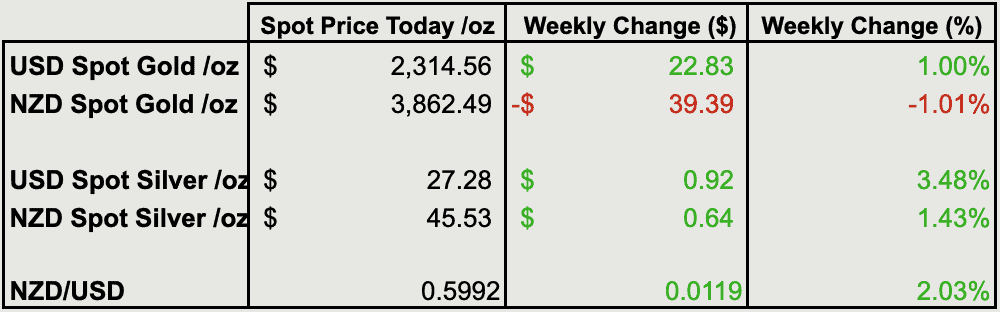

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3691 |

| Buying Back 1kg NZ Silver 999 Purity | $1354 |

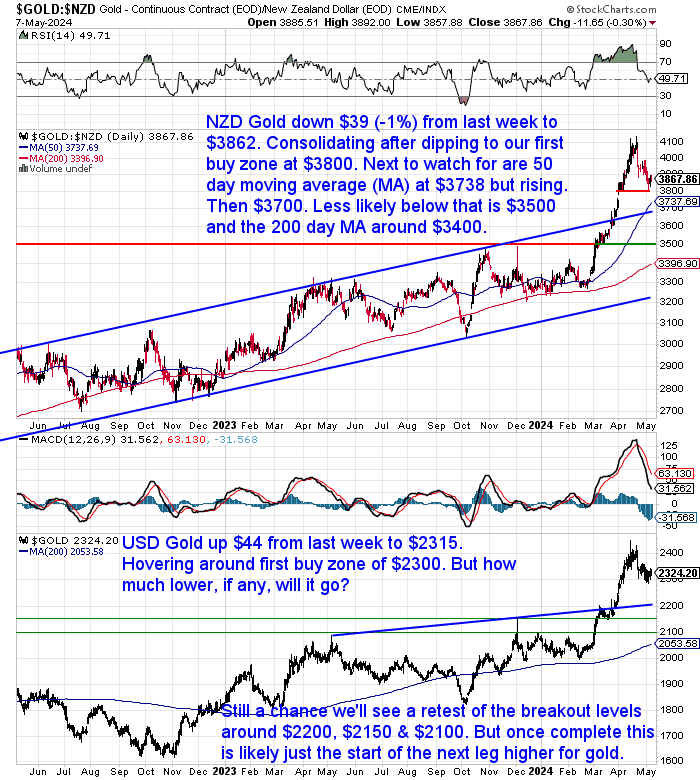

NZD Gold Hits First Buy Zone at $3800

Gold in NZ dollars was down 1% this week dipping to touch our first buy zone at $3800. The 50 day moving average is still rising and not far below here. Then we have $3700 and the top of the trend channel that it has broken out of. Possibly less likely below that is the horizontal support line at $3500 and teh also rising 200 days MA around $3400. With the RSI at neutral, this may be a good place to start layering in, just in case the correction is over already

It’s a similar situation in USD gold. As it consolidates around our first buy zone at $2300. There is still a chance we’ll see a retest of the breakout levels at $220, $2150, or $2100. But no guarantees. So as above, consider layering in from here.

