As we referenced in last weeks article on gold backwardation and negative Gold Forward Offered Rates, there has been plenty of talk around the interwebs of “high demand for physical gold and that this is backed up by falling COMEX inventories”. There have been arguments made that these falling inventories are signalling a soon to arrive end of the bullion banking system such as inferred in this piece on Zerohedge referencing the falling stocks at the JP Morgan Warehouse in particular But first let’s look at what exactly are COMEX inventories and then whether the fact they are falling a sign of a dwindling supply of physical gold.

What are Comex Warehouse Inventories?

COMEX warehouse inventories refer to gold bars held in one of a number of COMEX futures exchange approved warehouses such as those run by HSBC Bank, Brinks Inc., and Scotia Mocatta to name but a few. These gold bars are then classified as either Eligible or Registered gold stocks. An Eligible gold bar is a bar that was manufactured by an approved refiner, (for example Heraeus, Johnson Matthey or Metalor Technologies), has a documented chain of custody, and is in a COMEX licensed depository such as one of those listed above. Eligible gold can be owned by anyone, but it cannot be delivered against a futures contract. For example Eligible gold could be stored on behalf of manufacturers, investors, refiners, hedge funds, banks or producers. And some of these parties may then be holding the gold for their end customers. However once Eligible gold has been Registered (which means a warehouse receipt is created), then it can be delivered against a futures contract. So to try and simplify (if thats possible!), Eligible gold is gold that was manufactured by an approved refiner and has come into an approved depository/warehouse to be stored by any one of a number different types of customers. i.e. it passes muster and is eligible to be made available for settlement of a futures contract if the owner so chose. Whereas Registered gold means the gold now has a warehouse receipt and is registered as available for settlement of a futures contract.

Delivery of warehouse receipts versus physical delivery of gold

So futures traders who “stand for delivery” when their contract settles, rather than taking a cash payment, take delivery of the warehouse receipt. So the amount of gold in the registered category does not change. It remains registered and held within a COMEX approved warehouse but with a different owner. However if the buyer wants to take physical delivery of the gold, the warehouse receipt is broken. If the bars are still held at an approved warehouse then these bars will become eligible stock. Otherwise if removed from an exchange approved depository, the chain of integrity is broken and the bars are no longer eligible and are no longer tracked in the COMEX system.

