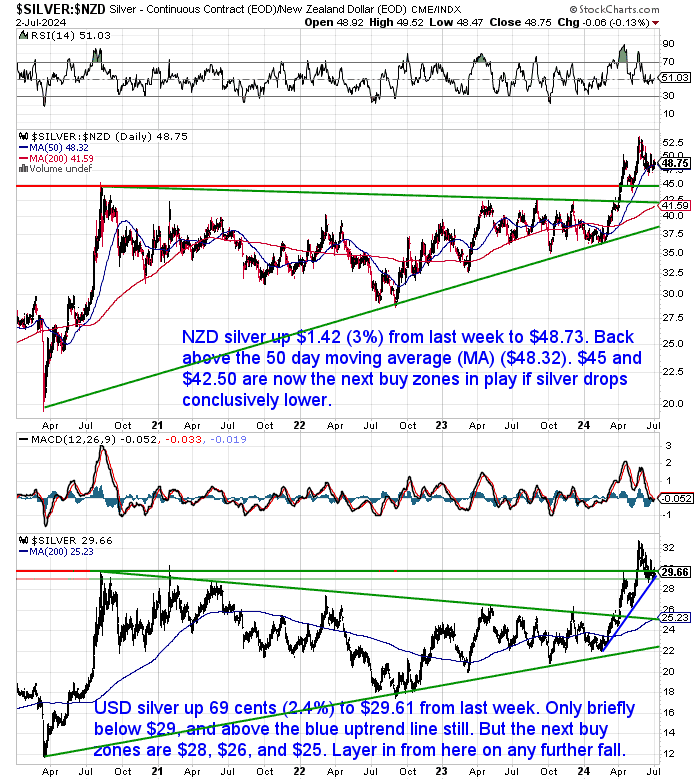

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3668 |

| Buying Back 1kg NZ Silver 999 Purity | $1448 |

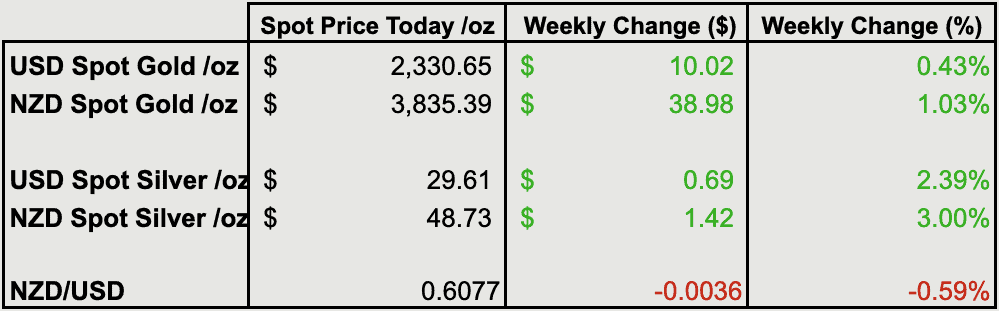

NZD Gold up 1%

Gold in New Zealand dollars rose $39 or 1% from a week ago. It is now back above $3800. Having risen up from the red-shaded region where gold gaped up in late March, today it sits just below the 50-day MA.

While in USD terms, gold is up $10 from a week ago and continues to hold above the key $2300 support line.

The RSI overbought/oversold indicator is right on neutral at 50, so to us it’s an even bet whether we go higher or lower from here in the short term. However in the long run this is likely just a short-term correction in a much longer run higher.

If gold does dip lower the next support levels are marked on the chart for both USD and NZD. Consider layering in with a purchase now and holding another few tranches in case of a further dip.

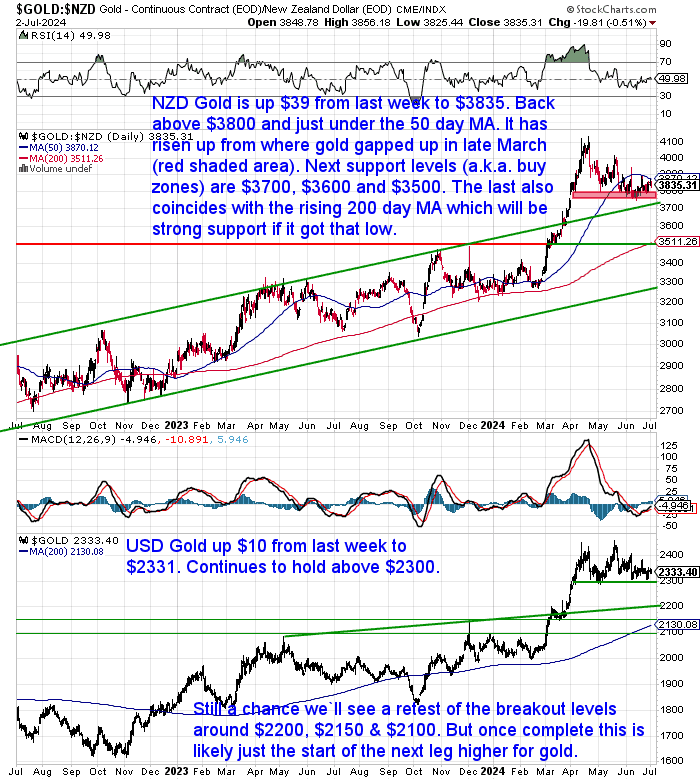

NZD Silver Jumps 3%

Silver bounced back harder than gold. NZD silver was up $1.42 or 3% from 7 days ago to $48.73. It’s now back above the 50-day moving average. It hasn’t broken conclusively below that line yet. If it does then $45 and $42.50 are the next buying zones to watch for.

While in USD terms silver dipped only briefly below the $29 support line. But so far it is holding above the blue uptrend line. In USD terms the next buy zones on any further fall would be $28, $26, and $25. Like gold, we’d suggest layering in from here as the direction is not really clear in the short term.

