Gold Survival Gold Article Updates

August 14,2013

This Week:

- 50 Day Moving Averages Taken Out

- 4 Reasons to be Bullish on Silver

- Upcoming NZ Presentations from High Profile Precious Metals Speakers

- Latest on Backwardation

- COMEX Gold Stocks: 42.5 Owners for Every Ounce

50 Day Moving Averages Taken Out

We mentioned last week that the 50 day moving averages had been firm resistance all year for both metals. And on Friday in our daily price alert email noted:

“Looking at the NZ Dollar silver chart, the moving average has been steadily falling all year and the price has so far not managed to get above it. But conversely NZD silver has also managed to stay above support around $24.50 so we have very compressed pricing which means we will see a break in one direction or the other very soon.”

(Learn more about Daily Price Alerts here)

Well that happened yesterday following a big move up on Monday, with silver now noticeably above the 50 day MA for the first time this year and now looking to test the next level of resistance around $27.50.

This morning the price sits at $27.02 compared to way back down at $24.66 last week, a massive 9.57% move in a week.

While gold is also up sharply from last week at $1662.27 versus $1617.82 in percentage terms it is up nowhere near as much as silver at just 2.75%. Gold also is only just above the 50 day moving average which it has managed to do multiple times in the past few months without actually getting firmly above this important technical level.

So it will take a little more time to see if gold can climb and hold firm above this level.

4 Reasons to be Bullish on Silver

In the last few days we have noted a few points which on their own may not mean much but together could be important positive indicators for silver. These are:

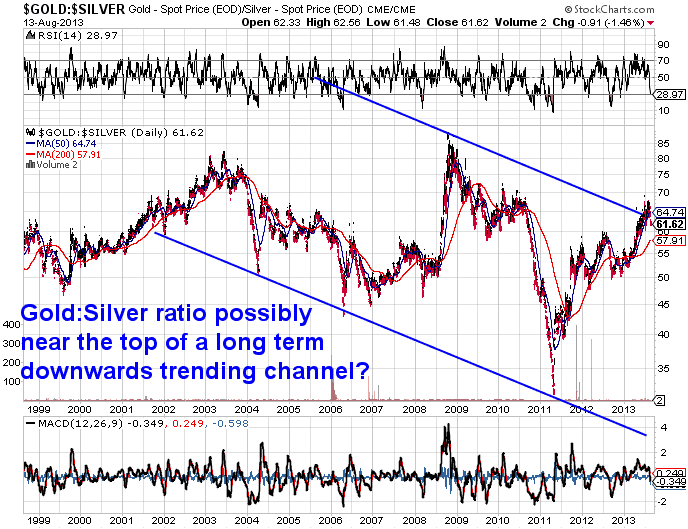

1. As already noted silver has been stronger than gold. We’ve seen this happen in the past around bottoms. Silver often falls faster and sooner than gold but then can lead gold out of a bottom too – could this be happening now? We last posted this chart of the gold to silver ratio (the number of ounces of silver it takes to buy one ounce of gold) back on June 19th when it sat at 63. Since then the ratio climbed higher to around 68 but over the past few days has dropped back down to 61.

As it shows there is a lot of downside for the ratio which means upside for silver.

2. The gold and silver mining stocks have been leading and outperforming the metals themselves. The last few days have seen some double digit moves for many mining shares globally. Again this can often be a positive sign and indicate a turning point.

3. Silver has been rising quite stealthily with little mention in the mainstream. The markets like to run with the fewest people on board and the fact we’ve heard little mention of silver lately is probably a positive factor.

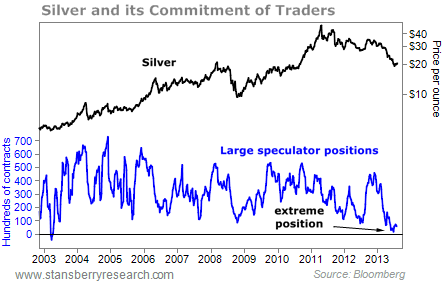

4. Speculative trading funds hold historically low net-long positions while producers and consumers, on the other hand, are massively long. From the Growth Stock Wire:

“At market extremes, speculative funds often lean heavily toward one side of the market – and it’s a good idea to bet against them.

In the 10-year chart below, you can see that speculative trading funds hold the lowest amount of bullish bets in 10 years.”

Silver has been trending higher so if this continues “the speculative funds that are now massively short the metal will rush in to buy in order to cover their short positions. That will drive prices higher. A rally back to $28 per ounce isn’t out of the question.” They then make the point that “Since silver is just off its recent lows, there’s a compelling risk/reward trade right here.”

