Recently we’ve shared the idea that money velocity could turn up. As a result inflation could surprise many people by finally increasing.

Gold expert Pierre Lassonde recently stated:

“The Federal Reserve and other central banks have piled up huge reserves. But there is no inflation because the money is sitting within the banks and they are not lending it. Therefore, you don’t get a multiplier effect.” -Pierre Lassonde, gold expert, interviewed by Finanz and Wirtschaft News, October 2017.

In the latest Incrementum Advisory Board meeting a similar idea was discussed…

HOW QUANTITATIVE TIGHTENING WILL LEAD TO INFLATION, NOT DEFLATION

Narratives, De-Dollarization and Inflation

In the meeting they discussed:

- How Quantitative Tightening will actually be inflationary, rather than deflationary

- How narratives, not reality, drive markets

- Why the US might go to war with North Korea in Q1 2018

- How and when de-dollarization will happen

The Incrementum Board had a special guest Ben Hunt, author of Epsilon Theory, a newsletter and website that examines markets through the lenses of game theory and history. He spent quite a bit of time also discussing the “narrative” around inflation and how that is about to change:

► Quantitative Tightening is deflationary in theory, but will be inflationary in practice

► The narrative around inflation is about to change, which in turn will

lead to higher inflation

► It’s the market narrative that’s important, not the underlying reality of markets

► He doesn’t think that reality moves long-term interest rates, but rather he thinks it’s expectations.

► The VIX has seized to be a good measure of risk because it is a target of too many investment strategies.

(Want to read more about the possible impacts of Quantitative Tightening? See this: Federal Reserve Balance Sheet Reduction: What Impact Will it Have?)

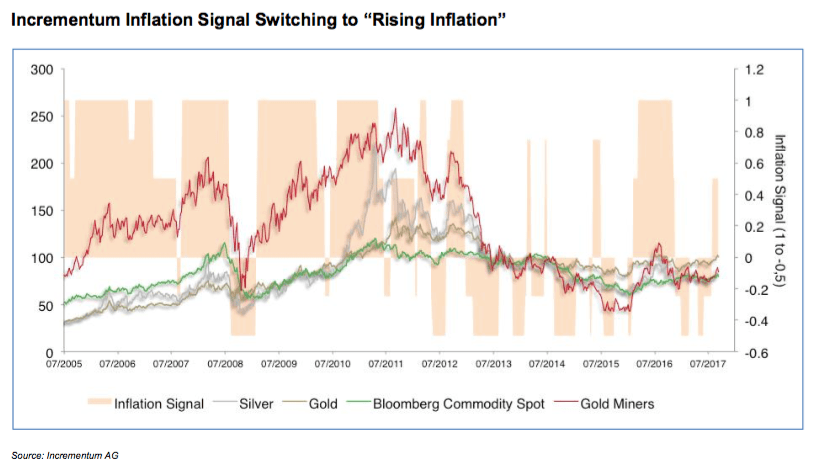

Incrementum Inflation Signal Switched From “Disinflation” to “Inflation”

Interestingly the Incrementum inflation signal also recently switched from “disinflation” to “inflation”.

Mark Valek commented that:

“Year to date we have seen quite a significant depreciation in the dollar, but the market didn’t take much notice of this yet. And if the Fed will not hike rates in December, as Jim believes, this will lead to the dollar weakening further. This might be a trigger point; i.e. a leg down in the dollar pushes through price inflation, which is already on the rise according to our inflation signal.”

Jim Rickards expanded upon this:

“In my mind, the natural state of the world is deflationary due to demographics, technology and debt. But central banks can’t tolerate deflation, so they have to push towards inflation through money printing. But you need more than money printing; you need a change in psychology, to get inflation going. If money printing is the gasoline, the change in psychology is the match that will light the fire of inflation.

In 2008 we saw an intergenerational change in psychology, which made people more prone to save. It will take a lot to change that psychology. However, if you can change it, it’s almost impossible to change it back. A good example is 1974, when there was a stock market crash in the US, and inflation ticked up. Before the crash there was focus on preventing inflation, but then the crash came and inflation collapsed and the Fed was battling deflation. As a reaction to that they created a borderline hyperinflationary episode between 1977 and 1981.

The reason I mention this is to point out that expectations can be hard to move, but once you move them they can turn on a dime, and they can be very hard to turn back. So right now inflation expectation are low despite all the money printing, but if for any reason that would turn, it could be almost impossible for the Fed to get the genie back in the bottle. With all the money that’s been printed over the years we could get screaming hyperinflation.”

Inflation Could Surprise – Simply Because No One Expects It Too

It seems to us that almost no one expects inflation to rise currently. But this is an idea quietly being discussed of late – albeit in limited circles. So the concept that inflation could surprise to the upside soon makes good makes sense. Assets like gold and silver that did well in the inflationary 1970’s will likely do well again in such an environment. Get a quote to Buy Gold or Silver here.

(Here’s another article with which also posits the idea that inflation could surprise us all: Deutsche Bank: The Fiat Money World May Be Coming to an End)

Below are the video highlights from the Incrementum Advisory Board discussion.

Or if you prefer you can view the transcript of their discussion here: Download Transcript

Read more: Could Stagflation Happen Again?

Pingback: Gold: The Ultimate Iron Lady - Gold Survival Guide

Pingback: The Next Gold Bull Market Looms - Gold Survival Guide