This Week:

- Increased Stagflation in the US and Increased Price Inflation in China

- Negative Interest Rates Put the Global Economy on a Razor’s Edge

- Rickards: Why Gold Is Going To $10,000

- More on Helicopter Money and “Universal Basic Income” in NZ

|

Have you not received our emails lately? We’ve had some issues with false spam classifications lately (even we only email people who have signed up to receive our emails). So a few people haven’t been receiving them. If this email is in your spam folder mark it as “safe” or “trusted” or “move to inbox”. If you use gmail you may see that it is sent via “weliketodeliver.com“. This is just our email service company and so the message can still be trusted. Any concerns just email us back or give us a call. Quotes, Ordering or Questions Call 0800 888 465 and speak to David or reply to this email with any comments |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1771.72 | – $53.87 | – 2.95% |

| USD Gold | $1225.50 | + $4.00 | + 0.32% |

| NZD Silver | $22.00 | – $0.81 | – 3.55% |

| USD Silver | $15.22 | – $0.04 | – 0.26% |

| NZD/USD | 0.6917 |

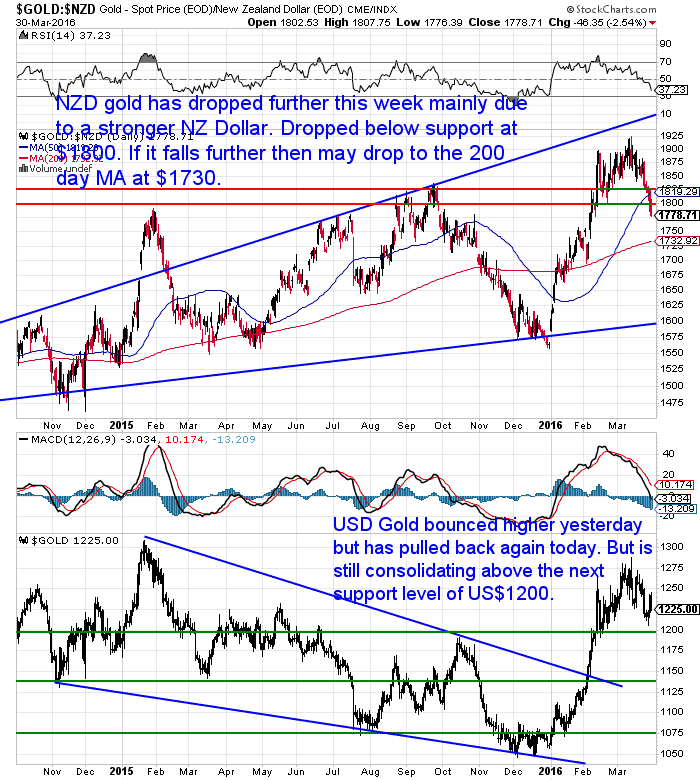

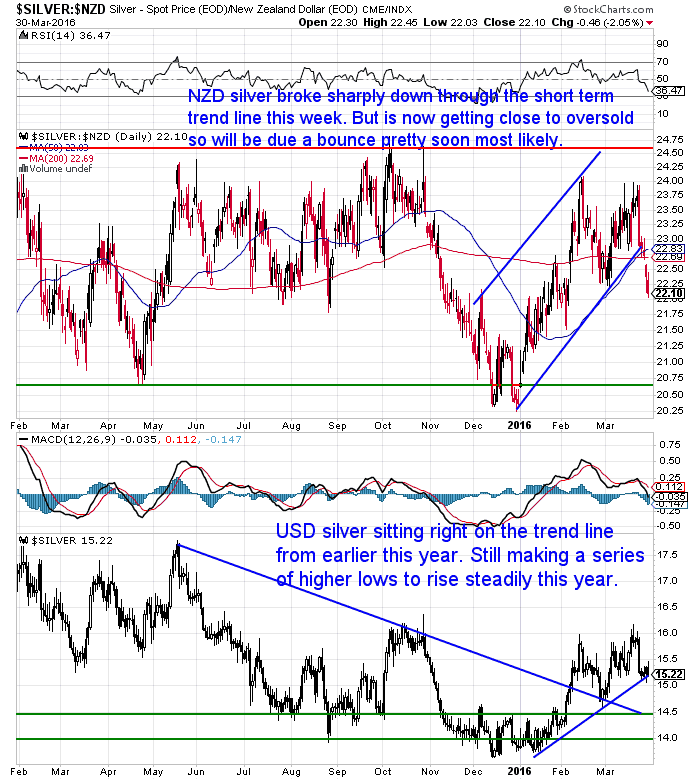

The correction in gold and silver continued this week with both metals down similar percentages in NZ Dollar terms.

