|

Gold Survival Gold Article Updates

Jul 30, 2014

This Week:

- NZ Dollar Continues to Drop

- Would Rising US Interest Rates Dent Gold?

- Where will NZ fit in a likely rejigging of the world monetary order?

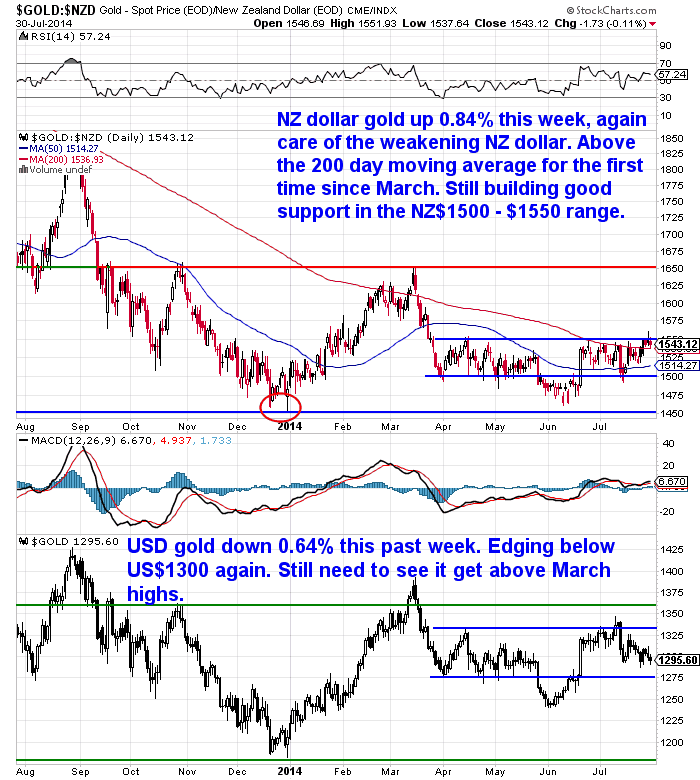

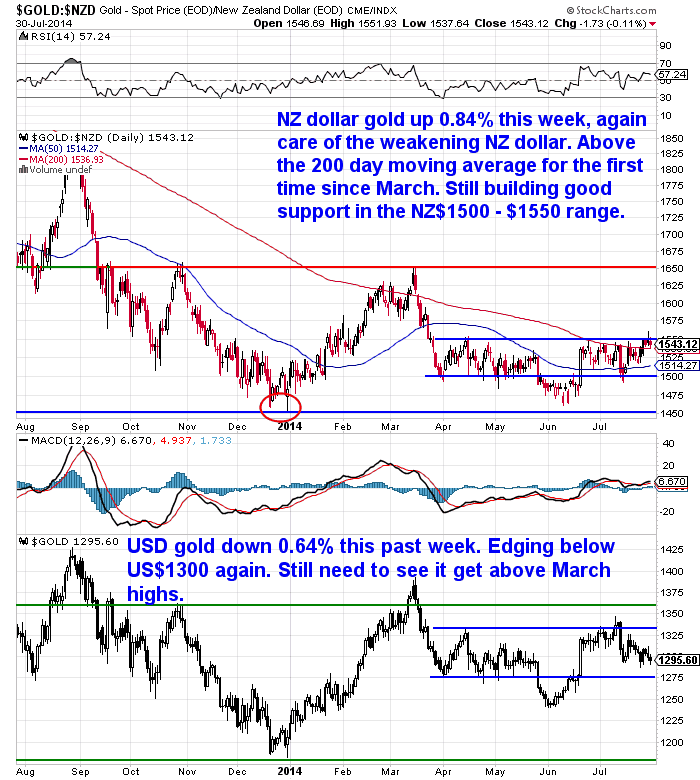

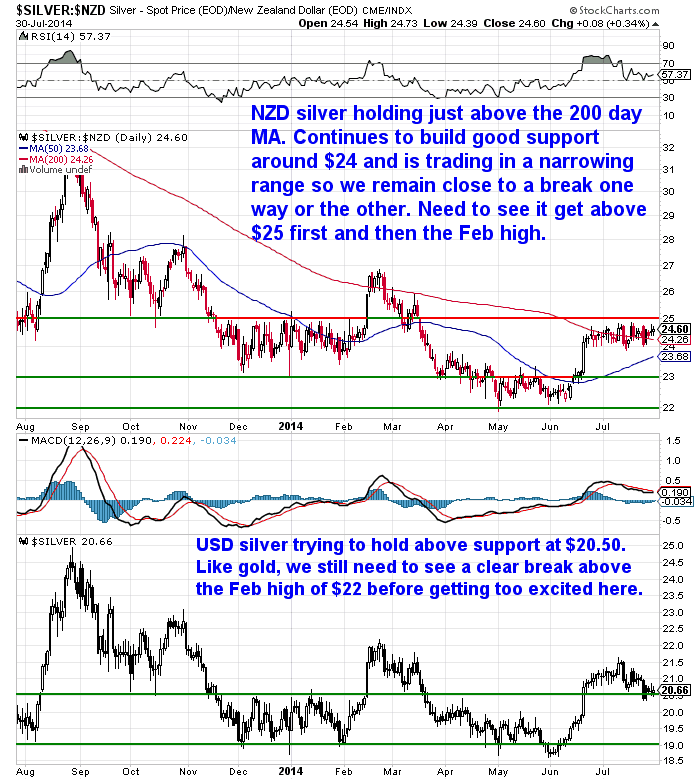

The weakening kiwi dollar has again been the main driver this week for precious metals prices in NZ dollars.

While Gold in US dollars is down US$8.41 or 0.64% to US$1296.74, in NZ dollar terms it is actually up $12.79 or 0.84% to $1529 this week.

