We keep an eye on what is happening with Bitcoin and in particular the technology behind it – the “blockchain” – as it could have significant impacts on society.

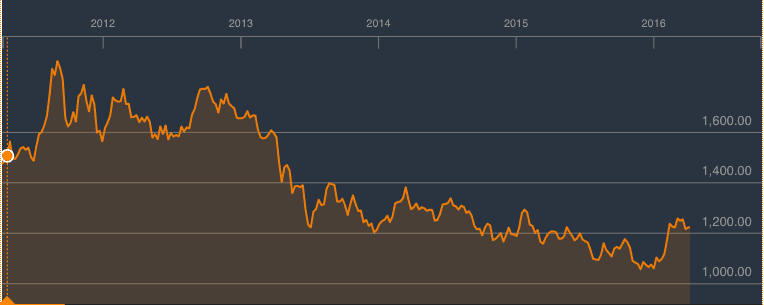

Bitcoin has been rising of late, interestingly at the same time as gold and silver. We came across the post below which echoes some the thoughts we’ve written about back in 2012 before we knew too much about bitcoin (see The Gold Standard: What Do We Think About it?).

In it Chris from Capitalist Exploits comments that we won’t see a return to a gold standard but makes an argument for why gold and Bitcoin may well work together (and rise together) in the future…

Wishes Aside, Gold Is Going To Fly

By Chris via Capitalist Exploits

Sure, it may just go to $650 an ounce first, which incidentally would be awesome for those of us who love going long asymmetry.

Rest assured however, when the wheels truly come off of what is easily the craziest monetary experiment of modern times, there will be no stopping gold from running.

A lesson I have learned (there have been many), and one that I’m particularly keen not to relearn, is that it’s dangerous to let emotions influence investment decisions.

It’s easy to get emotional about the shambles central bankers have made of our world.

It’s easy to be fearful of the consequences yet to be experienced as a result of their actions.

The world is more connected than ever before. This connection has brought positives such as increases in international trade, specialisation of resources and skills, and has certainly helped drag many out of poverty. The flip side is that what central bankers do has a truly global impact, and that impact is often harshest for those that can least afford it.

When Yellen, Kuroda, and Draghi manipulate interest rates lower they affect the cost of capital globally, and this includes the little guy in Dhaka buying an apartment, the merchant in Ghana exporting cocoa to Europe, or the tourism operator in Thailand marketing to Russian clients. Asset prices everywhere are affected by these clowns’ actions.

It’s no coincidence that the three culprits mentioned above are running the central banks of countries which also sport the most unsustainable patterns of expenditure and consumption imaginable, but they’re not the only guilty ones!

Meanwhile, some of the world’s most successful investors see the writing on the wall.

When questioned about this, Stanley Druckenmiller, the hedge fund manager who has compounded money at an annualised 30% return for 25 years had this to say:

“And when I look at the current picture of expected tax revenues combined with benefits promised to future generations, this is the most unsustainable situation I have seen ever in my career.”

Druckenmiller’s concern lies with the demographic trend in the United States and the growth in entitlement spending. As these two opposing forces have converged the response has been to actually increase expenditures by issuing more debt. The exact opposite of what any reasonable person would do.

This completely unsustainable path is prevalent not just in the United States, but even more prevalent in Japan – with Europe not far behind.

Looking back, historians will reflect on this era, scratch their heads and say to each other, “How did the populace let a tiny few create such a massive disaster… right in front of their eyes?”

They will further marvel at how this path was not followed by just one major economic power, which would have been bad enough on its own, but by all of the world’s major economies. It’s as if the entire world collectively went insane.

A “Popular” Solution?

A popular solution amongst those who realise the problem is to bring back the gold standard. That’s unlikely at best, and in truth it’s not a well thought out idea.

I can see the appeal. A government who’s spending is limited by having to back its currency issuance with physical gold reserves is a government limited to what it can tax and borrow.

Why then am I against it?

I’m against it for the same reason that the exchange rate mechanism was a terrible idea. A government should never be involved in fixing the price of anything. Whenever it does so it does a spectacularly poor job of it; imbalances are built up, inefficiencies increase and everyone but the political class suffers as a result.

The gold standard is a terrible idea for the same reason that fixing the price of wheat by the Soviets was a terrible idea.

Remember, a gold standard involves a fixed exchange rate policy, where the government buys and sells gold at a fixed price. I ask you: Why should we let the government set the price of anything?

A Better Solution

A system where participants are free to choose what currency they use is of course a free market. This can happen by decentralising the process of currency issuance, which would simultaneously compel any issuers of currency to compete on an even playing field.

Imagine you and I could issue our own currency. This currency can be backed by our assets, gold, real estate, seashells, whatever we choose.

Imagine you and I could safely and securely transact our assets without the need for doing so using any government issued currency as a medium.

I wrote about this concept in a recent post about how the blockchain is revolutionising finance.

With such a system it wouldn’t matter if a government printed up bits of paper because the market would mark up those currency units with a risk premium. That risk premium is of course interest charged or earned on the currency unit.

Any central bank printing up additional currency units relative to its peers would by punished by the market by way of being charged a higher interest rate on their currency units.

Market forces are always a better corrective measure than any fixed and centralised force can ever hope to be. If that wasn’t the case we’d all be speaking Russian… and clearly we’re not.

Today we have neither a gold standard nor any sound paper currency. What we do have is a technological revolution accelerating exponentially, allowing for an ever increasing ability to bypass existing archaic systems, such as government issued fiat.

Ironically, the accelerating force of currency debasement by central banks acts as a catalyst to the usage of alternative systems.

Gold and the blockchain may seem like strange bedfellows, but marrying the oldest form of money in the world with disruptive, revolutionary technologies will create additional liquidity.

With all the pieces of the puzzle being laid down on the board, what then is the catalyst for gold to be taken seriously again?

I think it’s important to understand that gold rises neither because of inflation nor deflation, but instead rises due to a loss of faith in government.

How is your faith in government faring?

This is the real reason for getting interested in gold.

We’re not going back to a gold standard, but we are lining up alternatives to the current lineup of ugly candidates, and that, my friend, involves gold. And, this time around it promises to become a default choice, as it once was.

At our upcoming Seraph Summit in Del Mar, California we will be hearing from a lineup of hand-picked experts, including exponential technology experts Kent Langley and Jeff Bone. Weighing in will be resource market heavyweight, Rick Rule.

As an investor it’s crucial to understand where we’re headed. I can think of no better way to experience a bit of “technological and financial enlightenment” than on the beach in sunny So Cal, mingling with some of the brightest (pun intended) people on the planet.

Remember to register here now, and I’ll see you in June!

– Chris

“If you don’t own gold, you know neither history nor economics.” – Ray Dalio, Founder Bridgewater Associates

This article originally appeared on Capitalist Exploits here.

You can now buy gold and silver with bitcoin. Check out this post to learn more about the pros and cons: How to Buy Gold and Silver with Bitcoin

Pingback: Our Thoughts on Bitcoin - Gold Survival Guide