Prices and Charts

Consolidation Continues

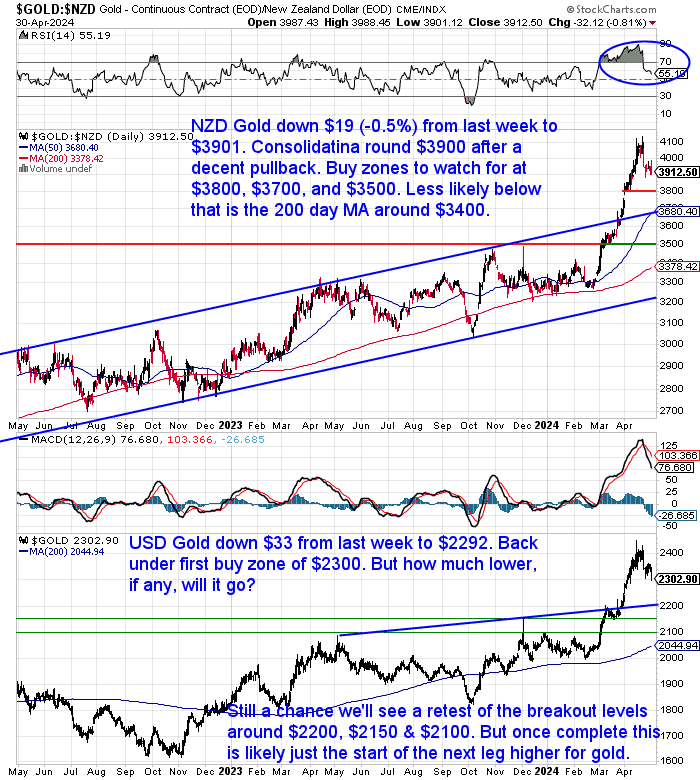

Gold in NZ dollars dropped about half a percent this week. Continuing the consolidation around $3900. Next buy zones to watch for are $3800, $3700 and $3500. Either of those last 2 would see NZD gold retest the recent breakout. So that would be a good healthy pullback to see.

USD Gold today dipped under the first buy zone of $2300. Next ones to watch are $2200, $2150 and $2100. Again hitting any of those would be a retracement of the breakout.

That will set gold up for the next leg higher.

NZD Silver Down 2.5%

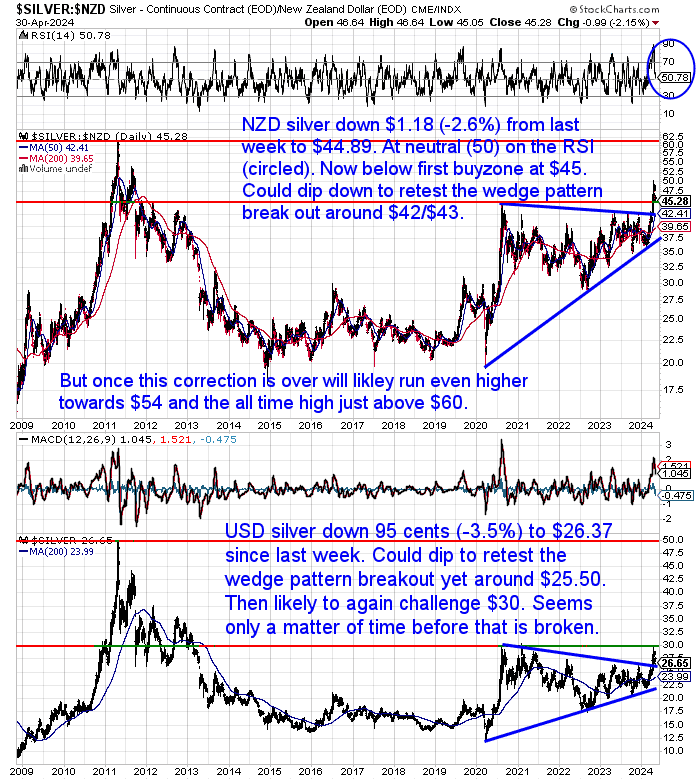

Silver has undergone a steeper correction compared to gold. In NZD terms it is already under our first buyzone at the 2020 high of $45. So like gold it could yet dip down to retest the breakout from the wedge formation around $42/$43.

In USD silver is not far off testing that breakout now. Less than $1 down is all it will take from here. So right now could be a good place to start layering in if it dips any further.