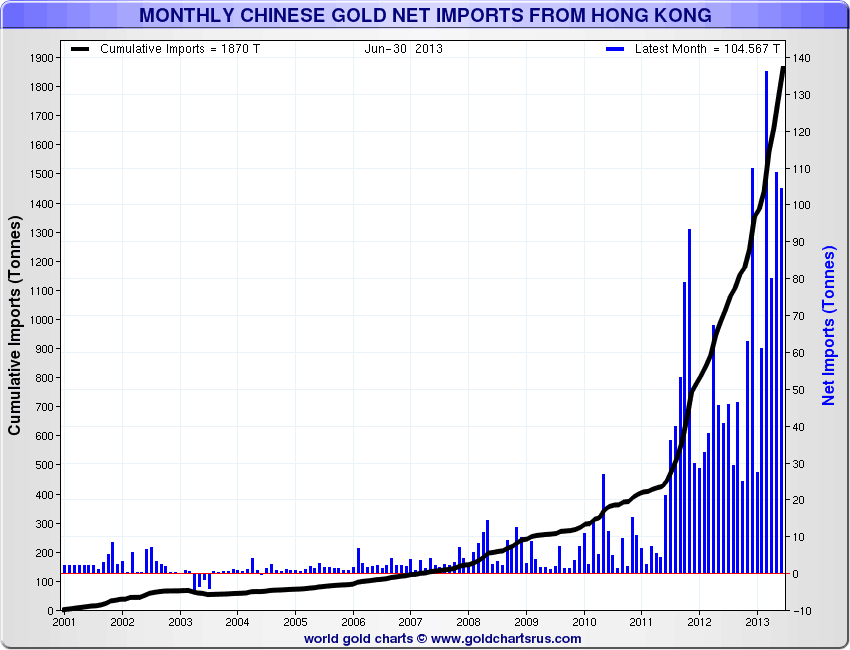

Eligible Stocks Being Sent East to China

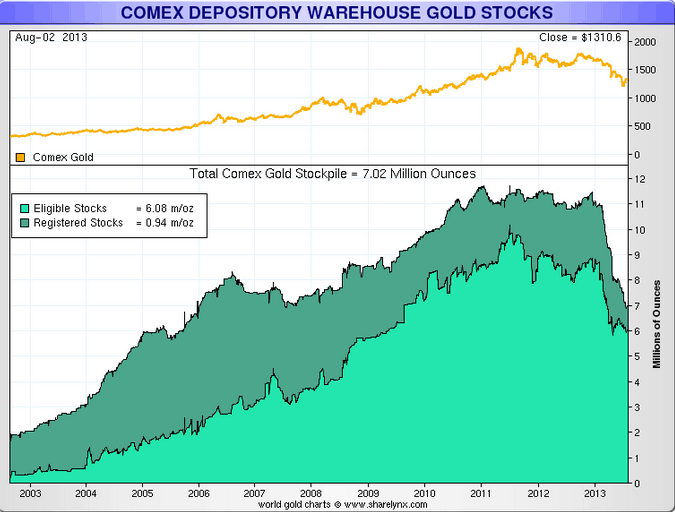

So, the argument put forward currently is that the bars are being removed from the exchanged approved warehouse altogether and likely being sent east to where there is a higher premium being paid for gold than that which would be earned by carrying or warehousing gold within the COMEX approved warehouses (see this piece for more on the mechanics of how and why this might occur ). Hence both eligible and registered stocks have been falling of late. And therefore this leads to the argument that we could be heading to a lack of supply in the COMEX very soon. However the corollary to this is that the levels in COMEX warehouses are still greater than they were prior to 2005. As can be seen in the chart below both eligible and registered stocks have fallen heavily since 2011 but are still both above 2005 levels.

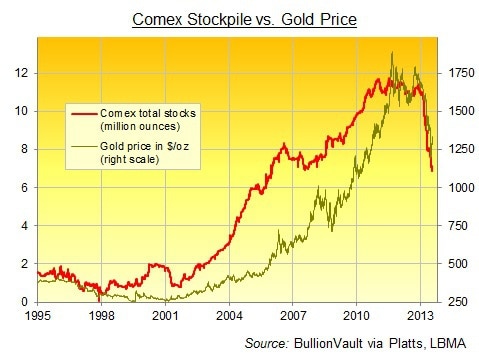

And in this article Miguel Perez-Santalla of BullionVault outlines how warehouse stocks usually rise and fall with the gold price:

“A main factor in the gold market is that typically, when gold registered stocks are falling, that means the gold price is falling too. This indicates that gold is being better used off the market, instead of being held on the exchange. As for the total quantity of eligible and registered stocks in CME warehouses, it also tends to track prices higher and lower. When gold prices rise, it attracts more investors, who make use of gold by holding it as a store of value. This metal itself needs storing, and it’s important to remember that, as we saw above, the Comex warehouses are used to do just that, alongside their role in vaulting gold bars for futures contract delivery. The higher gold prices go, in short, the more people want to own it. So the more metal there will be held in warehouses on behalf of investors. And when prices fall, as they have in the last nine months and more, some owners of metal will find better-rewarded uses elsewhere, outside Western investment stockpiles, and converted for instance into the smaller kilobar products favored by Asian investors currently paying $20 per ounce over international prices in China.”

In a recent email Adrian Ash of BullionVault noted that:

“There’s plenty of metal for sale through London, heart of the wholesale market. BullionVault users have been adding to their aggregate holdings this month (the first time since end-March). And we’ve had no problems – as in none – sourcing Good Delivery metal to re-stock our trading float, ready to offer for sale, alongside offers from other users, on BullionVault’s live internet exchange for physical gold.”

So while this is referring to the London wholesale market we can probably infer that there would seem to still be plenty of gold in the New York COMEX inventories to satisfy current demand and it is due more to the falling price that “some owners of metal will find better-rewarded uses elsewhere, outside Western investment stockpiles”. Also while this metal has likely been flowing to China, COMEX stockpiles are still greater than the mid 2000’s.

