Two Specials Today

Any quantity of local gold at spot plus 2.5% plus insurance and delivery or 1oz NZ Mint Gold Kiwi coins at spot plus 2.75%.

Minimum purchase 10 coins

Delivered and fully insured for $18,630 Reply to this email or phone David on 0800 888 465

This Week:

- Gold Lags Silver But Still Up Again

- Silver: 10 Reasons to BUY Lots! (Bix Weir)

- Chartist: Silver About to Bottom? Doesn’t Matter if You’re Buying in NZ Dollars

- Who Will Win the New American Civil War?

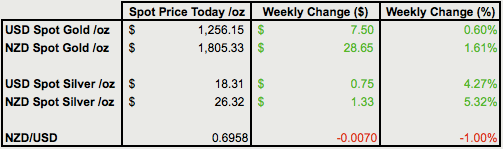

Prices and Charts

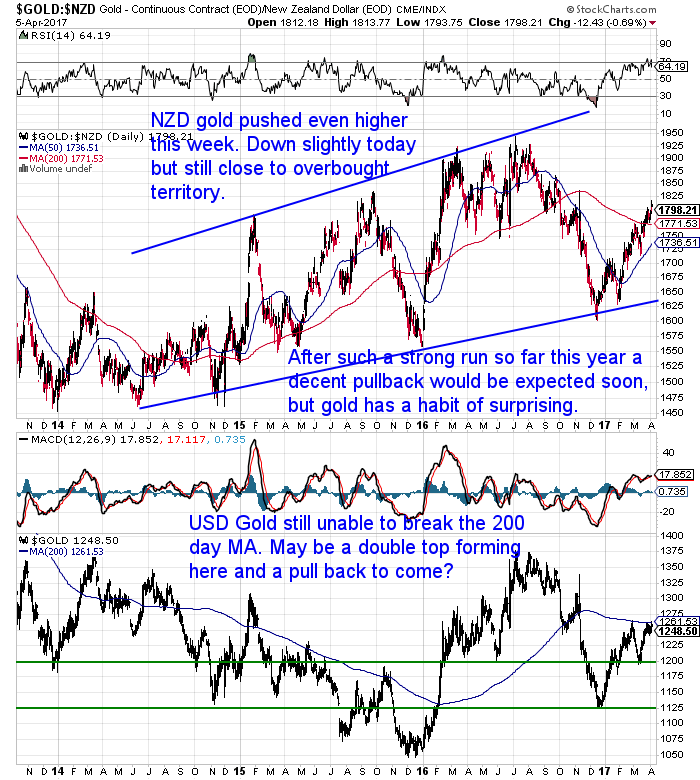

Gold Lags Silver, But Still Up Again

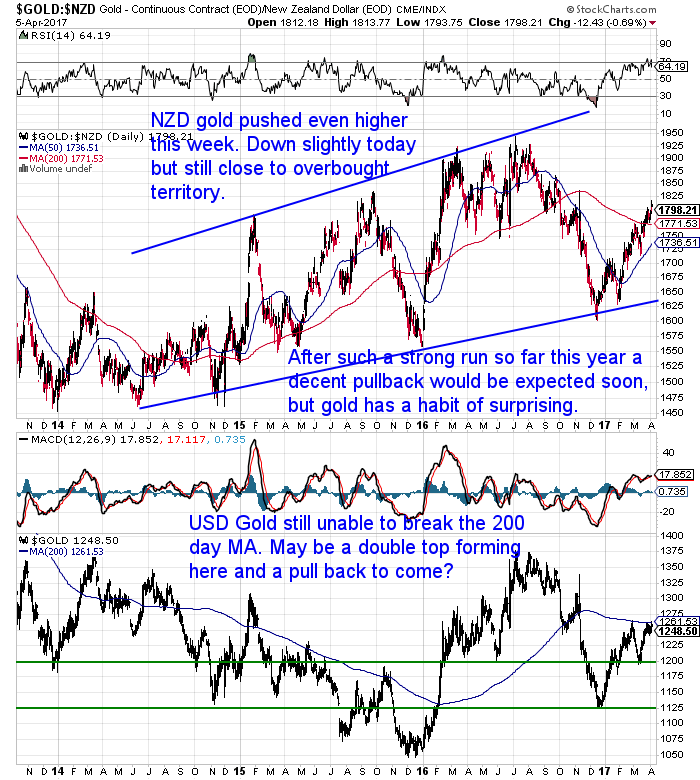

Gold was up again this week but lagging way behind silver.

