|

Gold Survival Gold Article Updates:

Apr. 10, 2014

This Week:

- NZ Government Deficit May be Bigger Than Expected

- Bank Bail-Ins Going Global

- Reader Question on Gold and Silver and Airport Customs

Rather a quiet news week this one in the world of precious metals it seems. Can’t say we’ve come across anything too earth shattering in our travels across the interwebs.

So a quick look at the prices since last week and charts

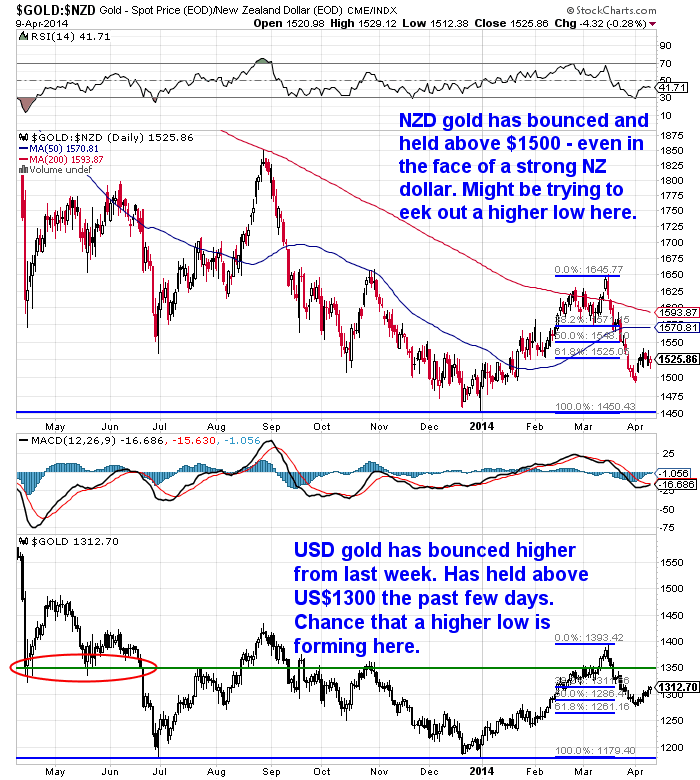

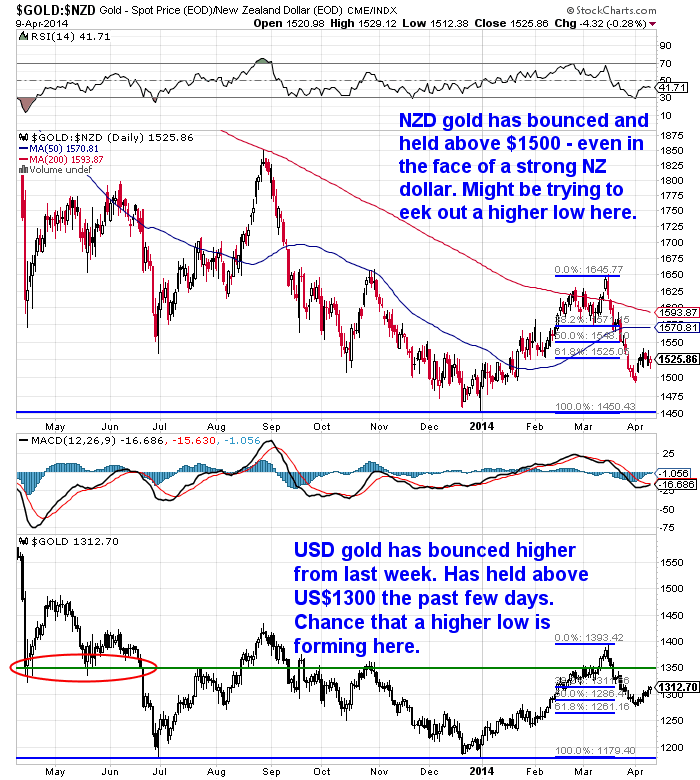

There’s been very little movement in prices in the past week for gold. Gold in NZD has held above the $1500 mark. We could make an argument that it’s attempting to put in a higher low at the $1500 level currently.

It is little changed from a week ago, down $1.50 an ounce or just 0.01% to $1508.50 today.

