Prices and Charts

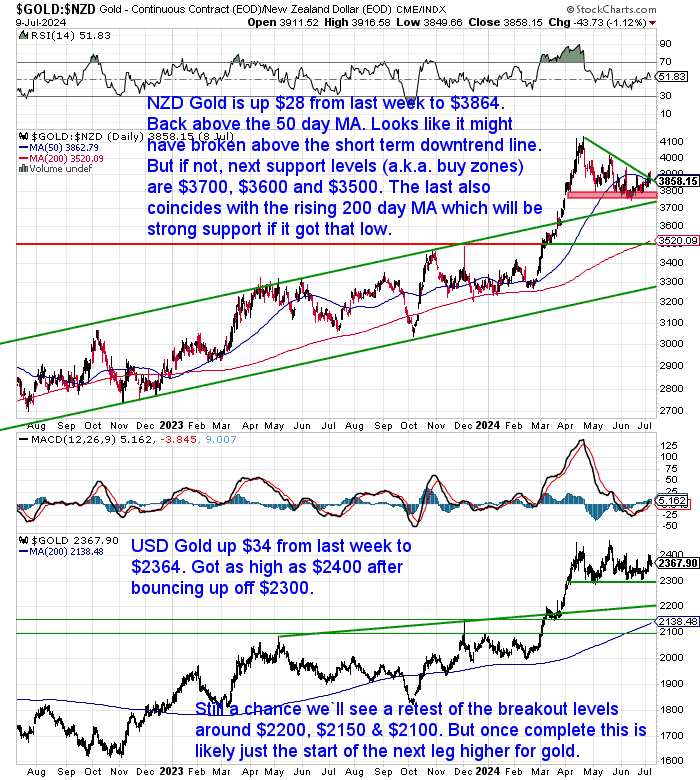

NZD Gold Breaking Above Short-Term Downtrend Line

Gold in New Zealand dollars is up $28 from a week ago to $3864. It got back above the 50-day moving average (blue line) and it may have broken above the short-term downtrend line. It looks like a pretty nice consolidation pattern has been formed here. So if this breakout is for real, then we could see it challenge the all-time high at $4100 from here.

However, if this is just a head fake, then the next support levels, and therefore buy zones, would be at $3700, $3600, and maybe even down to $3500. Although the 200-day moving average line has now risen above that level. So $3500 would be less likely.

It’s a similar look for USD gold. Up $34 from 7 days ago to $2364. After bouncing off the horizontal support line at $2300 again, it got up as high as $2400, before dipping down.

Until we see new highs, there remains a chance of a retest of the breakout levels around $2200, $2150, or even $2100. So layer in if we see any further dips.

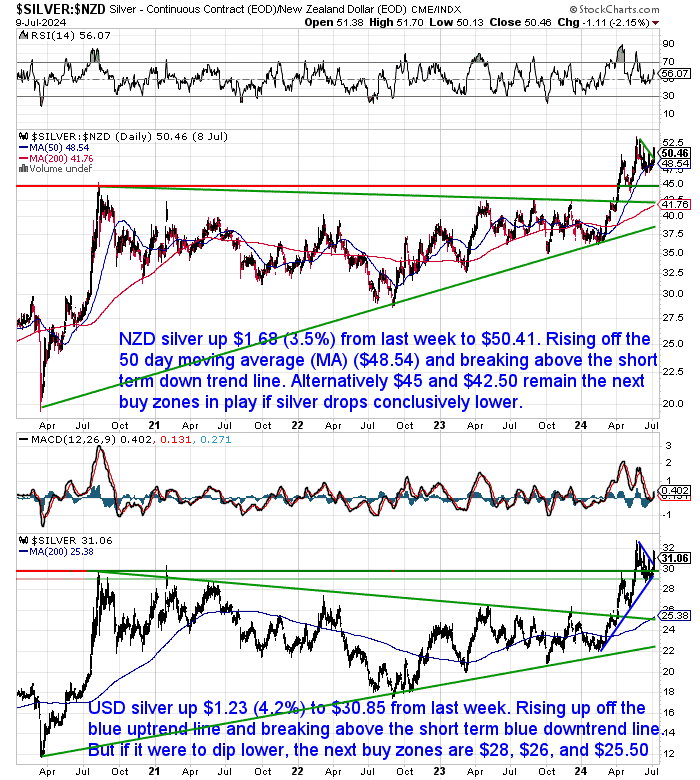

Silver Also Breaking Above Downtrend Line

NZD silver was up $1.69 or 3.5% from a week ago. Today it is sitting at $50.46. It has risen up off the 50-day moving average and looks to have clearly broken above the short-term downtrend line. So we might now see it challenge the June high above $52.