Gold has put in a strong run higher this year and looks ready for a decent pull back. But precious metals have a habit of surprising us. There still doesn’t seem to be a lot of belief in the current moves higher. Perhaps we’ll see them run higher yet?

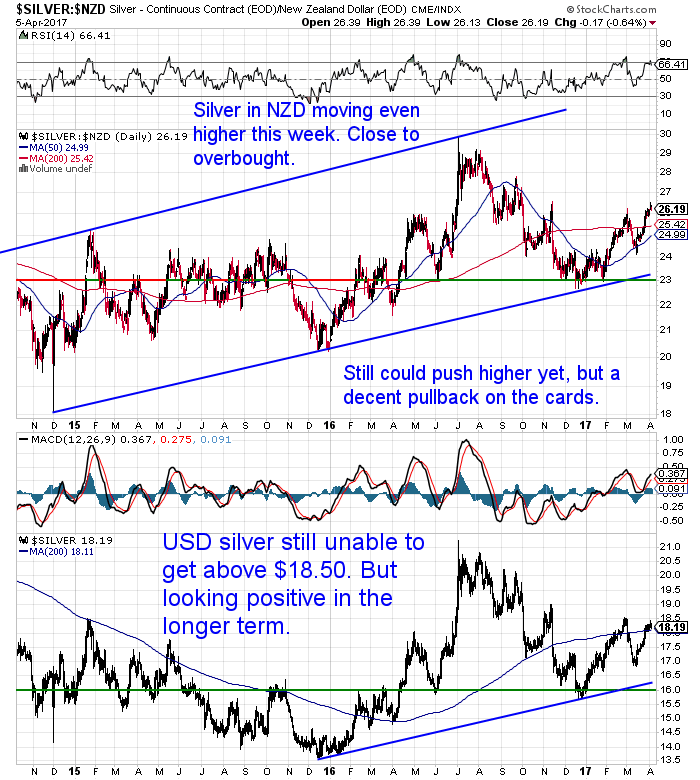

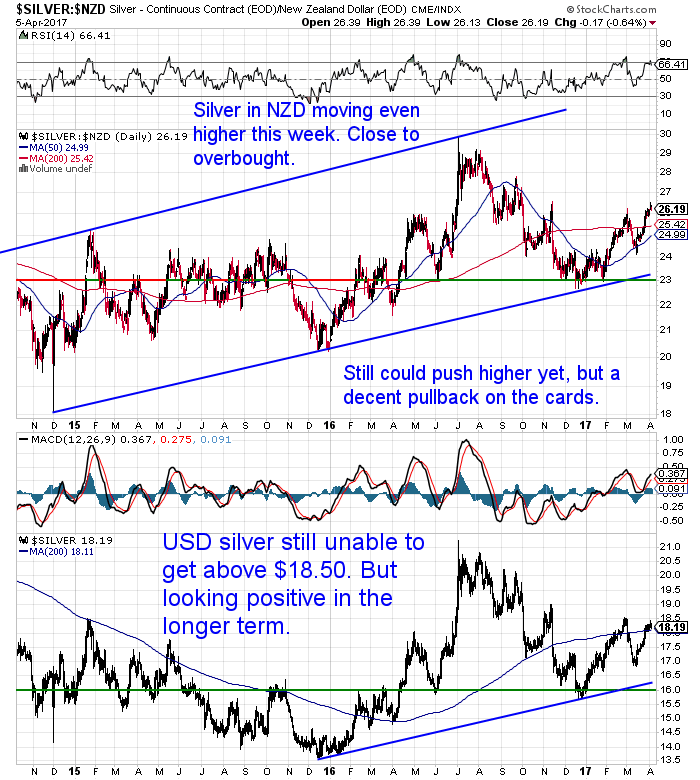

Silver has really leapt a rung or two, up over 5% in the past week. It too looks ripe for a pullback. That said there is still plenty of blue sky ahead. We could see a run towards $28 before too long. We’ll have much more on silver in today’s feature article.

The Kiwi dollar headed lower this week. We could yet see a bit of further weakness too.

Silver: Looking Good

We have a bit of a focus on silver this week.

In NZ Dollar terms it’s up around 13% since the start of the year. If that carried on it would equate to annualised gain of 52%! Now while we don’t necessarily expect that, we do think silver is in the early stages of a significant move higher.

We like that it still remains fairly well under the radar too. At some point in the not too distant future we’ll see some hefty rises for silver. Potentially during this year.

