This Week:

- Federal Reserve Balance Sheet Reduction: What Impact Did it Have in 2018? What about 2019?

- 2018-2019 Pop Goes the Bubble

- History Shows: 7 Straight Days of Silver Price Rises Equals More to Come

Prices and Charts

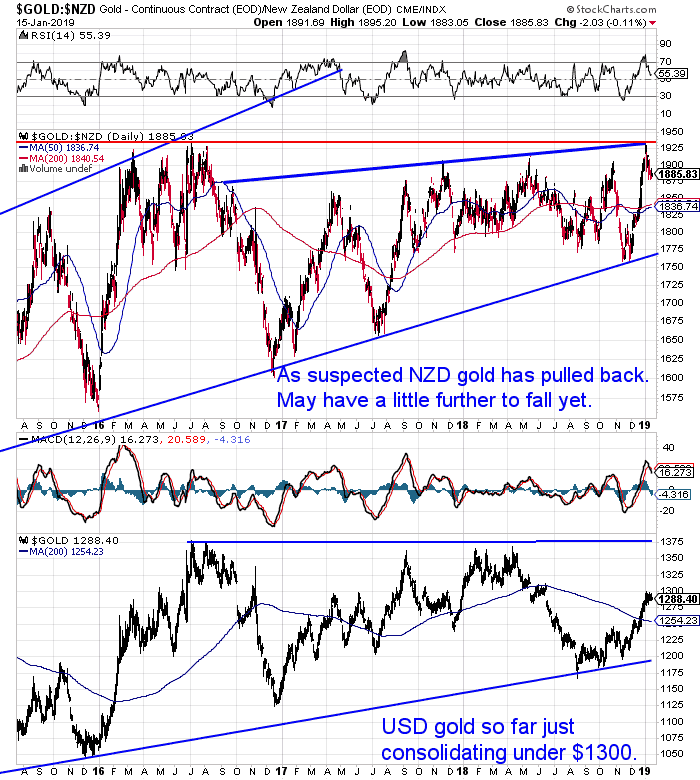

NZD Gold Correcting After Strong Run

As expected gold in NZ dollars has been correcting after a strong run higher to end 2018.

Having pulled back about $40 per ounce this year, it may have a little further to fall yet. Perhaps to around $1850 or even down to the 200 day moving average?

But we are getting close to the buying zone now.

Gold continues to make higher highs and higher lows since 2016. Once the 2.5 year high is broken just above $1925 there is a lot of blue sky ahead for the price of gold in NZ dollars.

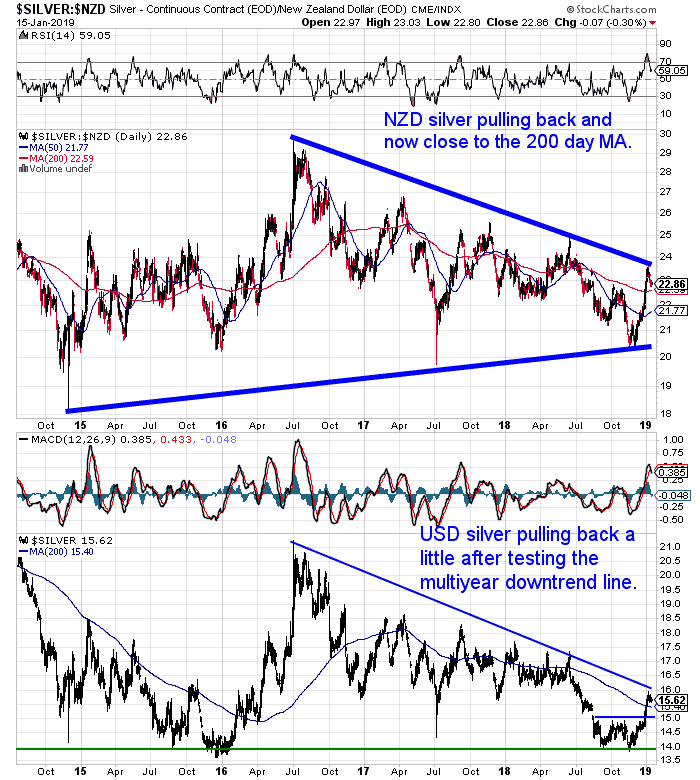

Silver Doing the Same

Silver is also pulling back as we thought it might after touching the multiyear downtrend line. NZD silver is now close to the 200 day MA. Maybe we’ll see it head even a little lower than that? As we said last week a move back to $22 would be about a 50% retracement of the late 2018 run higher.

So a buying zone approaches for silver too.