NZD gold is up above the significant 200 day moving average (MA) for the first time since March. Another potentially significant development is shown in the longer term chart below, where the NZD gold price looks to be breaking out above the 2 year downtrend line.

Of course there is the possibility that this could end up being just a “head fake” and turn back down again. But it is looking positive at this stage.

There is also a potential inverse head and shoulders pattern forming which if proves correct will lead to higher prices ahead.

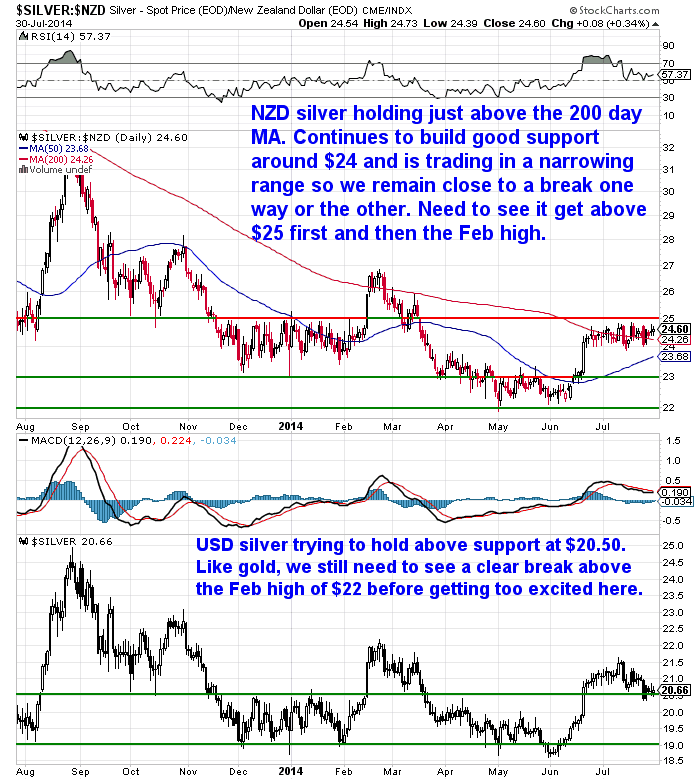

Like gold, silver in US dollars was also down for the week. Dropping 9 cents or 0.43% to US$20.63, but with the weaker Kiwi, silver in NZ dollars is up 25 cents or 1.03% to NZ$24.32.

