2 SILVER SPECIALS TODAY

Wanting Some Great Value Minted Silver Bars?

LIMITED STOCK – Just 2 Remaining

Sunshine Minting (USA) 100oz .999 Silver Minted Bars

$2528 each pick up

(Insured delivery price add $9.20 per 100oz bar)

Note: Compare to locally refined cast 100oz bars at $2508 each – pick up

Ph 0800 888 465 or simply reply to this email to secure them

SILVER COIN SPECIAL TODAY

1oz Perth Mint Silver Kangaroos 2016 BU (Brilliant Uncirculated)

Minimum order 500 coins

– $200 cheaper than 500 Silver Maples

1000 x 1oz Perth Mint 2016 Silver Kangaroos are $26,280 ($26.28 per coin)

– $500 cheaper than 1000 Silver Maples

5000 x 1oz Perth Mint 2016 Silver Kangaroos are $129,250 ($25.85 per coin)

Bonus for 1000 coins or more – more details further down.

(Price includes fully insured delivery via Fed Ex directly to you anywhere in New Zealand or Australia.)

Get a Huge Vehicle Survival Pack Valued at $304 for Free

- 2 x Inflatable Solar Lanterns

- 2 x 3-in-1 Car Escape Tools

- 2 x Credit Card Knives

- 2 x Credit Card Multi-tools

- 1 x Car Glove Box Survival Kit

- 1 x Vehicle First Aid Kit with Fire Extinguisher

This Week:

- If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

- Ask a Great Question – Win a Silver Coin

- Futures Traders Positions Very Bullish For Gold and Silver

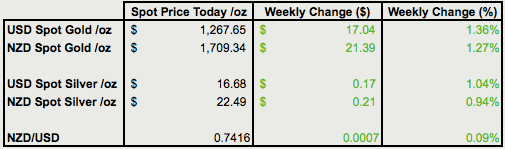

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1636 |

| Buying Back 1kg NZ Silver 999 Purity | $684 |

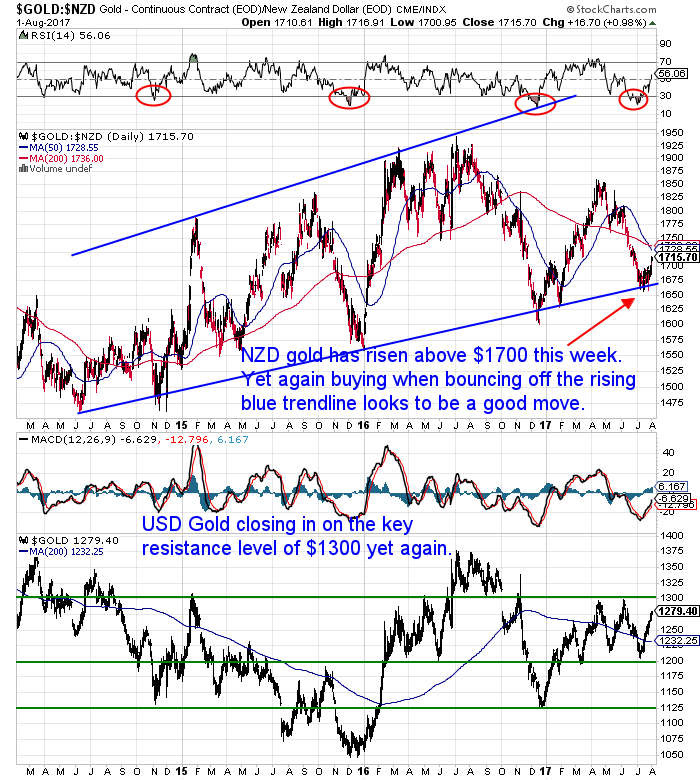

NZD Gold Up Sharply This Week

Late Update: The NZ dollar dropped half a cent late morning after NZ unemployment figures came in showing employment growth was down -0.2% compared to expectations of 0.7%.

If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

- How would this affect the NZ dollar?

- Could our government peg the NZ dollar to gold too?

- How likely are these scenarios?

- And what else could happen instead?

If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

Do you have all the essentials on hand if you need to leave home in a hurry?

Grab Your Own Grab ‘n’ Go Bag NOW….

Sorry Bad Link!

What Use Will Silver Coins be in New Zealand in a Currency Collapse?

- How we have no historical precedent to compare to.

- What we can learn from other countries.

- What silver coin options may be best in a currency collapse.

Ask a Great Question – Win a Silver Coin

- Email it in to us.

