1. Introduction: Why Basel III Matters for Gold

Big changes are coming to the gold market. Basel III banking regulations are set to reshape how banks handle gold, and this could have huge implications for investors.

The most important shift? Stricter capital requirements for unallocated gold (paper gold), making it less attractive for banks to hold. This could:

✅ Reduce paper gold trading

✅ Increase demand for physical gold

✅ Drive gold prices higher

With Basel III set to take full effect in the U.S. on July 1, 2025, investors should understand these changes and how they might reshape the gold market forever.

Table of contents

- 1. Introduction: Why Basel III Matters for Gold

- 2. What is Basel III? Understanding the New Banking Rules

- 3. The Shift Away from Paper Gold

- 4. Early Signs of Basel III’s Impact: London’s Gold Shortage

- 5. Will This Drive Up Gold Prices?

- 6. How Will This Impact Investors?

- 7. What’s Next? Future Basel Regulations & Gold’s Role in the Financial System

- 8. Conclusion: Key Takeaways for Gold Investors

Estimated reading time: 6 minutes

2. What is Basel III? Understanding the New Banking Rules

Basel III is a global regulatory framework developed after the 2008 financial crisis. Its goal? To make banks more resilient by enforcing stricter capital and liquidity requirements.

Gold’s Role in Basel Regulations Over Time:

- Basel I & II: Gold was treated as a Tier 3 asset, meaning it had high risk weightings.

- Basel III: Physical gold now qualifies as a Tier 1 asset—on par with cash and government bonds.

The Key Basel III Change for Gold: Net Stable Funding Ratio (NSFR)

- The NSFR forces banks to back unallocated gold (paper gold) with more capital.

- Holding physical (allocated) gold now has regulatory advantages.

The result? Banks may move away from paper gold, causing shifts in liquidity, pricing, and availability.

3. The Shift Away from Paper Gold

What is Unallocated Gold?

Unallocated gold is paper gold—a promise of gold ownership without physical delivery. Banks prefer it because:

✔️ It’s cheaper than storing physical gold.

✔️ It allows for leveraged trading.

✔️ It increases market liquidity.

Read more: Confusing Investing with Wealth Protection – The Risks of Paper Gold vs Physical Gold

How Basel III Changes the Game

Under the new rules:

🚫 Unallocated gold now requires 85% stable funding.

🚫 Banks must hold more capital to back paper gold trades.

🚫 Many may reduce their paper gold positions or shift to physical holdings. (Source).

This could lower gold market liquidity and reduce paper gold supply, leading to potential volatility.

4. Early Signs of Basel III’s Impact: London’s Gold Shortage

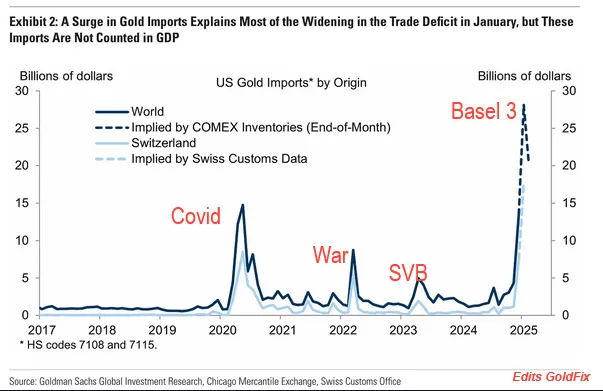

We’re already seeing the effects of Basel III—gold is getting harder to borrow. As we reported back in February:

🔹 Since the U.S. election, over 400 metric tonnes of gold have flowed out of London to New York. (Source). Other reports say it is over 2000 tonnes.

🔹 One-month gold leasing rates in London spiked to 3.5%, the highest level in years. (Source).

🔹 This signals a growing shortage of physical gold available for lending.

🔹 Why? Banks are possibly reassessing their gold reserves ahead of the new rules.

This could be why bullion banks have been covering their “short” positions in 2025, even while the gold price has continued to rise. Likely locking in losses (see “buying rallies” in chart below).

Basel III has been delayed multiple times from 2013 to 2022 (we first wrote about it back in 2012). But it now looks almost certain to finally take full effect in the U.S. on July 1, 2025. So this gold supply squeeze could worsen. Less available gold for lending could drive prices even higher.

5. Will This Drive Up Gold Prices?

Basel III Could Be Bullish for Gold—Here’s Why:

📈 Higher Demand for Physical Gold – Banks and investors shifting to allocated gold will push demand up.

📉 Reduced Paper Gold Supply – With less leverage in the market, artificial price suppression could ease.