News Flash: High Profile Speakers on Precious Metals coming to NZ

Here is some advance notice of upcoming visits to Auckland and possibly Wellington by high profile and well known precious metals names.

Our friend Louis Boulanger has organised for Ronald Stoeferle – writer of the excellent “In Gold We Trust” report – to be in Auckland for a late afternoon presentation on Saturday 14 September .

Then Louis has Chris Powell, Secretary and Treasurer of GATA (Gold Anti Trust Action Committee) lined up to be here on Monday 14th October before heading to Sydney for the Gold Symposium later that week.

Likewise John Butler writer of The Golden Revolution: How to Prepare for the Coming Global Gold Standard, will also be at the Sydney Gold Symposium and then will most likely also be here in NZ after this for at least one public event.

A bit of an all star line up and you don’t have to fly across the Tasman to see them! So pencil those dates in your diary. We’ll have more details for you very soon. It will be a great chance to mix with some other like minded people too – all too rare in the world of precious metals where odds are you are still on the lunatic fringe according to most of your friends!

Latest on Backwardation

A couple of weeks ago we wrote about gold backwardation and the negative GOFO rate, and noted that it depends on who you listen to as to what the definition of backwardation in gold is and therefore how significant it was. Some say it’s when the spot price is higher than the nearest futures price. While others say its when a near futures contract price is greater than a more distant futures price (read our article if this is all greek to you!). This week GotGold writer Gene Arensberg noted that:

“Not only is the spot or cash price (the price for gold sold for immediate delivery) trading above the near active futures contract, but we are now seeing the near months’ contracts trading at higher prices to months thereafter in the front part of the futures strip.”

So as we are now seeing near months contracts at higher prices than later months, we have backwardation in gold regardless of whose definition you go by.

Gene Arensburg’s reply to a question from a reader was also noteworthy we think. The readers question was:

—–

“I have read that when you got closer to delivery for the nearest contract, you were supposed to be careful using the front month contract to assess for backwardation as traders move to the next contract out in time. In other words, if you ignore the August contract, there is no backwardation in the series you posted (although it is close). Any thoughts on this and at what point during a month you should stop using the nearest month contract or if you should stop at all?”

—–

Arensberg said in reply…

—–

“As far as I am concerned even when cash or the spot contract for gold trades higher than the near active (now Dec) is enough to call it backwardation.

Using Aug is an academic exercise for most of us, but I think it suggests that people are willing to pay a premium over Oct, Dec and Feb to gain one of the few remaining (2476) Aug contracts not already cleared.

If normal the contracts would increase in price going out in time (normal contango). Instead, using the offer as a guide, in the screen shot above, Dec is discount to Oct, which is par with Sep (not a [sic] important month), which is discount to Aug: (The blue line is where it is because it is the first contract higher than spot at the time of the photo.)

Spot (not shown)~$1289

Aug $1288.50

Sep $1287.80

Oct $1287.80

Dec $1287.60

Feb $1288.40

Gold is different from most all other commodities in that it only very, very rarely trades at ANY backwardation. And when it does, it usually self corrects within seconds or minutes. What is noteworthy about this episode, is that it has continued for quite a while UNCORRECTED, at a time when the GOFO rate in London has been negative for an entire month. I do not know of any other time in LBMA history that has occurred.

SOMETHING HAS CHANGED. Something is causing stress to the gold clearing and futures markets.

Use August or not as you wish, but until it goes off the board it is useful as the first contract still tradable after the spot contract. Regds, GA”

—–

As Arensburg points out something a bit strange is going on here with this very rare event.

