Prices and Charts

Gold Up – But Still Overdue a Decent Pullback

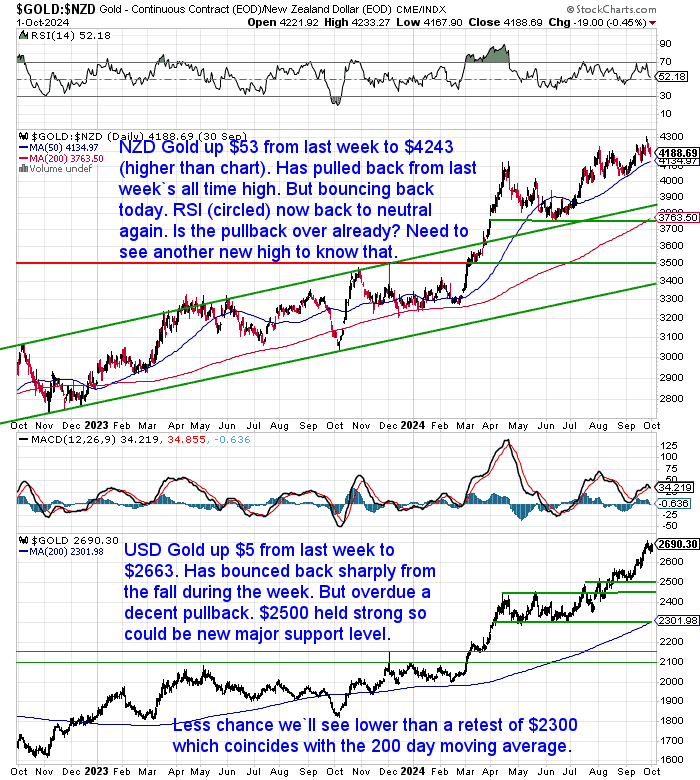

Gold in New Zealand dollars is up $53 (1.3%) from last week to $4243. It has pulled back from the recent all-time high. However it bounced back sharply today, maybe because of worries about the escalation between Israel and Lebanon? So we’re left scratching our head as to whether this pullback is over already?

While USD gold was up $5 to $2663. It has been a relentless run higher over the past year. Gold is overdue for a decent pullback. At some stage we’ll see a return down to the 200 day moving average (MA), currently coinciding with horizontal support at US$2300. Or in NZD terms that is at $3763. But it is a tough call to say whether that will be from here or even higher levels?

Last week money managers’ bullish wagers on gold jumped to the highest in more than four years. So that was a sign that gold was topping out in the short term.

But if we see the high of $2,685 clearly broken through, then even higher prices are likely coming first.

