Prices and Charts

NZD Gold Jumps 2.5% From a Week Ago

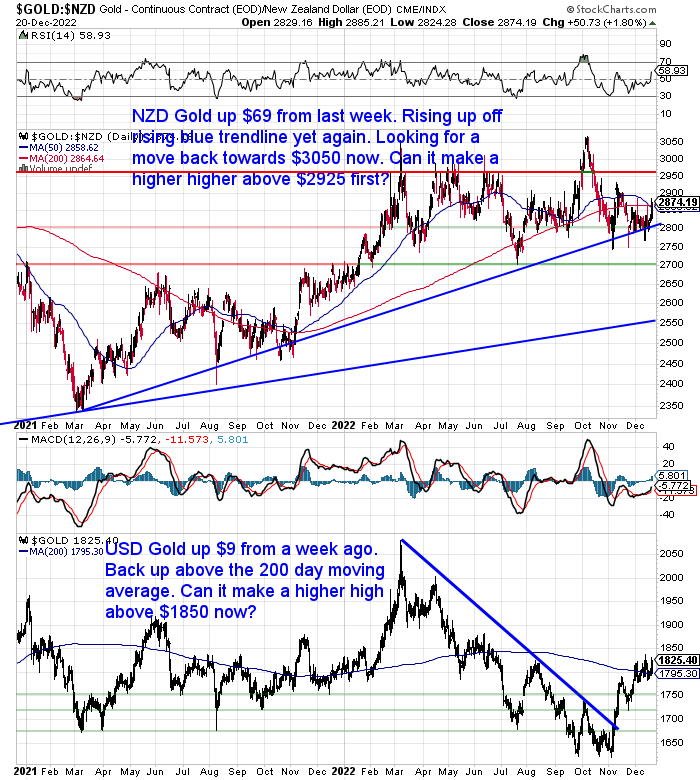

Gold in New Zealand dollars is up $69 or 2.5% from 7 days ago. Today it has risen sharply up off the blue trendline once again. That line is proving to be strong support. Now we are watching to see if it can make a higher high above $2925 and then make a move towards the early October high at $3050.

But recent history suggests any return to the blue uptrend line will be a good buying zone. So watch that line if you are sitting on the fence in terms of when to buy.

Gold in USD is back up close to the recent high. So we’re watching to see if it can put in a higher high above $1850 now.

NZD Silver Surging Over 4%

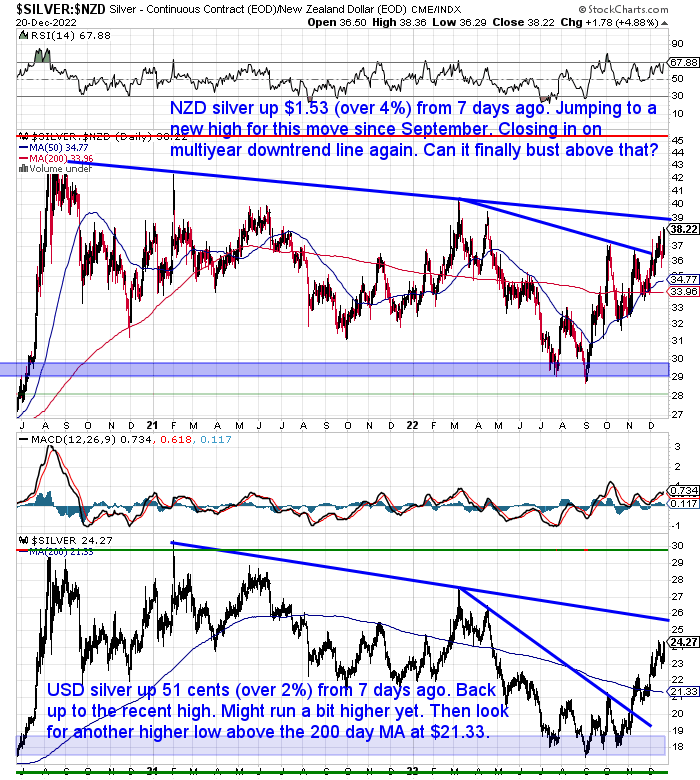

Silver continues to outperform gold. Surging over 4% from a week ago to a new high above $38 for this run higher from September. NZD silver is closing in on the multiyear downtrend line again. Can we see it finally bust above that? It is getting close to overbought (above 70) on the RSI indicator. So we may see silver pull back first once it touches the downtrend line. But both gold and silver do seem to be building quite nicely at the moment.

