Prices and Charts

NZD Gold Holding Above the Key 200 Day Moving Average

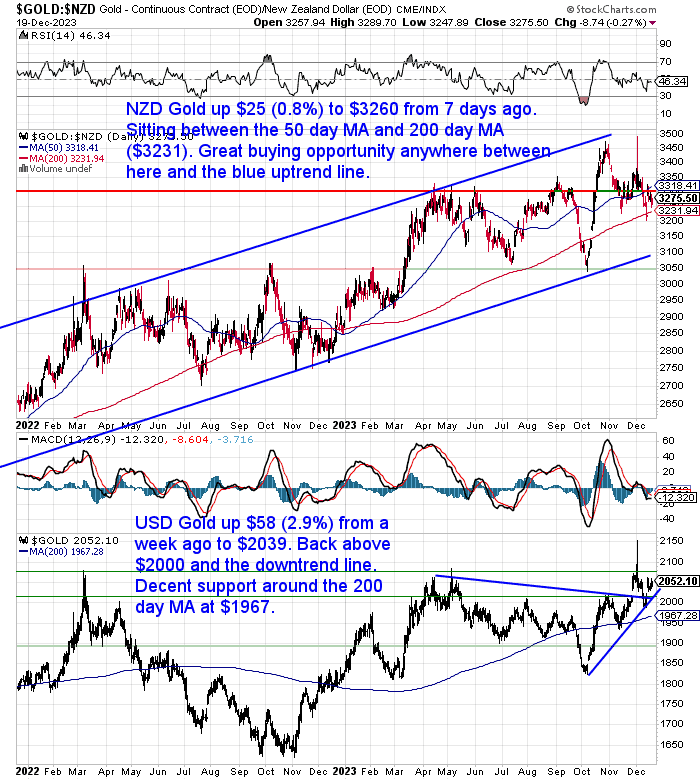

Gold in New Zealand dollars was up $25 from last week. The 0.8% rise kept the price above the 200 day moving average (MA) line. Currently sitting between there and the 50 day MA. Should be a decent buying opportunity anywhere between here and the blue uptrend line.

In USD terms gold was up 2.9% or $58 from 7 days prior. Back clearly above the $2000 mark and the blue downtrend line. There should likely be decent support around the 200 day MA at $1967.

Keep an eye out for a possible dip in the low volume Christmas/New Year period. No guarantees of course!

Silver Bounces Back Sharply

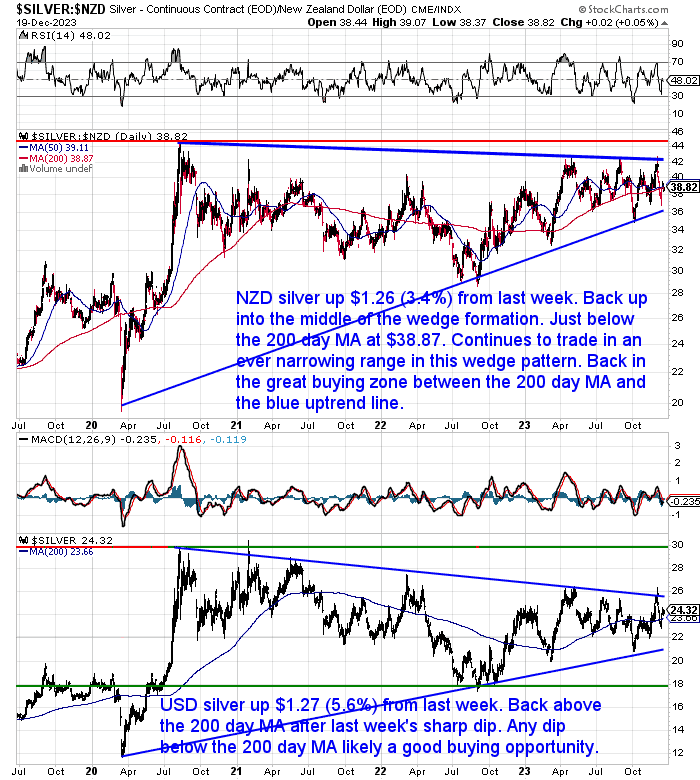

Silver in New Zealand dollars continues to yo-yo up and down between the blue trendlines in the wedge formation. It was up $1.26 (3.4%) from a week prior. Currently just below the 200 day MA, so back in the great buying zone between the 200 day MA and the blue uptrend line. It still looks like any dip to the latter should be bought.