NZD Silver Down 1.3%

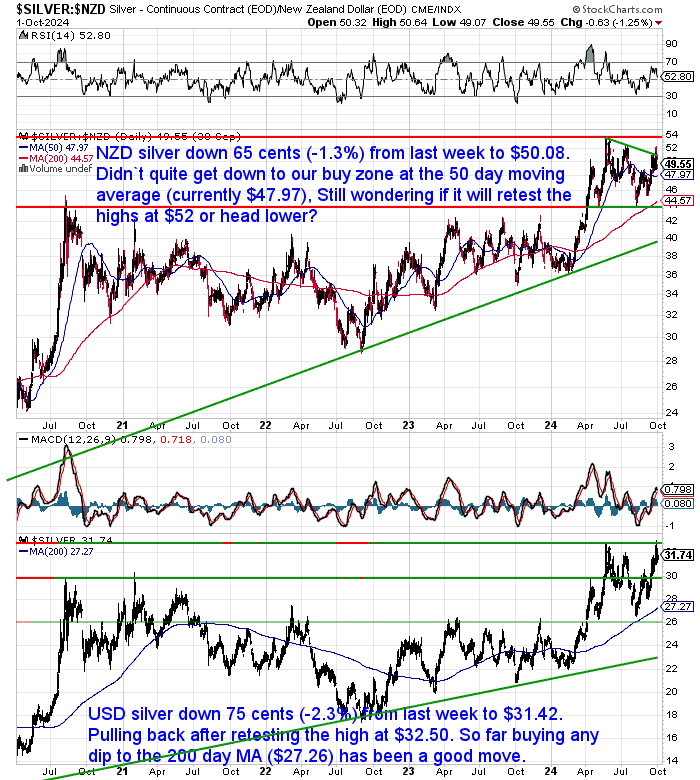

Silver in NZ dollars was down 65 cents or 1.3% from a week ago to $50.08. It didn’t quite get down to our buy zone at the 50-day MA around $48. So we are still wondering if it will retest the highs at $52 or head lower. It will likely follow Gold’s lead. So it’s a real toss-up from here. Probably layering in is the way to go.

While USD silver was down 75 cents or 2.3%. It pulled back after retesting the high at $32.50. Any dip down close to the 200-day MA, currently at $27.27 should be a good buying zone.

NZ Dollar Down from New 2024 High

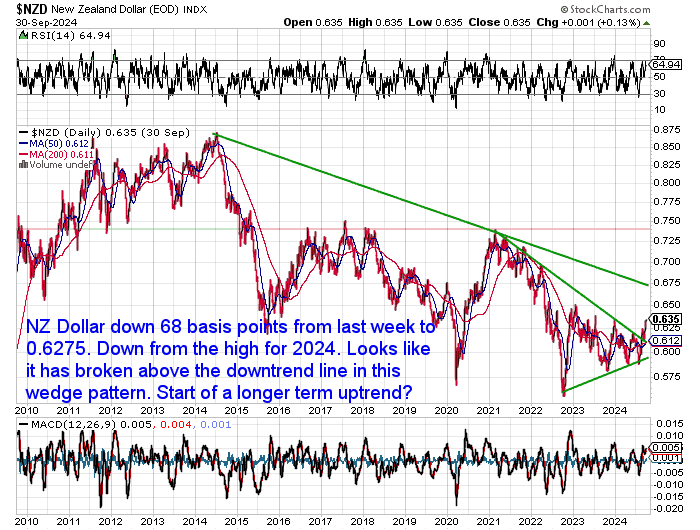

The Kiwi was down 68 basis points from last week. It made a new high for 2024 but is back down at 0.6275. It has broken above the multiyear downtrend line. So looks like this is the start of a longer-term uptrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Investing Guru Speaks: Why Ray Dalio Thinks Gold Belongs in Your Portfolio

Founder of the world’s largest hedge fund, Ray Dalio is known for his bold investment strategies. We’ve featured various thoughts from him in the past. But this week, we delve into his views on gold and explore why he recommends it as a portfolio holding.

The article explores:

- Why Ray Dalio believes gold is a crucial asset to consider, particularly in today’s economic climate

- What Dalio thinks lies ahead for the next 5-10 years

- How incorporating gold into your portfolio might align with Dalio’s investment philosophy

Curious if a renowned investor like Ray Dalio is onto something with his stance on gold? This article will help you decide if this precious metal aligns with your own investment goals.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Rate Cuts and Stimulation Going Global

This week saw more rate cuts from more central banks. Via ASB. Last Thursday:

“Central bank easing has continued. As was widely expected, the Swedish Riksbank cut their policy interest rate by 25bps to 3.25%, marking 75bps of cuts since May this year. With inflationary pressures compatible with 2% inflation an easing bias was maintained. The Riksbank also highlighted that the balance of risks had shifted towards economic activity remaining weak, which necessitated a faster pace of rate cuts than earlier signalled. The likelihood of a 50bp cut at one of the two remaining 2024 meetings was flagged, with further cuts in 2025 to move monetary policy settings into a more expansionary zone. There was little immediate market reaction. The Chinese yuan rose, and Chinese equities extended gains after the PBOC cut the 1-yr Medium-term lending facility by 30bps to 2%, the largest cut on record. Expectations are that further PBOC stimulus measures will be introduced (including likely cuts to Reserve Ratio Requirements over the next week or so) to try to kickstart the moribund Chinese economy.”

