ll see visually just how strong the move away from the US dollar has been.

We’re not necessarily of the opinion that the US dollar is going to “die” completely, however it seems certain that the global monetary system is set to change considerably in the coming months and years.

It just might be that the US dollar is the last domino to fall. [For more on this topic check out our article: If/When the US Dollar Collapses, What Will Gold be Priced in?]

This article was first published at Moneymorning.co.au

A serious crunch is coming this year.

The global conflict I’ve revealed to you this week is about to take a dramatic turn.

I’m not talking about a conflict with AK-47s, tanks and artillery.

In this war, the weapons are much more shocking…and whether you realise it or not, the ‘bombs’ are already whistling over your head.

This is a currency war — and it’s fought with capital flows, interest rates and fiscal muscle. If you don’t wise up before it’s too late, these weapons will set their target on your hip pocket.

Will your portfolio survive this war? Or will your and your family’s wealth end up as collateral damage?

The crunch that’s coming this year has been building for some time. It relates to the world’s pre-eminent reserve currency, the US dollar.

It would be one thing for us to tell you the world is slowly abandoning the dollar.

It’s quite another thing to grasp it visually.

Click on the map below to view a larger version…

That’s a complex chart. But it shows one clear trend — global powers are turning their backs on the US dollar in bilateral trade.

Notice China’s dominance of the pink lines. They show countries that have already walked away from the dollar when trading with each other.

Sure, this infographic comes from a biased source — Sputnik News, a Russian state media outlet. This organ traces its lineage back to the old Radio Moscow of Cold War days. Some observers have even called it the pro-Putin ‘BuzzFeed of propaganda’.

And of course, the Russians have an interest in talking down the dollar right now. Just think back to how Western sanctions crushed the ruble last year.

Still, I’m reasonably sure Sputnik didn’t just make these figures up. It’s the latest indicator of a trend that demands your attention…

Joining an exclusive club

The Chinese government appears confident that the time has come for its currency, the renminbi, to take a leadership role on the global economic stage.

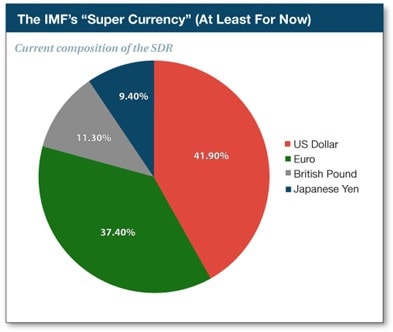

China’s next great leap toward reserve currency status should come later this year. If you’ve been reading us regularly, you know that’s when the International Monetary Fund (IMF) is set to add the renminbi to the ‘super currency’ it calls the ‘special drawing right’, or SDR.

It’s an exclusive club…as you can see in this pie chart —

Why should you care about what the IMF views as money?

Well, as Jim Rickards explains in today’s e-letter — as a currency’s global importance grows or diminishes, so too do the economic prospects of the nation that issues the currency.

That means Aussie investors have to make a choice. Do you ignore geopolitical shifts and leave it up to policymakers to do what’s best for you?

Or do you cast off the blinkers…learn about who’s waging the currency wars…and protect yourself now from the fallout of the big clash to come?

Your man in the corridors of power

In a fragile economic environment, you’re lucky to have an expert of Jim Rickards’ stature by your side.

I’m sure you know Jim by now. He briefs US intelligence agencies on economic threats…travels the world to meet senior government finance officials…and has decades of experience in the Wall Street ‘shark tank’.

Most recently, Jim went to the Pentagon last month to facilitate their latest financial war game…and he’s just back from Seoul, South Korea, where he met with former US Federal Reserve Chairman, Ben Bernanke.

Jim’s schedule fills up with these kind of events months in advance…but he’s made time to bring you today’s e-letter because he sees Australia playing a crucial role in the currency wars to come.

As Jim explains today, reserve currencies hardly make a peep when they kick the bucket…but the period that follows can bring untold devastation.

Read on, and you’ll find out how you can avoid becoming financial roadkill.

Cheers,

Tim Dohrmann,

Editor, Money Morning