NZD Dollar Hovers Above 0.5900

The New Zealand dollar just continues to bounce around the 0.5900. Today it is back below that level and remains not far from the recent low for the year.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Weekly Roundup: Mastering the Basics of Precious Metals

With gold and silver prices rising we have more new readers joining us. So this week, we’ve got 3 featured articles to give you the essential knowledge to navigate the exciting world of precious metals!

Understanding What You Buy: Gold Purity & Silver Purity Explained

Confused by karats, fineness, and hallmarks? This guide breaks down everything you need to know about gold and silver purity, ensuring you get exactly what you pay for when investing in these valuable metals.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way! We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support. Interested? Contact us today to learn more!

Demystifying the Market: What Does “Spot Price” Mean?

Gold and silver prices fluctuate, but what exactly is the “spot price” everyone talks about? This article clarifies this key term, explaining its impact on buying and selling decisions, and empowering you to stay informed in the precious metals market.

Beyond the Ounce: A Beginner’s Guide to Troy Ounces

New to precious metals? You might encounter the term “troy ounce.” This guide unravels the mystery, explaining what a troy ounce is, why it’s used for gold and silver, and how understanding it can benefit your investment journey.

New to gold and silver? Check out these articles, and you’ll gain the confidence to navigate the world of precious metals. But even if you’ve been around gold and silver we’re sure you’ll learn something about their history. Even we did while writing them!

Tit For Tat Confiscations

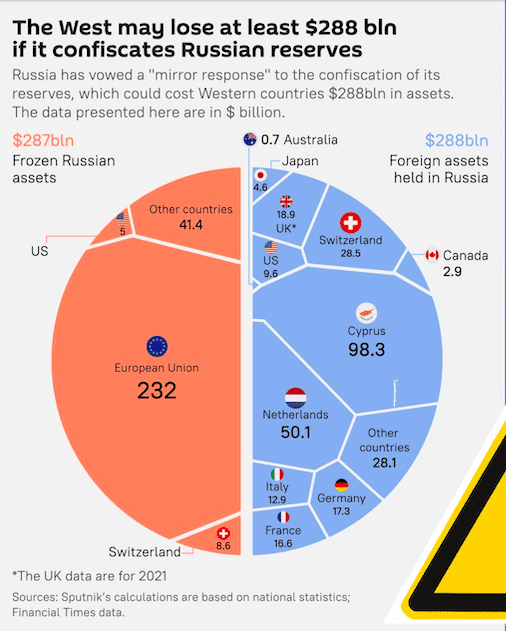

Back in March we mentioned how the US Treasury Secretary Janet Yellen was looking at sending frozen Russian assets to Ukraine. And how this would of course speed up movements out of the US dollar.

It now also looks like Russia will do something quite similar to western assets.

Russia To Seize $440 Million From JPMorgan

“Seizing assets? Two can play at that game…

Just days after Washington voted to authorize the REPO Act – paving the way for the Biden administration confiscate billions in Russian sovereign assets which sit in US banks – it appears Moscow has a plan of its own (let’s call it the REVERSE REPO Act) as a Russian court has ordered the seizure of $440 million from JPMorgan.”

Source.

This is potentially just the first of many moves against western financial institutions that Russia may make.

Source.

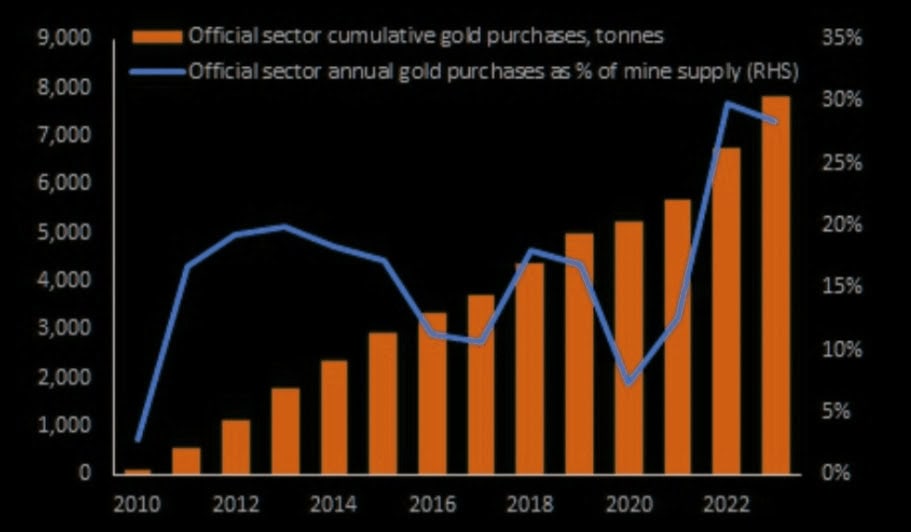

This will be another reason for more central banks and institutions to turn towards gold. As shown below central bank buying of gold has accelerated since 2022.