The question then really is how much more gold will flow east and for how long?

It would seem quite a lot and for a while yet given the monthly reporting of imports into China via Hong Kong continues to remain high at around the 100 tonne per month mark as seen below.

And the other point about gold flowing east is that it’s not that likely to return in a hurry. Because unlike we westerners who buy with a view to sell for a profit, easterners buy gold as a time honoured store of wealth. So don’t expect to see it coming back any time soon. Much like our conclusion in last weeks article on backwardation and negative GOFO rates, our theory on this topic is not dissimilar. These falling stockpiles are indicative of gold leaving western investment stockpiles and heading east. It could be that central banks are in turn supplying gold via leasing, swaps etc as argued here by Alistair Maclead to keep stock levels up, but we can’t know that for certain. But even if Central Banks are, while the actual physical metal keeps leaving the western depositories for the east, there will still be a limit to how much Central Bank gold can be supplied to the market. Especially given that it is unlikely that this metal will return to the COMEX warehouses even if/when prices rise. So while the existing inventories suggest the gold futures and gold banking system may not be on the verge of collapse, this flow eastwards is indicative of likely problems to come, when there may not be sufficient registered stocks to meet physical delivery requests in the western futures market.

“Emancipation” of Gold Price?

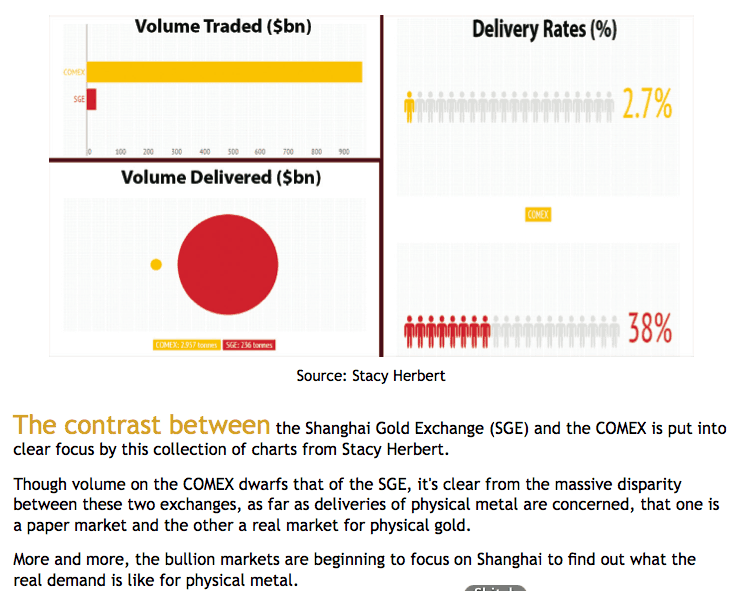

We may be heading towards what Jim Sinclair has referred to as the “emancipation” of the physical gold price from the futures price. That is…

“The emancipation will cause physical gold exchanges to take birth and to be the discovery mechanism for the price of gold… …With manipulation coming to an end the true value of gold will be discovered by the cash exchanges that are now taking birth. The advent of the cash spot exchanges around the world is the natural demise of the Comex set up as convertible and now being converted.”

This may well be evidenced by the difference in delivery rates of the Shanghai Gold Exchange and Comex seen in the chart below.

Sinclair continues…

“As long as one can buy spot, pay insurance, transportation and re-casted by Rand Refinery to Asian products sold profitably, the demands for real gold are ending the hay days or even existence of the futures exchanges.”

So more evidence pointing to a steady lessening of trust in the western gold futures market and another reason to be sure you have the real physical stuff yourself. What do you think? How significant are falling gold inventories? Let us know you’re alive and leave a comment below!

Pingback: Our Thoughts on Declining Comex Gold Inventories | Gold Prices | Gold Investing Guide

Pingback: 4 Reasons to be Bullish on Silver | Gold Prices | Gold Investing Guide

Pingback: Why Has the Gold Price Been Falling? | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide When Gold and Silver Go into Hiding and Why the Gold Must Keep Flowing