Then on Monday:

“Policy support has continued to be delivered in China. The earlier announced 0.5ppt reduction in the Chinese Reserve Ratio Requirement to 6.6% came into effect on Friday, with Chinese authorities also trimming the 7-day reverse repurchase rate to 1.5% from 1.7% on Friday. It follows a flurry of monetary and fiscal policy measures to support the embattled Chinese economy over the last week. Recent data – Chinese industrial profits -17.4% yoy in August – has not helped.”

The latest was yesterday where:

“China PMIs indicate factory activity continued to contract while the services sector slowed in September. The official manufacturing purchasing managers’ index was 49.8, remaining in contractionary territory. The non-manufacturing PMI fell to 50.0, the lowest in 21 months, showing construction and services activity lost momentum and moved to the verge of shrinking (Source Bloomberg). Separately, Chinese firms increased their overseas assets by about $71 billion in the second quarter, according to revised data from the State Administration of Foreign Exchange on Monday. That is an increase of more than 80% from a year ago and the highest level since records began in 1998 (Bloomberg).”

So Chinese businesses are doing what they can to get some of their assets outside of China as their economy continues to struggle.

Then over in the Eurozone rate cuts might also not be far off:

“President Christine Lagarde said the European Central Bank is becoming more optimistic that it will be able to get inflation under control and will reflect on that at its October interest-rate decision. Her comments to lawmakers in the European Parliament on Monday were the strongest hint yet from her of possible momentum gathering among officials toward a cut (Source Bloomberg).”

Everyone is Tightening While Loosening – But For How Long?

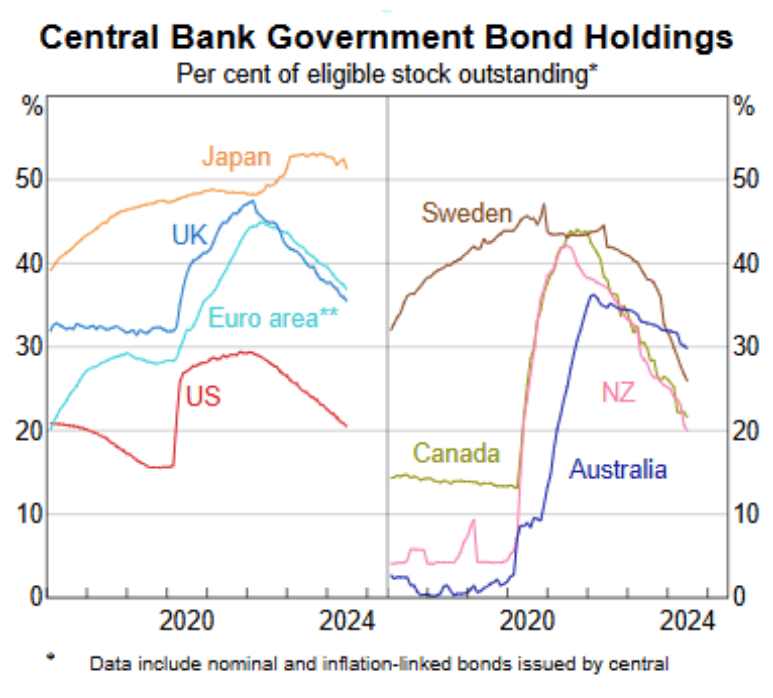

We mentioned last week that the US central bank was easing by cutting interest rates. But continued tightening by reducing their balance sheet a.k.a. Quantitative tightening.

The chart below shows that most developed countries have been doing the same thing and reducing their government bond holdings. They are all either also cutting interest rates or close to it (apart from Japan).

Dow Jones Topping Out?

This balance sheet reduction is unprecedented. We’d have to look back to the great depression to see a similar tightening by a central bank.

So who knows what might break eventually as a result of this? Maybe it will be the stock market?