⚡ Increased Price Volatility – Less liquidity in gold markets could make price swings more extreme.

Lessons from History: The London Gold Pool Collapse (1968)

A similar shift happened in 1968, when gold’s artificial price controls collapsed. Gold shot up 24x in value over the next decade. Could Basel III trigger a similar revaluation?

Related: What Price Could Gold Reach? 2025 Predictions

6. How Will This Impact Investors?

Potential Benefits

✔️ A stronger physical gold market – Less manipulation, fairer pricing.

✔️ Increased long-term gold value – Rising demand and tighter supply.

✔️ Gold as a safe haven – Central banks may hoard more gold.

Risks to Watch

❌ Short-term volatility – Adjustments to the market could cause price swings.

❌ Liquidity challenges – It may get harder to exit large gold positions quickly.

Investment Strategies Moving Forward

💡 Consider increasing physical gold holdings (bullion, coins).

💡 Be cautious with ETFs and paper gold (they may become less liquid).

💡 Stay informed about Basel III changes to time market moves wisely. Subscribe to our free weekly gold and silver update.

7. What’s Next? Future Basel Regulations & Gold’s Role in the Financial System

🔸 Could Basel IV go even further?

Regulators might tighten rules on derivatives and central bank gold reserves.

🔸 Will gold become a more important reserve asset?

Some believe gold could regain a formal monetary role in global finance. The gold remonetisation we discussed back in 2018 seems to now be playing out.

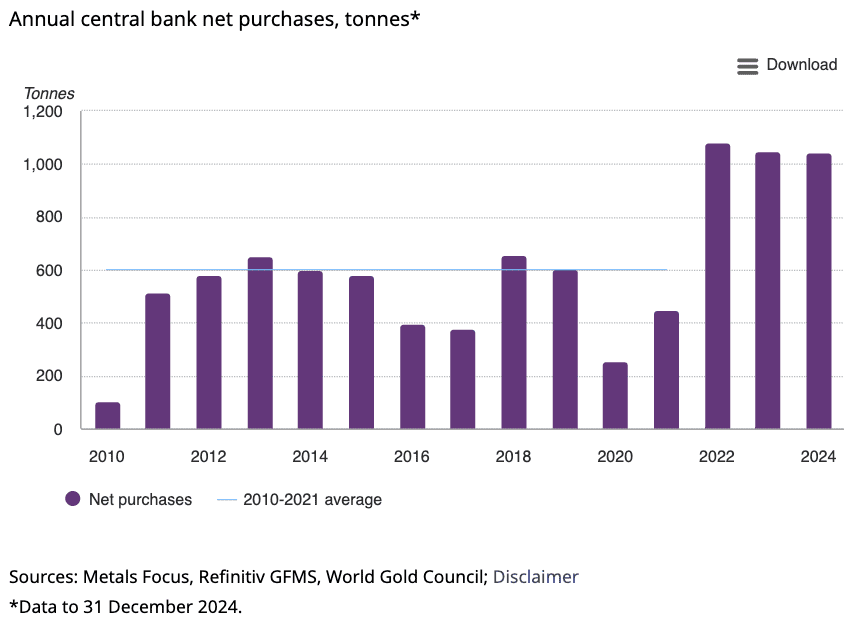

🔸 Central banks are already hoarding gold

Major economies (China, Russia, India) have been increasing gold reserves, possibly anticipating regulatory changes. [See: The Two-Tiered Gold Market: Why Central Banks Are Hoarding Gold While Retail Investors Sell Theirs]

🔸 Could this reduction in paper gold also flow into silver?

Unlike with gold, bullion banks have yet to reduce their paper silver short positions. So if paper silver supply is also reduced silver could also leap frog higher.

Related: Silver Price Predictions 2025: How High Could Silver Go?

8. Conclusion: Key Takeaways for Gold Investors

Basel III is a game-changer for the gold market. Here’s what you need to know:

✔️ Paper gold is becoming less attractive – Banks must hold more capital against it.

✔️ Physical gold demand is rising – This could drive up prices.

✔️ Liquidity is tightening – Gold markets may become more volatile.

✔️ London’s gold shortage is an early warning sign – Gold leasing rates are spiking.

👉 What should investors do?

- Consider shifting to physical gold while supply remains available: You can shop the range available here while premiums remain low.

- Stay informed about Basel III’s rollout and how it affects markets.

- Monitor gold price trends closely—we may be on the verge of a major shift: Get your free subscription to our daily price alert service here.

Final Thought: Gold’s role in the financial system is changing—are you prepared?

Stay ahead of these gold market shifts—subscribe to our newsletter for the latest insights.