NZD gold dropped through the $1800 level. If it keeps falling the 50 day moving average at around $1730 is the next mark to look for.

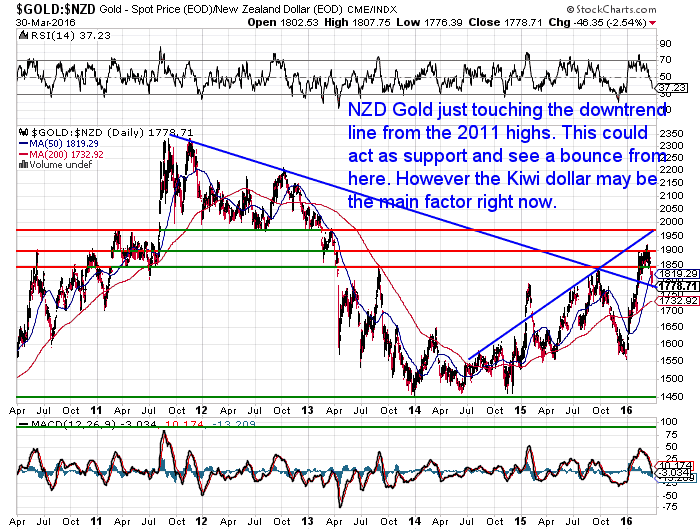

However in the longer term chart below, you can see it sits right on the downtrend line from 2011 now. So this could well act as support and we see a bounce from here.

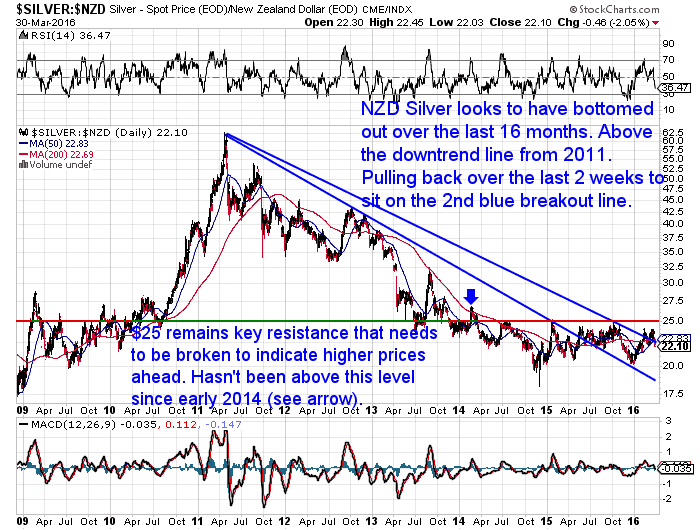

NZD silver broke sharply through the short term uptrend line this week. Like gold it is getting close to oversold now though. So may not drop too much further from here.

As you can see in the long term chart below, anything from here down may well be a good entry point in the long run as NZD silver appears to have bottomed out.