Check out this video from Bix Weir with 10 reasons to buy silver. They’re really more like changes to look forward to but still decent reasons to be buying silver as well.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

<

Never worry about safe drinking water for yourself or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions and has time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

Chartist: Silver About to Bottom? Doesn’t Matter if You’re Buying in NZ Dollars

Our feature article this week looks at a chart from a technical analysis “guru” who believes silver is about to confirm it has bottomed. We discuss why this doesn’t matter if you’re buying in NZ Dollars.

Stewart Thomson is also getting more bullish on gold and silver…

Who Will Win the New American Civil War?

Jim Rickards this week made the point that what is going on in American politics resembles a civil war:

“…on the political front, the United States is descending into what can best be called a second civil war.

This time it’s not North versus South. Now it’s President Trump and a relatively small band of top officials versus Democrats, global elites, mainstream media, mainstream Republicans, the permanent government, holdover Obama appointees, and Obama himself.

This new civil war is not violent or bloody like the first, but the stakes are just as high.

It is being fought over the issues of nationalism versus globalism, secure borders versus open borders, trade, sound money, domestic manufacturing, and so-called progressivism versus tradition.

American politics will remain in this dysfunctional state until either President Trump is politically disabled or his opponents are politically sidelined. This political dysfunction is likely to delay and dilute the impact of tax cuts and infrastructure spending.

…This is the calm before the storm. Political and economic uncertainty are set to return with a vengeance. Now is an excellent opportunity to take gains in stocks and reallocate to 10-year Treasury notes, cash, gold and euros — all of which are set to rally by summer.”

Source.

We’ve actually got 2 articles on the website this week that also discuss the civil war like battle between Trump and the Deep State from 2 quite different perspectives. So be sure to check them out too.

Gold and silver are both sitting in interesting places currently.

They’ve had strong runs higher this year and technically look ready for a pull back.

But in the big picture they are still a long way even from the highs of last year, let alone from 2011. Plus there is so little interest in buying that we wonder whether they might push even higher from here.

If you’re unsure what to do, perhaps follow the lead of one buyer we had last week. He took an initial position with a view to perhaps getting the chance to average down with his next 3-4 purchases.

We’ve still got the excellently priced 1oz Gold Kiwi coins going.

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

—–

This Weeks Articles:

|

|

Thu, 6 Apr 2017 1:44 PM NZST

A very bullish Stewart Thomson discusses the impacts of Indian demand, a looming US government debt crisis, and how inflation is set to surprise to the upside. And how these factors are all combining to boost gold and silver higher currently and into the future too… Debt Endgame And Gold Bull Era Graceland Updates By […]

|

|

|

Thu, 6 Apr 2017 1:25 PM NZST

Charting “guru” Chris Kimble this week had a long term silver chart that posits the theory that silver is very close to having bottomed out. This chart and his discussion refers to silver in US Dollars. Afterwards we’ll have a longer term NZD silver chart for you with our thoughts too. Here’s Chris: Silver; Bottoming […]

|

|

|

Wed, 5 Apr 2017 12:00 PM NZST

We have 2 contradictory articles on the site this week. Both taking a look at the Trump administration and what is going on behind the scenes in the “deep state”. However they have starkly different points of view as to what the final outcome of the current machinations may be. This one identifies three possible […]

|

|

|

Wed, 5 Apr 2017 12:00 PM NZST

Here is the second of 2 contradictory articles on the site this week. Both taking a look at the Trump administration and what is going on behind the scenes in the “deep state”. Interestingly this article has quite a positive outlook on what Trump may achieve in the coming months. We have our doubts as […]

|

|

|

Tue, 4 Apr 2017 3:09 PM NZST

Bix Weir believes that due to severely dwindling supplies of physical silver, in the early 1990’s, 2.75 billion ounces of silver was taken from a stockpile that was for use on the Manhatten project. Bix calculates that this might be close to being “used up”. And so silver could be closed to finally breaking free. […]

|

|

|

Fri, 31 Mar 2017 1:51 AM NZST

Two Specials Today Any quantity of local gold at spot plus 2.5% plus insurance and delivery or 1oz NZ Mint Gold Kiwi coins at spot plus 2.75%. Minimum purchase 10 coins Delivered and fully insured for $18,366 Reply to this email or phone David on 0800 888 465 This Week: New Financial Reporting Rules: First […]

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Note: For local gold and silver orders your funds are deposited into our suppliers bank account. We receive a finders fee direct from them. Pricing is as good or sometimes even better than if you went direct.

|

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

- To demystify the concept of protecting and increasing ones wealth through owning gold and silver in the current turbulent economic environment.

- To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.