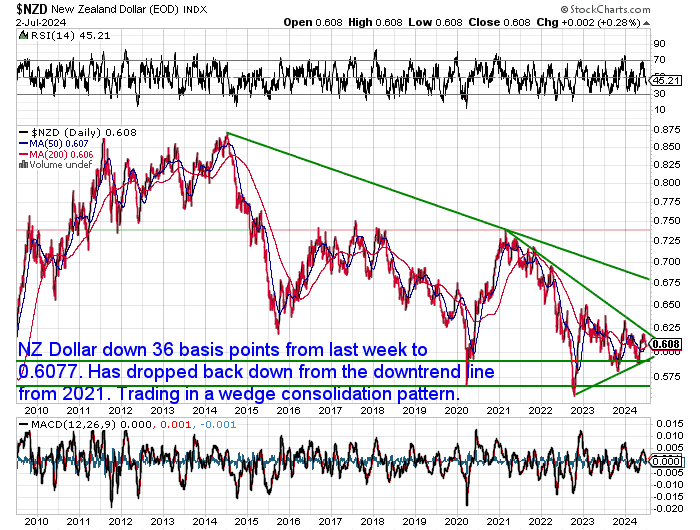

NZ Dollar Dips From Downtrend Line

The NZ dollar was down 36 basis points from last week to sit at 0.6077. Once again it dropped down from the 2021 downtrend line. But it is getting more and more compressed in the wedge or pennant consolidation pattern. In the coming months it will have to break higher or lower from here. Maybe higher?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Gold Price Rollercoaster: Does Seasonality Hold the Key in New Zealand?

Conventional wisdom suggests gold prices tend to rise during specific times of the year. This week, we explore the theory of gold seasonality and its potential influence on the New Zealand dollar gold price.

This week’s feature article investigates:

- The historical trends that support the concept of seasonal price movements in gold

- Whether these seasonal patterns hold true for the New Zealand gold market, considering the additional factor of currency exchange rates

- How understanding seasonality could potentially inform investment decisions

Curious if there’s a predictable pattern to gold prices in New Zealand, or if local factors disrupt the global trend? This article delves into the data and considers the potential benefits of using seasonality in your investment strategy.

Does Gold Seasonality Affect the NZ Dollar Gold Price? What About in 2024?

Become a Gold Survival Guide Partner

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Gold Survival Guide Q&A Call Recording: Analysing the Silver Breakout

In case you missed our recent Q&A call there is a recording available.

The theme was: “Analysing the silver breakout”.

We delved into various charts and looked at:

- Why this current breakout in silver is so significant

- What levels to look for as possible buying zones in the current consolidation or pullback

- Some potential price targets to look towards in the future

- Timing for these targets

- Plus we answered over 30 questions from our readers

Access the call recording below:

Q&A Call Recording: Analysing the Silver Breakout

Nearly 3/4 of Wealth Advisors Only Allocate 0.1% to Gold

In a world with more risks than ever, gold is still woefully under-owned:

“Despite the recent surge in gold prices, 71% of wealth advisors currently allocate only 0-1% of their portfolios to the metal. This likely marks…the resurgence of precious metals as crucial hedges against monetary and fiscal imprudence.”

Bank Analysts Turning in Favour of Gold?

The media plays a part in perpetuating the myth that gold is of little use in an investment portfolio. However perhaps just slightly this is starting to alter.

Mainstream Recognition of Gold

Interestingly, even mainstream outlets like CBS News have recently highlighted the benefits of owning gold, acknowledging its impressive performance. Bank of America analysts are predicting gold prices could reach $3,000 within the next 12 to 18 months, driven by non-commercial investment demand and continued central bank purchases.

It’s not just Bank of America analysts, Goldman Sachs Research is also now saying they expect gold to be higher by year-end:

“Gold emerged as the best commodity to serve as a potential hedge against inflation and geo-political risks. Goldman Sachs Research’s base case is that gold appreciates to $2,700/troy ounce by year-end.”

Of course, bank analysts’ projections often just reflect back on what recent moves have been. But nonetheless, in the past, these same banks had nothing but negative thoughts toward gold. So it does show a change in attitudes.

Nigeria Also Repatriating Gold Reserves

Now’s here’s a sign of the times headline for you:

Nigeria repatriates Gold reserves amidst concerns over US economy

“Amidst concerns over the deteriorating state of the US economy, Nigeria has taken a significant step by deciding to repatriate its gold reserves from the United States.”

Nigeria hold 21 tonnes of gold in total.

• The decision to bring back its gold reserves from American vaults reflects Nigeria’s desire to mitigate risks associated with the weakening US economy.

• By reclaiming control over its gold reserves, Nigeria aims to insulate itself from potential economic downturns and minimise exposure to external vulnerabilities.

You read that right, Nigeria is concerned about the US economy!

Just a month ago we reported that India was repatriating around 100 tonnes of its 822.10 metric tonnes in gold reserves from the UK back to its vaults in India. So they now hold around 50% at home.

“The freezing of Russian assets by Western nations has heightened concerns about the safety of assets held abroad. The RBI’s recent move to repatriate gold from the UK likely reflects these concerns.”

The source article above makes no mention of it, but perhaps Nigeria also has similar concerns to India? With Nigeria also considering joining BRICS it shouldn’t be a big surprise that they might move some assets from the West.

Have gold and silver bottomed? In our view, it’s still evenly balanced and we could still go a bit lower yet. However, today’s feature article shows that in buying now, history is well and truly on your side. As gold mostly rises from this time of the year until the end of the year. Silver is not quite as strong but still rises more than falls at this time of the year.

|

|||||||||||||||||||||||

|