The gold market is splitting in two. Retail investors are selling their gold at record highs, while central banks are aggressively accumulating. At the same time, the London Bullion Market is bleeding gold to the U.S. Is this just market noise—or the beginning of a financial reset?

Table of contents

Estimated reading time: 7 minutes

Retail Selling vs. Central Bank Buying

More Selling Than Buying in Retail Market

Firstly we have seen more selling than buying in the retail market. This is despite gold hitting record highs in just about every currency. Today gold is over US$2900 and NZ$5100 for the first time ever.

Why are retail investors selling gold despite record prices?

Retail investors can currently buy gold and silver coins for less than the cost of new coins from government mints. Yet, dealers are seeing more selling than buying. Some possible key reasons are:

- Profit-taking: Some believe gold is “too high” and want to cash in gains.

- Financial stress: Rising living costs and unexpected expenses force sales.

- Generational turnover: Many younger heirs prefer stocks and crypto over gold.

But selling is exactly the opposite of what you’d expect at a top in any market. So this indicates to us that this is actually just the start of the next phase up in gold.

(Note: These low premiums on previous issue silver bars and coins are still available. Check out some of the deals here.)

But Central Bank Buying Continues at Record Pace

Unlike the retail public, with central banks there is far more buying than selling.

The World Gold Council’s latest Gold Demand Trends report covers Q4 and the full year of 2024. Central banks have continued to buy the yellow monetary metal at a record pace:

Central Banks added an estimated 332.9t of gold to their holdings in the fourth quarter, ramping up buying into price weakness. This brought gold purchases to 1,044.6t (-0.6%YoY). In the period post-Russia’s invasion of Ukraine, Central Banks have added 3,093t to their reserves. In 2024, demand was led by Poland (90t), Türkiye (75t), India (73t), China (44t), the State oil fund of Azerbaijan (25t), Czechia (20t), and Hungary (16t).

Source.

This chart clearly shows how everything changed following the confiscation of Russia’s foreign exchange reserves in 2022:

Chinese Buying Under-Reported

China is buying far more gold than it officially reports. Research from Jan Nieuwenhuijs reveals that China has been using a “backdoor” through London to secretly accumulate reserves, moving over 1,050 tonnes since 2022. (Read more about that research here).

London is Hemorrhaging Gold

But now it seems China isn’t the only one buying gold via London.

Since the U.S. election, over 400 metric tonnes of gold have flowed out of London to New York. Wait times for withdrawals—once just a few days—have stretched to up to eight weeks.

Why is This Happening?

One common explanation is that U.S. dealers are importing gold ahead of potential Trump-era tariffs on precious metals. With tariffs on China, Mexico, and Canada already announced (though delayed for negotiations), dealers are rushing to bring in metal before any duties take effect.

Another factor at play could be arbitrage. The price of gold in the U.S. has been trading at a premium compared to London, incentivizing traders to buy metal in London and sell it in New York for quick profits.

Yet, some suspect a deeper issue—gold shortages.When questioned about the withdrawals, the Bank of England denied any shortage, stating that “longer-than-usual wait times” are simply due to higher demand. Adrian Ash of BullionVault says:

“Digging out physical bullion bars from large vaulted stockpiles takes time, manpower, trucks, and transport. Meeting a surge in demand will always stretch capacity, but London vaults have been working overtime to service this London-New York flow.”

Signs of a Breaking System?

Chris Powell of the Gold Anti-Trust Action Committee (GATA) takes a more skeptical view. He suggests the Bank of England could be leasing out large amounts of gold to suppress prices—just as they have in the past. If true, this would indicate that central banks are not yet ready for gold to be revalued, or they need more time to unwind their short positions.

