This Week:

- NZ Dollar 4th worst performing fiat currency so far in 2015

- Negative Interest Rates Not Ludicrous

- The War on Cash (and Savings) Continues

- A Gold Refiners Views on the State of the Market

- Triffin’s dilemma and why the SDR is in the Globalists Plans

|

GOLD

1oz NZ Mint 99.99% Gold Kiwi Coins Normally priced at Spot + 5.7% at NZ Through us: Packaged Gold Kiwis: (Approx (Only limited stock left) Ph 0800 888 465 and speak to |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1781.61 | – $8.65 | – 0.48% |

| USD Gold |

$1127.40 | + $2.40 | + 0.21% |

| NZD Silver |

$23.20 | – $0.40 |

– 1.69% |

| USD Silver |

$14.68 | – $0.15 |

– 1.01% |

| NZD/USD | 0.6328 | + 0.0044 | + 0.70% |

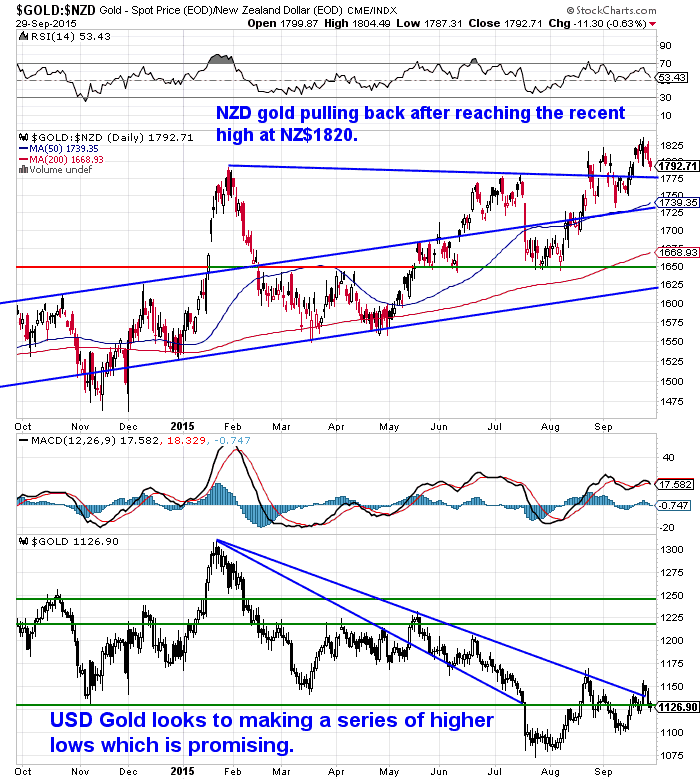

Gold in NZ Dollars has pulled back quite sharply this week after reaching record highs last week. Perhaps we’ll see $1775 or $1740 reached. Although for the last couple of months, the dips have been quite shallow.

Even gold in US dollar terms is looking a bit better of late, making a series of higher lows since the July low.

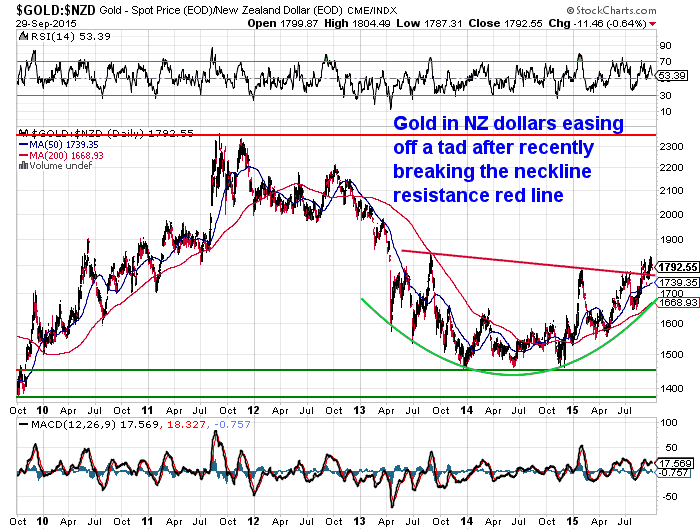

David posted this longer term NZD gold chart in our daily price alerts this week (go here to sign up for a Daily Gold & silver Price Alert if you’re looking at buying and want an easier way to keep track of the price.) It makes the recent break higher look even more significant as the resistance line went right the way back to 2013.

Even with this new high being reached, NZD Gold still has a fair bit of potential upside ahead yet to reach the previous all time high of NZ$2350.

