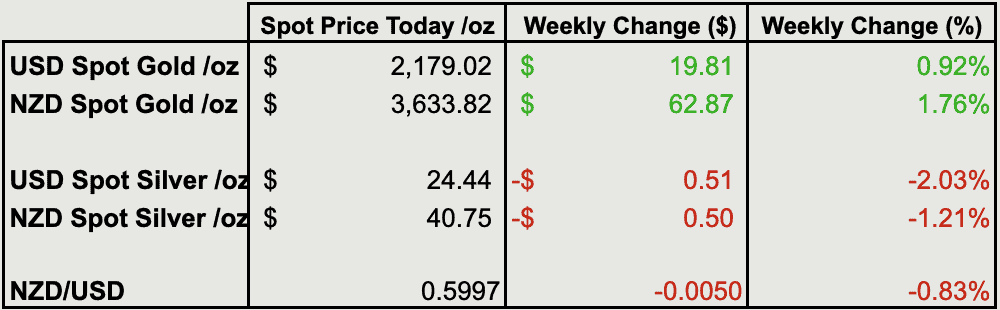

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3470 |

| Buying Back 1kg NZ Silver 999 Purity | $1212 |

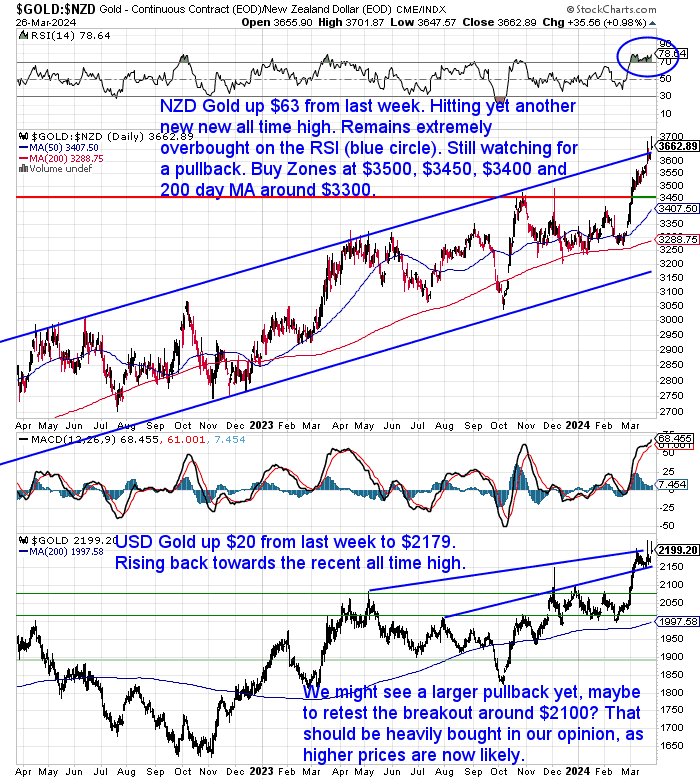

NZD Gold Hits Yet Another All-Time High

Gold in New Zealand dollars was up $63 from last week. Hitting $3634 today. It remains extremely overbought on the RSI indicator (circled in blue) as it has been this whole month while rising $200. A pullback will happen at some stage. But it is a case of how much higher that may yet be. We’d think a pullback to retest the break out at $3450 to $3500 would be likely at least. It may be advisable to layer in on any fall.

