Prices and Charts

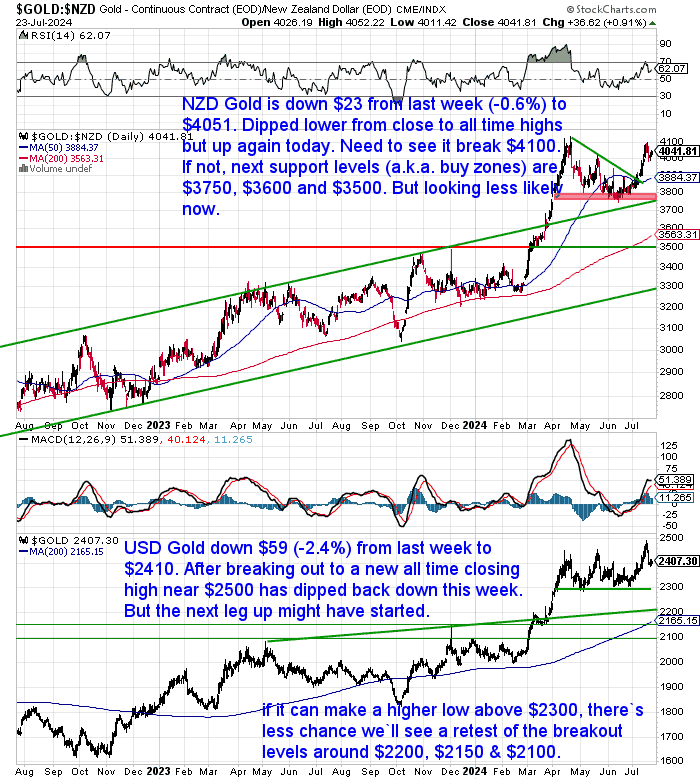

NZD Gold Dipping Down After Retesting All-Time High

Gold in New Zealand dollars is down $23 from 7 days ago. After getting up close to the all-time highs around $4100 it dipped down towards $4000 but is up again today to $4051. So we still need to see it break $4100. Otherwise, the next support level would be the 50-day moving average at $3884 currently. Below that but looking less likely would be $3750, $3600 and $3500.

While after hitting a new all-time high the previous week gold in USD dollars dropped $59 (-2.4%) to $2410. However, the next leg up may have started. We’re watching to see if it can make a higher low above $2300 now. As that will mean a much lower probability that we see a retest of the breakout levels at $2200, $2150 and $2100.

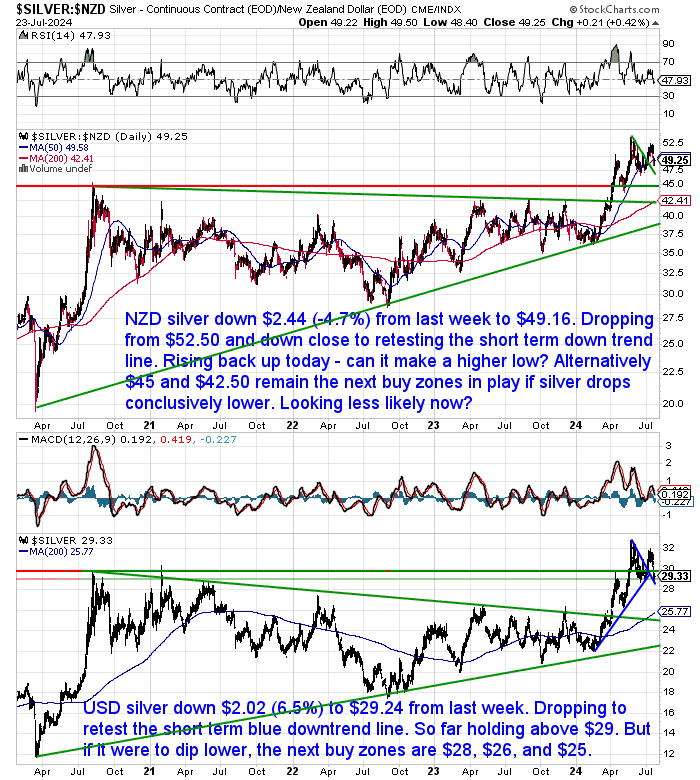

Silver Drops Sharply – Down 6.5%

Silver was hit much harder this week. In NZD terms it was down $2.44 or 4.7%. Dropping down from $52.50, it is close to retesting the breakout from the short-term downtrend line.But rising today so we’re wondering if it can make a higher low around here?

Otherwise, if it drops conclusively lower then $45 and $42.50 remain the next buy zones to watch for.

In USD terms silver was down $2.02 or a hefty 6.5% from 7 days prior. It has dropped right down to retest the short-term blue downtrend line. So far it is managing to hold above the $29 mark. But if it were to dip lower then the next buy zones to watch for are $28, $26 and $25.

