This Week:

- Falling Dairy Prices to Usher in Weaker NZ Economy and Banks?

- Who Will Raise Rates? The Market or the Fed?

- A Couple of Indications That We May Have or Be Near a Bottom in Gold

- The War on Cash is Heating Up

- 2016 – GOLD & SILVER RISING – A GOLD AND SILVER BOTTOM MAY BE IN

- Some Thoughts on “The Big Short”

- Satyajit Das: 2 Outcomes – “Managed Depression” or “The Mother of All Crashes”

|

LIMITED QUANTITY GOLD SPECIALS ***** 1 oz GOLD KIWI COINS Currently $1909 Ph 0800 888 465 and speak to David or reply to this email. |

Quite a lot going on in the world at the moment so we have a number of articles on the website this week. See the usual section at the end of this email for them. But first a run down on gold and silvers movements from a week ago.

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1825.58 | + $35.58 | + 1.98% |

| USD Gold | $1209.08 | + $14.61 | + 0.81% |

| NZD Silver | $23.10 | + $0.22 | + 0.96% |

| USD Silver | $15.30 | + $0.03 | + 0.19% |

| NZD/USD | 0.6623 | – 0.005 | – 0.75% |

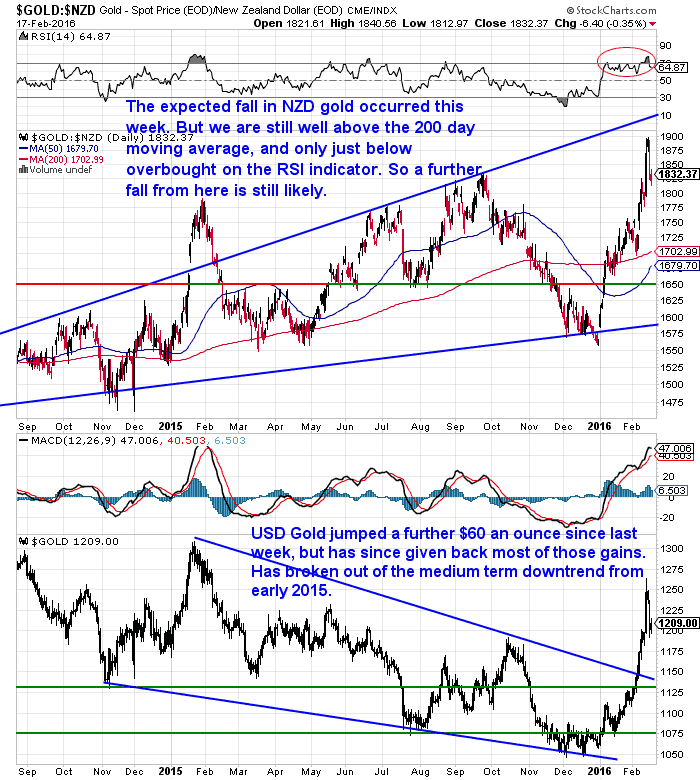

Gold extended its gains from last week, jumping up sharply yet again before retracing much of the latest move.

Odds favour more of a pullback yet, however maybe we will see another run higher first? There’s seems to be a lot of people expecting a sharp correction now, maybe the opposite will happen?

Maybe we’ll see a consolidation around the US$1170 mark before a test of last years high just above US$1300? In New Zealand dollar terms this would translate to around the NZ$1950 level, which was resistance right back in 2009 and again in 2011.

