2016 was an eventful year with the “surprise” results of Brexit and the US presidential elections. So with 2016’s end it’s time for our review of gold and silver performance in NZ Dollars during the calendar year. Plus a look back at our predictions from a year ago as well. After all there is no point making guesses if you don’t look back upon them and grade yourself!

As usual we’ll also cast our eye forward into the year to come and take an educated guess at what 2017 might hold in store for gold and silver in NZ dollar terms.

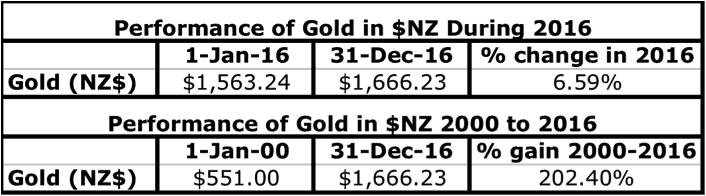

Gold in $NZ – Performance During 2016

The price action in gold last year was not dissimilar to 2015. Gold shot higher for the first few months, then couldn’t get much higher for the next quarter. It then spent the last 6 months falling. However unlike 2015, it didn’t fall back as far and actually started climbing again mid December, to end with a gain of 6.59%.

Looking from much longer term basis, since 1 January 2000 gold is up just over 200%.

We thought gold might head lower in the low volume trading between Christmas and New Year as it often does. But this year it did just the opposite and started moving higher. This has continued into the first 2 weeks of 2017, and gold in NZ Dollars is up $85 from the mid December low.

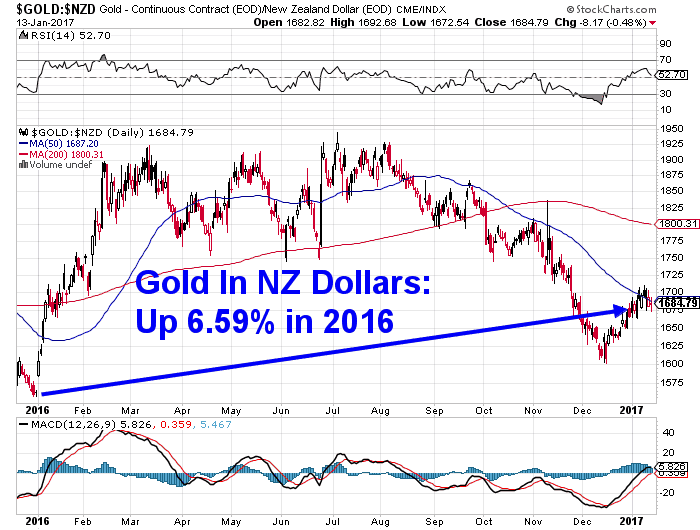

Silver in $NZ – Performance During 2016

A marked change in silver’s performance this year. It was up just over double the amount gold was: 13.49% from 1 January to 31 December 2016.

Over the longer term though silver is still underperforming gold, up 124% since 1 January 2000.

Silver lagged gold to begin with last year but continued rising all the way into July, before falling for 5 months.

A Look Back at Our 2016 Predictions/Guesses

Now lets look back to what we guessed 2016 had in store and see how we did.

First we said:

“the long bottoming action in precious metals that has been in play for many years will finally come to an end this year. So the US Dollar prices of gold and silver will finally end the year higher than they began for the first time since 2011.”

A tick for that one, as USD gold was up 8.5% in 2016, while silver was up 15.7%.

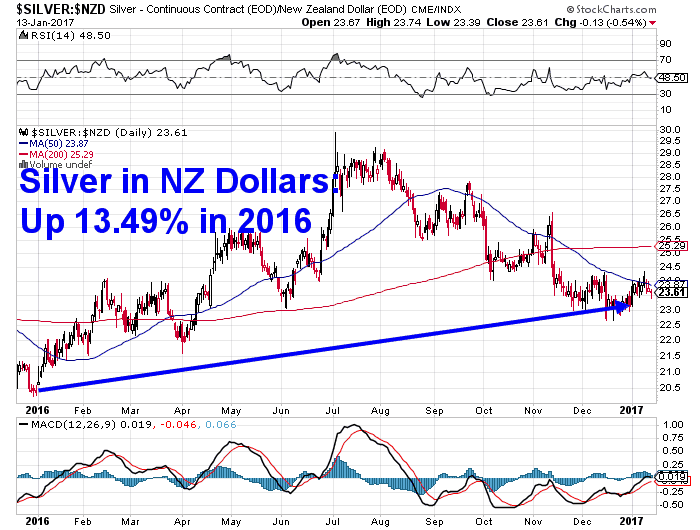

We did think the NZ Dollar would strengthen against the US Dollar so this would dent the gains in gold and silver in NZ Dollar terms.

“…it will be the gold and silver prices in US dollar terms that will have the most impact on the local precious metals prices. With a slightly higher Kiwi dollar maybe taking the edge off of some of the gains.”