Silver in US dollars is also closing in on its multi year downtrend line. We could see it head up towards that before a bit of a pullback.

NZ Dollar Down Almost 2% This Week

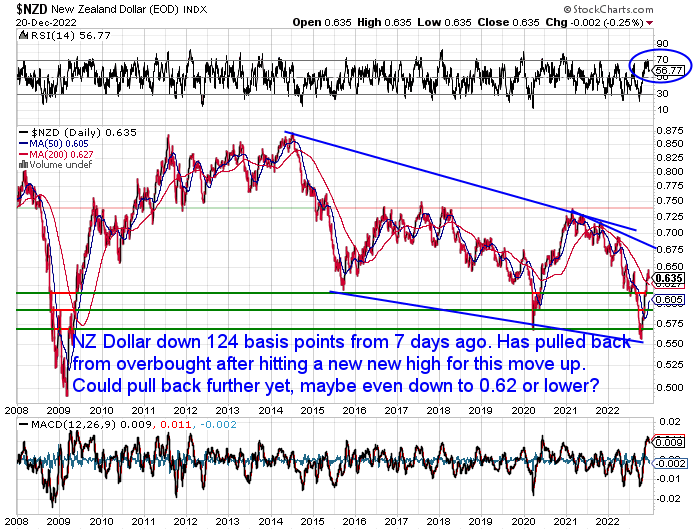

While gold and silver have been strong this week, the Kiwi dollar has weakened. Down by close to 2 % so that gave local precious metals prices a further boost. We could still see the NZ dollar pull back a little further yet.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Silver Coin Premiums Drop Even Lower With Falling Demand

The premium or mark up above the spot price has continued to drop over the past couple of weeks. This often happens as demand falls off.

So we once again have backdated silver coins such as Canadian Maples, Austrian Philharmonics and South African Krugerrands all available for sale.

Of note is that the backdated silver maples are now over $2100 cheaper per 500 mint box compared to the latest issue 2022 maple coins. The Philharmonics and Krugerrands are close to $200 cheaper again. Those 2 are the lowest priced world mint silver coins currently.

As we’ve often seen in the past, these times of low demand often end up being some of the best times to buy. When the crowd is not buying is likely a contrarian signal that you should be doing just the opposite.

First Time Buyer Question: How is Gold Going to Trend in the Next 6 Months?

As noted already it’s currently the quietest it has been in some time in terms of demand for physical precious metals. So probably many first time buyers are wondering the same thing: How is gold going to trend in the next few months?

In this post you’ll discover:

- How Do We Think Gold is Going to Trend in the Next 6 Months?

- Buying Strategy If We Don’t Know How Gold Will Trend in the Next 6 Months

- If Gold Prices are Manipulated is it Possible to Predict the Best Time to Buy?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

More of the Mainstream Are Starting to Join the 1970’s Redu Theme

If you’ve been following us for any length of time you’ll have heard us say that we think something similar to the 1970’s is the most likely scenario we are heading for. Of course history doesn’t repeat, but it does rhyme. And we have thought for some time that the tune will be similar to that of the 1970’s. With low growth and high inflation compared to the recent past. Or what is known as stagflation. (For example, we pondered “Could stagflation happen again?” back in 2018).

Just this week Australia’s sovereign wealth fund announced it was altering its investment strategy for the times ahead. Specifically:

“Australia’s A$200 billion ($134.28 billion) sovereign wealth fund is increasing exposure to gold, commodities, … as it warns the future will echo the low-growth, high-inflation era of the 1970s.

The Future Fund outlined the changes, which also included widening its currency basket, in a note on Friday that questioned the value of traditional 60-40 portfolios [60% stocks-40% bonds] and called for an investing shift to confront a world dealing with war, inflation and climate change.

“In this kind of environment there is a real risk of simultaneous slow growth, high unemployment, and rising prices that has some parallels with the stagflationary period that struck developed markets in the 1970s,” the note said.”

Source.