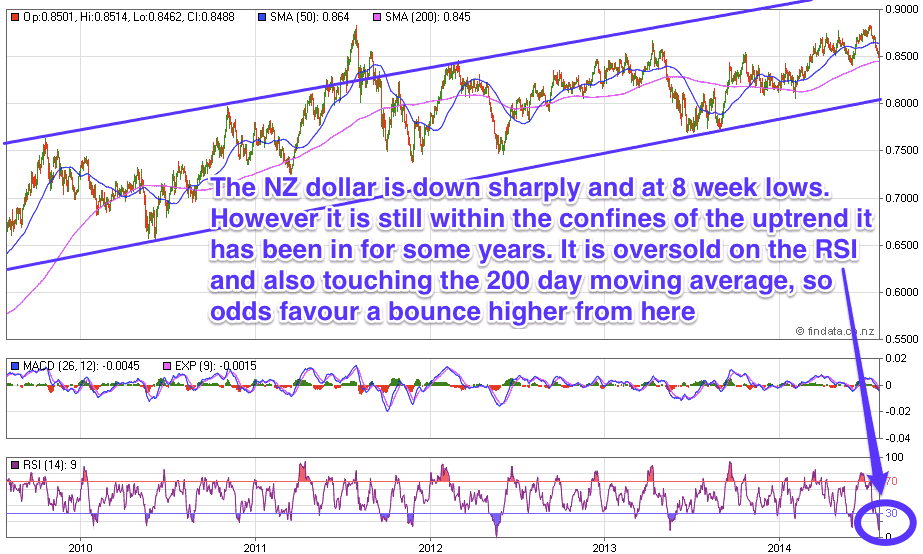

NZ Dollar Continues to Drop

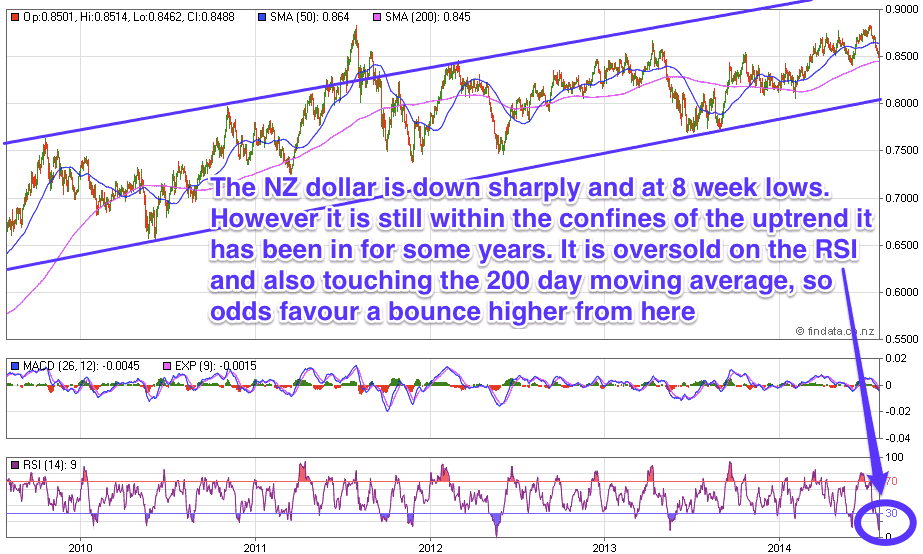

The falling NZ dollar trend has continued with it now at 8 week lows against the USD. Fonterra lowering its milk payout forecast from $7 to $6 per kg milk solids this week looks to have helped nudge it lower. With this cutting $3.8 billion off national income.

However looking at the NZD/USD chart it is oversold now and about to touch the 200 day moving average so we should likely see a bounce higher from here as it has done in the past when the RSI has gotten this low.