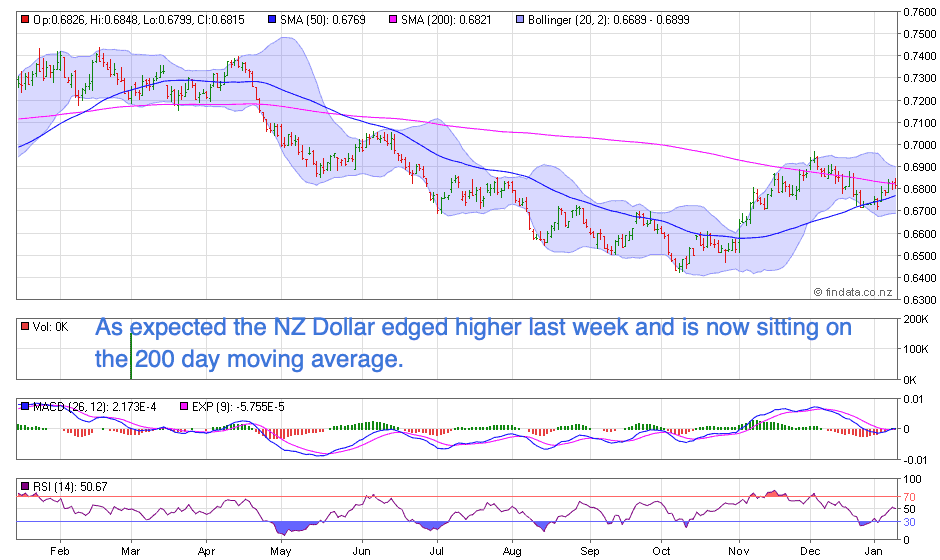

Meanwhile the NZ dollar also moved higher as we suspected it might last week. Now sitting right on the 200 day MA.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Free Shipping NZ Wide.

Federal Reserve Balance Sheet Reduction: What Impact Did it Have in 2018? What about 2019?

In our year in review article last week we commented on how poorly most assets did in 2018.

This week we’ve revisited what we think was the likely cause of this poor performance: The Fed balance sheet reduction or quantitative tightening (QT).

When we first wrote about this in September 2018 we suspected it could be what causes the likes of share markets and property prices to stop their ascent.

We think this may be the economic measure to watch closely in 2019.

Even though the US central bank head Jerome Powell has recently talked down the odds of further US interest rate hikes this year. The data we are following shows the Fed has continued its QT at the same pace as promised.

So read on to see:

- What is central bank balance sheet reduction?

- What was its impact in 2018?

- What will be the impact of QT in 2019?

- How might the Fed and other central banks respond?

- What to do to prepare?

2018-2019 Pop Goes the Bubble

Also on the topic of poor performance of share markets and other assets is the latest article from Darryl Schoon. See why Darryl thinks 2018 saw the start of the popping of these bubbles and how it will continue in 2019.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

NZ Economy Continues to Slow

ANZ’s Truckometer indexes are now clearly flashing warning lights about a slower growth path for the New Zealand economy.

This is one of the measures pointing to why the Reserve Bank will eventually need to cut interest rates.

“ANZ Bank economist Liz Kendall says the New Zealand Institute of Economic Research’s latest quarterly survey of business opinion shows the Reserve Bank will eventually need to cut interest rates. Other economists agree that deteriorating business profitability raises risks that future employment, investment and economic growth generally could deteriorate, but they’re still picking the next move in the official cash rate – eventually and definitely not soon – will be up.”

Source.

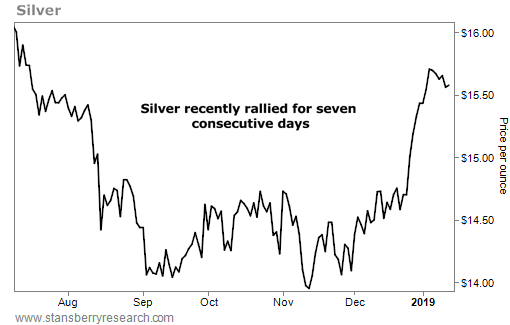

History Shows: 7 Straight Days of Silver Price Rises Equals More to Come

As you’re no doubt aware, silver finished 2018 strongly.

But did you know it went up for 7 days straight? More importantly did you know what this has meant historically?

“While stocks ended 2019 with a plunge, another asset class soared.

Thanks to massive uncertainty in the stock market, precious metals have moved into a silent uptrend in recent weeks. Gold jumped nearly 5% in December alone.

But if you only focus on gold, you could miss out…

You see, silver will always live in the shadow of gold. It will always play second fiddle. But today, overlooking this precious metal is a mistake.

Silver recently moved higher for seven consecutive days. And history says that momentum should lead to further gains. The reason is simple…

When an asset moves higher several days in a row, it’s often a sign that the trend is accelerating. It signals that more upside is likely.

This is exactly the setup we are seeing in silver right now. Take a look…

Silver had been trudging along. But that changed in December. The metal absolutely soared… And it jumped for seven straight days in the process.

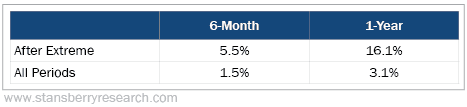

This big move higher could mean even more gains for silver. We can see this by comparing similar moves in silver to normal periods going back to 1975. Take a look…

Silver has returned just 3% a year since 1975. That poor return doesn’t mean you should ignore the precious metal, though. Buying after consecutive up days tends to mean a strong uptrend is underway… And big gains have followed in times like these.

Similar instances have led to 6% gains in six months and a solid 16% gain over the next year. Those returns crush the typical poor returns of silver.

Precious metals were the silent winner in the final weeks of 2018. The trend is up in both gold and silver. And that means now is a safe time to buy.”

Source.

Silver has pulled back in the last 2 weeks, but history shows that there is likely to be more upside ahead in 2019 for silver.

Check out the deals available currently.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Learn More and Pre-order NOW….

—–

|