This Week:

- PAMP Suisse vs Local NZ Gold / Silver: Which Should I Buy?

- Australia Has 80 Tonnes of Gold, How Much Gold Does New Zealand Have?

- A New Gold Scandal – England Denies Australia Access To Its Gold

- Bank Conduct and Culture Review: NZ Not as Bad as Aussie, But Still Plenty of Issues

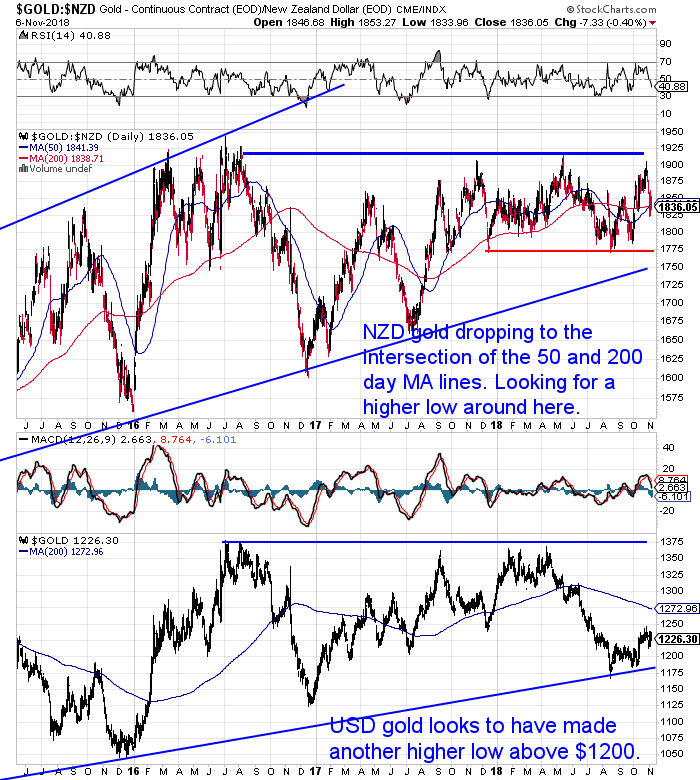

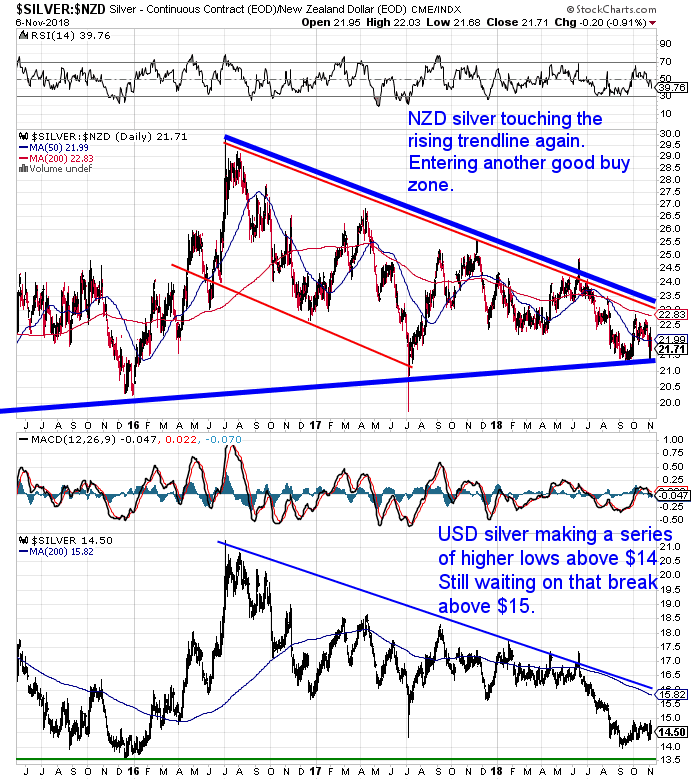

Prices and Charts

Stronger Kiwi Dollar Holding Back Local Precious Metals Prices

The local gold price fell almost 1.5% this week solely on the back of the NZ Dollar strengthening just under 2%.

This is clearly shown in the chart below. Where the USD gold price rose slightly (bottom chart), the NZD gold price is now back to the intersection of the 50 and 200 day moving average lines.

We’re now looking for a higher low around here. Anywhere between here and $1775 is likely to be a good buying zone.

NZD silver also fell. Although not as much a gold. Silver briefly touched the rising uptrend line and is now in what should be another good buying zone.

As already noted the Kiwi dollar had a strong week. But it may struggle to get too much higher right now. It is close to overbought on the RSI (near 70). Also edging above the Bollinger bands. Plus at the same time close to what should be strong overhead resistance at 0.67.

So if the dollar dips down from here that could help boost NZ gold and silver prices in the coming week.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Free Shipping NZ Wide.

A New Gold Scandal – England Denies Australia Access To Its Gold

A friend (thanks G.C.) shared an interesting video with us this week: A New Gold Scandal – England Denies Australia Access To Its Gold.

Researcher John Adams has uncovered some startling information about the state of Australia’s gold reserves (which are 99.9% with the Bank of England). This is rather reminiscent of delays surrounding the repatriation of Germany’s gold reserves. As G.C. noted it looks like “same story – different country”.

