This Week:

- NZ Dollar Falls – Why is the NZ Dollar Weaker and Where to Now?

- RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

- Why the Push for Higher Wages May be at Just the Wrong Time

- What’s Going on in Turkey? Why is the Lira Plummeting?

Prices and Charts

NZ Dollar Plunge Pushes Up Local Gold Price

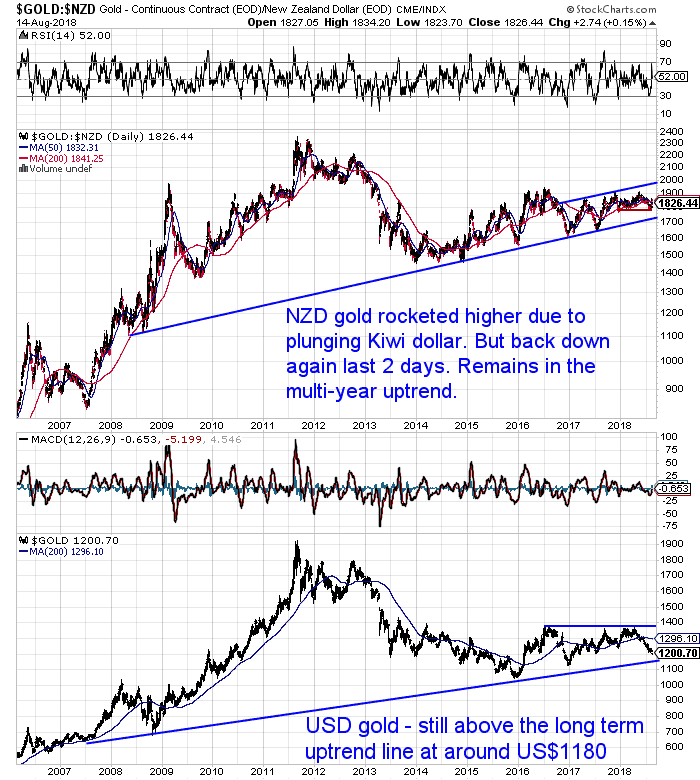

The NZ Dollar plunged earlier this week, boosting local gold prices. But with offshore goldpriced in US dollars dipping below $1200, local NZ gold prices have now come back to be up about 1% on a week ago.

We’ve zoomed out to a longer term view of gold this week. US prices are not too far above the long term uptrend line around US$1180 (lower part of the chart). While the local NZ gold price sits midway between the rising support and resistance lines.

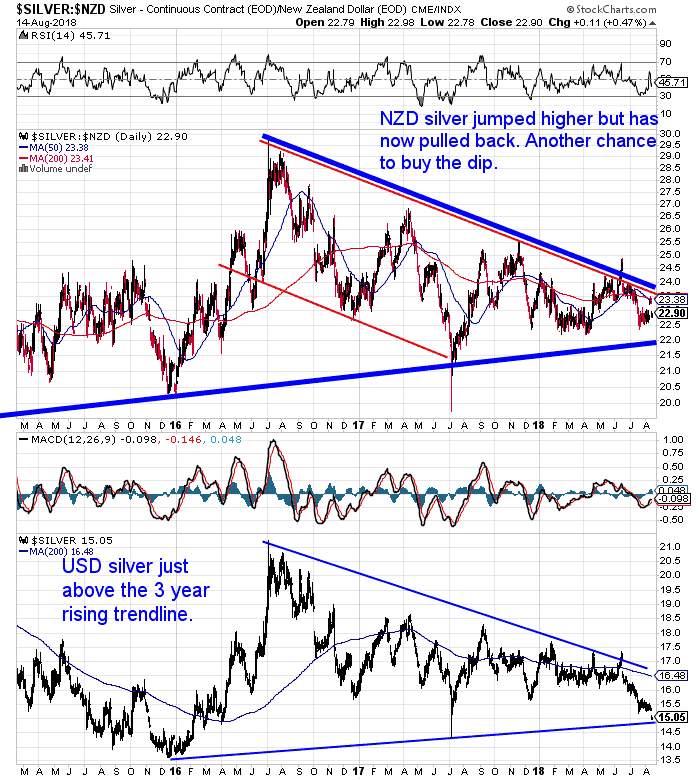

The weaker Kiwi dollar also caused NZ silver prices to shoot higher earlier this week. But then like gold, silver pulled back. Now sitting pretty much where it was a week ago. Another chance to buy the dip.