The below chart (hat tip to Chris Weber) is of the broad US stock market, the Dow Jones Index. Stretching all the way back to 1897! The Dow is hitting the VERY long term uptrend line. So it could be due to turn lower from here. Will this last for years like after 1929 or 2001? Or will it be short and sharp like 2020? That is anyone’s guess.

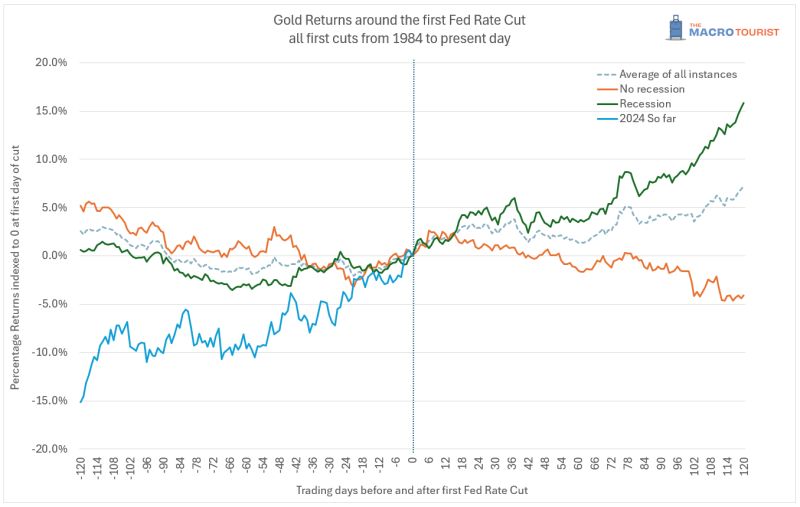

Gold Performance After Rate Cuts

Last week we shared some stats on the last 2 times the Fed first cut was 50+ bps. Which was a stock market fall and a recession.

Here’s a great chart that looks at how gold performs after a rate cut…

“My dear pal Kevin Muir has done a great job showing the performance of various asset classes after the first #ratecut. He divided the easing cycles into ones followed by a recession with those that can be labelled as “soft landings”. As you can see on the following chart, the returns present a much different picture.

“𝘏𝘦𝘳𝘦 𝘪𝘴 𝘨𝘰𝘭𝘥. 𝘐𝘵’𝘴 𝘩𝘪𝘨𝘩𝘦𝘳 𝘪𝘯 𝘵𝘩𝘦 𝘪𝘯𝘪𝘵𝘪𝘢𝘭 𝘤𝘰𝘶𝘱𝘭𝘦 𝘰𝘧 𝘸𝘦𝘦𝘬𝘴 𝘢𝘧𝘵𝘦𝘳 𝘵𝘩𝘦 𝘧𝘪𝘳𝘴𝘵 𝘳𝘢𝘵𝘦 𝘤𝘶𝘵, 𝘣𝘶𝘵 𝘵𝘩𝘦𝘯 𝘵𝘩𝘦 𝘳𝘦𝘤𝘦𝘴𝘴𝘪𝘰𝘯 / “𝘴𝘰𝘧𝘵 𝘭𝘢𝘯𝘥𝘪𝘯𝘨” 𝘨𝘳𝘰𝘶𝘱𝘴 𝘥𝘪𝘷𝘦𝘳𝘨𝘦. 𝘉𝘪𝘨𝘭𝘺! 𝘐𝘧 𝘺𝘰𝘶 𝘣𝘦𝘭𝘪𝘦𝘷𝘦 𝘢 𝘳𝘦𝘤𝘦𝘴𝘴𝘪𝘰𝘯 𝘪𝘴 𝘤𝘰𝘮𝘪𝘯𝘨, 𝘣𝘶𝘺 𝘨𝘰𝘭𝘥. 𝘏𝘢𝘯𝘥-𝘰𝘷𝘦𝘳-𝘧𝘪𝘴𝘵.” Kevin Muir

Source.

The chart shows that if a US recession eventuates after a rate cut then gold historically does very well. So while gold might be undergoing a pull back in the shorter term, in the longer run the odds point to more gains ahead.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|