On top of a summary of the video, this article also compares the history of both Australia and New Zealand’s gold reserves. Find out who has the worst timing in terms of goldreserves sales…

PAMP Suisse vs Local NZ Gold / Silver: Which Should I Buy?

One of the most common questions people have when buying gold or silver bars/ingots, is should they go with locally refined bars or an oversea brand like swiss PAMP.

If you’re wondering that, then check this out.

But you’ll also see how right now you can actually get PAMP silver bars for the same price as local. Quite a deal.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Bank Conduct and Culture Review: NZ Not as Bad as Aussie, But Still Plenty of Issues

The FMA and Reserve Bank report into banking conduct and culture has now been released.

The report called for banks to remove all sales incentives for staff – such as selling banking products to customers.

Key Points:

- Banks warned to change their culture

- Government urged to tighten up banking regulations

- Banks told to remove all sales incentives for staff

- Customers complain about being pressured to buy financial products

- More needs to be done to protect “vulnerable” customers

- Changes must be made by next year

Probably not surprisingly the report also raised a number concerns about the relationship between banks and intermediaries such as mortgage advisers. Something that was a major probably in Australia.

“The report found a number of banks “highlighted conduct risks associated with their limited oversight of the customer interactions that occur through brokers and other intermediaries”.

…The report echoes concerns raised by Australia’s Royal Commission. The Commission’s interim Haynes report suggested broker sales incentives led to misconduct and called for an end to value and volume-based commissions for mortgage advisers.

The FMA and RBNZ report also criticised the way banks offer advice. It found “inherent conflicts of interest”, “particularly apparent in vertically or horizontally integrated firms” that manufacture products and provide advice. The regulators said the conflict of interest influenced sales incentives and prevented staff from identifying inappropriate sales.”

Source.

The report seems to show that culture in New Zealand banks is not nearly as bad as in Australia. But the results are still pretty damning for the NZ banks.

So what is the answer?

Is it as Consumer New Zealand thinks that there are just gaps in the regulation?

“What both the regulators have said, is that there are gaps in regulation.

“They could do more with banks and just harden up, but they just don’t have to tools to do that.

“They just need a bit more regulation, so that they can ensure that banks behave properly.”

Source.

We doubt that will make any difference. Even in Australia what ever changes they make are unlikely to change the structure of the monetary and lending system.

Banks will still have a government granted oligopoly on the ability to lend money into existence.

Maybe a few less people will be ripped off by being conned into products they don’t need or aren’t suits. And perhaps the odd marginal borrower won’t be lent to is all.

Other News on Banks and Property Market

We spotted a number of other interesting tidbits of news about banks and the property market this week. Here’s a selection of them.

Falling Australian house prices a warning for NZ: commentator.

“Tightening bank lending is leading to a property crunch in Australia and it could also happen here, a housing commentator says. Christchurch-based Hugh Pavletich of the housing thinktank Demographia says reports of Sydney and Melbourne houses losing $1000 a week are a result of rising interest rates and the Australian banking inquiry, making banks ultra-cautious.”Read more

Fund Manager Slade Robertson on NZ Property: Are we heading for crash or correction?

“It is incredible to think 10 years have passed since the GFC. All asset classes were hit, including property.

The recovery has been similarly incredible. With this recovery has come negative consequences, including a repricing of residential homes to a level now unaffordable for many.

With the Auckland market now being regarded as one of the most expensive in the world relative to income levels, it is no surprise the New Zealand coalition Government has looked to intervene.

Supply-side strategies are being represented by initiatives such as KiwiBuild and demand is being tempered with policies such as the ban on foreign buyers.

But this will be a difficult path to navigate. With the global economic cycle showing signs of maturity, interest rates rising, and the regulatory environment negatively impacting the availability of credit, it appears likely the New Zealand housing market will fall.

The big question is by how much.”

Read more.

Borrowing growth slowing on all fronts

Latest Reserve Bank monthly figures show declines in the rate of annual borrowing growth across the personal, housing, business and agricultural sectors.

Business confidence is down and it appears as if this is being backed up by a more cautious approach to borrowing on all fronts. The latest Reserve Bank figures monitoring sector credit show the annual rates of borrowing growth have slowed across the personal, housing, business and agricultural sectors.Read more.

Taylor Kee at money morning NZ reports on possible easing of lending

So we have borrowing growth slowing and the risk of house prices falling. Meanwhile…

“According to Interest.co.nz, the rumour mill suggests that RBNZ authorities want to make it easier for banks to lend to people who struggle to afford a down payment.

The loan-to-value ratio (LVR), which is essentially a measure of risk, is something that the state regulates heavily. These regulations prevent banks from taking on too many risky loans. It’s something that American banks got a little too greedy with…and it resulted in one of the greatest market crashes in world history.

So hearing that the RBNZ wants to relax those protections now…at what seems to be a peak of a 50-year bubble…should make you nervous.”

With all these negative items about banks and real estate in the news it makes us wonder if any fall in house prices may not be that big (yet)? As the biggest falls usually don’t come when many people are expecting them.

But nonetheless it makes sense to have an alternative asset like gold or silver as insurance. Just in case. Especially when gold and silver are still quietly rising in value.

So be sure you have some hard assets as financial insurance in case of a downturn and fall in other asset prices.

Check out the deals going currently.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Back in Stock – Learn More NOW….

—–

|