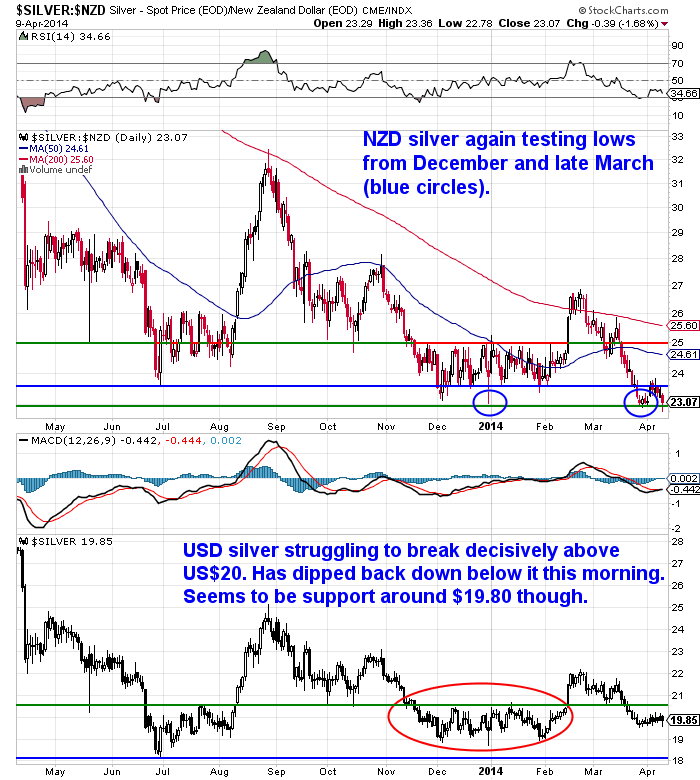

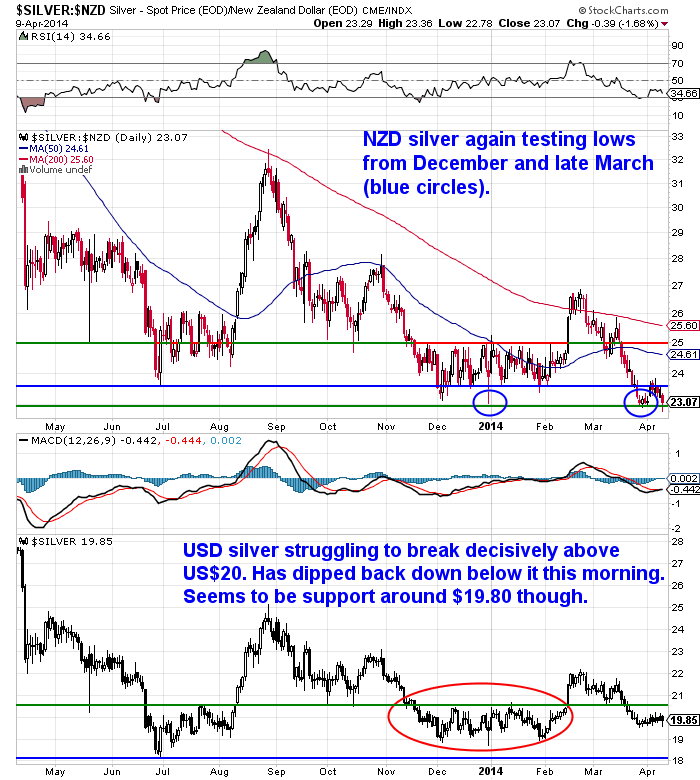

Meanwhile NZD silver is down 52 cents or 2.22% from last Wednesday to $22.86. It has dipped back down again to the lows of late March. This is a function of the Kiwi dollar returning to recent highs and US dollar silver dipping back below US$20 this morning.

So if you’re after silver, an excellent chance this morning to get it at prices last seen 3 and a half years ago.