Otherwise if silver drops conclusively lower, then $45 and $42.50 remain the next buy zones to watch for.

USD silver is in a very similar situation. It has risen up off the blue uptrend line, to break above the blue downtrend line. A rise of $1.23 or a hefty 4.2% from 7 days ago.

But if it were to dip lower, the next buy zones would be $28, $26 and $25.50.

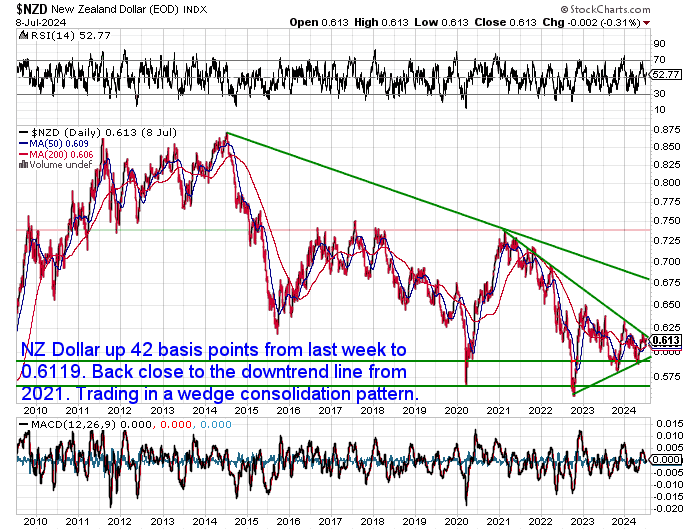

NZ Dollar Back Just Under the Downtrend Line

The NZ Dollar was up 42 basis points from last week to 0.6119. Yet again back close to the downtrend line dating back to 2021. The Kiwi continues to trade in this wedge consolidation pattern. But it is getting narrower and narrower so will have to break one way or the other soon.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Demystifying the Troy Ounce: A Unit of Measure for Precious Metals

Ever come across the term “troy ounce” when exploring gold or silver prices? This week’s feature article tackles this unit of measurement, often used in the world of precious metals.

The article explains the concept of a troy ounce, including:

- How it differs from the standard ounce you might be familiar with

- Its historical origins and significance in the precious metals trade

- Why jewellers and investors use troy ounces to measure gold and silver

Curious to understand the language used in the precious metals market? This article sheds light on the troy ounce, equipping you to navigate gold and silver pricing with greater confidence.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Gold Survival Guide Q&A Call Recording: Analysing the Silver Breakout

In case you missed our recent Q&A call there is a recording available.

The theme was: “Analysing the silver breakout”.

We delved into various charts and looked at:

- Why this current breakout in silver is so significant

- What levels to look for as possible buying zones in the current consolidation or pullback

- Some potential price targets to look towards in the future

- Timing for these targets

- Plus we answered over 30 questions from our readers

NZ Treasury Outlines Likely Costs of Financial Institution Failures

The NZ government Treasury has been looking at the potential costs of the failure of a NZ financial institution.

The most likely type of financial institution to fail and require the new deposit guarantee scheme to kick in would be of a non-bank deposit taker and would be likely to cost between $800 million and $1 billion up front, with recoveries likely to reduce the cost to between $100 million and $400 million.

Source.

The report goes on to say:

“There is significant uncertainty about the likelihood of deposit taker failures over the period of the SoFA,” which covers the initial five years.

“With the exception of finance company failures during the global financial crisis, there have been very few failures of deposit takers in recent years that would provide data to estimate the likelihood of failures,” Treasury says.”

Nonetheless, it would seem to be a non-zero risk and therefore one that is worth planning for.

You can learn more about the NZ Bank Deposit Scheme at the link below. Including what is covered, how much, plus what the risks will still be even when this scheme comes into place in 2025:

- New Zealand Bank Deposit Protection Scheme – Does N.Z. Have Bank Deposit Insurance?

-

NZ Retail Spending Slumps – US Heading for Recession?

For anyone living or owning a retail business in New Zealand, it won’t be a surprise that the NZ economy is very sluggish right now. In fact according to this headline the slump in retail spending is approaching the levels last seen after the 1980s sharemarket crash…

Retail spending slump nearly surpassing ’80s sharemarket crash, worse than GFC

New Zealanders are giving up spending at a rate that surpasses the downturn of the global financial crisis (GFC), and is close to passing that of the 1980s sharemarket crash, as well as the tough times of the 1970s.

Source.

Plus we have house values continuing to fall:

Auckland house values have dropped for the past five months in a row and fell further in the latest quarter, Quotable Value says. “Auckland led the reductions with a 2.6% average home value decline in the latest quarter.

