Prices and Charts

NZD Gold Up Just Under 3% Since 21 December

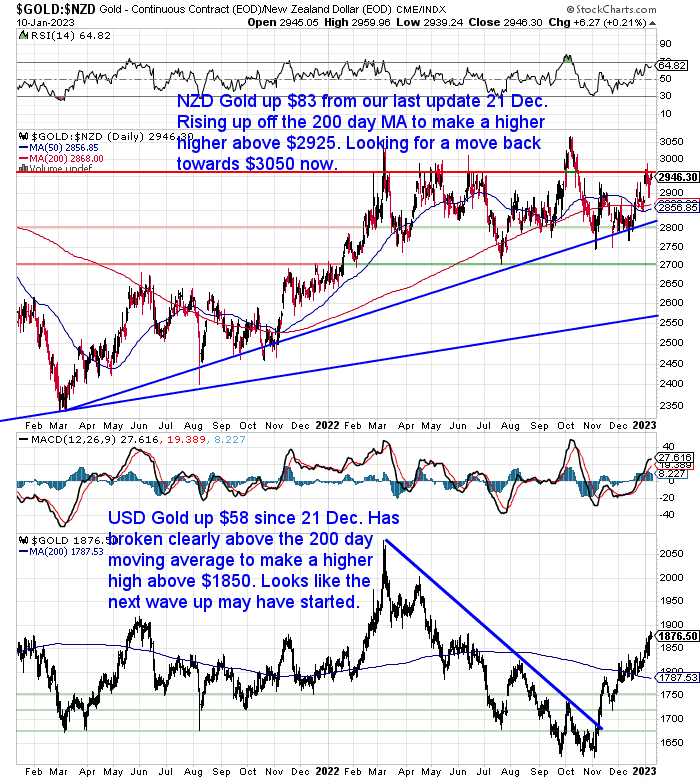

Gold in New Zealand dollars is up $83 since our last weekly update on 21 December. It jumped strongly off the 200 day moving average (MA) and made a higher high above $2925. We’re now watching to see if NZD gold can move up towards the 2022 high of $3050.

Gold in US dollars continued the strong up move that has been in play since early November. It has broken clearly above the 200 day MA and is closing in on US$1900 for the first time since April 2022. It looks like the next wave up for USD gold may have started. But it is close to being overbought so a pullback soon won’t be a surprise.

Conversely NZD Silver Was Down Just Under 3%

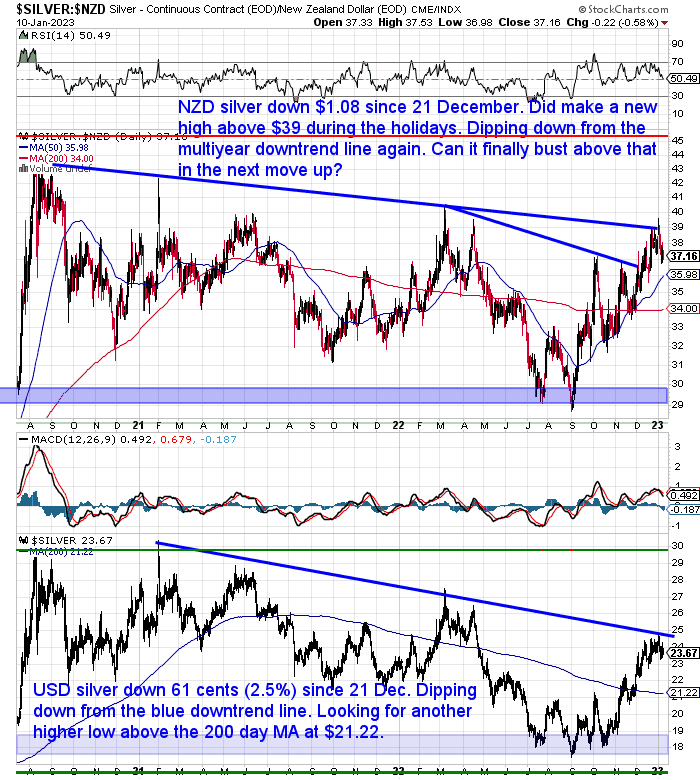

Meanwhile silver in NZ dollars was down just under 3% since our last update. During the holiday break it did push higher and get back above $39 per oz. But since then it has pulled back after hitting the multi year downtrend line again. Now silver is back in the low $37’s, but remains above the 50 day MA. That could be a good buy zone to watch for again. As NZD silver has held above that moving average line since September.

Not Much Change in NZ Dollar

Not Much Change in NZ Dollar

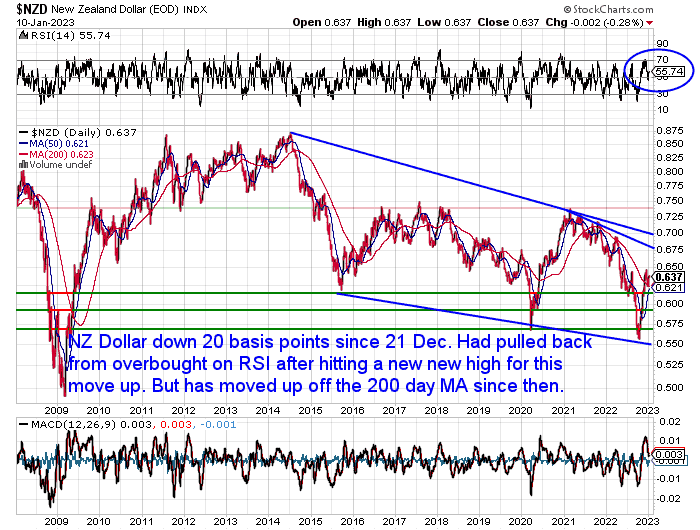

The New Zealand dollar is up just 20 basis points since 21 December. After hitting a new high for this move up, the Kiwi had pulled back from overbought on the RSI, to now be back in neutral territory. It has moved back up off the 200 day moving average. Could just quietly strengthen again from here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Gold and Silver Prices Held Up Well Over Holidays

Just before Christmas we reported how the low volume Christmas/New Year break is where we often see a spike down in gold and silver prices. This has occurred in 9 of the last 13 years. But in 2022/2023 prices actually rose during this low volume time.