Silver in USD was up a hefty $1.26 (5.6%) from last week. Back above the 200 day MA after the sharp drop. Any dip below the 200 day MA is likely to be a very good buying opportunity.

The wedge formations continue to narrow. A breakout in the New Year is on the cards.

Kiwi Dollar Close to Breaking Out

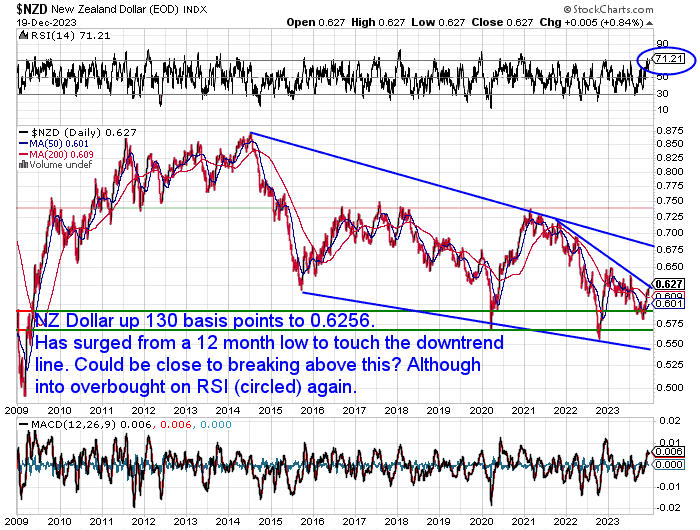

The Kiwi dollar was up over 2% this week. Hitting a 5 month high at 0.6256. As we saw above, this put a dampener on local NZ gold and silver prices (although they were still up). The Kiwi looks to be close to breaking out of the downtrend dating back to 2021. But the RSI is now overbought above 70 (circled). So maybe a pullback first.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Dutch Central Banks Admits Gold Revaluation Likely in a Crisis

Back in May this year there was this…

“Stunning quote by Dutch central bank (DNB).

Reporter: Why do we need gold?

DNB: “Gold is the ultimate anchor of trust. If the entire financial system collapses, you still have the gold and the gold retains its value.”

Source.

Then more recently Jan Nieuwenhuijs has expanded upon this following another somewhat surprising interview with Aerdt Houben, Director of Financial Markets for the Dutch central bank:

“In a recent interview the Dutch central bank (DNB) shares it has equalized its gold reserves, relative to GDP, to other countries in the eurozone and outside of Europe. This has been a political decision. If there is a financial crisis the gold price will skyrocket, and official gold reserves can be used to underpin a new gold standard, according to DNB. These statements confirm what I have been writing for the past years about central banks having prepared for a new international gold standard.

Wouldn’t a central bank that has one primary objective—maintaining price stability—serve its mandate best by communicating the currency it issues can be relied upon in all circumstances? By saying gold will be the safe haven of choice during a financial collapse, DNB confesses its own currency (the euro) does not weather all storms. Indirectly, DNB encourages people to own gold to be protected from financial shocks, making the transition towards a gold based monetary system more likely.”

Source.

It’s worth clicking through to read the short transcript of some key points in the interview.

Then also on this topic we have another Dutch man, Willem Middelkoop, saying:

“After bottoming out around 1999, the gold price has increased by almost 10% on average per year. This revaluation of gold brings some advantages for central banks. De Nederlandsche Bank President Klaas Knot remarked in a November 2022 interview that the current gold revaluation accounts can be used to restore central bank balance sheets: ‘The balance sheet of the Dutch central banks is solid because we also have gold reserves and the gold revaluation account is more than €20bn, which we may not count as capital, but it is there.’

Earlier this year, Bundesbank executive board member Joachim Wuermeling agreed gold revaluation accounts could be used to cover losses on the balance sheet: ‘The most important revaluation item is the reserve for 3,355 tonnes of gold. In fact, the value is about €180bn above the cost of purchasing it, so this is a reserve for us… The balance sheet of Deutsche Bundesbank is on firm ground, and this certainly makes it easier for us to bear losses over a certain period.’

For technical and accounting reasons, central banks are more likely to turn to the GRAs as a psychological cushion, rather than use them formally to reinforce their capital. There is an opportunity for the US as it still values gold at its historical cost price of $42.22 per ounce. The gold reserve held by the Treasury is partially offset by a liability for gold certificates issued to the regional Feds at the statutory rate, which the Treasury may redeem at any time. This means that 8,000 tonnes of gold is used for both balance sheets.