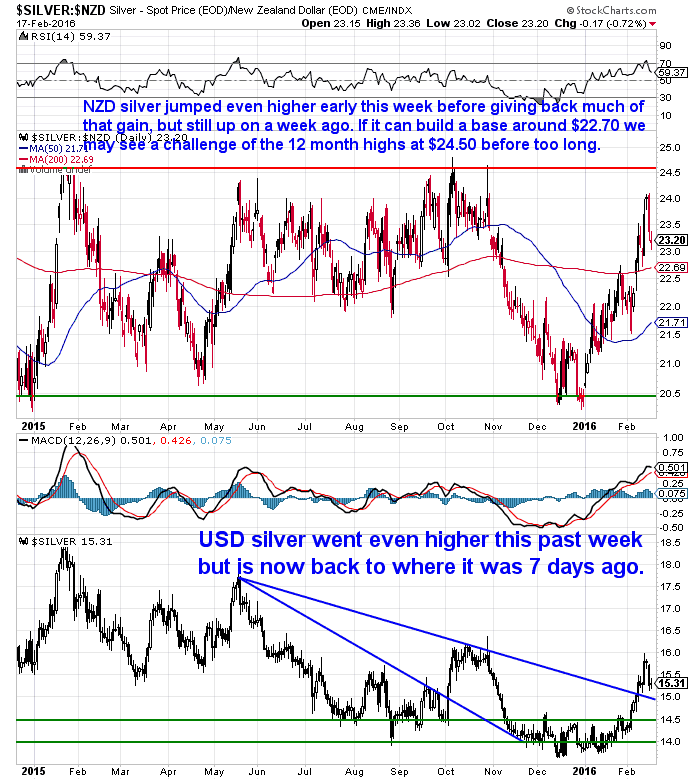

Silver also jumped sharply higher again this week before giving back much of the gains. Maybe it can muster a stand around the 200 day moving average before an attack at the past years highs around NZ$24.50

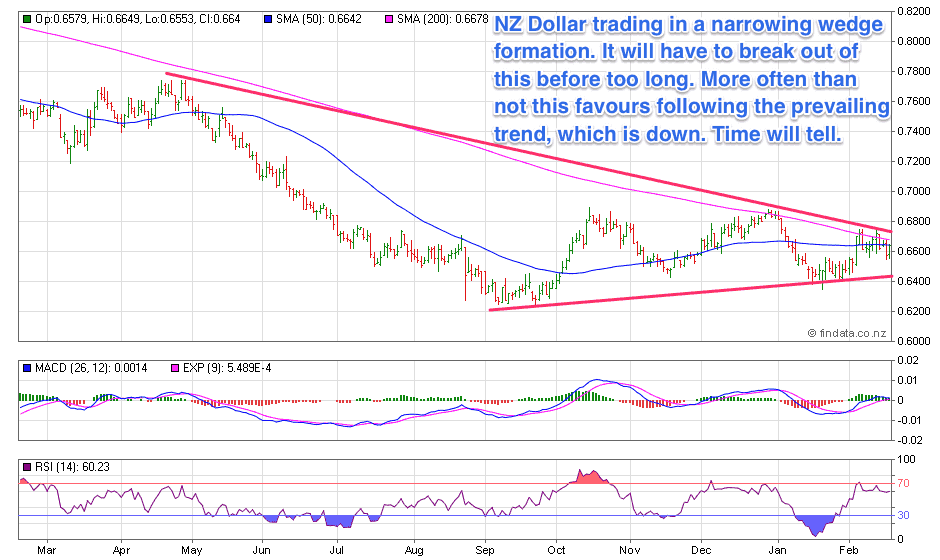

The Kiwi Dollar weakened this week after a fall yet again in the Dairy auction (more on that below). The NZ Dollar is now trading in an ever narrower wedge formation. It will have to break out of this pretty soon. More often than not in this situation we see it follow the prevailing longer term trend which would be down. Time will tell.

Falling Dairy Prices to Usher in Weaker NZ Economy?

Yesterday saw the Whole Milk powder price in the Global Dairy Auction drop another 4%.

Source.

This is probably not that surprising, given that this article explains how the average dairy farmer may lose an astonishing $140,000 this year!

Patrick Smellie gives a good rundown of why dairy prices have plunged.

“- falling oil prices hitting oil-producing countries, which are also some of the biggest dairy consumers outside China;

– ongoing over-production in the European Union, which is flooding other markets; and

– low global grain prices, which feed most dairy herds around the world. Grain is cheaper in part because low oil prices are killing the bio-fuels market.

Meanwhile, the potential value of New Zealand dairy exports to China is being constrained by the terms of the China-New Zealand free trade agreement, which allows China to impose ‘safeguard’ tariffs on dairy imports once they reach a particular volume.