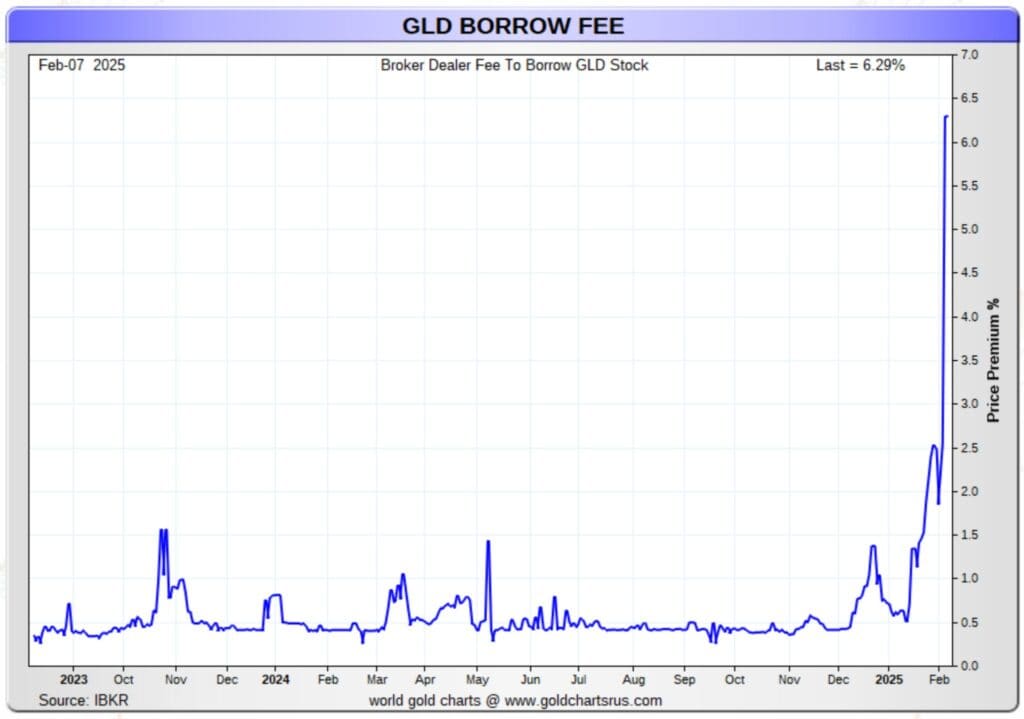

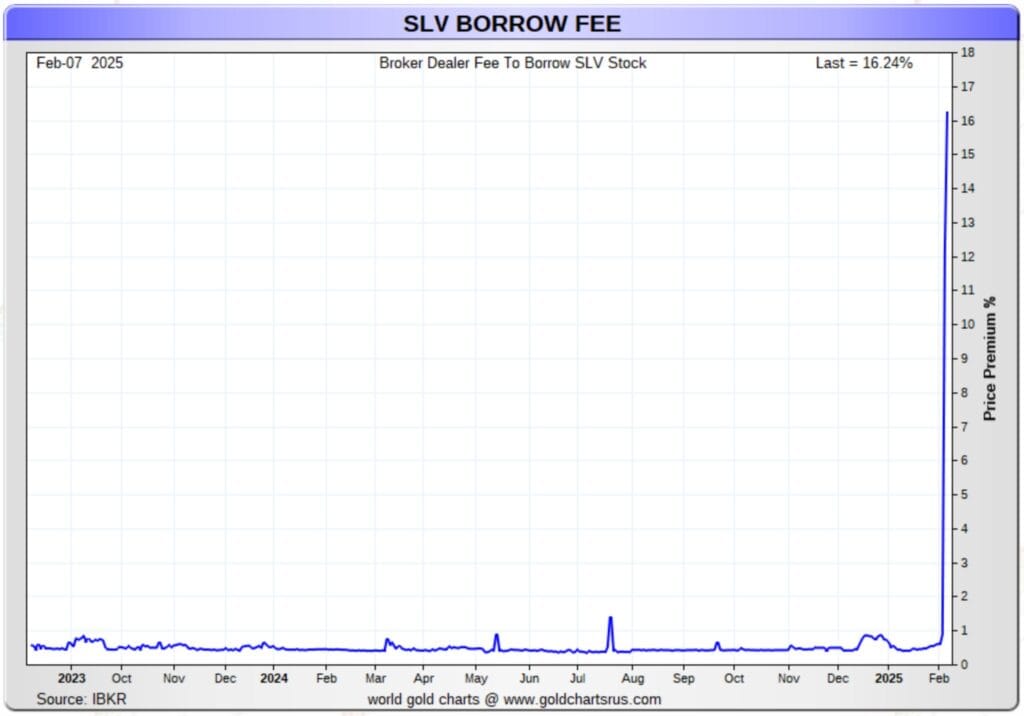

The numbers seem to back this up. Gold leasing rates—typically around 0.5%—have skyrocketed to 12%!