It will be interesting if there has been a change in sentiment in the longer term to the NZ dollar. But it does seem that it will have trouble getting to new highs at the moment. Perhaps it will remain in the sideways range between 0.75 and just under 0.90 that it has been in since the 2011 highs?

Especially with supposedly better numbers coming out of the US overnight – in the form of higher than expected growth and inflation numbers.

We’ve seen some reports that expected higher inflation rates in the US will force the Fed to raise rates earlier and hence damage gold.

Would Rising US Interest Rates Dent Gold?

However this as always neglects to look at real interest rates (the interest rate after inflation).

It also doesn’t consider that the Fed could well be very late in raising rates – just as they have in the past.

The Inflation horse may well have bolted before they take any action. Adrian Ash of Bullionvault made some good points also on the lack of correlation between rising interest rates and gold. Along with the lack of correlation between gold and the stock market.

Basically in both cases gold is just as likely to go up or down when interest rates and stocks are rising. Not fall as common wisdom would have it. You can see an example of this in the below chart direct from the St Louis Fed itself of gold versus interest rates. The Fed raised rates steadily from 2004 to 2006 and gold pretty much doubled during this period.

So lifting interest rates back then certainly didn’t dent gold.

Why was this?

Here’s Ash’s theory:

—–

“From spring 2004 to summer 2006, and starting from what were then all-time low “emergency rates” of 1.0%, the Fed raised its key interest rate 17 times in “baby step” increments of 25 basis points. The S&P 500 gained 13%, but gold priced in Dollars rose nearly 60%, gaining 48% when adjusted for the change in US consumer prices. All this while the real Fed Funds rate, also accounting for inflation, rose three percentage points to turn positive for the first time since mid-2002.

One explanation is that the big money which drives gold higher or lower doesn’t tend to make decisions based on overnight rates. Instead, it looks at longer-term yields, most notably 10-year US Treasuries. Fed chairman a decade ago, Alan Greenspan noted how his central bank’s tightening cycle hit a “conundrum” in the bond market, because longer-term yields failed to rise in tandem. Indeed, real 10-year yields actually fell between mid-2004 and mid-2006, briefly turning negative for the first time since 1980.

Here in 2014, bond yields have again ticked lower so far, despite the Fed’s quasi-tightening of tapering its quantitative easing asset purchases. Both gold and equities have risen with bond prices. Short-term rates will meantime start the next hiking cycle from new record lows, and the current “emergency rate” has also been applied far longer than Greenspan’s 1.0% low – a full six years by end-2014, against just 12 months for the Maestro’s tech-crash reflation.

You won’t need reminding how the US economy reacted to “normalization” a decade ago. Given 0% money and QE since 2009, can it really bear a return to positive real rates next year? The gold market says not.”

Source.

—–

Low Demand Equals Steady Prices???

It remains deathly quiet in gold and silver physical markets here in NZ still. In fact even more so the past couple of weeks. Our experience matches those of others we talk to. It also seems to be not too dissimilar to other western nations where sales remain down from reports we have read.

So we could argue that the fact the gold and silver prices are holding up well in the face of a lack of demand is a positive.

Also the argument that China has put a floor under the price around current levels might well stack up.

But how can this be in the face of reports of falling Chinese gold demand like this one from Reuters?

—–

China Gold “Demand” Slumps 19.4%, but Output Rises (Reuters)

In summary, China’s gold “demand” dropped 19.4% in the first six months of 2014 from year ago, reports the China Gold Association. In the same period, production rose strongly as miners increased output to protect profit margins.

Chinese gold demand from January to June was estimated at 569.45 tonnes (18.3 million ounces), compared with 706.36 tonnes (22.7 million ounces) in the same period last year. The bulk of the decline was attributed to investors losing their confidence in the metal as an investment tool after the gold price registered its first annual decline in 13 years. Sales of gold bars and coins fell 62.1% and 44.3%, respectively. Lower demand this year is also attributed in part to huge buying last year, when the drop in prices prompted many to bring forward their purchases, eating into 2014 demand.

