Could the New Zealand (and global) economy be headed for stagflation? See just what stagflation is, what causes stagflation and what offers the best protection from it…

In last week’s article “Why the Push for Higher Wages May be at Just the Wrong Time”, we mentioned that there is the possibility of New Zealand (and other countries) heading into a stagflationary environment:

“The trouble for New Zealand is that it seems this increase in wages may come just as the whole economy is starting to lose steam. So we won’t see any gains in productivity in the next few years either.

Will employers settle for lower margins? Maybe, but likely not. Instead they’ll pass the costs onto consumers i.e. wage getters. Best case we’ll see general price inflation eat into any wage gains. Worst case we’ll see job losses as employers retrench to make up for higher labour costs.

A possible outcome is we could be heading for a stagflationary environment like the 1970’s. With low growth but higher inflation. “

What is Stagflation?

Stagflation is where an economy sees slow or no growth, but with higher general price inflation, and higher unemployment.

The name comes from the combination of stagnant (economy) and inflation.

This was something most mainstream economists thought was impossible to happen. High inflation should not occur in a weak economy. Until the 1970’s proved them wrong. Where inflation rose while the economy contracted and unemployment also rose.

What is the Cause of Stagflation?

Here’s a pretty solid explanation of the cause of stagflation:

“Stagflation occurs when the government or central banks expand the money supply at the same time they constrain supply.

The most common culprit is when the government prints currency. It can also occur when central bank monetary policies create credit. Both increase the money supply. That creates the inflation.

At the same time, other policies slow growth. That happens if the government increases taxes. It can also occur when the central bank raises interest rates. Both prevent companies from producing more. When conflicting expansionary and contractionary policies occur, it can slow growth while creating inflation. That’s stagflation.”

Stagflation in the 1970’s

Stagflation occurred in the United States and many other countries including New Zealand in the 1970s.

What Caused the 1970’s Stagflation?

The conventional argument as to what caused inflation in the 1970’s was the “oil shock”. Where the petroleum producing nations restricted oil supply, causing prices to increase sharply.

But as is often the case this only looks at the surface of the issue.

It should come as no surprise that this period of stagflation occurred after the US severed the last tie between the US dollar and gold in 1971.

This allowed the US and other governments to increase the supply of what were now fiat currencies with no handbrake. Resulting in large currency swings. The oil producing nations increased their prices in response to the inflation of the US dollar. Soaring oil prices were a product of the change in the monetary system. The rising oil prices did not cause of stagflation.

The US and New Zealand governments also implemented price controls and wage freezes during the 1970’s.

US president Nixon also imposed a 10 percent tariff on imports (ring any bells with current US policy?). The aim was to lower the balance of trade and protect domestic industries. But the result was rising import prices.

So the 1970’s stagflation was caused by:

- An increasing money supply due to the severing of gold from the US Dollar

- Wage and price freezes

- Tariffs on imports

Consequences of Stagflation

Stagflation was finally staved off in the late 1970’s by very high interest rates. Mortgage rates were around 20% for some people!

Higher interest rates averted a complete collapse in the global monetary system caused by stagflation. Imagine the impact of higher interest rates today after the massive increase in debt we have seen in the past decade or 2.

“This idea of facing higher rates and higher inflation with decelerating economic momentum – that’s stagflation and that’s very frightening for both stock and bond investors.”

– Jim Paulsen, chief investment strategist at the Leuthold Group.

What Might Cause Stagflation to Happen Again?

This time around stagflation may be caused by an over supply of cheap credit.

All the currency created to avert the financial crisis in 2008 could finally start to enter the system.

Up until now this currency has served to shore up bank balance sheets that were damaged as a result of the 2008 financial crisis. It has caused asset prices such as share prices and real estate to rise for the past 10 years. But all this currency has not been let lose upon the economy as a whole – yet.

While we have seen higher participation rates in New Zealand employment, wages have not risen as the likes of higher migration has served to keep wages in check.

