RETURNING SPECIAL WITH PRICES FALLING

1oz Perth Mint Silver Kangaroos 2016 BU (Brilliant Uncirculated)

Minimum order 500 coins

Based on Spot Silver at NZ$23.70 per ounce

500 x 1oz Perth Mint 2016 Silver Kangaroos are $14,080 ($28.716 per coin)

– $200 cheaper than 500 Silver Maples

1000 x 1oz Perth Mint 2016 Silver Kangaroos are $27,580 ($27.58 per coin)

– $500 cheaper than 1000 Silver Maples

5000 x 1oz Perth Mint 2016 Silver Kangaroos are $136,000 ($27.20 per coin)

Bonus for 1000 coins or more – more details further down.

(Price includes fully insured delivery via Fed Ex directly to you anywhere in New Zealand or Australia.)

Get a Huge Vehicle Survival Pack Valued at $304 for Free

Free with any order of 1000 or more 1oz Silver Kangaroo coins.

This subscriber only deal (it’s not mentioned anywhere on the website) contains enough gear to spread across 2 vehicles. The pack includes:

- 2 x Inflatable Solar Lanterns

- 2 x 3-in-1 Car Escape Tools

- 2 x Credit Card Knives

- 2 x Credit Card Multi-tools

- 1 x Car Glove Box Survival Kit

- 1 x Vehicle First Aid Kit with Fire Extinguisher

Call David on 0800 888 465 to learn more about this deal or just reply to this email. Note: Minimum order is 500 coins.

This Week:

- How a Silver Coin Could Circulate Today and Protect Citizens Purchasing Power

- Is the RBNZ Aiming to Cause a Property Crash?

- Carrying Gold into a Foreign Country. What are the Rules?