ASB Also Making Comparisons to the 1970’s for Housing

ASB this week increased its house price prediction to a total fall of 25%, which also rhymes with the 1970’s…

“Faint glimmer of hope but train still in the tunnel. ASB has revised its house price prediction to a total fall of 25%. That’s a sizable price fall, and in inflation-adjusted terms it is nearly as large as the 1974-1980 slump.”

Read more

Recession for USA in Next Few Months?

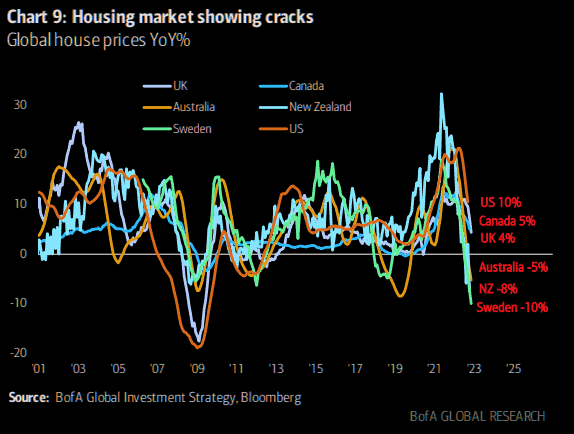

Bank of America (B of A) Chief Investment Strategist Michael Hartnett thinks there is a rising possibility that the USA will see a recession in the next few months…

Recession ASAP

Hartnett points out why we could see a recession within 10-12 weeks:

1. yield curve extremely inverted

2. oil crashing despite the China reopening, Russia oil price cap, SPR running “dry” and OPEC saying supply is constrained

3. bank stocks tanking recently

4. ISM manufacturing new orders down 3 straight months at time of high inventories

5. Housing looking shaky

Source.

The B of A chart shows the NZ housing fall at 8% Year on Year, is second only to Sweden and USA. Although the ASB report cited above says house prices are now down 14% overall.

Despite Fall NZ Housing Still Expensive on Multiple Measures

Also a report from Harbour Asset Management points out that despite these falls, NZ housing remains expensive on a price to income ratio and mortgage serviceability basis…

“…the nationwide data implies a 30% decline in house prices is necessary to return this house price-to-income ratio to average, assuming no change in income. Alternatively, if prices don’t move, it would take seven years of 5% income growth to return the ratio to average.”

… It currently requires 64% of the median household disposable income to service a 30-year mortgage on a median house. For the new house buyer, house prices would need to decline by 28% for the mortgage servicing ratio to return to the 15-year average.”

“Many commentators have highlighted the weakness in the housing market, with bank economists among the first to place high risks going into 2023 for yet lower house prices and falling activity. Perhaps we are already well-progressed in the adjustment of house prices and the housing market, however, numerous indicators point to yet further pressures from:

- Low affordability

- Strong near-term building activity, and

- Low population growth.

Most periods of adjustment are measured in years and, in the absence of a significant change in incomes, interest rates or migration, the housing market may face further adjustment into 2023.”

Source.

Kiwis Warned to ‘Prepare’ as New Grim Picture of ‘Challenging’ 2023 Emerges

ASB also believes that, like the USA, NZ will enter a recession next year…

“New Zealanders are being warned to “prepare now” for what one major bank predicts will be a “challenging 2023” due to “stubbornly high” inflation and an official cash rate expected to hit a 14-year high.

ASB on Tuesday released its December quarterly economic forecast, predicting New Zealand will enter a recession in 2023 with rising unemployment, high inflation and climbing interest rates.

Chief economist Nick Tuffley said there is a clear message for New Zealanders: “Prepare now for a challenging 2023.”

“My advice to New Zealanders is act now: don’t wait until challenges land at your doorstep to get on top of your finances,” he said.

“Take advantage of the help available from your bank to get your loan structure right and take a hard look at your spending and saving levels.”

Source.

That is probably good advice overall. Although of course in what looks like being a high inflation environment, saving dollars may not be so much help to the average Kiwi.

Better of course to hold something that will retain its purchasing power over the years to come. Wonder what that could be?

For a quote on gold or silver:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|

| |

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

|

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Plus we accept BTC, BCH, Visa and Mastercard

|

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2022 Gold Survival Guide.

All Rights Reserved.

|

|