Two Specials Today

Any quantity of local gold at spot plus 2.5% plus insurance and delivery

or

1oz NZ Mint Gold Kiwi coins at spot plus 2.75%.

Minimum purchase 10 coins

Delivered and fully insured for $18,366

Reply to this email or phone David on 0800 888 465

This Week:

- New Financial Reporting Rules: First Step to Capital Controls in New Zealand?

- High Unemployment & High Inflation Coming

- Billionaires Building NZ Boltholes

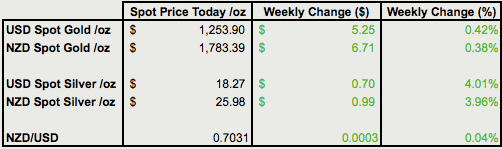

Prices and Charts

|

Looking to sell your gold and silver? Visit this page for more information |

|

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1713 |

| Buying Back 1kg NZ Silver 999 Purity | $793 |

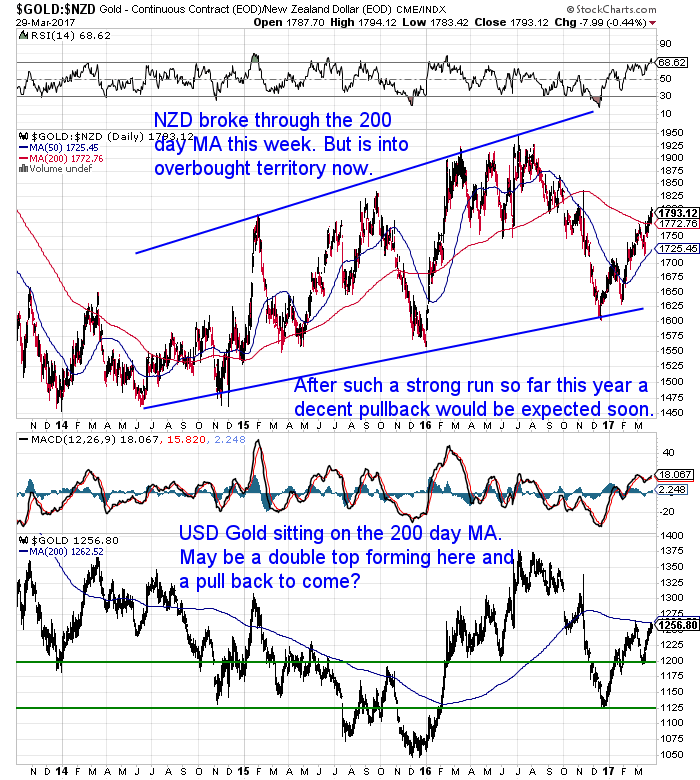

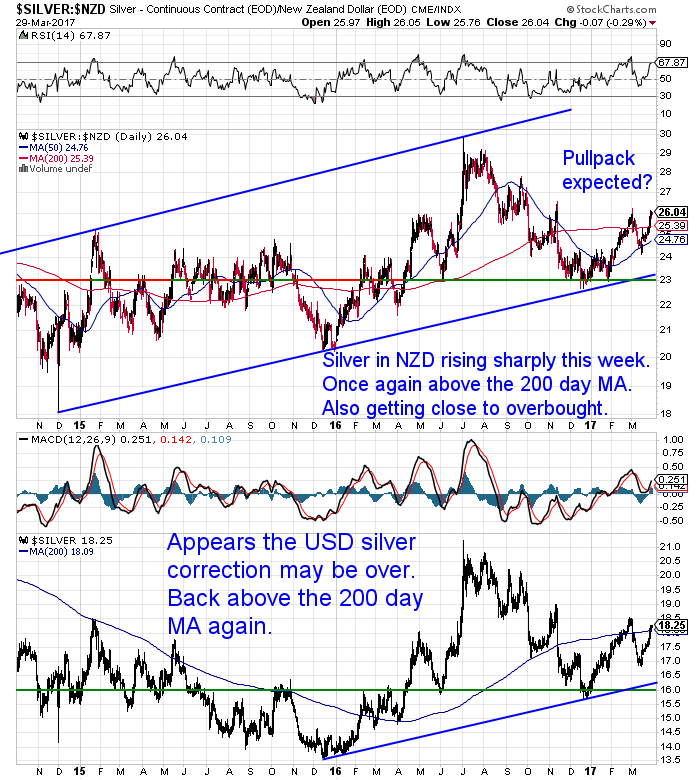

Gold and NZ Dollar Flat But Silver Flying

Sign up to our daily price alerts to save you keeping an eye on the price everyday.

New Financial Reporting Rules: First Step to Capital Controls in New Zealand?

New Financial Reporting Rules: First Step to Capital Controls in New Zealand?

Is This Further Evidence That Silver Manipulation May Finally Be Ending?

Ted Butler has updated his thesis from a few weeks ago that managed money traders appear to have finally woken up to the fact that they were being “played” in the silver futures market:

“…after decades of allowing themselves to be led in and out of COMEX silver futures contracts by their commercial counterparties, several managed money traders appear to have woken up to the fact they’ve been duped all along. A key component of the silver manipulation for the past 30 years has been the knee-jerk and mechanical reaction of the managed money traders to collectively sell whenever the commercials rigged prices lower beyond certain moving averages. Ditto for buying on rising prices.

The dependability of the managed money technical funds to obey commercially rigged price signals made the funds the true enablers of the manipulation. The commercials, mostly domestic and foreign banks, made their profits by getting the technical funds to buy high and sell low. Without the technical funds to maneuver at will, the commercials would have little reason to prolong the silver manipulation.”

But Butler believes the data shows these “managed money traders” are no longer being duped.

“From the time the COT data started tracking managed money traders around 2009 until the fall of 2013, the long position of managed money traders in COMEX silver rarely fell below the 20,000 contract level at the depths of price declines.”

Butler explains how the core non-technical fund managed money long position has grown massively since 2014. Climbing to reach 96,000 contracts on Feb 26.

The long position has since then fallen, after the recent sharp $1.50 selloff in silver, but still leaves over 80,000 contracts long in the managed money category. Some 4 times more than the long standing base of 20,000 in the years up to 2013.

So the point overall is that these traders are no longer being sucked into going short at the bottoms and long at the tops as they have done previously. Meaning the odds of silver being manipulated both higher and lower appear to have shortened lately. Silver will be interesting to watch. There is a lot of upside ahead potentially.

What Do Tech Billionaires Know that the Rest of Us Don’t?

Did you hear the reports this week of the significant number of foreign buyers of New Zealand land?

The Daily Mail in the UK did. They’ve written about how tech Billionaires are building boltholes here down under. Very interesting to see who is on the list and where they’re buying.

The question to ask then is what do they know that most of the rest of the world don’t?

Tech Billionaires Building Boltholes in New Zealand

Have you got your own silver or gold “bolthole” in place yet? If not, keep a close eye on the price in coming days as you may get a chance to “buy the dip” in both metals shortly.

There are still the excellently priced 1oz Gold Kiwi coins going.

This Weeks Articles: |

|||

|

|||

|

|||

|

|||

|

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.