- 3 Charts Indicating a Buying Opportunity for Gold

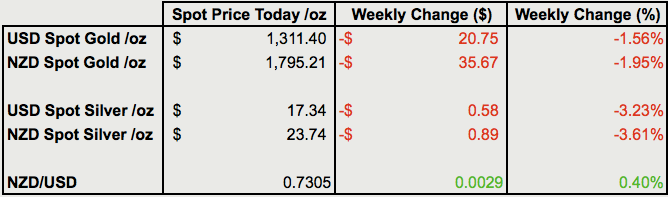

Prices and Charts

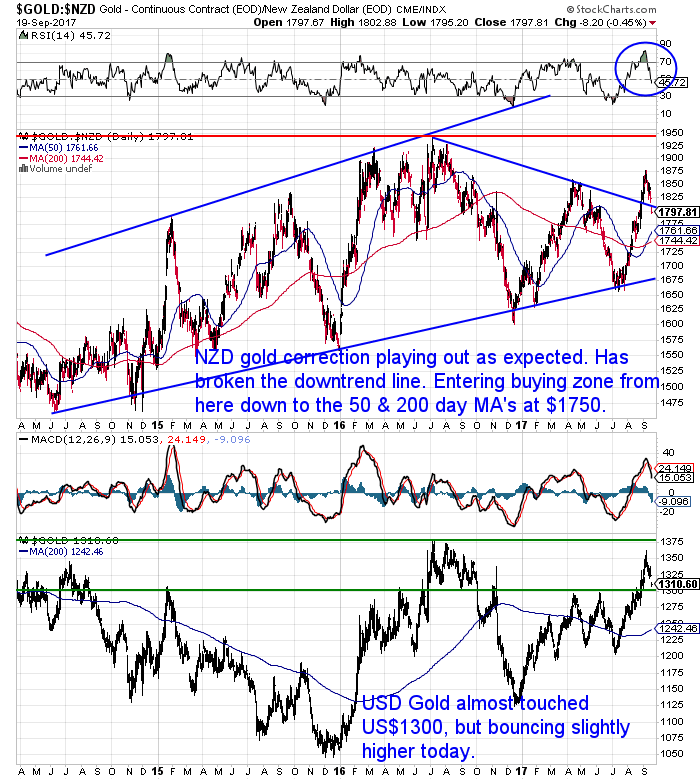

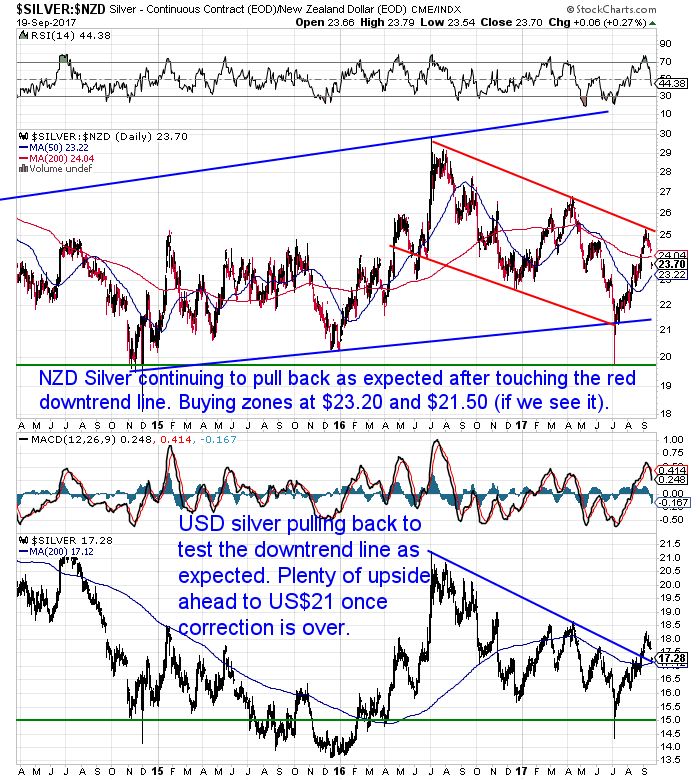

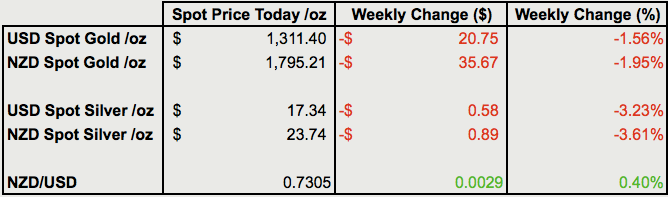

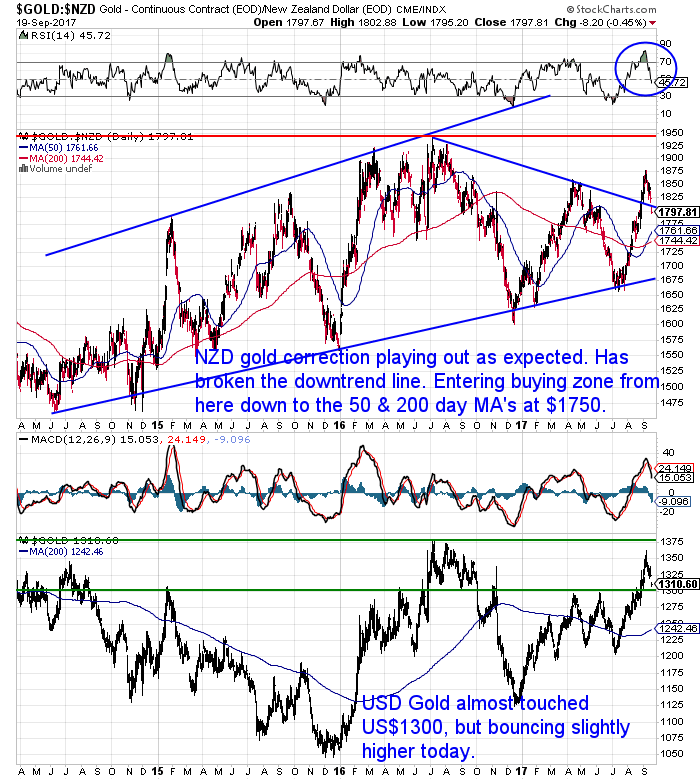

Gold and Silver Correction Arrives in Earnest

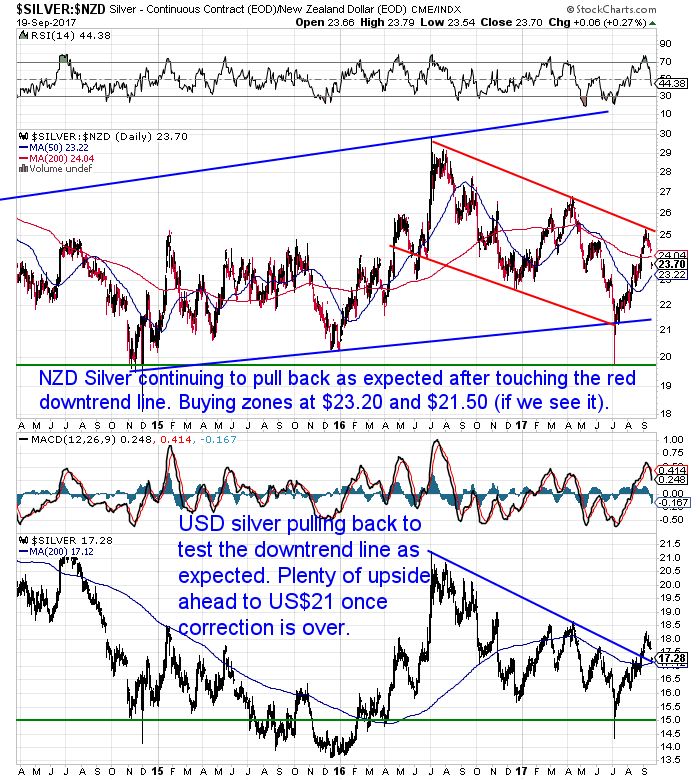

The much expected correction in gold and silver arrived in earnest this past week.