Central banks lease gold to bullion banks, who then sell it into the market.

The proceeds are reinvested at higher interest rates, profiting from the spread.

However, if confidence in paper gold breaks down, the entire system risks collapse.

It’s Not Just Gold – Silver Lease Rates Are Spiking Too

Gold isn’t the only metal showing stress. Lease rates for silver have surged as well, mirroring the volatility in gold. This suggests that the paper metals market is facing severe liquidity constraints.

London’s Role as a Gold Hub is Fading

According to analyst Vince Lanci, these disruptions signal a fundamental shift in the global gold market:

“London’s role as the world’s gold hub is fading. The LBMA has operated on the assumption that gold can always be leased. That model is breaking down. Basel III, de-globalization, and central bank accumulation are reshaping the market. Nations are preparing to use their Gold and Silver in trade once again.”

Source.

With China and Saudi Arabia repatriating gold and London struggling to keep up with outflows, the days of the LBMA’s dominance may be numbered.

So What Does This All Mean?

We’ve seen China quietly accumulating gold through backdoor channels, massive outflows from the LBMA, and central banks continuing their record purchases. Meanwhile, retail investors are doing the opposite—selling their gold holdings.

This isn’t just a coincidence. It suggests a major shift in the global monetary system. Central banks and sovereign nations seem to be preparing for a world where gold plays a more significant role in trade and reserves—while everyday investors, misled by mainstream narratives, are giving up their gold at the worst possible time.

Could we be approaching a global gold revaluation or a currency system reset? The actions of governments and institutions hint that they’re securing real assets before the next financial upheaval.

Is the U.S. Also Repatriating Gold?

It’s not just China withdrawing gold from London. Previous reports suggest the U.S. has been doing the same—possibly ensuring its own reserves are fully allocated as trust in paper gold diminishes.

As Lanci bluntly puts it:

“The freely available supply of gold looks much smaller than assumed.”

If this trend continues, those holding paper claims on gold may wake up to a harsh reality—while those with physical bullion in their possession will be the true winners.

The Big Picture: What This Means for Gold Prices

If U.S. dealers are importing large amounts of gold ahead of potential Trump-era tariffs, this could create short-term price distortions—but the real concern is long-term supply.

- Gold premiums in the U.S. are rising, signaling a shrinking supply of physical bullion.

- If tariffs are enforced, gold imports could slow, pushing prices even higher.

- This could force the COMEX and LBMA to rethink their ability to meet delivery demands, accelerating the shift toward a fully allocated, physical gold market.

For investors, the key takeaways are clear:

- Gold is moving from weak hands (retail sellers) to strong hands (central banks and institutions).

- The availability of physical gold is shrinking while paper gold markets remain vulnerable.

- If gold’s role in the monetary system is shifting, the time to secure physical bullion is now.

The Unfortunate Conclusion

While retail investors sell their gold, central banks are doing the opposite—quietly accumulating at record levels. This trend has been most pronounced in the East, but now even Western nations appear to be joining the rush for physical gold.

Why? Nations are preparing to use gold and silver in trade once again.

Meanwhile, the average investor is being misled. Some believe the narrative that inflation is under control and are selling their metals. Others are selling simply because they have no choice—forced to liquidate assets to cover rising costs.

If the future brings higher inflation, a revaluation of gold, or a shift in the monetary system, those who sold their gold will find themselves completely unprepared.

The reality is simple:

✅ Central banks will hold the gold.

❌ The average person won’t.

History has shown that those who prepare before a crisis emerge on top.

The writing is on the wall: while the public offloads gold, governments and institutions are silently accumulating.

When the next financial shift happens, who do you think will be prepared?

Don’t be left behind. Secure your gold and silver today.

It seems that the Canadian governments sale of all its gold in 2015 has resulted in a loss of over 100 billion dollars. I plan to hold unto my reserves which are a little less. At least our Govt here are in no danger of repeating this feat as they have none.

That sounds about right Maurice, As you point out the RBNZ has no gold and hasn’t for a long time. https://goldsurvivalguide.co.nz/how-much-gold-does-the-reserve-bank-of-new-zealand-have/ Most was sold in the 60’s and the last of it in 1991. https://goldsurvivalguide.co.nz/australia-has-80-tonnes-of-gold-how-much-does-new-zealand-have/ We shudder to think how much that would have been worth now.