In recent years, New Zealand has reached those quotas by the end of January. This year, they were triggered on January 20.”

However the key point in it is that yet again it comes back to debt driven increases in land values:

“For all the angst about how far dairy prices have fallen recently, they are not that far away from long term historical averages. However, New Zealand dairy farms have become relatively expensive producers in the meantime, in part because dairy farmland prices rose so strongly in the recent boom.”

The question now is how will this flow through to the rest of New Zealand? How many farms are going to face mortgagee sales?

The latest financial results from a couple of our banks indicate that perhaps we are in the early stages of a change to more difficult times, and the dairy sector is contributing to this.

Here’s some key takeaways:

“ANZ Bank New Zealand has recorded a $78 million, or 18%, drop in unaudited December quarter net profit after tax to $347 million from $425 million in the equivalent quarter of the previous year.”

…”The New Zealand economy continues to perform well. Headwinds are emerging, however, because of global concerns about credit risk, resulting in wholesale funding costs increasing for banks,” CEO David Hisco said.

ANZ is New Zealand’s biggest rural lender disclosing exposure of $11.3 billion as of last June.

…ANZ NZ’s provision for credit impairment more than doubled to $27 million from $13 million, which ANZ attributed to lower write-backs. The bank also said interest margins have contracted due to strong lending competition and a customer preference for fixed-rate mortgages.

…BNZ’s parent, National Australia Bank, yesterday said NZ dairy loans have pushed up its bad and doubtful debts. NAB said its ratio of 90 plus days past due and gross impaired assets to gross loans and acceptances was 0.68% at 31 December 2015, up from 0.63% at 30 September 2015. The increase stems from the inclusion of NZ$420 million of NZ dairy loans as impaired assets, but with no loss currently expected, NAB said.”

The economists here continue to downgrade Fonterra’s forecast payout having been overly optimistic for more than a year now.

Odds are that NZ won’t be immune to the financial storm that seems to be gathering. And the bank’s financials are where this will show up first. Just as they are with European banks currently. Keep an eye on them.

We also think the odds are high that we will see some serious spending programmes from the NZ government regardless of who is in power. This follows the central planner mould the world over, where only the government can save us.

This week Finance Minister Bill English said:

“The government has scope to play with the timing of an extra $3.5 billion of spending tagged for the next two years if the global economy deteriorates and starts to bite locally.”

Of course they will have to borrow more in order to do this. So expect NZ debt levels to continue to rise.

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

Who Will Raise Rates? The Market or the Fed?

Martin Armstrong had a great article this week discussing interest rates.

It backs up what we wrote in December:

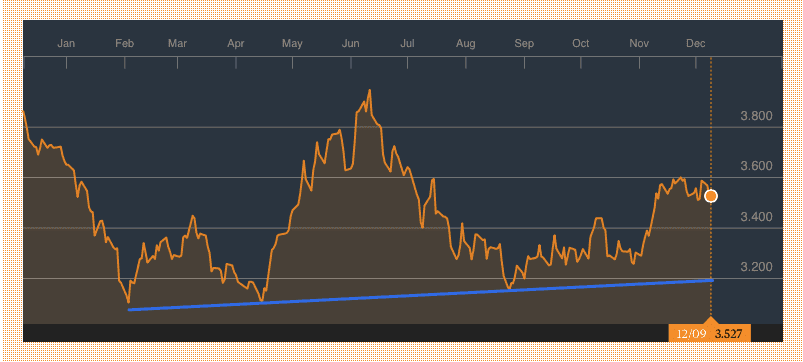

“[Interest rates] will likely surprise people too. It’s important to remember that yes indeed central banks can control short term interest rates like the RBNZ overnight cash rate (OCR). However it is “the market” that controls long term interest rates.

And when you look at these they do seem to be telling a different story. US 10 Year Treasury bond rates bottomed out in January just below 1.70% and are now 2.22%. That may not look like much by it is over a 30% change relative to where they were.

The same occurred here. With 10 year NZ government bond rates looking like they bottomed at the start of the year, as you can see in the chart below from Bloomberg (hard to read but the months are at the top). They have just slowly headed higher since then even while the RBNZ has continued to cut interest rates.