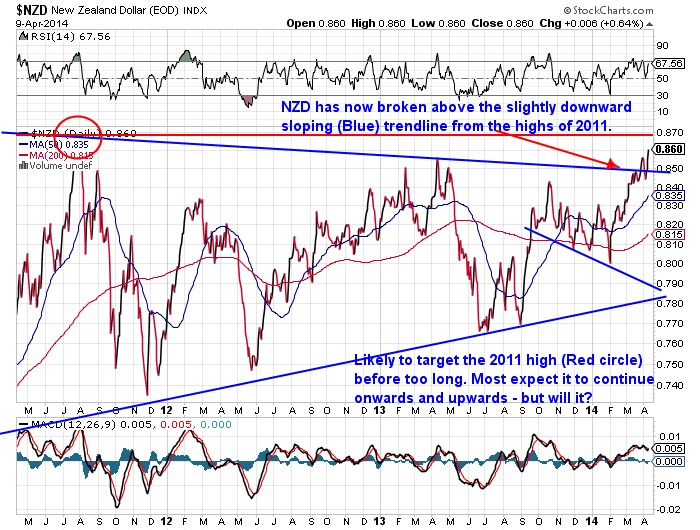

Speaking of the higher Kiwi dollar…

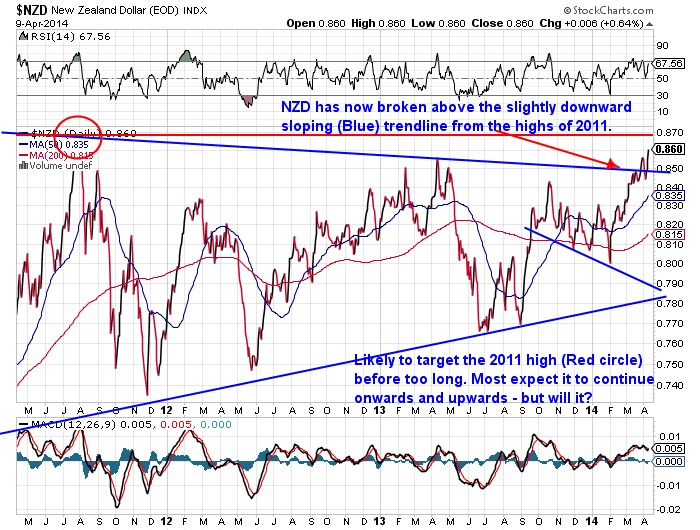

It is up above the highs of last week. According to one report, “after the Federal Reserve minutes from its last meeting in March pushed out expectations of when the Fed will start raising interest rates.”

See: NZ dollar jumps to 3-year high as traders pull back US interest rate bets on dovish Fed minutes

The story highlights what most seem to think:

—–

“The key global economies appear stuck with low interest rates for a while yet and, with the RBNZ as the only major central bank looking to unwind monetary policy quickly, the NZD can only go higher,” Bancorp Treasury Services said in a note, adding that the record high 88.41 US cent level is “under threat”.

—–

So yes the old 2011 high is likely to be tested before too long now, but with most expecting that the NZ dollar “can only go higher”, we wonder if it will?

Precious metals remain a good hedge against the possibility that it doesn’t.

What could cause a stumble for the dollar? Maybe the government deficit unexpectedly continuing to grow?

NZ Government Deficit May be Bigger Than Expected

It was reported yesterday that the tax take for the year to date was again below forecast:

—–

Govt tax take falls short, again – deficit rises

“The Treasury still expects the government to reach its targeted surplus in the 2015 financial year, even as the current tax-take continues to fall short, and widening the Crown’s operating deficit.

The government’s operating balance before gains and losses (obegal) was $1.39 billion in the eight months ended Feb. 28, more than twice the $509 million shortfall predicted in the December half-year economic and fiscal update, though less than half the deficit of $3.01 billion a year earlier.

Core tax revenue of $39.47 billion was $1.14 billion below expectations, and the Treasury anticipates more than half that deficit will remain by the end of the financial year, with assumptions around personal tax and custom duty not eventuating, and lower corporate tax and source deductions though to be a matter of timing.”

—–

So the angle seems to be that the economy will continue to grow and further boost tax revenues so the budget surplus will be okay in 2014/15. Could well be the case.

However given the treasury’s forecasts for tax revenue for the first 8 months of this financial year are so far off – by $1.14 billion – who’s to say they’ve guessed right for the next year after that?

A budget deficit of nearly $1.4 billion against a forecast of $509 million is not insignificant. And as the opposition parties are sure to remind us, not that flash when all the news is about the NZ economy powering ahead. So it will be interesting to see how the next 4 months play out and whether some of this is clawed back via higher tax revenues (Claw being the operative word here, given we are talking about taxes).