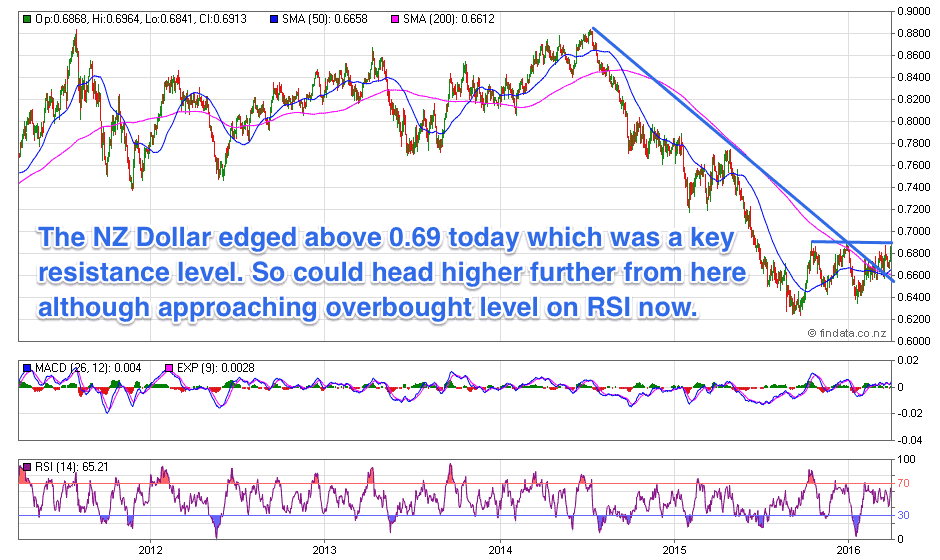

The Kiwi Dollar has been the main driver of local metal prices here this week. As can be seen by the disparity in the percentage moves between the US Dollar and NZ Dollar metal prices in the table above.

As is often the case markets surprise. With the Kiwi dollar gaining strength even after the recent RBNZ interest rate cut. Today the dollar has just edged above the key 69 cent level so we could well see higher prices ahead. Although it is approaching overbought levels in the RSI indicator now.

Increased Stagflation in the US and Increased Price Inflation in China

It seems Fed Head Yellen’s speech yesterday which “sparked a gold rally” according to Bloomberg, also sparked an NZ Dollar rally. Yellen intimated that the Fed might have to keep rates close to zero for longer than they originally thought. Surprise, surprise.

As the Daily Bell noted, this:

“…sets the stage for increased stagflation in the US and increased price inflation in China.”

“Expanding US growth via monetary means has created asset bubbles in the US but not much real economic growth.

And piling more yuan on the fire in China is only going to make Chinese problems worse in the long term. More resources misdirected into empty cities and vacant skyscrapers – all to hold off the economic day of reckoning that will arrive nonetheless.”

The article also discusses the real likelihood that central bankers agreed at the January G20 meeting to coordinate a weakening of the US Dollar.

We agree with their conclusion…

“The real idea is to make people so miserable that they will accede to further plans for increased centralization of monetary and governmental authority.

…Conclusion: As we have suggested before, the reality for the US going forward is increased and significant stagflation. Low employment, high price inflation. On the bright side, this will push up the prices of precious metals and real estate. Consider appropriate action.”

Read more: Could Stagflation Happen Again?

Jim Rickards also commented this week on the movement in currency cross rates. Agreeing that it was also a co-ordinated move.

“[T]he Fed weakened the dollar with their dovish comments at the March 16 meeting. (Again, by doing nothing and signaling slower tightening, they changed expectations, which is a form of ease.)

With Europe and Japan tightening and the U.S. easing at the same time, nobody noticed that China effectively devalued, because the yuan/dollar cross-rate was unchanged. Neat!

Europe is a larger trading partner to China than the U.S., so the yuan/euro cross-rate is actually more important to the Chinese economy. What happened under the Shanghai Accord was a coordinated devaluation that went unnoticed because China took no official action and the yuan/dollar cross-rate was unchanged. It was an invisible devaluation of the yuan.

Japan and Europe were the losers in this round of currency manipulations. Japan was the winner in 2013 with Abenomics. Europe was the winner in 2014 with negative rates and Euro QE. Now it was the turn of China and the U.S. to get a lift.

The U.S. and China are the world’s two largest economies. If they go down, the whole world goes down with them. Both economies were showing signs of weakness. It was time for Europe and Japan to give it up to China and the U.S. That’s the legacy of the Shanghai Accord.”

Speaking of Rickards we’ve posted a great interview with him on the website this morning where he discusses his new book out next month:

Speaking of Rickards we’ve posted a great interview with him on the website this morning where he discusses his new book out next month:

Rickards: Why Gold Is Going To $10,000

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $179 you can have 4 weeks emergency food supply.

Learn More.