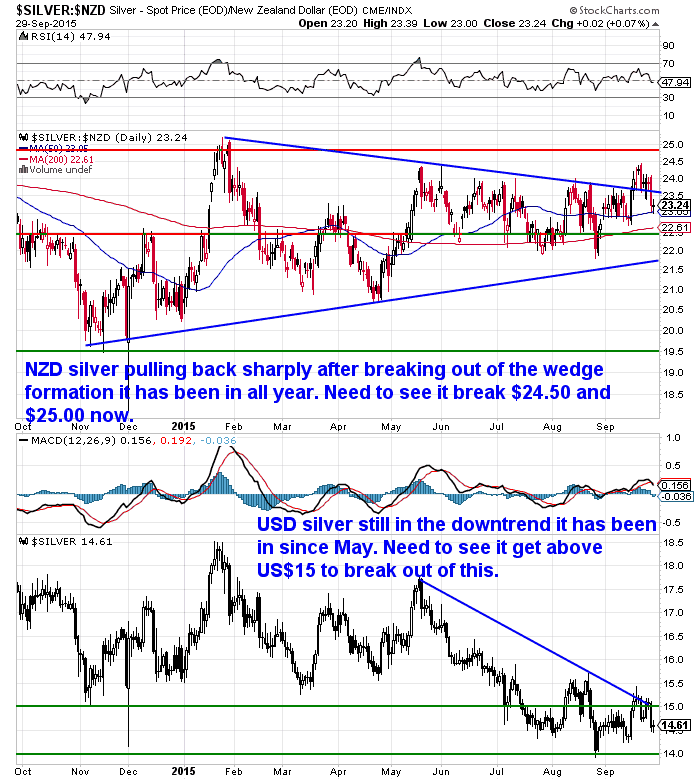

NZD Silver has pulled back quite sharply after breaking out of the wedge formation it had been in. We’ll now need to see it get above NZ$24.50 and $25.00.

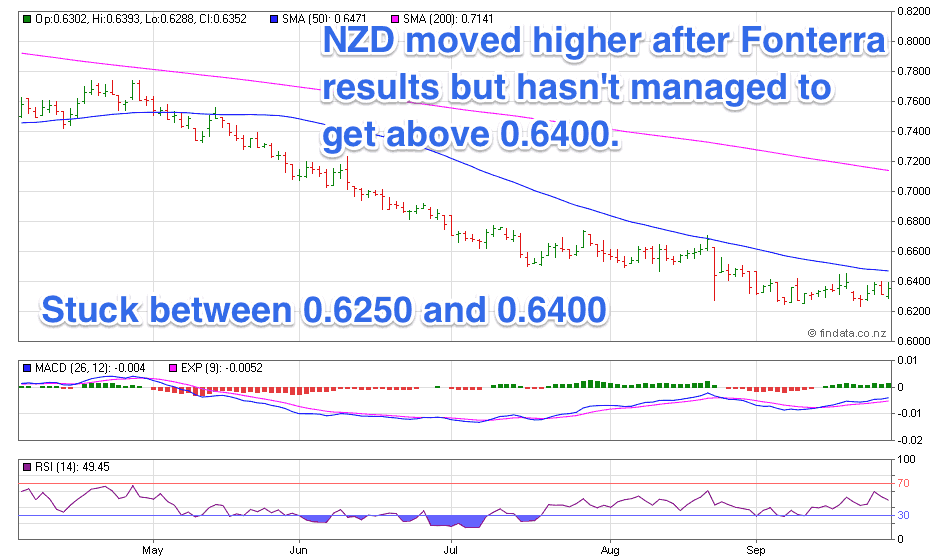

The Kiwi dollar did move higher after the Fonterra results last week but is still stuck between 0.6250 and 0.6400.