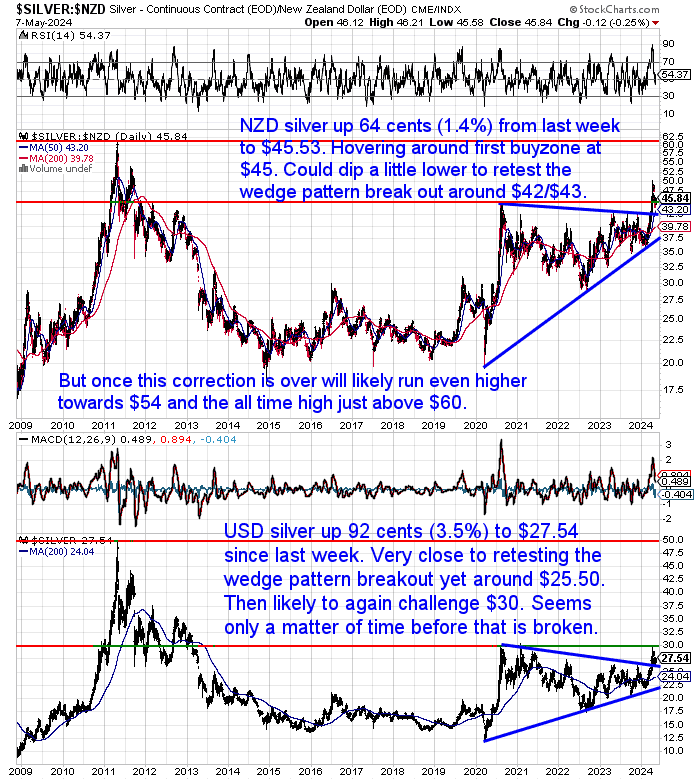

Silver Much Stronger Than Gold This Week

NZD silver was up 1.5% from 7 days ago. But during the week it dipped down close to the 50-day MA. Also close to retesting the wedge pattern breakout around $42/$43. So back into a good buying zone.

Same situation in USD Silver, very close to retesting the wedge pattern breakout around $25.50.

So once this consolidation is over, we should see another challenge of US$30. Once that is broken, it could be a fairly quick move towards US$50.

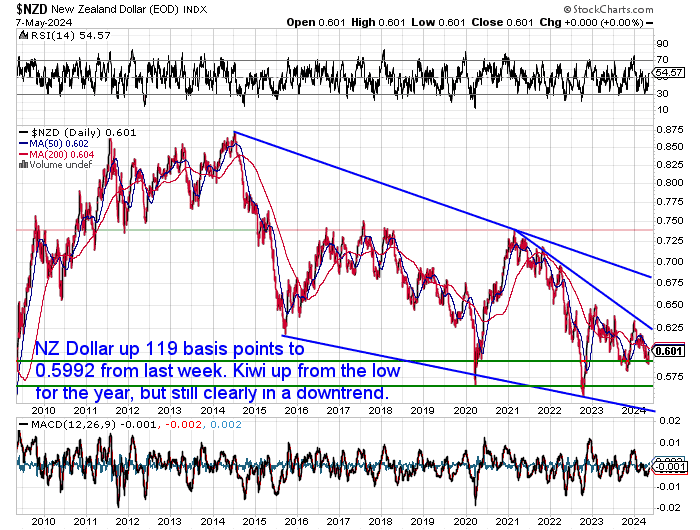

NZ Dollar Up 2%

The NZ Dollar surged 2% higher this week, getting back above 0.6000 although it’s just under that today. But it remains clearly in a downtrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

The Future of Cash in NZ

The RBNZ is looking at options for keeping cash available in towns:

“The Reserve Bank of New Zealand – Te Pūtea Matua is opening applications for towns wanting to trial either local cash depots with automated cash banking facilities that work with all banks, or a security van service. “Retailers and their customers are frustrated by cash banking difficulties, especially in rural New Zealand,” says Ian Woolford, the Reserve Bank’s Director of Money and Cash.”

Meanwhile, Australia’s Macquarie Bank to go fully cashless in push to become ‘completely digital’.