—–

Negative Interest Rates Put the Global Economy on a Razor’s Edge

We featured some of an article by Satyajit Das back in February, Satyajit Das: 2 Outcomes – “Managed Depression” or “The Mother of All Crashes”.

He’s back today with why negative interest rates are such a problem. Here’s a condensed version – full article available at the link below.

Negative Interest Rates Put the Global Economy on a Razor’s Edge

“Several of the world’s central banks—the ECB, Switzerland, Sweden, Japan—have started a risky experiment with negative interest rates. The intent is to reduce debt by confiscation and transfer wealth from savers to borrowers. Traditional means of bringing excessive debt under control have failed.

Negative yields mean that if an investor places a deposit with a bank, at maturity the investor receives less than the original investment. In effect, the depositor pays to place money with the bank.

Negative real rates entail return on the amount invested but loss of purchasing power because inflation rates are greater than the return. Negative nominal rates involve a guaranteed loss of capital invested.

So far, negative rates have not boosted growth or inflation. Instead the policy is creating serious economic and financial distortions. The lack of effect on the real economy reflects the failure of these policies to materially increase consumption and investment. Negative rates also may create deflationary pressures.

Moreover, reducing excess reserves has proved difficult because of the lack of demand for new credit. In part, this is because most banks have not passed the negative rates on to the majority of customers.

Lending rates have not come down in line with official rates. Concerns about profitability, compounded by new higher capital and liquidity regulations, have reduced banks’ willingness to lend.

Most economies with negative rates are caught in a credit trap. Credit demand is weak and credit supply is constrained. Policy measures such as negative rate and additional QE are increasingly ineffective.

Negative interest rates are not helpful with managing exchange rates; they change the role of default or bankruptcy in debt markets. As shown in Japan, they create zombie companies and industries by distorting the cost of capital and finance encouraging malinvestment.

Negative rates delay essential restructuring that removes the detritus of previous crises. They restrict the supply of credit to the wider economy. Misallocation of capital deepens the malaise, and an ultimate resolution to this global problem becomes even more costly and difficult.”

More on Helicopter Money and “Universal Basic Income” in NZ

Last week we had a headline, “How about NZ’s own form of “helicopter money”?” Which look at a policy by Labour to trial a “universal basic income”.

In response to this we received an insightful reply from a reader who thought we might be a bit “askew” on our understanding of helicopter money.

“As far as I’m aware, for a thing to be helicopter money it has to be directly created by the central bank. If labour do their “free money” there’s no indication it won’t be funded by taxes and debt. As much as the cheapness of that debt is linked to a central bank printing money to manage the OCR, it’s not helicopter money.

Helicopter money comes from the suggestion that a central bank can stimulate the economy by creating money and distributing it directly (facetiously, from a helicopter).

At present, they only “loan” the money, or buy stuff with the apparent plan to sell it again.

I think. Could be wrong. The whole scheme is deliberately unclear.”

He was right in that the definition of helicopter money is that Central banks would print and either directly fund government debt to fund infrastructure spending or other means of getting currency directly into people’s pockets. Here was our reply:

“Yes we’d have to admit perhaps we are drawing a long bow to call it helicopter money.

However we more wondered whether it is just an early warning sign. We are still a long way behind the rest of the world with higher interest rates instead of zero or negative like many other nations. But with rates still being cut here we think we are on the same track, just further behind.

Also negative interest rates are spreading quickly and the topic of helicopter money has sprung up and is being discussed widely all of a sudden as well. Whereas a year ago it wasn’t mentioned in the mainstream.

And as per the Casey Research article we posted, the “basic income” idea has suddenly gained a lot of traction:

“European politicians are heavily pushing this policy.

-

Finland wants to pay its citizens around $1,000 a month.

-

The Netherlands and the U.K. have also proposed dishing out free money.

-

In Switzerland, there’s a proposal to hand out around $2,800 a month to everyone. This one is surprising since the Swiss are generally sensible about money.

-

The basic income virus has also infected Canada, which recently announced a pilot program in Ontario.”

This week we read another article from the Daily Bell which agreed with our thinking on this topic. Here’s an excerpt, but we suggest you read the full article as it ties in the ideas of negative interest rates, cashless society, and universal basic income nicely.