Bank Bail-Ins Going Global

It was interesting to see Mike Maloney’s GoldSilver.com this week drawing attention to the bank bail in laws that are steadily being enacted across the developed world. Of course good old NZ was at the forefront of this with the RBNZ’s Open Bank Resolution scheme, which we first wrote about back in 2011.

If you’re unfamiliar with the OBR, check out this short video summary we put together on it.

It has various links on there to get yourself up to speed on the risks your money in the bank faces.

Anyway, it was interesting to hear the straight shooting Rick Rule’s take on the bail-ins that occurred in Cyprus. In a Q&A session at a conference he pretty much said, it’s a very good thing as it highlighted that people should be taking an active interest in where they keep their savings.

He points out most people expect the government to bail them out, but if the people of Cyprus had their money in gold and silver or in an offshore bank they would have been unaffected.

—–

“If we’re stupid enough to put money in a bank that has too poor of an equity slice, and the bank goes upside down, we’re unsecured creditors of a moron which makes us a double moron”.

—–

Harsh but true.

Here’s the full video of Rick Rule:

Unfortunately most NZers are still blissfully unaware of the risks to any money in an NZ based bank.

(If you have someone you’d like to inform you can always forward them the link to our video. Just go to this link and down at the bottom look for “Share the Knowldge”, which you can do via Facebook, Twitter, email etc.)

Reader Question on Gold and Silver and Airport Customs Clearance

Given how many Kiwi’s spend time working in the likes of Aussie or elsewhere overseas, we had a question this week that we thought you might be interested in hearing the answer to:

—–

“I have a question that you may be able to help me with.

I have a few 100oz bars of silver, and some small 1-2oz bars of gold that I was planning on carrying with me from Australia to New Zealand during my next trip. Do you know if I’ll be hit with any import taxes on these? What about problems carrying the metal on my carry on?

If I will be hit with fees, I am probably best to sell the bullion here and then buy some more metal through your site…”

—–

And here’s our reply:

—–

“We haven’t had first hand experience with this so what we are saying here is what we believe to be the case and what we’ve heard from other people.

As there is no GST on 99.5% pure gold and 99.9% pure silver (see IRD Website), you should not have any duties to pay on bringing these into the country.

However you might want something to prove the purity of them. Such as if you have the invoice you received when you first bought them. Then if you do get stopped at customs you will be able to prove they are above these levels and do not attract GST. Might also be an idea to print out the page from the IRD too. It could depend upon the knowledge of the customs officer as to whether they know precious metals don’t attract GST.

Although gold and silver shouldn’t really come under the foreign currency or bearer bonds that the customs declaration form talks about – it may still be advisable to declare them if you are bringing in more than the $10,000 currency limit.

We know of people who have had no trouble but that was just bringing in a kilo bar or 2 of silver.

If you don’t want to take the risk and want to sell and re-buy over here, then here is a quote as you asked for….”

—–

So there you have it – that’s what our take is. By all means let us know if you have any experience with physically bringing bullion into NZ. We’d love to hear a border crossing story or two.

Conversely if you are in need of some bullion and don’t want to “run the gauntlet” at customs, we’re happy to help out. Both metals are once again looking pretty cheap here.

This Weeks Articles:

| Gold Merchants/ Users expect higher gold prices in 2014? |

2014-04-02 23:01:13-04 2014-04-02 23:01:13-04

Gold Survival Gold Article Updates Apr 2, 2014 This Week: Inflation Is Coming, What to Do—NOW NZ Dollar down sharply overnight Gold Merchants/Users expect higher gold prices in 2014? A couple of podcasts and one article on the website this week. They’re linked down the page further. Particularly interesting were the numbers crunched by […]

read more…

We Have Seen This Play Before |

2014-04-09 07:16:33-04 2014-04-09 07:16:33-04

We wrote a couple of weeks ago that according to a few reports, there seems a reasonable chance that outright money printing may be coming to Europe before too long in order to avoid the much dreaded deflation. Below, our “favourite billionaire”, Hugo Salinas Price, gives a great response to even the likes of the […]

read more… |

|

2014-04-02 23:01:13-04

2014-04-02 23:01:13-04 2014-04-09 07:16:33-04

2014-04-09 07:16:33-04

Pingback: NZ Dollar, RBNZ Announcement and Inflation | Gold Prices | Gold Investing Guide