NZD gold was down almost 2% from the same time a week ago.

We can see in the chart below that gold in NZ dollars has fallen through the downtrend line. This was the first area of support we were looking for it to reach.

Now that it has fallen below that support line, odds favour gold in NZD to move lower towards the 50 day moving average (MA) around $1760.

As is often the case in a precious metals correction, silver took a larger tumble. Down over 3.5% this week. We have entered the first of our buying zones in silver too. With the white metal down below its 200 day MA and not far from the 50 day MA at $23.22.

The kiwi dollar has ticked slightly higher. It now sits at the top of the upper Bollinger band. But as we wrote last week, the NZ Dollar may struggle to get too much higher than where it sits currently.

So a falling Kiwi could help put the brakes on the precious metals correction currently under way.

Sign up for our daily price alert. That will help you identify the likely highest reward times to buy gold or silver in the coming weeks.

Learn more about that here.)Win A Silver Coin

Another reader questions answered this week – see further down. As always keep them coming and be in to win a 1oz silver coin. You can

send us your question in here or just hit reply to this email.

Is the RBNZ Aiming to Cause a Property Crash?

Following on from our reader question on capital gains tax on property last week. Here’s something we stumbled across this week…

Carrying Gold into a Foreign Country. What are the Rules?

- What is a Legal Tender Gold Coin?

- Do You Have to Declare Legal Tender Gold Coins Face Value or Metal Value?

- 3 Things to Do Before You Try Carrying Gold into a Foreign Country

- The Safest Course of Action When Carrying Gold into a Foreign Country

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

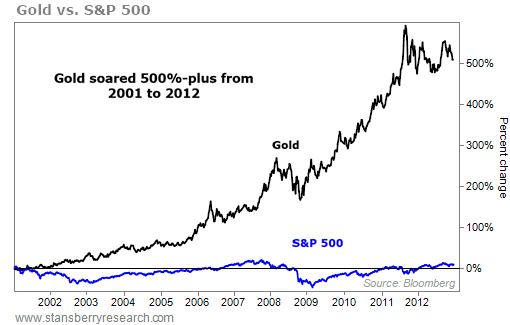

3 Charts Indicating a Buying Opportunity for Gold

We believe this current correction is an excellent buying opportunity in both metals. Why?

Because it appears we are in the early stages of the next great bull market in gold and silver. Here’s 3 pieces of data that back this up:

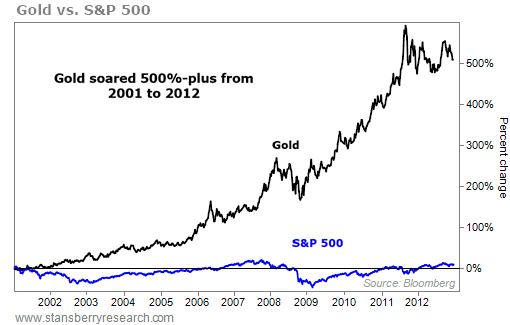

Gold is outpacing the overall stock market for the first time since 2011.

“The metal is on pace to break that trend [underperforming the stock market] this year. And that alone could be a major sign going forward.

You see, the last time gold broke out of a five-plus year slump versus the stock market was the late-1990s. Gold underperformed stocks for six straight years from 1994 to 1999… And like today, it fell 26% during that slump.

Gold’s massive bull market didn’t start immediately after that… The metal still lost money in 2000. But, in 2001, it started a 12-year streak of positive returns. Take a look…”

Source.

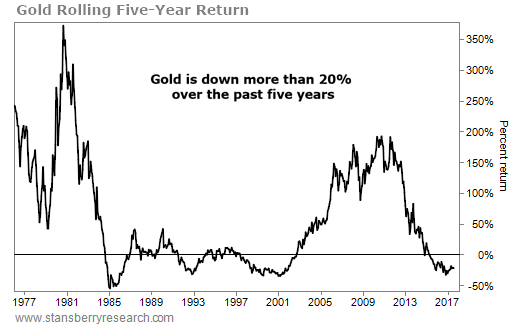

Number 2 bullish sign for gold prices

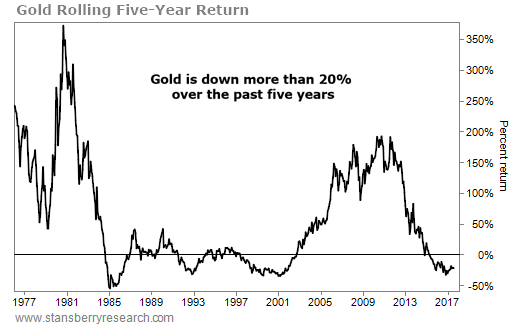

“Gold’s rolling five-year return – a simple gauge to look at how well gold has performed over any five-year period – shows why now is the best time to buy since the last bull market in gold…

Gold has lost around 22% over the past five years. And as you can see, that’s one of the worst five-year returns in gold’s history. But it also sets up a long-term opportunity.