“When the mainstream media trumpets something all at once, we have learned from experience that it signals something of significance.

Central bankers are changing the institution dramatically and offering consumers a good deal more “benefit” from the central banking mechanism itself.

This means a push for “basic income.” That means – quite literally – giving away money to whole populations.

That’s what central bankers are setting up to do via “helicopter money” and the issuance of “electronic” money.

Once the process is in place, governments can pass the enabling legislation. Of course, no one is admitting it right now. The reason for helicopter money and electronic money is to stabilize the monetary system.

But that’s not really true. This is “directed history” at work.

From the article:

Faced with political intransigence, central bankers are openly talking about the previously unthinkable: “helicopter money”.

A catch-all term, helicopter drops describe the process by which central banks can create money to transfer to the public or private sector to stimulate economic activity and spending.

Long considered one of the last policymaking taboos, debate around the merits of helicopter money has gained traction in recent weeks.

The article goes on to remind us that top ECB banker Mario Draghi just this past week “refused to rule out the prospect” of helicopter money.

Is all of this a coincidence? As we just reported HERE, central banks have embarked on a campaign of further monetary control.

The idea is that negative interest rates, cashless societies and a “basic income” will combine to make central banks a good deal more integral to people’s daily lives than they are now.

For instance, we’ve reported on RSCoin, which is a central bank variant bitcoin and is being actively considered for use by the Bank of England. Other variants are being considered elsewhere.

These central bank bitcoin variants are likely to be issued directly by the central bank, which will receive payment in turn directly from buyers.

Thus central banks will go into the business of commercial and consumer banking.

Combine a banking bitcoin with helicopter money and you essentially have a distribution method for a “basic income.”

And a basic income may be necessary if central banks continue to offer negative interest rates. It’s a way to compensate people for increasingly ludicrous and costly central banking policies.

We mentioned that the third part of this central bank strategy is the basic income, but we never fully explained how it fit together.

Cashlessness is a program generated by negative interest rates because people will try to take their funds out of banks and put their wealth in cash.

So central bankers must confiscate cash.

People will be increasingly incensed by cash confiscation and negative interest rates. But by offering people a “basic income,” central banks may be able to alleviate anger.

After all, people will see the money as “free” for the most part. In such an instance, people will also be likely to accept reasons that central banks have confiscated cash and imposed negative interest rates…

Conclusion: Bribing the public with “free money” to ignore other authoritarian actions – like confiscating cash – is a terminally corrupt concept. The system is growing worse at an exceedingly rapid pace and will certainly fail, sooner or later, with disastrous consequences. Look to yourself, and to your friends and family for the lifestyle and living solutions you need, not centralized, bureaucratic programs – no matter how tempting they seem.”

That sums up what we were thinking perhaps much better than we could state!

This week there was an interview with Labour’s Grant Robertson on this topic. The main thrust of the argument for a basic income from what we could gather is that more and more jobs are being lost due to automation and technology and so we need something to safegaurd against this.

Of course don’t expect anyone in government to discuss financial repression and the underground partnership between central banks, governments and global corporates (banks in particular) that enables this.

As the global economy continues to stagnate while central bank policies lead to higher debt levels and asset price bubbles, it will only get worse for the average man and woman. Odds are that sooner or later New Zealand will follow suit. Granted we have a couple hundred more basis points in interest rates to go before we need to get more “inventive”. But we think these ideas being floated globally are serious warning signs.

If you haven’t yet followed the advice of the Daily Bell and taken “appropriate action” with precious metals and real estate, it’s not too late especially with precious metals still (unlike real estate) a long way from their highs.

Also along with looking “to yourself, and to your friends and family for the lifestyle and living solutions you need, not centralized, bureaucratic programs – no matter how tempting they seem.”

We might be able to help you directly with the “lifestyle and living solutions you need” – although now that we’ve mentioned it it’s an area we are contemplating. That is how we can connect the many readers and customers of like minds that we have? If you have any suggestions of what we could do then email us back.

But for now we can assist with the precious metals side of things! Get in contact if you have any questions about purchasing.

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,660 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[Now with FREE delivery] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

Unsubscribe | Report Abuse

|