Why is Hugo Salinas Price our “favourite billionaire”?

Because he is someone who has pushed, and continues to do so, for a change that will impact vastly more people for the better than the likes of Bill Gates who espouses population control and vaccines for third world nations.

Or unlike Warren Buffet who is openly disparaging of gold, Salinas Price has pushed hard for the remonetisation of silver in Mexico. He understands that a monetary system that is balanced and equitable will have far reaching benefits the world over.

Now while the odds of this push in Mexico being successful may not be that high, he continues to promote education of the monetary metals via his Mexican Civic Association Pro Silver and website Plata.com.mx (Plata is silver in Spanish).

We posted an interview with him on Greg Hunters WatchDogUSA last August. (See: Hugo Salinas Price: We’re Going to be Drowning in Worthless Paper). He is back again with Greg. This time expanding upon a series of articles he wrote early this year. See these:

The Crumbling World Order and Who Will Pick Up the Crumbs?

One Trillion Dollars’ Worth of Bonds Magically Turn into Cash

The Coming Revaluation of Gold

To follow is a summary of what he covers or scroll down to see the full interview.

Hugo Salinas Price interview on USAWatchDog: Gold Repriced at End of Contraction Phase

Salinas Price feels that there has been a change in the world in expectations and attitude towards growth and debt in the world.

How the world has become much more conservative, looking to consolidate, get out of debt and keep what you have.

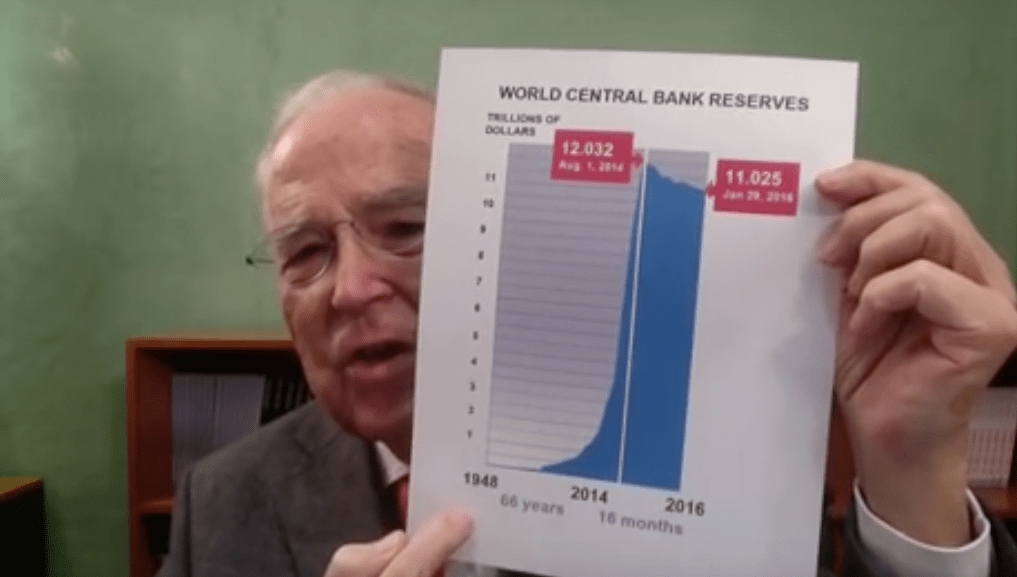

Central Bank reserves have peaked

How he feels we have reached a breaking point demonstrated by the change in Central Bank reserves. These took off in 1971 when the final link with gold was severed.

They grew exponentially until August 4th 2014, where a change occurred and reserves have been going down since. (See the screenshot of the chart below).

But we are now in the contraction phase of Central Bank reserves and this is a self reinforcing cycle.

Gold will be revalued

When we come to the end of this contraction phase, we will find ourselves in a world where there is no other recourse but to revalue gold so that it makes debts payable.

This revaluation may be to $8,000, $10,000 some have gone as far as $50,000.

But this value of gold will diminish the weight of debt on the world.

That will be the outcome of this century of inflation we have had.

What about silver?

Silver will also be revalued in some way even if it is just dragged up with gold being revalued. Silver will be needed for smaller purchases.

He still wonders who bought the $1 trillion in bonds that were sold over the past 18 months, without affecting the price of bonds and without interest rates going up?

Central Bank reserves will go down much faster than they were built up.

Why Central Bank reserves have fallen

Exports are down around the world because importing countries are not buying as much.

So if the exporting countries are not exporting as much they are not growing their reserves.

So if businesses aren’t doing so well they want to get out of debt (they have taken on debt in $US in the good times).

So they go to the central bank and say they want $X to be able to exit their $US debt. So the central bank has to buy $US to action this. Hence central bank reserves are falling globally.

We are going into a worldwide depression

The end result of which will be that nations will realise they have to revalue gold in order to keep trade coming in. As no country is completely self sufficient.

His thoughts on Bitcoin – of which he is not a fan.

How he is not so sure that the current troubles are driven by the fall in the price of oil. Rather it is by excessive debt.

On Whether Gold and Silver is at a Bottom

The fact that gold and silver is jumping higher indicates there is more interest in gold in the last couple of months.

Not just central bank gold will be revalued but everyones gold will be worth more and “that is what will pull humanity forward again.”

Via: WatchDogUSA