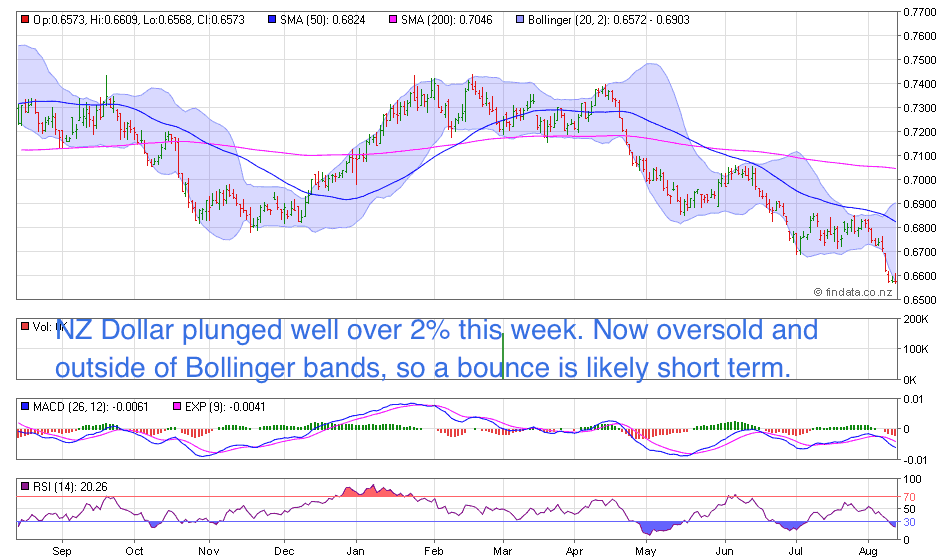

Kiwi Dollar Plummets

The New Zealand dollar plummeted well over 2% this past week. It’s now oversold and outside of the Bollinger bands. So short term a bouncer is likely.

Longer term the Kiwi has broken below the trend lines.

What caused the sharp fall and where might the NZ dollar head now? We have a crack at answering those questions in the article below. Along with a useful chart that shows how gold has benefited any New Zealander that has held it while the Kiwi dollar has weakened.

Unsure About Any Terms We Use When Discussing the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Update: RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

In our post about the NZ dollar you’ll see it was the latest monetary policy statement from the reserve bank that sent the dollar for a tumble.

As a result of the monetary policy statement we’ve updated a previous post with new information. A further cut in interest rates could be more likely than most people thought.

Why the Push for Higher Wages May be at Just the Wrong Time

With the teachers strike today, we’ve taken a look at the push for higher wages. The same thing is happening in the USA. What will the impact of these likely increases in wages be for NZ?

Why haven’t wages kept up with the growth in the NZ economy?

The average household may well be right to push for higher wages. But see why this could be coming at just the wrong time…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Russia Finance Minister: We May Abandon Dollar In Oil Trade As It Is Becoming “Too Risky”

Following on from our report of Russia Selling US Treasuries and Buying Gold, ZeroHedge reported on further news out of Russia this week.

“Finance Minister Anton Siluanov said that Russia “aims to keep reducing its investments in American securities” following new U.S. sanctions and said that the “US dollar is becoming an unreliable tool for payments in international trade.” The minister also hinted at the possibility of using national currencies instead of the dollar in oil trade.”

The post concludes with:

“With Russia hinting that it is close to giving up on the dollar entirely in oil trade and shifting to a petroyuan-based regime, how long before other nations follow suit, especially with the US increasingly energy self-sufficient?”

Source.

Yet another piece of news pointing to the eventual demise of the US Dollar as the sole global reserve currency.

What’s Going on in Turkey? Why is the Lira Plummeting?

Commenting on the NZ dollar falling, we also mentioned the crisis in Turkey. What’s going on there? Why has the Turkish lira taken a beating this year?

The commonly recited view is that it is due to US sanctions against Turkey for not releasing a US pastor whom Turkey has held for the past 2 years.

However as usual there is likely more to this than meets the eye.

As Jim Rickards pointed out this week:

“Funny how many of the nations opposing dollar hegemony are under U.S. economic pressure these days, Turkey being the latest. The Trump administration launched tariffs against Turkish steel and aluminum imports Friday, which helped a massive selloff in the lira.

Has the U.S. launched the latest sanctions against Turkey to punish it for its recent anti-dollar rhetoric?

And Turkish president Erdogan has expressed the desire to move the system away from the dollar [much like Russia as mentioned already today].

…[The] Turkish Central Bank decided to bring its 220 tons-worth of gold home from the U.S. this spring”.

But Turkey has gotten itself into trouble by massively increasing its internal money supply and also massively increasing it’s level of debt. Even more importantly 50% of this debt is denominated in foreign currency like the US dollar. With the US dollar strengthening, this has made debt servicing much more difficult.

The Turkish central bank attempted to boost liquidity yesterday. But the Lira fell yet again.

“But analysts said the measures won’t have any direct impact on the lira because it doesn’t ease a core concern—the hefty debt exposure of Turkish banks and corporations—and warned the central bank has limited reserves of its own to weather the storm,” The Wall Street Journal notes.

Turkey is not a massive importer or exporter. In fact it’s not so different from New Zealand on a global scale. So Turkey may not be enough to bring the house of cards down.

However Turkey does have significant loans, mainly with European banks from the likes of Spain and France. So there could be contagion given these countries aren’t exactly in fantastic shape themselves.

Bill Bonner today outlined how this could occur:

“Turkey owes nearly half a trillion dollars in foreign debt. As the lira goes down, the dollar goes up, making it harder to pay.

Most likely, Erdoğan will impose capital controls, which will be deeply upsetting to the entire global financial system.

Lenders will panic, realising that their collateral — locked behind walls erected by a strongman leader — may be worthless. And the trust on which the whole bubble financial system depends will vanish.

The moneymen will look to the East…to India…and rush to fetch back their funds.

They will look West too…to Greece and Italy…and wonder about their investments there.

And finally, they will look to New York…and see another bulge in the great bubble: US stocks, particularly the high-flying techs. ‘Weren’t they bid up by the same cheap money?’ they will ask themselves.

And then…the whole shebang may come crashing down.”

We’re not so sure that Turkey will be the pin that bursts the bubble. But hey who knows?

In the meantime make sure you have your financial insurance in place just in case. You still have the chance to buy the dip.

Check out the deals going currently.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Only Only One Left in Stock – Learn More NOW….

—–

|