Meanwhile, jewelry and industrial demand in the first half rose 11% from a year ago to 426.17 tonnes (12.4 million ounces), while industrial consumption rose 11.3%.

The decline in Chinese gold consumer demand was foreseen. However, the long-term demand from the country is expected to expand to at least 1,350 tonnes (39.3 Moz) by 2017, due to growing China’s middle class and its wealth, the World Gold Council noted this April.

So if you didn’t read it last week check out the article by Casey Research’s Jeff Clark which debunks widespread reports that Chinese demand for gold is falling. So if you didn’t read it last week check out the article by Casey Research’s Jeff Clark which debunks widespread reports that Chinese demand for gold is falling.

The TRUTH about China’s Massive Gold Hoard

Also this article in the weekend from the always level headed Lawrie Williams on Mineweb looks at the confusion about Chinese imports via Hong Kong:

—–

“China’s Hong Kong gold imports continue to dive

The latest net gold import figures into mainland China from Hong Kong show a huge fall year on year, but although this indeed indicates a definite downwards trend, all may not be as it seems.”

Source.

—–

Rare 5x Investment Is a Buy Again

Every time the Casey Research team recommends this one unique investment, it’s delivered a 5-to-1 return. The first time, it quickly returned 568%; the second, a gain of 656%. And now it’s a buy again. The only drawback: it’s extremely rare. In two decades, this is just the third time they’ve seen this buying opportunity. If you missed it before—now is your chance to get in while the window is open.

Click here for all the details of this explosive 5x opportunity.

Where will NZ fit in a likely rejigging of the world monetary order?

This Daily Bell excerpt from a post we read this week discusses the “directed history” of purposeful unions such as the often discussed North American Union (USA, Canada, Mexico), and the existing BRICS:

—–

“Take a step back, please, and observe the dialectic. That’s how globalist elites work, by creating conflicts that move a given argument or sociopolitical strategy forward. Sometimes the dialectic is accomplished via a war. Other times, it is created via supposed economic necessity.

Of course, the necessity in such cases is manufactured; and we would argue that is the case when it comes to this suddenly polarized economic world. Just look at this: …

…

“Although the dollar’s reserve status won’t end overnight, the global payments system is now moving inexorably towards that outcome. The US currency accounted for just 33pc of all foreign exchange holdings in 2013, on IMF numbers, down from 55pc in 2001. Within a decade or so, a “reserve currency basket” may emerge, with central banks storing wealth in a mix of dollars, yuan, rupee, reals and roubles, as well as precious metals.“

…

This is simply too neat. The alternative media has been predicting this outcome for decades, virtually ever since Keynes suggested his globalist bancor after World War II. But now that this “global payment system” is almost a reality, we’re supposed to believe it is merely an “inexorable outcome.”

In the US, the Obama administration is fragmenting the border between the US and Mexico. Waves of immigrants are sweeping into the US as part of what is shaping up to be the seeming deliberate implementation of a North American Union that is eventually supposed to encompass Canada as well.

The US stock market is being shoved into the stratosphere in order to create what we call a “Wall Street Party” that will create enormous faux-prosperity before a destined crash. But the crash itself will simply add more impetus to monetary globalism. Out of chaos … order, in this case an international money-regime.

For a decade, this Internet Era has revealed the plans of internationalist bankers in more and more detail. Every significant monetary or military event points the way toward this ongoing consolidation. That’s why articles like this one in the Telegraph are so surprising. We can see clearly that the dollar’s destabilization was a manipulated event, one that the Bush regime pursued through several regional wars and a plethora of “security” spending as they secured the fundaments of a massively expensive surveillance state.

There was nothing natural or inevitable about any of this. The concept of the BRICS was created by Goldman Sachs; its evolution is convenient, even suspicious. The dollar’s destabilization was an act of political orchestration as well. And now we are to believe that a “reserve currency basket” is the obvious destination.