That proved to be the case also, as can be seen in the NZ Dollar chart below. The Kiwi Dollar was up just under 2% versus the US Dollar. And so local precious metals gains weren’t as high as those in US Dollars.

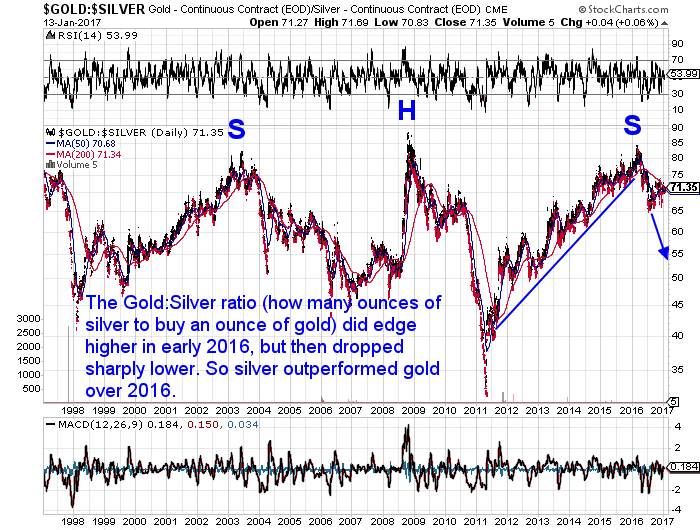

We thought silver would also rise in 2016 and outperform gold:

“…we also reckon this could be the year that silver again outperforms gold. For the first time since 2012. So the gold:silver ratio pictured in the chart earlier will head lower this year.”

As noted already this was certainly the case. Silver’s outperformance is clearly reflected in the long term gold silver ratio chart below where the ratio fell sharply in 2016.

To see how the Gold Silver Ratio is calculated, how it can be used, and where it might head to next see: What is the Gold/Silver Ratio?

Our final call was:

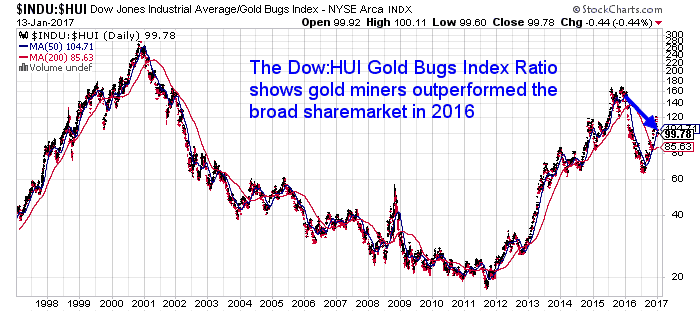

“We think global sharemarkets might struggle this year which could be what gives a boost in interest in precious metals. This might finally make it a good time to have a look at a few precious metals mining companies too.”

Well we didn’t quite get that right. While sharemarkets did go nowhere for most of 2016, the likes of the US Dow Jones Industrial average shot higher in the last 2 months and ended the year higher on the back of Trump’s election.

However we were right about precious metals miners. As shown in the chart below they out-performed the Dow Jones. With the Dow Jones:HUI Gold Bugs Index ratio falling over the course of 2016. Meaning the Gold miners index rose more than the Dow. So you’d have been better off buying a group of gold miners than blue chip stocks.

So overall we did pretty well with our 2016 guesses we’d say. So what does 2017 have in store for us?

Our Predictions for 2017

Our Predictions for 2017

We’re finding 2017 a bit tougher to call than last year. Trump has certainly thrown the cat amongst the pigeons and so 2017 could be full of surprises.

We think we may see a continuation of a number of the trends of 2016 though.

In NZ Dollar terms, we reckon both gold and silver will end 2017 higher than they began. The drop in prices in the second half of 2016 has likely scared many people away, who probably believe that the rise in the first half of 2016 was just a short term jump higher in the longer term trend of gold falling.

But we believe we have seen the bottom in both metals and the trend has likely turned so we will see a number of years of rising prices now.

We also believe silver will again outperform gold like it did in 2016.

Our guess is that the NZ Dollar again ends the year higher than it began against the US Dollar. But again gold and silver will rise more than the Kiwi does, so local precious metals prices will end the year higher.

A final thought but perhaps not a prediction for 2017 is that at some point we will see precious metals rise at the same time as interest rates (Government Bond rates) do. We saw precious metals rise in the first half of 2016 and interest rates rise in the second half. In the later 1970’s we saw these trends coincide and we reckon it will happen again before too long.

As noted already this was certainly the case. Silver’s outperformance is clearly reflected in the long term gold silver ratio chart below where the ratio fell sharply in 2016.To see how the Gold Silver Ratio is calculated, how it can be used, and where it might head to next see: What is the Gold/Silver Ratio?

Pingback: Gold & Silver in NZ Dollars: 2017 in Review & Our Punts for 2018 - Gold Survival Guide