Today’s feature article also touches on the future of cash, but also Central Bank Digital Currencies…

Is Cash On Its Way Out? The Rise of Central Bank Digital Currencies (CBDCs) in New Zealand and How This Might Affect Gold and Silver

New Zealand, like many countries around the world, is grappling with the potential introduction of Central Bank Digital Currencies (CBDCs). What exactly is a CBDC, and how might it impact your everyday life? More importantly, what does it mean for the future of gold and silver in New Zealand? This article dives deep into the world of CBDCs, exploring the Reserve Bank of New Zealand’s (RBNZ) considerations, the global landscape of digital currencies, and the potential consequences for traditional precious metals. Unsure if a CBDC future is a golden opportunity or a reason to run for the hills? Check out this week’s feature article.

If New Zealand Introduces a Central Bank Digital Currency, How Will This Affect Gold and Silver

Become a Gold Survival Guide Partner

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Largest Ever Bank of Japan Currency Intervention?

Following on from last week (Japanese Yen – What a Weak Currency Looks Like),

this might have been one of the biggest currency market interventions by the Bank of Japan. But as Jared Dillian of the Daily Dirtnap says:

“Interventions to support a currency never work in the long run.

Interventions to weaken a currency always do.

Quote:

Bar Napkin math says this waBar Napkin math says this was one of the biggest interventions in BOJ history. If the last one cost 35b this one must be close to a 100billion.”

So expect the Yen to continue to weaken.

Singapore Follows The Chinese Central Bank Lead into Gold

Also following on from last week where we commented how the Thai Pension Fund increased its gold investments, this week we see Singapore has also been doing the same thing.

“Why Singapore is buying gold, 237 tonnes so far is an interesting development. Singapore is close to Chinese ethnicity, and has its finger on the political and financial pulse of the entire region. It is emulating the PBOC, which is selling US$, not for other currencies, but gold.

Singapore is almost certainly signalling to get out of fiat currencies – for reasons yet to become public!Krishan Gopaul – Senior Analyst, EMEA, at the World Gold Council:

Just released data from the Monetary Authority of Singapore shows that its #gold reserves rose by over 4 tonnes in March – the second consecutive month of buying. This means Q1 net purchases total nearly 7 tonnes, with gold reserves now standing at 237 tonnes.”

Crazy Low Silver Price Forecasts = Silver to Have Bg Rise?

Care of Ronni Stoeferle are these incredibly low silver (USD) price forecasts by the big banks…

“Have a look at #SILVER price forecasts by the big banks according to Bloomberg (CPF) function:

– End of 2024: median price of USD 24.8

– 2025: 25.80

– 2026 25.75

– 2027: 25.00

– 2028: 23.63Confirms our hypothesis that silver remains as popular in the financial sector as a pork knuckle and a pint of beer among vegan anti-alcoholics.”

In a nutshell they all think silver prices will stay stagnant for the next 4 years. But we’d say the fact that silver prices have been relatively stagnant for the last 4 years pretty much guarantees they won’t be for the next 4! We’d say it’s more likely they’ll have another 1 in front of them (as in $120), than stay below $30.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

This Weeks Articles:

If New Zealand Introduces a Central Bank Digital Currency, How Will This Affect Gold and Silver

Wed, 8 May 2024 10:15 AM NZST

This article looks at the development of central bank digital currencies (CBDC) in New Zealand and around the world. It then explores how a CBDC might affect the value and use of gold and silver in New Zealand and around the world. What is a CBDC? A CBDC is a digital form of central bank […]

The post If New Zealand Introduces a Central Bank Digital Currency, How Will This Affect Gold and Silver appeared first on Gold Survival Guide.

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: $1452.75 (pick up price – dispatched in 2 weeks)

Box of 500 coins (dispatched in 4 weeks):

2024 coins: $26,400.45

Backdated coins: $26,316.85

Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon. Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2022 Gold Survival Guide.

All Rights Reserved.Read More…