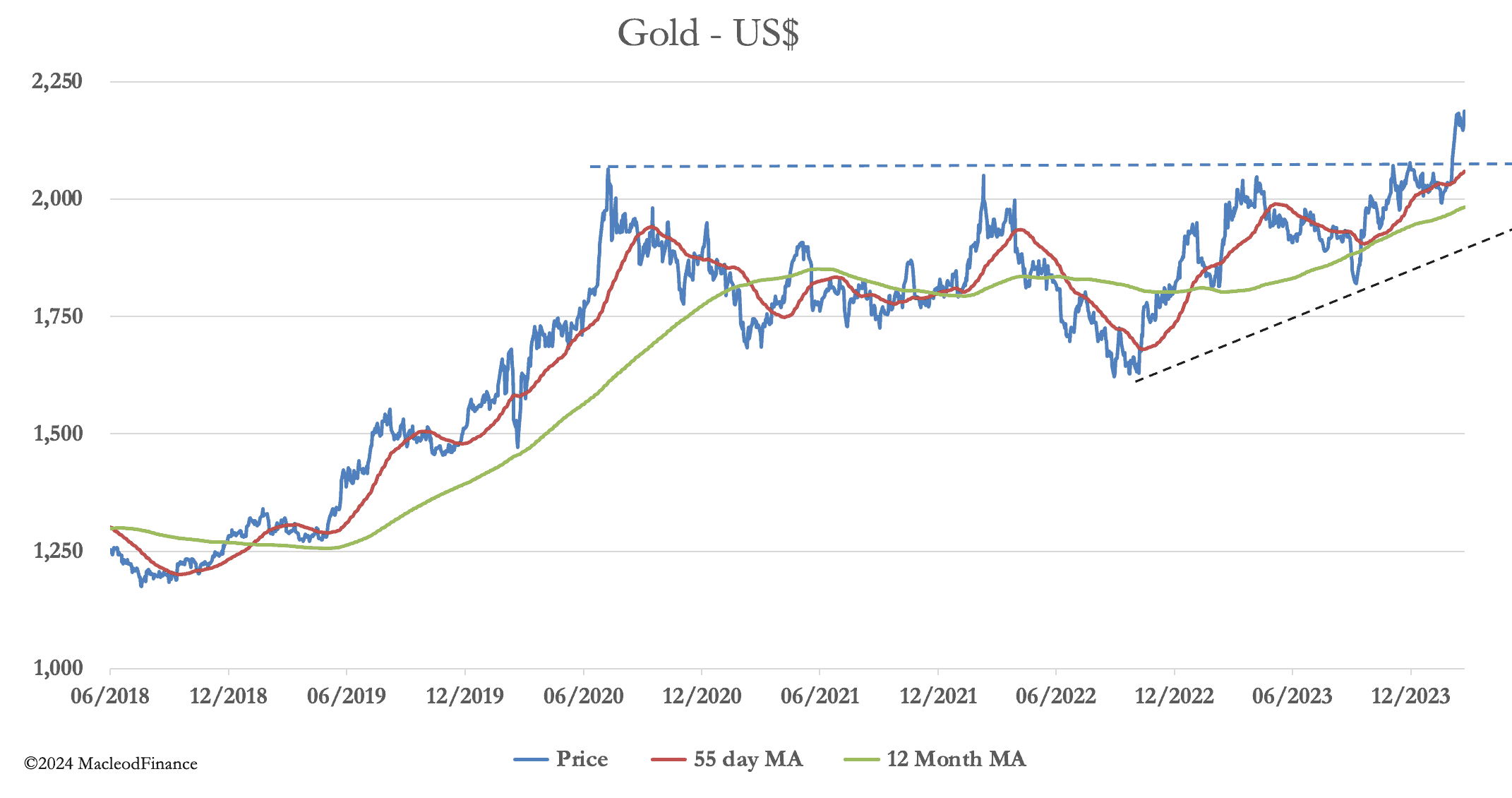

In USD terms gold was up $20 from last week to $2179. Rising back towards the all-time high at $2200. Maybe we’ll see a correction back down to the breakout area around $2100? However, the chance remains that gold could work its way down from overbought with a sideways consolidation. Bull markets like to run with the fewest people on board, so they do like to surprise. That would be one way to do it.