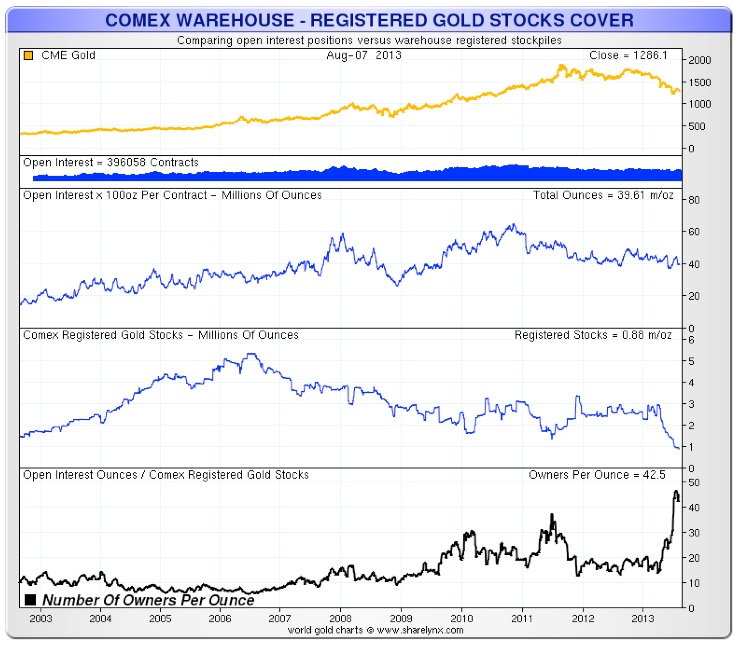

COMEX Gold Stocks 42.5 Owners for Every Ounce

Following on from our article last week looking at the significance or otherwise of declining gold stockpiles on COMEX, this week we spotted this chart from Nick Laird’s Sharelynx. It plots COMEX registered Gold Stocks versus Open Interest in futures contracts and shows that there are 42.5 “owners” for every ounce of gold in the COMEX registered stocks.

Of note is the fact this reading of 42.5 is at an all time high. So this too is an indicator that something not altogether normal is going on in the gold market. The level of trust in the futures market may be on a steady decline.

This Weeks Articles

From “our favourite billionaire” Hugo Salinas Price. This piece is short and acts as a bit of an introduction to a much older article of his on the topic of global trade and structural imbalances as a consequence of the current credit based global monetary regime…

From “our favourite billionaire” Hugo Salinas Price. This piece is short and acts as a bit of an introduction to a much older article of his on the topic of global trade and structural imbalances as a consequence of the current credit based global monetary regime…

Some Thoughts on ‘International Reserves’

In case you had any doubt as to the effects of “quantitative easing” and the existence of the Fed itself, the following has “quantitative analysis” showing exactly what the impacts have been…

In case you had any doubt as to the effects of “quantitative easing” and the existence of the Fed itself, the following has “quantitative analysis” showing exactly what the impacts have been…

The Federal Reserve Relies on a Flawed Economic Model

Finally this article shows the money supply has grown massively since 2008, however there is still no inflation in the price of consumer goods to show for it (well at least according to official government numbers anyway). Because banks are paid interest by the US Federal Reserve to hold deposits for them, the banks have taken the cheap money from the Fed and used it to repair their balance sheets (with the help of not having to mark their “assets” to market), rather than lending money out to businesses. Most likely because the banks fear the state of the economies into which they would lend, they prefer to have keep this new money on deposit with the Fed instead of lending it out.

So that is probably why in answer to the question “how long do you think it will take for price inflation to become obvious?” Terry answers “Within twelve months after you hear that the economy has at last fully recovered from the recession.” i.e. this extra money will find its way into the global economy in much larger doses than it has to date.

So that is probably why in answer to the question “how long do you think it will take for price inflation to become obvious?” Terry answers “Within twelve months after you hear that the economy has at last fully recovered from the recession.” i.e. this extra money will find its way into the global economy in much larger doses than it has to date.

A Monetary Master Explains Inflation

Well, we’re starting to wonder if the threat of further significant downside has receded somewhat now. Will this prove to be the case? Only time will tell. If you think it could be a lower risk entry point for silver (or gold) then get in touch and we can let you know your options.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| The Federal Reserve Relies on a Flawed Economic Model |

2013-08-08 21:16:26-04 2013-08-08 21:16:26-04 |

In case you had any doubt as to the effects of “quantitative easing” and the existence of the Fed itself, the following has “quantitative analysis” showing exactly what the impacts have been… The Federal Reserve Relies on a Flawed Economic Model By Lacy H. Hunt, Ph.D., Economist In May 22 testimony to the Joint Economic […]

| Some Thoughts on ‘International Reserves’ |

2013-08-08 23:36:51-04 2013-08-08 23:36:51-04 |

Here’s the latest from “our favourite billionaire” Hugo Salinas Price. This piece is short and acts as a bit of an introduction to a much older article of his on the topic of global trade and structural imbalances as a consequence of the current credit based global monetary regime. If you like this piece we […]

| A Monetary Master Explains Inflation |

2013-08-11 18:43:25-04 2013-08-11 18:43:25-04 |

The term “inflation” can be confusing as it has different meanings to different people. Here’s one definition along with what we can expect in regards to the level of inflation in the future, and an interesting theory as to when to expect inflation to rear its head… A Monetary Master Explains Inflation By Terry Coxon, Senior […]

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1662.27/ oz | US $1322/ oz |

| Spot Silver | |

| NZ $27.02/ ozNZ $868.73/ kg | US $21.49/ ozUS $690.90 / kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$943.34

(price is per kilo only for orders of 5 kgs or more)

(delivered and insured)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Gold Prices | Gold Investing Guide Why are US Bonds being sold?