Gold has performed so poorly in recent years that it’s basically due to move higher. Over the long term, it should “revert to the mean…”

Mean reversion simply means that a stretched rubber band does eventually move back to its center.

If stocks are too cheap, they’ll tend to move back toward normal prices. And in gold today, when long-term rolling returns are extremely low, they tend to revert to higher returns in the future.

In the short term, we always say that the trend is what matters. But over the long term, mean reversion is what matters.

In short, we haven’t seen a pattern like this since the early 2000s… right before one of the best opportunities to buy gold in history.”

Source.

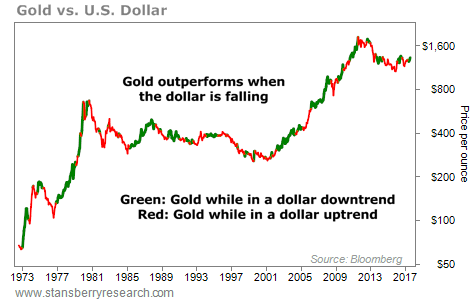

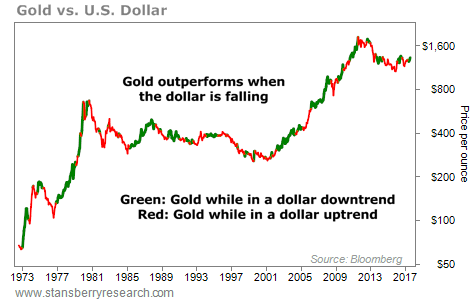

Reason 3: When the U.S. dollar is going down, the price of gold (usually) goes up.

“Gold’s compound annual return since the early 1970s has been about 6.9% a year. But when the dollar is weakening, gold goes up at 12.2% a year. And when the dollar is strengthening, gold only goes up 1.8% a year.

…To identify uptrends and downtrends, we looked at whether the dollar was above or below its 10-month moving average at the end of a month. Then, starting at the date of that signal, we measured gold’s performance over the following month.

You can see dollar downtrends led to strong gains in gold…

So… why is this important today?

Because we are now in one of those times when gold has historically delivered double-digit compound annual gains.

…The greenback recently hit its lowest level since early 2015. It has now clearly broken down from a multiyear uptrend…

Major currencies tend to move glacially. They have slow, long-term moves higher or lower… not drastic crashes or spikes.

So this year’s decline isn’t something that happens often. The dollar is down 9% in just the first eight months of the year – a massive fall for a major currency.

…the dollar could decline for the next two years.

If that’s true, then gold could be starting a multiyear bull market.”

Source.

As we said already, we’ve hit the first of our buying zones we’d been watching for. So could be time for a quote for gold or silver…

Call David on 0800 888 465 for a quote or with any questions.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

—–

This Weeks Articles:

|

|

Tue, 19 Sep 2017 1:21 PM NZST

A common misconception is that carrying gold into a foreign country is illegal. There may be the odd jurisdiction where this is the case. However, for the vast majority of countries it is perfectly legal to bring gold into the country with you. Generally even without paying any import duties. From the US customs website: […]

|

|

|

Mon, 18 Sep 2017 5:42 PM NZST

Last week we tried to answer the question Could a Capital Gains Tax on Property Increase Investment in Gold & Silver in NZ? This came about as a result of the Labour party discussing changes to the tax system. But there is also another change relating to property that has been talked about recently. The […]

|

|

|

Mon, 18 Sep 2017 3:00 PM NZST

A few articles in one today. But all related to the topic of how a silver coin could be put back into circulation. First up, see what happened to Mexican silver coins that had a currency value that quickly was overtaken by depreciation of the peso. How the coins were melted into bullion for sale […]

|

|

|

Wed, 13 Sep 2017 6:34 PM NZST

This Week: What Does Gold Spot Price (Or Silver Spot Price) Mean? Could a Capital Gains Tax on Property Increase Investment in Gold & Silver in NZ? Why is 1oz PAMP Gold Lady Fortuna Minted Bar Worth Less Than a Canadian Gold Maple Coin? Prices and Charts Looking to sell your gold and silver? […]

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Note: For local gold and silver orders your funds are deposited into our suppliers bank account. We receive a finders fee direct from them. Pricing is as good or sometimes even better than if you went direct.

|

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

- To demystify the concept of protecting and increasing ones wealth through owning gold and silver in the current turbulent economic environment.

- To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.