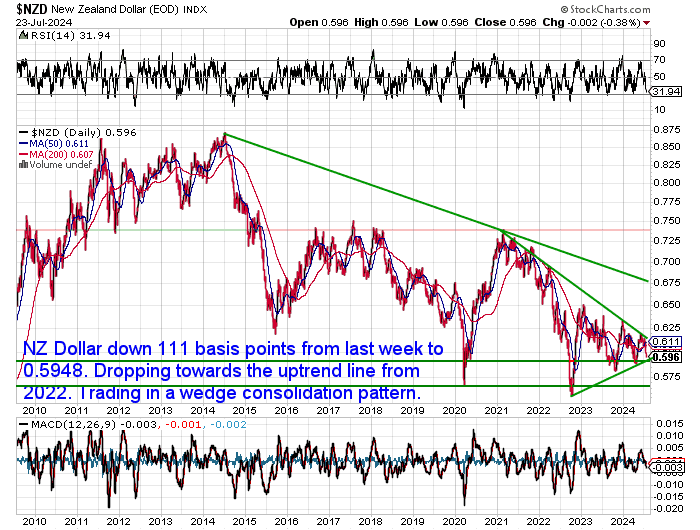

NZD Weakens Almost 2%

The New Zealand dollar is down 111 basis points from a week ago to 0.5948. It is once again closing in on the green uptrend line in this wedge consolidation pattern. Getting more and more compressed and will have to break out of this ever narrowing range soon. The weakening is likely on the back of expectations that the RBNZ will cut interest rates soon. “An OCR cut could come as early as next month, the ASB says.”

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Gold Rush! Now What? Cashing In on Your Gold After a Price Surge

Gold prices have been on a tear this year. But what if you’re already a proud owner of the precious metal? This week’s feature article tackles the question: will gold dealers be eager to buy back your holdings if you decide to sell during a price surge?

The article explores:

- Factors influencing the buyback practices of gold dealers in a rising gold market

- How supply and demand dynamics can impact the price you receive for your gold

- Strategies for maximizing the value you get when selling your gold

Intrigued by the potential to capitalize on the gold price surge, but unsure about the best time to sell? This article gives you valuable insights to navigate the gold buyback process and potentially secure a more profitable outcome.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Gold Survival Guide Q&A Call Recording: Analysing the Silver Breakout

In case you missed our recent Q&A call there is a recording available.

The theme was: “Analysing the silver breakout”.

We delved into various charts and looked at:

- Why this current breakout in silver is so significant

- What levels to look for as possible buying zones in the current consolidation or pullback

- Some potential price targets to look towards in the future

- Timing for these targets

- Plus we answered over 30 questions from our readers

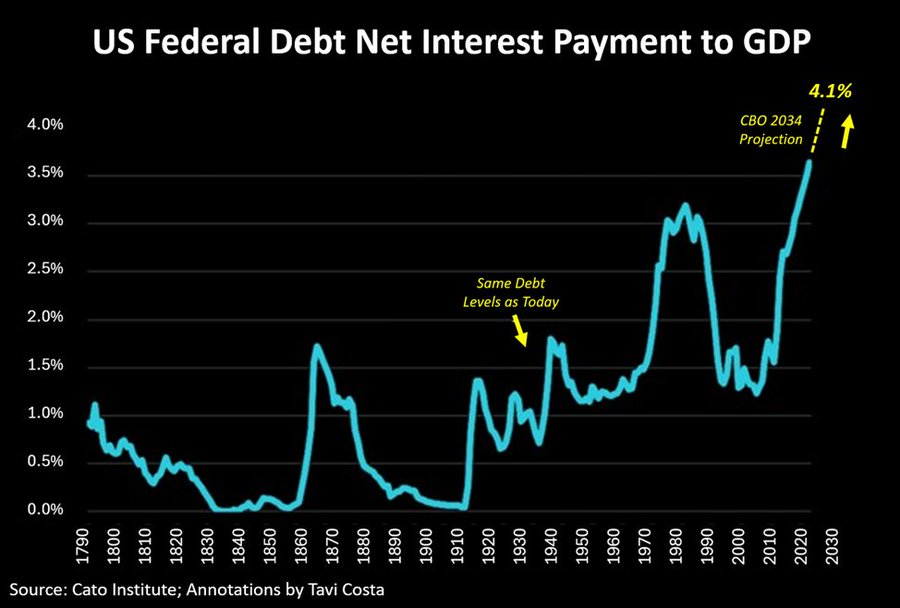

One Chart Shows Why the Fed Will Cut Instead of Worrying about Inflation

According to Tavi Costa here is the one chart that shows why the US central bank will cut interest rates before long. As they will start to worry more about US debt servicing costs than the risks of higher inflation levels. Thereby pretty much guaranteeing higher inflation levels:

“This is probably the single most important issue in today’s economy irrespective of what president or political party will be leading the country:

Net interest payment as a percentage of GDP is projected to reach their highest level in over two centuries.