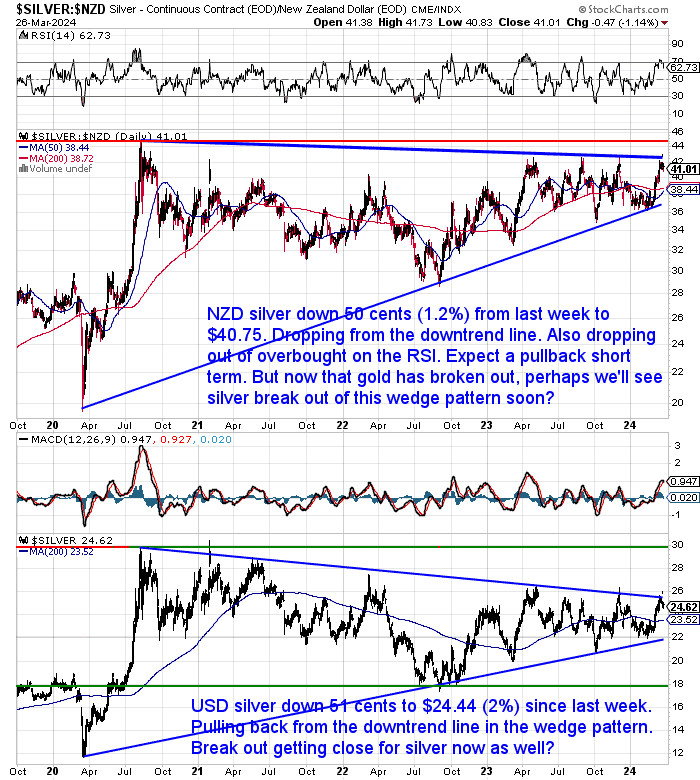

Silver Pulling Back from Downtrend Line

Meanwhile after surging higher to once again hit the downtrend line, NZD Silver has pulled back a little in recent days. Down 50 cents (1.2%) to $40.75. This has also taken the RSI back down from overbought. But we could still see a further pullback. In our opinion, any dip back down towards the uptrend line should be heavily bought. As that has been strong support.

The USD silver chart looks similar. It was down 51 cents (2%) to $24.44.

In either currency, the silver spring is getting wound tighter and tighter inside this wedge pattern. A breakout is inevitable (and perhaps even imminent?). With gold breaking out it’s more likely silver will break up rather than down. So we may be seeing a final opportunity to buy silver at these current levels.

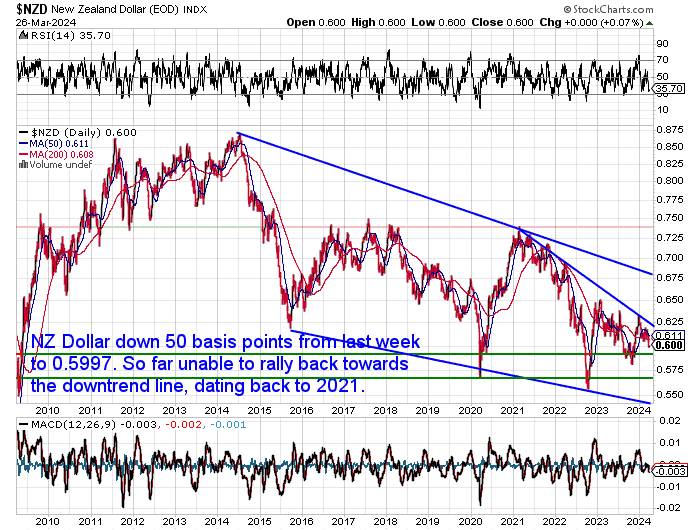

NZ Dollar Back Below 0.6000

The NZ dollar remains weak. Down 50 basis points this week and back below 0.6000 for the first time since late last year.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Chinese Gold Buying Continues While the West Languishes

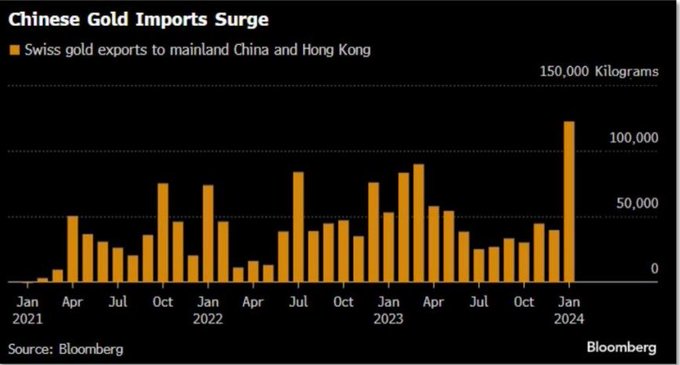

Perhaps the introduction to this chart is a bit strong. However, there is pretty clear evidence that China continues to be the main buyer of gold globally. While in most Western countries demand for gold remains very limp..

“Is this the most important chart in finance…??”