- Send it via the contact form on our contact page.

- Post it on Facebook or

- Twitter if you prefer.

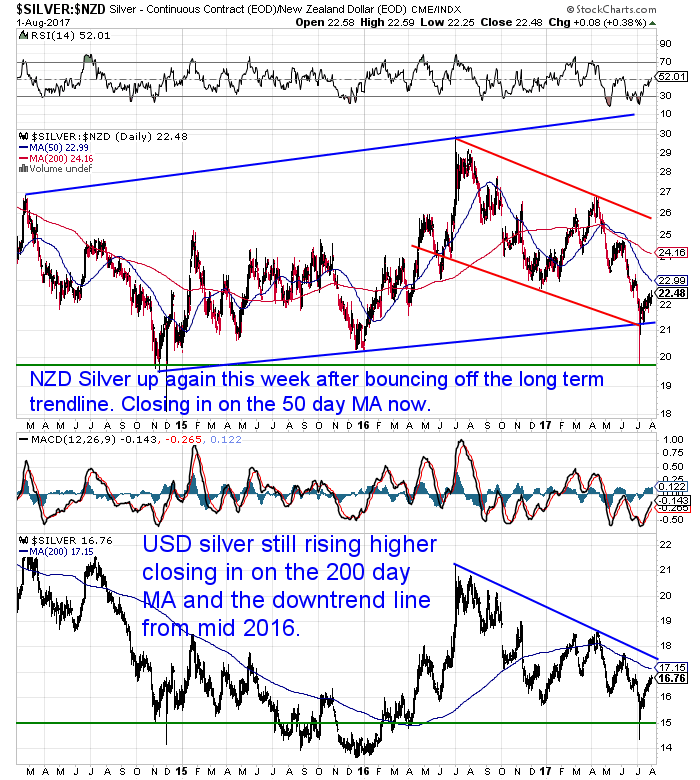

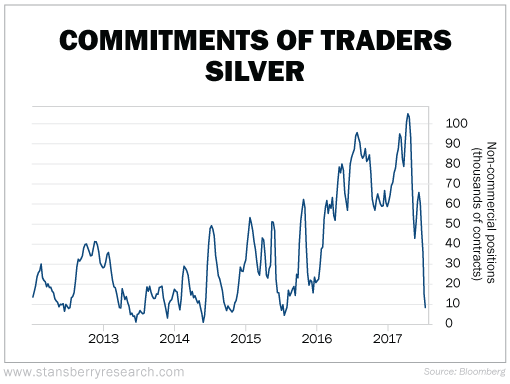

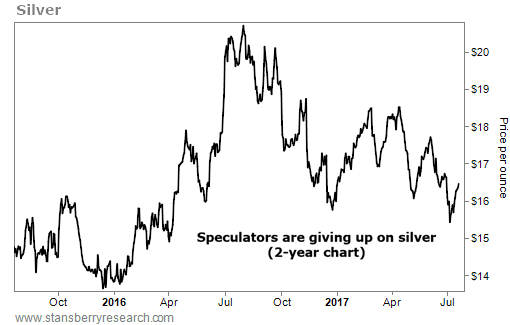

Futures Traders Positions Very Bullish For Gold and Silver

As you can see in the chart, speculators now hold even fewer bullish bets than they did in late 2015, just before the new bull market began. It appears they’re finally throwing in the towel for the first time in nearly a year.

Remember, these traders are known as the ‘dumb money’…

As a group, they tend to be wrong at the extremes. They get super bullish at market tops, and super bearish at market bottoms. So today’s pessimism is a bullish sign for prices going forward.

But that’s not all. As you can see in the next chart, silver prices have begun to diverge over the past few weeks…

The dumb money is giving up, but silver prices have been moving higher, anyway. This, too, is a bullish sign.

“speculators’ gold-futures and silver-futures short positions have soared to near-record and record extremes in recent weeks. These elite traders are hyper-bearish, and betting heavily for more precious-metals downside. But gold and silver soon soared on short-covering buying following all past episodes of excessive and record short selling. There’s nothing more bullish for gold and silver than extreme shorts!

All futures sold short must soon be offset by proportional near-term buying to close out those trades. It quickly feeds on itself thanks to the incredible leverage of gold futures and silver futures. The resulting sharp short-covering rally soon entices in new long-side futures speculators and later investors with their vastly-larger pools of capital. Excessive and record futures shorts are the best gold and silver buy signals available.”

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

This Weeks Articles: |

|||

|

|||

|

|||

|

|||

|

|||

|

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.