Source.

Thai Pension Fund Increases Gold Investments

But it’s not just central banks…

“The Thai [$35 bn] Government Pension Fund is reducing investments in assets that may be affected by war, and increasing investments in gold and oil to mitigate risk.”

Notice a trend?

Source.

Now here’s some very interesting prognosticating on the impacts of more central banks turning to gold.

Gold – what if?

UBS playing with numbers: “…if all central banks especially in emerging markets had a minimum of 10% of their reserves in gold (compared to the Fed and the Euro area who have 76% and 57% of their reserves in gold respectively), the increase in gold demand would be 75% of global supply”.

Source.

Japanese Yen – What a Weak Currency Looks Like

But it’s not just central banks buying gold.

The big news over the weekend was the almost certain intervention by the Japanese central bank in the foreign currency market to defend the ever weakening Yen. The Yen hit a level against the USD not seen since 1990!

ASB:

“Japan likely intervened to support the yen on Monday, according to a Bloomberg analysis of central bank accounts. The Bank of Japan reported Tuesday that its current account will probably fall ¥7.56 trillion. That’s much bigger than a drop of about ¥2.1 trillion estimated by private money brokers, suggesting that intervention of about ¥5.5 trillion took place (source: Bloomberg). Meanwhile the NZD has weakened against the USD overnight and is back below 0.5900 this morning. USD/JPY has lifted back to trade near ¥158.0 this morning.”

The problem for Japan is these interventions only often serve to slow a trend, not actually reverse it.

Why is the Yen so weak? Tavi Costa points out:

“The BoJ is trapped” in one chart.

Japan is experiencing increasing inflation expectations alongside a continuous devaluation of the yen, exhibiting an almost perfectly negative correlation.

This reflects the dilemma of an economy burdened by excessive debt, necessitating continuous accommodative monetary policies in the face of structural inflationary pressures.

While this might be more pronounced in Japan, this trend is reflective of a global fiat debasement phenomenon.

Source.

So back to our opening point that it’s not just central banks buying gold. Japanese citizens have responded to their devaluing currency and high inflation expectations by buying gold, while the western world has done the opposite:

Gold demand in 2023 (year-on-year change):

World: 0%

China: +16%

Japan: +273%

Middle East: +2%

US: -1%

Canada: -13%

France: -16%

Germany: -71%

UK: -13%

Switzerland: -27%

Source: WGC

Latest NZ Inflation Numbers: Down But Still High

Meanwhile here in NZ inflation expectations are not so high, even though the numbers remain that way.

The cost of living for the average New Zealand household has increased 6.2 percent in the year to the March quarter, according to new data from Stats NZ. The increase comes after a seven percent increase in the year to the December quarter.

The most recent high was 8.2 percent recorded in the year to the December 2022 quarter.

The biggest contributing factors for the average household’s cost going up included interest payments increasing 28.2 percent, private transport supplies and services increasing 9.6 percent, and insurance increasing 17.9 percent.

Source.

However…

“Inflation is not falling as quickly as economists expected, with one high-profile consultancy picking the next interest rate cut might not come until 2025.

Petrol prices might be partially to blame, with data from price-tracking app Gaspy showing the average cost of a litre of 91 has risen 26c so far this year to an average $2.86.

…With the economy in recession — as the Reserve Bank planned — some economists were asking, why is inflation not coming down faster?

“Who’s doing the spending?” Olsen said. “And we know actually from the numbers that the spending isn’t great. And so the question now becomes, who out there in the economy is still lifting prices when their business is obviously not seeing the same levels of growth?

“The question we’re trying to figure out now is, is it just a bit of a delayed effect? It takes a while for that stuff to come through. Or is it that we’ve got some quite thorny issues still in inflation — the likes of rents going higher, the likes of insurance that might be keeping things too high?”

Another possible cause was cash-rich Baby Boomers spending to tick items off their bucket lists.

Unemployment and wage cost data due this week should make the situation clearer, Olsen said.”

Source.

That’s where economists likely get it wrong, that inflation is all about people spending money and forcing prices up due to demand. So they’re left scratching their heads when inflation is high even while the economy is struggling.

But the 1970’s clearly showed that demand could be low or stagnant while inflation went up.

We continue to warn that this is the likely outcome for NZ and most of the world.

So maybe we should follow the lead of the Japanese citizenry?

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|