So we think expect long term interest rates to rise in comparison to short term rates, which central banks – including ours – will try and keep low for as long as possible.”

Armstrong explains this as well:

“Some people are confused by what I mean when I say that rates will rise as we move into the sovereign debt crisis, which will pick up steam in 2017 moving into 2020. We are NOT talking about central banks raising rates; we are looking at the FREE MARKET. As people realize that government debt comes with a risk, capital will begin to shift into the private assets. The market will not buy all the government debt that appears ready to explode. With central banks moving negative on short-term rates, smart money will wake up and flip into equities. If equities break-even, that is better than a guaranteed loss in government bonds. In Japan, the 10 year rate just went NEGATIVE so you want to park money with the government for 10 years and pay them to hold it?

The FREE MARKET will force rates higher. Sure, central banks can keep short-term rates NEGATIVE as long as they buy the government debt. But this cannot continue indefinitely. The FREE MARKET will always win. This is how governments fail. The game remains on as long as there are bids at their auctions to sell new debt. What happens when there is NO BID? That is how the FREE MARKET will raise rates. Smart capital will move from public to private debt and equities in addition to gold and real estate on a VERY SELECTED basis.”

Here is another post he then made expanding on this topic if you need more.

Here is another post he then made expanding on this topic if you need more.

Armstrong has a very interesting backstory. You can read about that in one of the articles posted on the site this week. It also looks at 3 different opinions as to why gold and silver may have bottomed.

2016 – GOLD & SILVER RISING – A GOLD AND SILVER BOTTOM MAY BE IN

And speaking of bottoms…

A Couple of Indications That We May Have or Be Near a Bottom in Gold

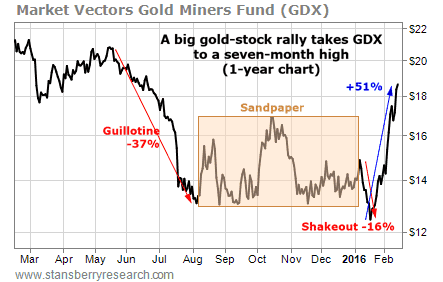

Gold mining stocks have shot higher in recent weeks in what appears to be a classic big rally after a shake out:

“You see, the big move higher came on the heels of a steep decline that took gold stocks to a 13-year low. GDX dropped 16% in seven trading days. On January 19, it closed 81% below its 2011 high.

…This sort of steep drop – one that takes an asset to a new short-term low and is followed by a big rally – is called a “shakeout”… And it could mark the end of the four-year-long bear market in gold and gold stocks.

…This was the largest percentage rally in GDX in more than five years. And it came right after a classic shakeout. It looks like a bottom.”

Read More about the “Guillotine and the Sandpaper”.

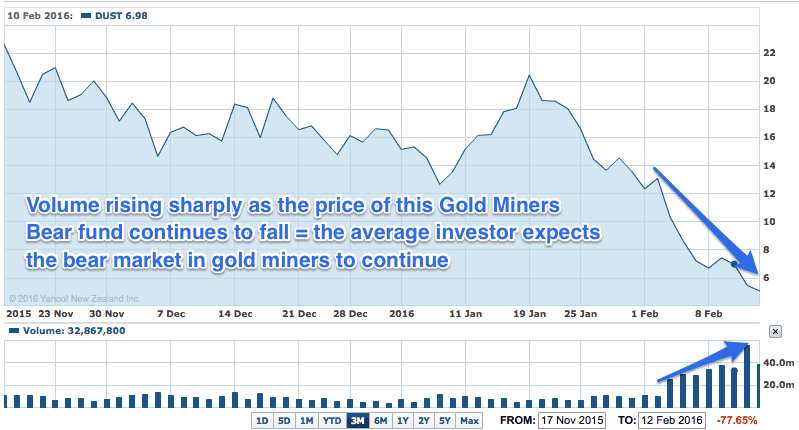

Another interesting phenomenon, that we haven’t seen anyone other than our favourite newsletter writer Chris Weber discuss, is the action in DUST. The Direxion Daily Gold Miners Bear 3X ETF. This is an exchange traded fund that is meant to do the inverse of the gold miners index multiplied by 3. So if gold miners are up DUST should fall 3 times as far and vice versa.