NZ Dollar 4th worst performing fiat currency so far in 2015

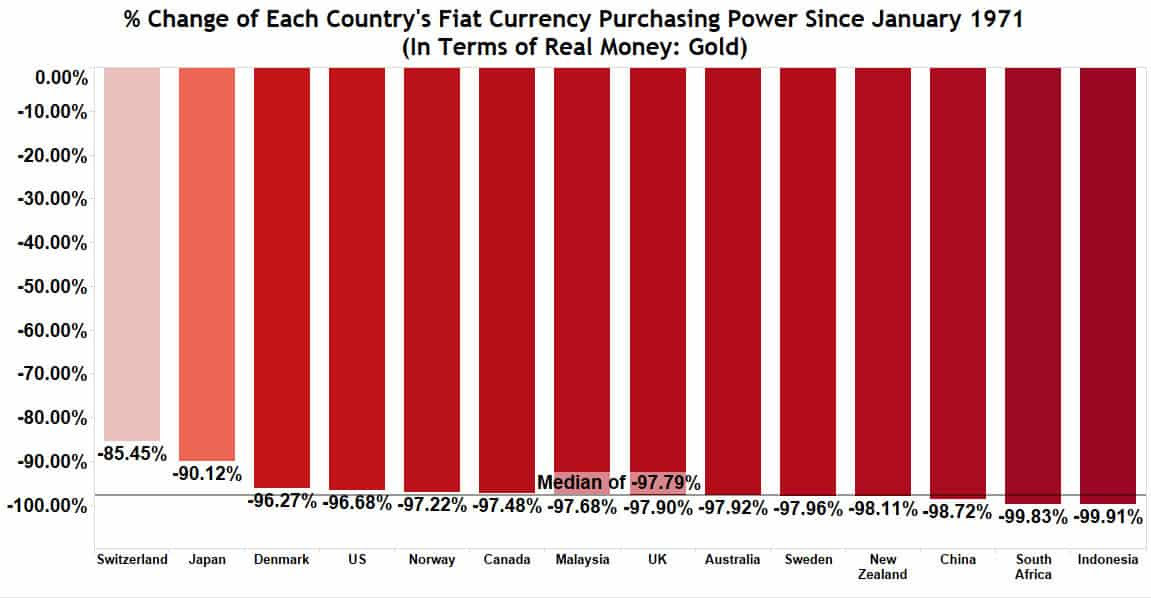

The Kiwi has certainly taken a pounding this year. Some stats from the National Inflation Association (NIA) show that it has actually been the 4th worst performing fiat currency so far for 2015! Down 15.54% in purchasing power.

This is obviously reflected in the rise in the NZ Dollar price of gold.

Source.

You might also be surprised to know the NZ Dollar is also the 4th worst performer since 1971! behind only Indonesia, South Africa and China.

Negative Interest Rates Not Ludicrous

We mentioned last week how one US federal reserve FOMC member thinks negative interest rates may be a good idea. Most probably think this sounds ludicrous, but this was Yellen’s answer when questioned about the prospect:

‘Let me be clear that negative interest rates were not something that we considered very seriously at all today. It was not one of our main policy options…

‘I don’t expect that we’re going to be in a path of providing additional accommodation. But if the outlook were to change in a way that most of my colleagues and I do not expect, and we found ourselves with a weak economy that needed additional stimulus, we would look at all of our available tools. And that would be something that we would evaluate in that kind of context.’

So she certainly didn’t rule out the possibility by any means. All options remain on the table. Although the mainstream still seems to think there will be an interest rate rise this year.

However we wonder if the recent “still on hold” decision on interest rates has at least (finally!) put a dent in the belief in the Fed and central bankers in general? Greg Canavan at the Daily Reckoning Australia summed this up pretty well this week with this statement:

–The market doesn’t know anymore. For so long investors confidently took their lead from the Fed. The Fed provided guidance and confidence…investors bought stocks. It was pretty simple.

–Not anymore. The end of US quantitative easing and tightening monetary policy via the ‘jaw-bone’ (talking about the need to raise rates) has done enough to halt the bull market. It’s sent shock waves through emerging markets and now the effects are filtering through to the world’s major economies.

–It’s the same problem as always. The Fed sets monetary policy based on domestic considerations but the US dollar is a global reserve currency. The Fed’s decisions have global ramifications.

–If you take a big step back, what you’re really seeing here is the demise of the US dollar as the world’s reserve currency…the demise of the post Second World War international financial system. That might sound strange given the strength of the greenback against virtually every other currency.

–But that’s just the point. Before it crumbles it will take all other currencies down first. This will cause havoc across financial markets…especially in the opaque derivatives space.

–The world is in the process of losing its monetary anchor. And while no one knows how it will play out, right now, it’s starting to look pretty ugly.”

It’s a good point that he makes how the somewhat counter-intuitive rise of the US dollar is not necessarily a sign of solidity and stability in the global monetary system.

We’ve mentioned the US dollar might be the last domino to fall many times before such as:

“Of course, all currencies today are priced with the USD as the reference point. And anyone with a cursory understanding of monetary history will know that this is a floating or elastic reference point.

But the US dollar needs to function in order for all currencies to continue to function.

Many talk about the US dollar being the first to collapse. However as it is at the centre it could likely be the last. We first heard Sandeep Jaitly say this many years ago and it took a bit to get our head around. More recently Ronald Stoeferle also was of this theory when in NZ last year.