Analyst Jan Nieuwenhuijs summarises just how significant Chinese gold buying has been. He makes some best guesses based upon World Gold Council estimates of central bank buying. His estimate is that “the PBoC now holds 5,358 tonnes, which is 3,108 tonnes north of what’s officially disclosed at 2,250 tonnes”:

“China Is Leading the Dance in the Gold Market

Exceptional strong gold demand from both the Chinese central bank and private sector has been driving up the gold price over the past two years, by which they have taken over control over the gold price from the West. The People’s Bank of China (PBoC) bought a record 735 tonnes of gold in 2023, of which about two thirds were purchased covertly. In addition, the private sector net imported 1,411 tonnes in 2023, and a whopping 228 tonnes just in January of 2024. If the West joins the Chinese gold buying craze, in fear of rate cuts and currency debasement, it will be a perfect storm for gold.”

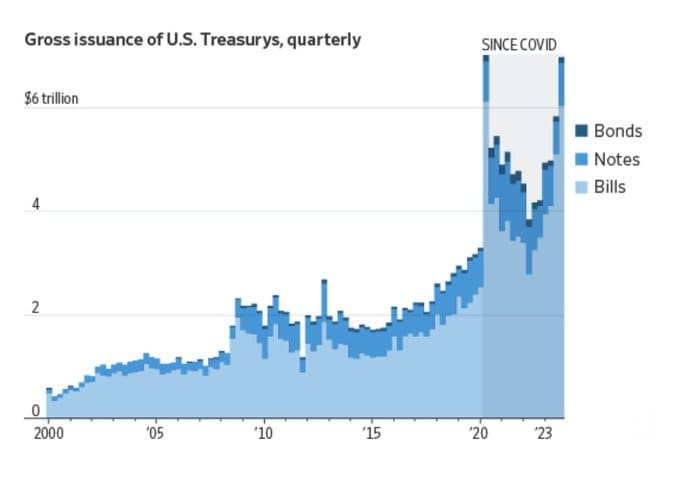

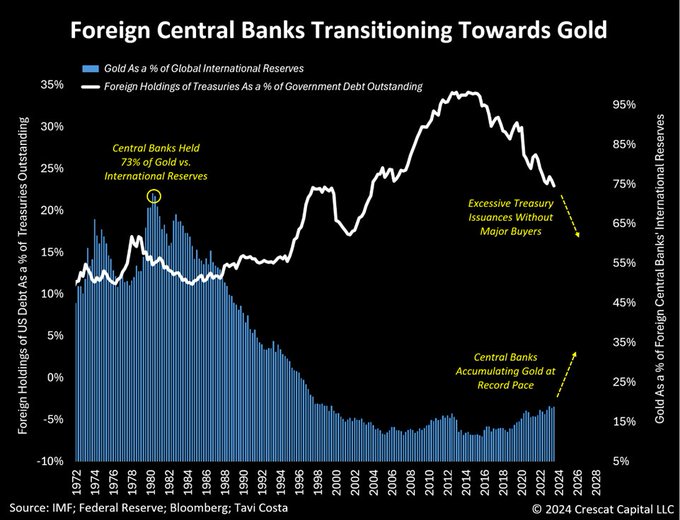

But it’s not just China. Tavi Costa points out that foreign (non-US) central banks are increasing their gold reserves while at the same time they hold less US government bonds as a percentage of the US debt outstanding. Or put another way, the US treasury is having to issue more and more bonds to pay for the ballooning US deficit. Clearly shown in this chart…

When Money Dies ( .. printing goes parabolic)…

Wow! Back to COVID levels

Meanwhile other central banks are reluctant to purchase at these increased levels. Instead it seems they are opting to increase their gold reserves.

Gold’s role as a neutral asset with millennia of history as money is experiencing a resurgence relative to US Treasuries for global central bank reserve accumulations.

These monetary institutions are left with no recourse but to assume responsibility for these challenges, acting as primary liquidity providers to address their own sovereign debt and asset valuation imbalances.

We are witnessing what might be described as the most undisciplined monetary and fiscal environment in history.

As we’ve discussed before, the US response to the Russian invasion of Ukraine of freezing Russian reserves, likely sped up this trend. Now to incentivise the move from the US dollar to gold even more, we have this:

“Yellen urges world leaders to ‘unlock’ frozen Russian Central Bank assets and send them to Ukraine

The United States and its allies froze hundreds of billions of dollars in Russian foreign holdings in retaliation for Moscow’s invasion of Ukraine. Those billions have been sitting untapped as the war grinds on, now in its third year, while officials from multiple countries have debated the legality of sending the money to Ukraine. More than two-thirds of Russia’s immobilized central bank funds are located in the EU.”