International market participants as well as central bankers around the world will be watching whether – perhaps after the presidential election in less than 12 months – the US will move towards any explicit or implicit gold revaluation. That would mark a further step in gold’s long journey back towards the centre of the monetary stage.”

Source.

Over at Sovereign Man, they also commented on this interview with the Dutch central bank. Pointing out that:

“The Dutch understand this concept very well; after all, they once held the world’s #1 reserve currency position… and then lost it. So they know the same thing will happen to the dollar. It’s inevitable.

I agree entirely with this view and have written about it extensively: I believe there is a very high likelihood that the dollar loses its reserve dominance within the next 10-years, and probably sooner.

The [US] Congressional Budget Office has already forecast (rather optimistically) that interest on the debt, plus mandatory entitlements like Social Security, will consume 100% of US federal tax revenue by 2031.

This means that everything else, including the military, will have to be financed by debt.

Two years later in 2033, Social Security’s primary trust fund will run out of money, according to the program’s annual trustee report.

These are not conspiracy theories; rather, these are the government’s own forecasts. And I believe that either event could trigger a reset of the global financial system in which the US loses its dominance over the rest of the world.

Personally I don’t think that anyone trusts China enough to anoint its yuan as the new global reserve currency.

But gold is an asset that has a 5,000+ year history of trust and confidence.

And if gold does become the global reserve once again, you can likely bet that gold prices will go to the moon.”

Source.

All these comments point to a certain inevitability of some sort of monetary change likely involving gold. So in this week’s feature article we look at how this would affect New Zealand.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

US Central Bank: Interest Rate Cuts Coming?

The big news this week was the apparent about face from the US central bank indicating that interest rate cuts are likely coming to the USA next year:

Fed holds rates steady, indicates three cuts coming in 2024

“Along with the decision to stay on hold, committee members penciled in at least three rate cuts in 2024, assuming quarter percentage point increments. That’s less than what the market had been pricing, but more aggressive than what officials had previously indicated.

…Markets, though, followed up the meeting and Chair Jerome Powell’s press conference by pricing in an even more aggressive rate-cut path, anticipating 1.5 percentage points in reductions next year, double the FOMC’s indicated pace.”

Source.

Recently rising sharemarkets have likely been an indicator that markets have seen this coming.

Interest Rate Cuts Also Now Expected in New Zealand

Back here in New Zealand we’ve seen a sudden similar change in outlook too.

ASB reported on last week’s very poor GDP figures:

Weak GDP opens door to early OCR cuts

“Q3 GDP contracted by -0.3% instead of the 0.2% expansion expected. Q2 GDP got revised down from 0.9% to 0.5%. And the annual round of benchmarking revisions further reduced GDP in recent years. All up, the level of GDP as at Q3 was 1.6 percentage points lower than we had anticipated. …GDP is down 0.6 percent over the year to September, with three out of four quarters registering contraction. That is in effect a mild recession at a headline level – and a marked 3% contraction to date on a per-capita basis.”

As a result they now believe that:

OCR cuts coming sooner as economy softens

- Q3 GDP and revisions show the economy has been losing momentum to a greater extent than envisaged

- Inflation pressures will follow suit

- Accordingly, we now expect the RBNZ will first cut the OCR in August 2024

Pretty much all the NZ bank economists expect inflation to return to “normal” at 2%.

“Headline inflation is 5.6%, as measured by the consumers price index (CPI) for the year to September 2023, down from a peak of 7.3% measured 15 months earlier.

“We are winning the war on inflation. But the war is far from over,” Kiwibank chief economist Jarrod Kerr said.

“We remain of the view that the RBNZ has done more than enough to cool the economy, and drive inflation back down to the 2.0% target midpoint. The RBNZ can sit tight, watch the data unfold, and simply trust the process. Monetary policy is working.”

Source.

We’re seeing much the same from the mainstream in the USA too.