Source.

As a result we are starting to see more mortgagee sales appearing now too:

A rise of mortgagee sales is only the beginning of a “painful period”, as one property expert warns that “it’s going to get much, much worse”. While not at the levels seen during the Global Financial Crisis, mortgagee sales have been climbing.

…One real estate regional manager in Wellington told RNZ his team normally appraised up to three properties a year for potential mortgagee sales – that was now up to three a month.

Source.

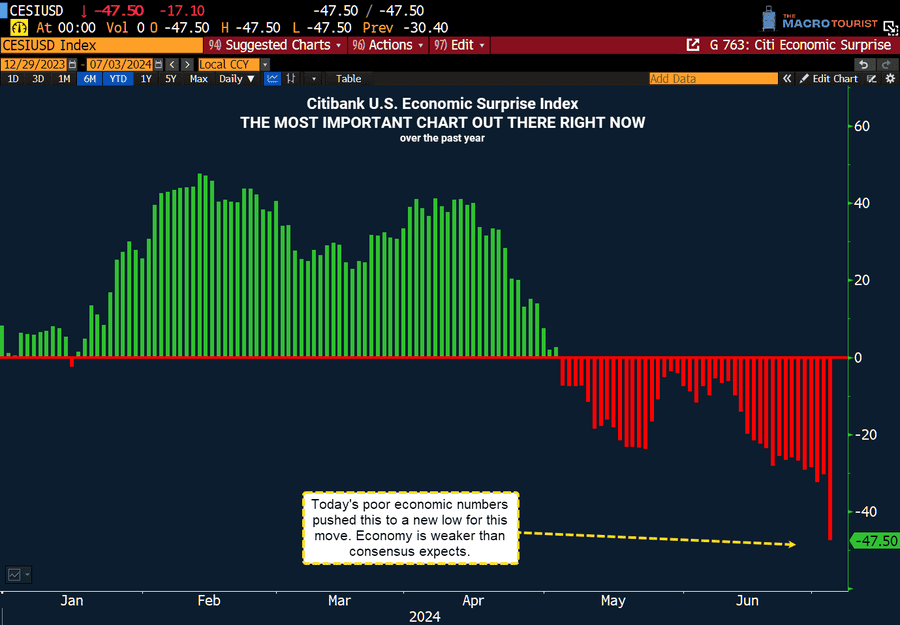

By comparison the US has been holding up pretty well. However, the Citibank Economic Surprise Index shows that may be about to change…

The most important chart right now (according to the great @kevinmuir): US Economic Surprise Index

…and it just worsened even more…

#hardlanding #recession ht

@kevinmuir

Source.

So the US may finally be headed for a recession too.

Dutch Central Bank Has the Right Idea

The Central Bank of the Netherlands (DNB) is perhaps one of the most vocal proponents of the need for gold as an anchor to the Dutch economy. Analyst Jan Nieuwenhuijs outlines the many comments the DNB has made over the past decade, culminating in last week allowing some journos through its new gold vault…

Today, on July 2, 2024, the central bank of the Netherlands (DNB) invited 12 journalists to have a look inside its new gold vault at the Dutch army base near Zeist. DNB stores 190 tonnes (one third) of its gold in this vault. The central bank states it invited the journalists to show the gold is there, how it is safeguarded and serves as the asset of last resort (“insurance”). Journalists couldn’t bring cameras but video images were provided by DNB.

Earlier, in May 2023, DNB said “gold is the ultimate anchor of trust. If the entire financial system collapses, you still have the gold and the gold retains its value.”

In October 2022, DNB Governor Klaas Knot mentioned, “the balance sheet of the Dutch central banks is solid because we also have gold reserves and the gold revaluation account is more than 20 billion euros,” in response to a question about DNB’s losses due to unconventional monetary policy.

In April 2019 it read on DNB’s website: “Gold is the perfect piggy bank – it’s the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again.” Although this statement was removed several years later, it can still be read on the Internet Archive.

DNB allowed journalist with their own cameras in its previous vault in Amsterdam in April 2016. This was a little while after DNB had repatriated 120 tonnes from Federal Reserve Bank of New York in November 2014.

DNB (as well as other European and Asian central banks) is clearly pro gold and prepared for a new gold standard.

Source.

RBNZ – Not So Much

That is of course in stark contrast to the Reserve Bank of New Zealand (RBNZ). Who as we shared last month, has zero gold reserves and it would seem no intention to have any:

How Much Gold Does the Reserve Bank of New Zealand Have in 2024?

So would you rather be like the Dutch or New Zealand central bank?

Do you have enough (or any?) reserves in place in case, as the DNB says: “the entire financial system collapses”?

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|