The potential benefits of cutting interest rates to ease the burden of rising debt service payments are becoming far more significant than the Fed’s obsession with inflation and labor markets.

The urgent need for financial repression in the US economy has never been more apparent in my view.”

Source.

Here’s an even more alarming way of looking at the same issue:

Interest on the federal debt was equal to 76% of all personal income taxes collected in Jun – that’s the Treasury’s largest source of revenue and three-quarters of it gets consumed just by interest; does Congress know? Do they even care?

Source.

So 76% of the US treasury’s largest source of revenue is being consumed to pay the US interest bill!

Ronnie Stoeferle: Quietest All-Time High in 20 Years

In last week’s newsletter we wrote that “USD Gold Hits New All Time High – Hardly Anyone Notices”.

We weren’t the only ones to notice no one noticing. Frank Giustra wrote in response to an X post from In Gold We Trust Report’s Ronnie Stoeferle:

pure gold bar Giustra

@Frank_Giustra

I THINK IT MEANS WE ARE ONLY IN THE EARLY INNINGS..

Quoting:

Ronnie Stoeferle

@RonStoeferle

I’ve been writing, thinking, and investing in gold for nearly 20 years, and this is by far the quietest all-time high I’ve ever seen!

#Gold #IGWT24 @IGWTreport

Source.

We’d have to agree with Ronnie. We thought the all-time high from earlier in the year arrived without much fanfare. But last week’s jump wasn’t even accompanied by a short blast of an out-of-tune trumpet!

So yes we’d say it’s still very early in this run higher.

Term Deposits: Bigger Returns or Lower Risk? A Better Way to Get Both

An interesting sponsored article in the NZ Herald by General Finance notes that:

“1.6 million New Zealand households held term deposits at the end of November last year* – 49 per cent more than the start of 2022 – with the average deposit nearly $89,000.”

Source.

We were surprised by how high that number was. Although being an average there are likely some very large term deposits pushing that number higher. Nevertheless, almost $100,000 on average across 1.6 million households is a lot.

The article goes on to compare:

“…a 12-month term deposit of $100,000 with General Finance at a 7.5 per cent interest will deliver a pre-tax yield of $7500. In comparison, the best interest rate on offer from the ‘big four’ banks, as of writing, is 6 per cent, yielding $5900-$6136 pre-tax on $100,000. The higher figure is a result of re-investing returns so the amount compounds quarterly.

King [managing director of General Capital, the owner of General Finance] says that equates to a return of $1364 or 22.2 per cent higher ($7500 versus $6136) when a saver opts for a General Finance term deposit.

With the bulk of term deposits deposited with the big four banks, and many billions sitting in low-interest savings and cheque accounts, it is prime time to look at alternative options, says King.

“The only way to get ahead of inflation at the moment is to deposit your money at a higher rate than the big banks are currently offering,” he says. “Smart investors know that risk increases as the interest rate goes up, but they balance risk and reward knowing they are not going to get ahead of inflation while leaving their money in low interest rates where it may be safer.”

We’d say there is an alternative to “depositing your money” or more correctly “currency”. Instead simply convert your currency into “real money”: i.e. gold and silver. When you buy gold you don’t have to research the alternative deposit takers as Mr King outlines:

“King emphasises that every investor needs to do due diligence on the company they are depositing with. Is the company regulated? Is it part of the Deposit Compensation Scheme? Does it have to file accounts and meet capital adequacy ratios with the Reserve Bank? Does it have a Trustee, regular audits, and a good board of directors?

These are some of the questions prospective depositors should ask when researching companies to deposit their money with.”

By our calculations, gold in NZ dollars is up 22% from the 1st of January. Annualised that would be close to 40%. Of course, there is no guarantee gold will continue to rise at the same rate for the rest of 2024. But it looks likely to be up more than 7.5% by the year’s end.

Looking back over the past few years we also calculate that NZD gold was up 13.7% in 2023 and 7.3% in 2022.

For sure the usual small print applies that “past history is no guarantee of future returns”. However, we seem to be in an environment where there are many risks and therefore many reasons to hold gold. Also as Frank Guistra and Ronnie allude to above, we are likely only in the very early stages of this current gold bull market. So higher than average returns seem likely in the years ahead.

To us holding significant sums of currency in a bank or alternative deposit taker seems to be at risk of not keeping up with inflation, not to mention the counterparty risks involved.

So why take either risk when you can hold gold and silver instead?

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|