Conclusion

If it is destiny, it is a manipulated one.”

Source.

So where will NZ fit in a likely rejigging of the world monetary order?

Whether it is one forced on the players by circumstance or rather as the Daily Bell post purports is rather a “directed history” set in motion by a “global elite”?

Perhaps this RBNZ press release from 3 days ago gives a bit of a clue…

—–

“Deputy Governor appointed chair of Asian central banking group

Reserve Bank Deputy Governor Grant Spencer has been appointed chair of an international central bank group: the EMEAP Working Group on Financial Markets.

EMEAP (Executives’ Meeting of East Asia-Pacific Central Banks) is an organisation of central banks and monetary authorities from Australia, China, Hong Kong, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore, and Thailand.

Reserve Bank Governor Graeme Wheeler said: “The appointment reflects the high regard that peers at other central banks around the region have for Grant.”

EMEAP’s Working Group on Financial Markets reviews central bank policies and developments in foreign exchange, money, and bond markets in the region. The Working Group played a key role in establishment of the EMEAP’s Asian Bond Fund. The Working Group also works with the major country central banks and the Bank for International Settlements (BIS) in a forum on foreign exchange markets.

More information: http://www.emeap.org/”

—–

While NZ remains more militarily aligned with the USA, we seem to be walking a careful line between the West and the East. Given China is now our largest trading partner, it would perhaps make sense to be aligned with them in any new currency bloc were one to form.

We still think the theory of a collapsing US dollar simply being taken over by the Chinese Renminbi/Yuan is too simplistic and it won’t be smooth sailing by any means. Much like the Daily Bell says this is all likely “directed history” where the public players are not the ones actually pulling the strings.

But we do believe a change in the monetary order is inevitable.

So are you prepared?

Don’t rely on the Central Bankers and politicians, start your own central bank and begin your own bullion reserves while prices remain low. Get in touch if you have any questions at all.

This Weeks Articles:

| RBNZ Lifts Interest Rates – NZD Falls |

2014-07-24 01:18:27-04 2014-07-24 01:18:27-04

Gold Survival Gold Article Updates: Jul. 24, 2014 This Week: RBNZ Lifts Interest Rates – NZD Falls Gold & Silver Miners vs the Metals Themselves The TRUTH about China’s Massive Gold Hoard We have a bit of a chart-a-pallooza for you this week. Plus a couple of good articles and another great video from […]

read more…

We’re Ready to Profit in the Coming Gold Correction—Are You? |

2014-07-29 19:35:06-04 2014-07-29 19:35:06-04

See not only how many gold corrections there have been since the start of the current bull market, but also how many surges there have been too. Importantly also see a number of the ongoing trends that continue to support gold and what to do in the current flat gold price environment… We’re Ready to Profit in […]

read more…

Prof. Antal Fekete: The Ignored Anniversary – Episode 04/17 |

2014-07-30 18:51:13-04 2014-07-30 18:51:13-04

04/17 Prof. A. Fekete: The Ignored Anniversary This is the forth video (just 5 minutes long) from Professor Fekete in a series of 17 short videos. (Here is the link to the 1st video: Prof. Antal Fekete: The Banking System – Episode 01/17 and 2nd video: Prof. Antal Fekete: Money creation – Episode 03/17) We’ve learnt a great […]

read more…

|

|

So if you didn’t read it last week check out the article by Casey Research’s Jeff Clark which debunks widespread reports that Chinese demand for gold is falling.

So if you didn’t read it last week check out the article by Casey Research’s Jeff Clark which debunks widespread reports that Chinese demand for gold is falling.

2014-07-24 01:18:27-04

2014-07-24 01:18:27-04

2014-07-29 19:35:06-04

2014-07-29 19:35:06-04

2014-07-30 18:51:13-04

2014-07-30 18:51:13-04

Pingback: Gold Prices | Gold Investing Guide A Bipolar week for precious metals - Gold Prices | Gold Investing Guide