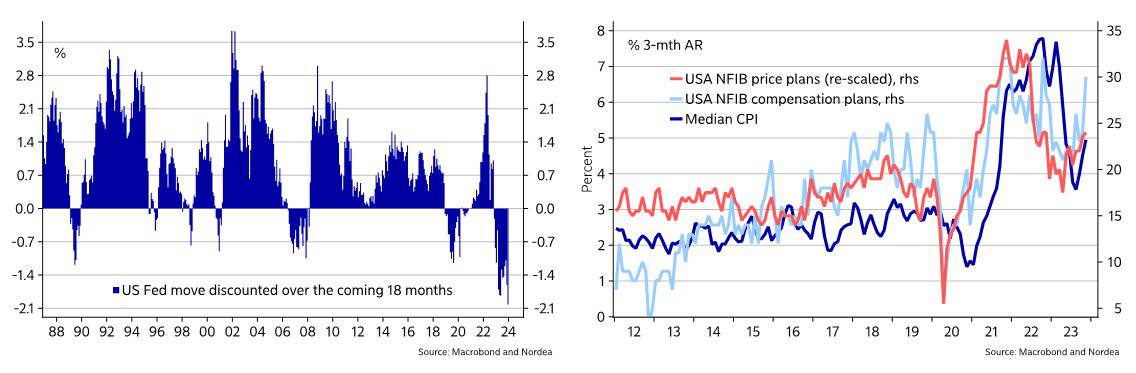

However Paulo Macro made a couple of good tweets following the recent Fed announcement of coming cuts…

“Oh yea – no Second Inflation Wave guys. Remember the many who poo-poo’d that concept as they sought a deflationary recession.

So the Fed is OK with the largest rate cuts ever discounted over the coming 18 months, despite small business price plus compensation plans high and rising. And median/sticky CPI accelerating the past three months. Didn’t see that one coming…”

Source.

So in a nutshell he is saying that the numbers show the US CPI is actually ticking higher. While the Fed is looking likely to have significant rate cuts in the coming 18 months.

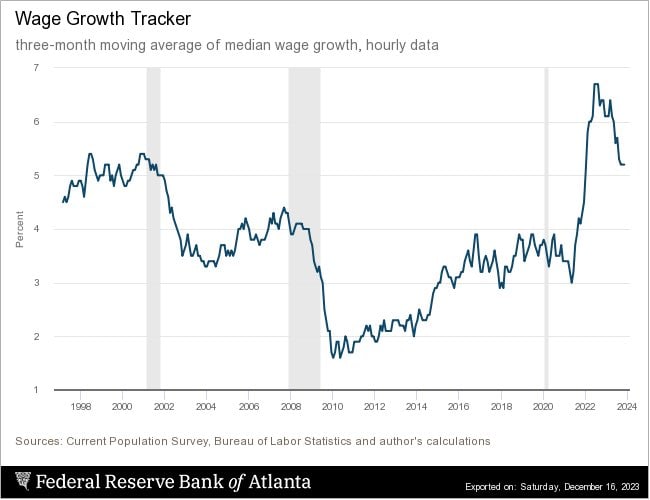

Then here is more where he points out that US wage increases are still very high:

“Per the prior tweet – amazes me that guys think this keeps falling to some perfect 2% landing. Fed just made it impossible and plenty obvious. You don’t put cuts on the table like this! Rates = sticky wages?? Nuts!! Even Brazil’s CB knows better!!!

Source.

So the mainstream and bank economists might be correct that there are short term interest rate cuts coming in the next year or so. However we think these are more likely to be just a short term correction in a longer term cycle of higher interest rates.

Likewise inflation may head down lower yet, but as we’ve said many times in recent months, we still think there are more cycles of high inflation to come in the years ahead.

The reason the bank economists won’t see these waves coming is that their beliefs around inflation are totally different (and wrong!).

From the ASB report mentioned earlier on, here is what they say about the fall in GDP:

“Another way of putting this is that the level of demand in the economy has been lower than anticipated, but the supply capability of the economy has also probably been lower than previously thought. It’s that gap between excess demand and supply that creates inflation. All other things equal, growth likely needs to slow by slightly more than expected to get inflation under control, to ensure that gap gets closed.”

We wouldn’t agree with that inflation definition.

Inflation in consumer prices is the end result of more currency being created. That’s why we believe there is likely more to come. Because you don’t reverse over a decade of super low interest rates and currency creation with highish interest rates just for a year or two. So any interest rate cuts will be adding fuel to the inflationary fire still to come.

To repeat, we believe we are still in the early stages of a multi-year cycle of higher interest rates and higher inflation. That’s likely why the USD gold price has been showing life and flirting with new highs. It’s likely only a matter of time before a break out.

Our open days to lock in order are listed at the top of this email. So other than the Stats we are not shut – just merely have a reduced product range.

So you are still able to purchase if we see any further dips during the low volume Christmas and New year break.

This will be our last weekly update for 2023. All the best for the holiday season and you’ll hear from us again on the 10th January.

Get in touch for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|

Pingback: 5th Best Time to Buy NZD Silver Since July 2022 - Gold Survival Guide