As we discussed last week, this trend seems to be changing. Higher wages now appear likely. These higher wages may come just as the New Zealand economy is slowing down. Higher minimum wages equals guaranteed higher prices.

Companies will likely pass these higher prices on to consumers. They may also try to cut costs through redundancies. So we could see unemployment rise.

Petrol prices are already rising due to a falling NZ dollar. We’ll also see the price of other imported goods rise.

So it Seems We Have Most of the Ingredients For the Makings of Stagflation

As the Daily Reckoning recently noted, other people smarter than us have recently warned of the risk:

“Investors better wake up to the growing risk of stagflation.”

“By all metrics, inflation is heating up, but it’s not clear the same can said for underlying economic activity.”

– Danielle DiMartino Booth, former adviser to the president of the Federal Reserve Bank of Dallas .

“Stagflation is about to emerge. We are moving into a different phase of the economy, to a stagflation not seen since the 1970s.”

Alan Greenspan – former Federal Reserve Govenor

“Now we’re returning to that unpleasant combination of low growth and high inflation…Stagflation may be in the cards. If so, it will be a return to the late 1970s when the “misery index” was created to describe the stagflation combination of high interest rates and high unemployment at the same time.”

– Jim Rickards.

Stagflation and Precious Metals

In the 1970’s stagflationary period we saw the precious metals of gold and silver perform incredibly well. Gold went up over 2000%.

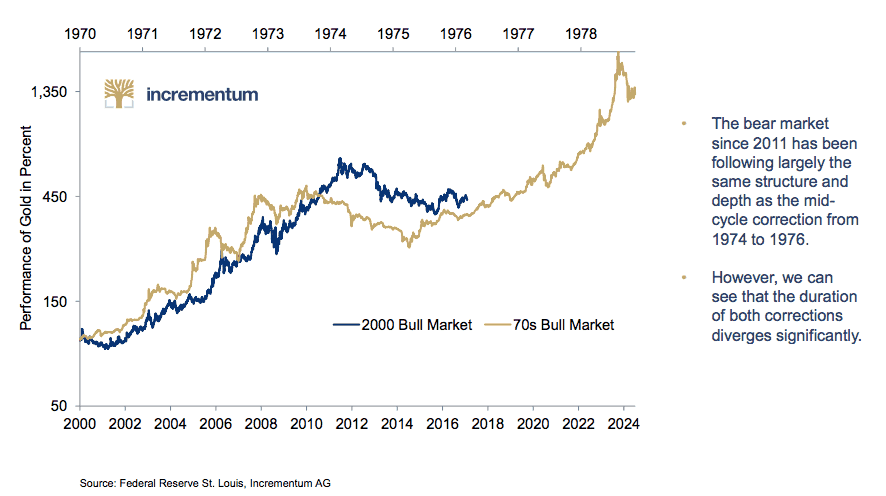

The chart below clearly illustrates how gold performed in the 1970’s stagflationary period (gold line – top scale). Then superimposed onto the same chart is the current bull market in gold from the year 2000 to 2017 (blue line – bottom scale).

As we have previously explained, the current bull market in gold seems to be mirroring the 1970’s bull market, although the time scale is drawn out about 2 to 1 in the current period.

Read more: Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation?

So if we are heading towards a stagflationary period, buying gold and silver should give some protection from the rise in price of everyday goods and the stagnating of the economy.

Pingback: STAGFLATION IN EXTREMIS & THE EXPLOSIVE RISE OF GOLD

Pingback: World Gold Council Study: The Impact of Inflation and Deflation on Gold's Performance

Pingback: Here’s How Inflation Could Surprise Everyone - Gold Survival Guide

Pingback: The Number One Reason to Buy Gold in New Zealand Today - Gold Survival Guide

Pingback: Gold in NZ Dollars Hits New 6 Year Record High - Gold Survival Guide

Pingback: Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation? - Gold Survival Guide