Here’s a couple of questions from a first time buyer, mainly looking at how we think gold is likely to trend over the next 6 months…

Table of contents

Estimated reading time: 4 minutes

Our reader asks:

“How do you think gold is going to trend in the next 6 months?

I have been watching the gold pricing charts… but it seems to be hit and miss of when is the best time to buy. I know the prices are manipulated so is it possible to predict the best time to buy?”

How Do We Think Gold is Going to Trend in the Next 6 Months?

If we knew this we’d be on a beach sipping cocktails! It really is anyone’s guess.

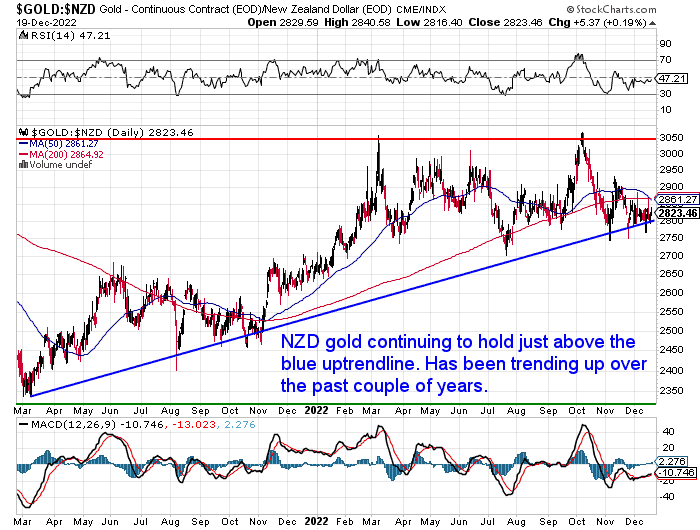

But a look at the NZD gold chart might help us a little bit. We can see over the past couple of years the trend has been steadily up (see the rising blue trendline below).

More recently, we’ve seen NZD gold consolidate above $2700. But it did touch the 2 year high again in October.

We could make a good argument that buying anywhere along the blue uptrend line makes sense. That is pretty much where we sit today.

We are now watching for a move back up to form a higher high above $2925.

So if we had to guess we’d say in 6 months NZD gold is likely to be higher than where it sits today.

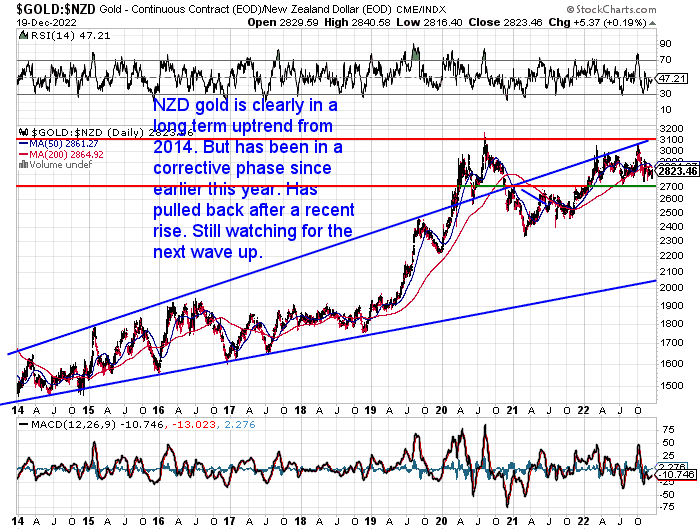

Now let’s also cast our eye back over a longer time frame…

The 9 year chart below shows gold in NZ dollar has been in along terms uptrend since 2014. Albeit in a consolidation phase for this year. But we get the feeling that an attack of the 2020 high, just below $3200, is likely in the not too distant future.

But at the end of the day we’re just making educated guesses as to where things will stand in 6 months. That is still a pretty short term horizon when you are buying gold for financial insurance. It is a core asset that you just buy and forget about.

Buying Strategy If We Don’t Know How Gold Will Trend in the Next 6 Months

That’s one of the reasons why we recommend getting a foothold at least. Then if you want to chance your arm on a bigger pullback you can “keep some powder dry” to buy on the dip.

But of course you do risk it not happening and instead having to buy at higher prices. But this is at least better than not having bought anything and then buying the whole tranche at higher prices!

If Gold Prices are Manipulated is it Possible to Predict the Best Time to Buy?

As for manipulation, well who knows exactly when this takes place? So trying to time those movements is nigh on impossible (for more on that see: If Gold and Silver Are Manipulated, Why Bother Investing?).

But gold in particular does show some seasonality. Even here in New Zealand, history shows the second half of the year gold does better. Often making the first half of each calendar year the better time to buy.

See this post for more detail on gold seasonality: Does Gold Seasonality Affect the NZ Dollar Gold Price?

There are a number of other factors to consider in deciding when to buy gold and silver. Including:

- Along with why buying this year is often better than waiting until next year. As we wrote a couple of weeks ago in 10 of the last 11 years buying towards the end of one year saw the gold price higher at the end of the following year. So recent history shows the end of the year is a very good time to be buying.

Check out this post for everything there is to know about when to buy gold or silver.

Hopefully that is some help to you. At the end of the day the best time to buy “insurance” is before you need it. So for most people it makes sense to at least buy some gold today.

Editors Note: First published 13 May 2019. Updated 20 December 2022 with a new charts.

Pingback: Gold in NZ Dollars Hits New 6 Year Record High - Gold Survival Guide

Pingback: More of the Mainstream Are Starting to Join the 1970’s Redu Theme - Gold Survival Guide

Pingback: Falling Demand, Falling Silver Coin Margins, Time to Buy? - Gold Survival Guide