An even stronger trend exists in terms of buying at the end of one year. Where in 10 of the last 11 years the price at the end of the next year has been higher. We’ll have to wait another year to see if that one plays out again.

Goldman Sachs: Whatever the Fed Does Should be Positive for Gold

Goldman Sachs trading desk analysts have a few reasons why gold will likely be higher in a year.

Fed and gold

Few thoughts from GS trading that are bullish gold:

1. If the Fed pivots too early and becomes dovish in a high inflation scenario, it could be bearish for the US dollar, which would help gold

2. If the Fed pivots too late and causes a bigger recession than is currently priced in, there could be a flight to safety, which would also help gold

3. When the rate hiking cycle ended in late 2018, gold marked its lows in late October-November of that year and was up 20% in 2019

Source.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Recession Fears and Falling Business Earnings

Another factor that is likely to remain bullish for gold is the arrival of a recession.

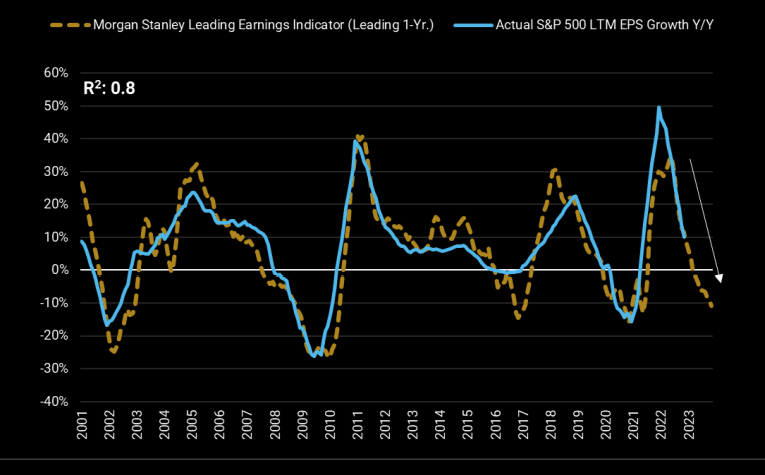

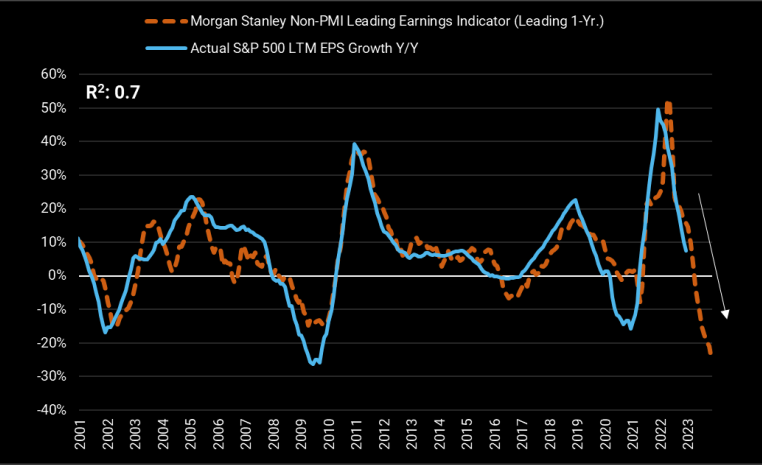

Morgan Stanley’s Chief investment officer, Michael Wilson, has been probably the most vocal bear amongst the bank analysts in 2022. As The Market Ear points out below he has also been very accurate in his calls last year. This week he has been making the rounds saying to expect another 20% fall in US stock prices if the US enters a recession.

Wilson’s concern

Wilson’s main concern is that “…most are assuming “everyone is bearish” and, therefore, the price downside in a recession is also likely to be mild (SPX 3,500-3,600). On this score, the surprise might be how much lower stocks could trade (3,000) if a recession arrives”.

The earnings bear

Morgan Stanley’s Wilson has been very accurate in his calls during 2022. He says that the market attention is shifting from inflation/Fed to earnings and recession next. Leading indicators are basically indicating big cuts to earnings.

MS

MS

Source.

2022 Was a Record Year for Central Bank Gold Purchases

There has been strong demand for retail gold throughout most of 2022. Although with a slow up for the last couple of months of the year. Latest numbers show that central bank demand hasn’t slowed at all with China buying strongly in November and December. 2022 was a record year with over 400 tonnes of gold bought by central banks globally.

This week’s feature article looks at these central bank numbers with some interesting charts and then compares where the RBNZ sits against other central banks in terms of gold reserves.

You’ll discover:

- Central Banks Buy Record Amounts of Gold in 2022

- So is the Reserve Bank of New Zealand (RBNZ) Also Buying Gold?

- How Does New Zealand Compare to the Leading Gold Holding Nations?

- The Top 100 Gold Holders

- Why the RBNZ is Very Unlikely to Buy Gold

What are central banks preparing for? They know what is going on. The slow but steady end of the USD as the world’s reserve currency.

Maybe you should be preparing for and doing the same thing?

For a quote on gold or silver:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Big News: IMF Asks “Gold a Barbarous Relic No More?” - Gold Survival Guide