We are seeing this currently, with many emerging market currencies falling massively against the dollar in the past year. A collapse is more likely to begin in the periphery and move towards the centre. So somewhat paradoxically, in a “dollar collapse”, it may well be that the US dollar is the last domino to fall.”

From: If/When the US Dollar Collapses, What Will Gold be Priced in?

Ronni Stoeferle also shares this viewpoint as he discussed when speaking here in Auckland 2 years ago:

He didn’t think so. Mainly because the US is so dominant militarily. In fact he thought the US dollar will likely be the last fiat to fail. [A view we have noted in the past more than once which is shared by Sandeep Jaitly and one that NZ dollar based buyers of gold should take heed of. As if the US dollar is the last to fall, at some point in the future the kiwi dollar may be very weak against the US dollar. Something virtually no one expects now, and gold would be the hedge against this.]”

Source.

Seems we are at that “some point in the future” now.

The War on Cash (and Savings) Continues

The negative interest rate topic does seem to have been popping up a lot in recent weeks. The central planners often seem to implement ideas by first floating them in various sources first.

Kris Sayce from Money Morning Australia mentioned a speech given by Bank of England chief economist, Andrew Haldane, on 18 September:

“‘One interesting solution, then, would be to maintain the principle of a government-backed currency, but have it issued in an electronic rather than paper form. This would preserve the social convention of a state-issued unit of account and medium of exchange, albeit with currency now held in digital rather than physical wallets. But it would allow negative interest rates to be levied on currency easily and speedily, so relaxing the ZLB constraint.’

Like all central bank speeches, the aim is to confuse or hide the real message. But if you read it a couple of times, you’ll get the drift…

Mr Haldane is saying that this would allow the central bank to confiscate money ‘easily and speedily’ from savers. Because that is what central bankers mean by negative interest rates.

He’s also saying that flat out seizure of savings by using negative interest rates is a lot easier and quicker than inflation. Inflation can take months or years to develop.

So, aside from helping out the banks, why else would a central bank want to do this?

It’s confiscation by another name

One of the big frustrations for governments is that people aren’t spending enough money.

They see that as the main cause of the current low levels of economic growth. That’s why they’ve told their central banks to print hundreds of billions and trillions of dollars.

It’s why in 2009 the Australian government sent cheques in the post, in order to get people to spend.

But when people are worried about the future, they’re less likely to spend. People are generally sensible. They want to set money aside, budget, and not be wasteful.

So, governments have gone further into debt in order to counter this. It’s why the Australian government is now in debt to the tune of $391.4 billion.

It’s why, according to the report from McKinsey & Co, government debt has grown faster than any other sector. Global government debt has grown 9.3% each year from 2007 to 2014. By contrast, household debt has only increased 2.8% each year.

Perhaps you’re starting to get it. If the only form of money is electronic money, it’s easy for the government to seize it through negative interest rates.

The only way the government can’t seize your savings is…if you don’t have any savings. And you won’t have any savings if you spend your money because you’re afraid of the government taking it with negative interest rates.

The trend is clear. We’ve warned for more than six years that the government was planning to grab private superannuation wealth. But we’ve also warned that regular savings were at threat too.

A new form of financial slavery is fast approaching. Your employer will pay your wages into the bank (as it does now). But in the near future, it’ll be a race to spend your wages as quickly as possible before the government swipes it all.

If you think this is far-out and whacky, that’s fine. Just remember that central bankers don’t say things that will make them look silly among their peers. Mr Haldane has published these views because it’s an idea that governments and central bankers are thinking about right now.

You ignore this risk at your peril.”

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

Old Stock Clearance 18% Discount on 60 Serve Bucket

For just

Learn More.

—–

The US government about to shut down…again

This is so far staying fairly well under the radar, but the US government is yet again about to have a debt ceiling showdown.

Jason Stevenson also out of the Daily Reckoning Aussie reports:

“Do you remember the US debt ceiling crisis in 2013?

Looking back, the US government endured a 16-day long shutdown that year. It ended with a bill that extended the debt limit until February 2014. Congress then approved the most recent extension, which expired this past March.

Unsurprisingly the can was kicked down the road. That is, until now.

Officially, the US government will run out of money in mid-November to early December.

There are now growing concerns that Capitol Hill will shut down on 1 October — the same date it closed down in 2013.

Again, US government must raise the debt limit which currently stands at around US$18.1 trillion. A figure which should blow out to US$21.7 trillion by the end of this year.

This is just another debt problem that many US politicians don’t take seriously enough — they seem to believe that money grows on trees.

It doesn’t.