Weber noted that since the start of February DUST has been appearing in the most traded stocks. See the screenshot from Yahoo Finance below taken yesterday. DUST was the 11 most traded stock in all US listed stocks on volume of just under 45 million, just behind Facebook!

And here’s the daily volume for the past couple of months. You can clearly see how much it has risen in February.

(See the latest numbers on Yahoo Finance.)

“So what?” you may think.

Well, here’s the significance of this.

DUST is a bear fund, meaning if you buy it you expect gold miners to fall and so DUST’s share price will rise at 3 times the amount miners fall.

So the fact that more and more people have been buying it since the start of February while DUST has actually fallen sharply, likely indicates that the average investor expects the bear market in gold and gold miners of the past 5 years to continue.

They saw the gold miners reach a record low on 19 January (the high on the DUST chart below) and they simply expected this to continue.

Or put simply, they think gold miners will keep falling so they are buying an inverse fund that they expect to rise.

So this is bullish for the miners, as at the extremes the herd is generally wrong.

The War on Cash is Heating Up

One likely reason for more people moving into gold and silver is the appearance of negative interest rates in even more countries these past few months.

But as we’ve reported many times in the past months, there is also a parallel meme being floated that “cash is bad, m’kay”?.

This week we’ve seen even more articles on the topic of outlawing cash and moving to a cashless society after perpetual world improver Larry Summers wrote a piece in the Washington Post calling for the axing of the US $100 bill.

Just this morning we some excellent responses to this that are worth checking out:

Martin Armstrong: Larry Summers Calls to End $100 Bills — Here Comes the Totalitarian State

Simon Black: The ban on cash is coming. Soon.

Bill Bonner: When Cash Is Outlawed… Only Outlaws Will Have Cash

The War On Savers Intensifies—Germany Moves Toward Cash Ban To Facilitate NIRP

These 4 articles all argue along similar lines that the real reason for the steady push to ban cash is not about stopping crime or money laundering. Rather it is so that the central planners will have complete control over your money. They will be able to instigate negative interest rates and people won’t be able to escape to cash as cash will not exist.

Jim Rickards also follows this line of thinking:

“It’s a two-step process. First, eliminate cash as much as possible. Paper money is the best way to avoid negative interest rates. So paper money must be abolished before the elite plan can be implemented. This forces you into the digital bank system.

Step two is to impose negative interest rates as a disguised tax or wealth transfer. Once everyone is forced into the banks, it’s easy to impose negative interest rates to confiscate your money. Getting savers into digital accounts is like rounding up cattle for the slaughter. For now, it’s just talk by the Fed.

But they’re getting you used to the idea now so they can impose a negative interest rate hidden tax in 2017 or 2018.

The best way to foil the elite plan is to buy physical gold. Gold is a form of money than can never be banned — even by Harvard professors!”

So Rickards thinks negative interest rates are at most only a couple of years away in the US. Here in NZ with our higher rates we may be towards the back of the pack. But we’re still on the same ship as most of the western world, so where they go we likely follow.

So take heed of the straws in the wind and consider some alternatives to cash now. Unlike the USA and unlike laws already in place in Australia, gold and silver have never been confiscated or banned from ownership in New Zealand.

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,310 and delivery is now about 3 weeks away.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles: |

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

|

Today’s Spot Prices

Spot Gold |

|

|

NZ $ 1825.58 / oz

|

US $ 1209.08 / oz

|

|

Spot Silver

|

|

|

NZ $ 23.10 / oz

NZ $ 742.66 / kg |

US $ 15.30 / oz

US $ 491.86 / kg |

|

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

|

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

|

Our Mission

|

|

We look forward to hearing from you soon. Have a golden week! David (and Glenn) |

|

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Unsubscribe | Report Abuse

Gold Survival Guide

PO Box 74437

Greenlane Auckland 1546

New Zealand

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

Pingback: A Precious Metals Correction Must Come Now? Mustn't It? - Gold Survival Guide