While we don’t think a US dollar collapse is right around the corner, as one analyst points out:

“If that doesn’t speed up de-dollarization I don’t know what will.”

The US Dollar on Shaky Ground: What Happens to Gold if it Takes a Dive?

Speaking of “de-dollarization”, while the US dollar has reigned supreme for decades, global geo-political events in recent years have the dollar in a weaker position. Some people are wondering about the potential for a US dollar collapse. In this week’s feature article, we explore the implications for gold in such a scenario.

This article delves into:

- Possible scenarios for gold pricing if the US dollar loses its dominance

- How historical events can inform us about the relationship between gold and collapsing currencies

- Whether gold will continue to be a valuable asset in a post-dollar world

Intrigued by the future of gold and the potential impact of a weakening dollar? This article will give you valuable insights to navigate these uncertain economic times.

If/When the US Dollar Collapses, What Will Gold be Priced in?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

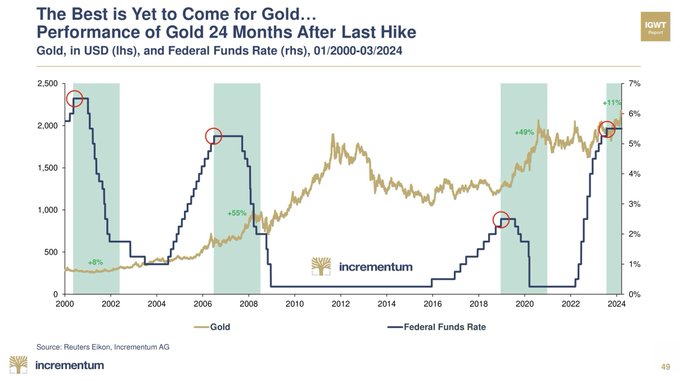

Best is Still to Come For Gold

Gold has broken out and hit all time highs in most currencies. No real news there. But Alisdair Macleod notes that:

The technical chart is very bullish. This is next:

The message here is that after the current minor pullback, this phase of the bull market is only just starting.

While this chart (from the excellent In Gold We Trust Report preview chartbook) shows that, assuming the US central bank has stopped raising interest rates, the best is yet to come for gold. As the last couple of times have seen around a 50% increase 24 months later..

We highly recommend you check out the 2024 #IGWT Preview Chartbook at the link above. It contains over 50 of the most important charts for this year’s report. Including quite a few on the potential for silver.

Speaking of silver, Bill Murphy of Lemetropole Cafe and GATA.org, comments that

“… The monthly silver chart is the most bullish he’s seen in his life…”

– Is silver building up steam for an explosive vertical move?

– Bill notes $26 & $30 are the last two hurdles left to eclipse, by the silver bulls.– Once those resistance points are cleared, little technical resistance remains.

– A monthly close above $30 could soon be followed by a retest of $50. Above $50, there is little technical resistance below $100.”Silver may continue to frustrate for a bit longer, but we’d also agree that it is due to play some serious catch up before too long.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

This Weeks Articles:

If/When the US Dollar Collapses, What Will Gold be Priced in?

Mon, 25 Mar 2024 1:10 PM NZST

In the second quarter of 2023 the US dollar’s share of global foreign exchange reserves was 58%. Down a touch lower from the previous figure we reported of 59.0% in the fourth quarter of 2020. The US dollar share of global reserves has been falling fairly steadily for the last 20 years. Down over 10 […]

The post If/When the US Dollar Collapses, What Will Gold be Priced in? appeared first on Gold Survival Guide.

Read More…

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: 1317.50 (pick up price – dispatched in 3 weeks)

Box of 500 coins (dispatched in 4 weeks):

2024 coins: $23,924.32

Backdated coins: $23,631.86

Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon. Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2022 Gold Survival Guide.

All Rights Reserved.

Pingback: Gold Cycles vs Property Cycles in 2024: When Will Gold Reach Peak Valuation? - Gold Survival Guide