And no doubt, while arguing whether money does grow on trees, a US government shutdown seems likely. This is, of course, extremely bad management.

With the shutdown looming, many ‘leaders’ worry that investor sentiment could change rapidly. [Especially] if such episodes become routine.

But perhaps, they’ve already become routine…”

So there are a few dominoes set to topple at the moment. This also seems to be happening in slow motion. We guess that is until it doesn’t.

This week we posted an article by an old favourite of ours Chris Martenson. He looks at the possibility of a gold shortage in the future. Or rather a shortage of people wanting to sell.

This week we posted an article by an old favourite of ours Chris Martenson. He looks at the possibility of a gold shortage in the future. Or rather a shortage of people wanting to sell.

With all the talk of silver shortages of late it makes for an interesting read.

Is a Physical Gold Shortage Now Likely?

A Gold Refiners Views on the State of the Market

Also this week we read the transcript of a very interesting interview with an unnamed member of senior management of one of the largest Swiss refineries.

His comments back up some of what Chris Martenson discusses. Like this comment in answer to a question on the tightening of physical supply in the gold market and how difficult is it to source the metal they need today?

We’d highly recommend you read (or listen) to that interview. Here’s the link:

The most important gold industry interview of 2015

Then also check out Bron Suchecki’s comments on it from a Perth Mint employees perspective here:

Bron points out that it was a shame the interviewer didn’t ask him whether he was referring to sourcing 400 oz bars (wholesale bars). Regardless the interview did show that precious metals markets are certainly tight at the moment even at the major refiners level.

Triffin’s dilemma and why the SDR is in the Globalists Plans

We’ve read plenty of Jim Rickards opinion on the IMFs Special Drawing Rights (SDR). But a recent article of his made this concept much easier to understand and so we thought worth sharing an excerpt here.

He discusses on Triffin’s dilemma and why the SDR is in the globalists plans. Triffin’s dilemma means [emphasis added is ours]:

“If the dollar was the lead reserve currency, then the entire world needed dollars to finance world trade. In order to supply these dollars, the U.S. had to run trade deficits.

The U.S. sold a lot of goods abroad, but Americans quickly developed an appetite for Japanese electronics, German cars, French vacations and other foreign goods and services. Today, China has replaced Japan as the main source of exports to the U.S.; still, Americans have not lost their appetite for imports financed by printing dollars.

So the U.S. ran trade deficits, the world got dollars and global trade flourished. But if you run deficits long enough, you go broke. That was Triffin’s dilemma. Any system based on dollars would eventually cause the dollar to collapse because there would either be too many dollars or not enough gold at fixed prices to keep the game going. This paradox between dollar deficits and dollar confidence was unsustainable…

“Is there no way to escape the room? Is there no way out of Triffin’s dilemma?

A new gold standard might be one way to solve the problem, but it would require a gold price of $10,000 per ounce in order to be nondeflationary. No central banker in the world wants that, because it limits their ability to print money and be central economic planners.

Is there an alternative to gold? There is one other way out. That’s our old friend, the SDR. The brilliance of the SDR solution is that it solves Triffin’s dilemma.

Recall the paradox is that the reserve currency issuer has to run trade deficits, but if you run deficits long enough, you go broke. But SDRs are issued by the IMF. The IMF is not a country and does not have a trade deficit. In theory, the IMF can print SDRs forever and never go broke. The SDRs just go round and round among the IMF members in a closed circuit.

Individuals won’t have SDRs. Only countries will have them in their reserves. These countries have no desire to break the new SDR system, because they’re all in it together. The U.S. is no longer the boss. Instead, you have the “Five Families” consisting of China, Japan, the U.S., Europe and Russia operating through the IMF.

The only losers are the citizens of the IMF member countries — people like you and I — who will suffer local currency inflation. I’m preparing with gold and hard assets, but most people will be caught unaware, like the Greeks who lined up at empty ATMs last month.

This SDR system is so little understood that people won’t know where the inflation is coming from. Elected officials will blame the IMF, but the IMF is unaccountable. That’s the beauty of SDRs — Triffin’s dilemma is solved, debt problems are inflated away and no one is accountable. That’s the global elite plan in a nutshell.”

The latest noise is that China may join the SDR a year from now. So if you want some protection in advance of these monetary system changes as Rickards recommends, you know where to find us.

Todays price is for a box of 500 x 1oz Canadian Silver Maples is $14,485 (+ $65 fully insured delivery) and delivery is now about 3 weeks. There is a backlog with some products, so get in touch if you want to know timeframes for delivery. A popular option remains local NZ silver where you can pay a deposit of 20% and the balance a few days before it is delivered to you.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|