|

Gold Survival Gold Article Updates:

Jul 9, 2014

This Week:

- What Would Happen to the NZ Dollar When the US Dollar Collapses?: Reader Question

- Gold Rises on Fed Minutes Stating QE ends in October

- NZ Dollar Could Strengthen But What About Gold and Silver?

- India and Modi: A possible positive factor for gold

- NZ govt operating deficit bigger than expected as tax take lags

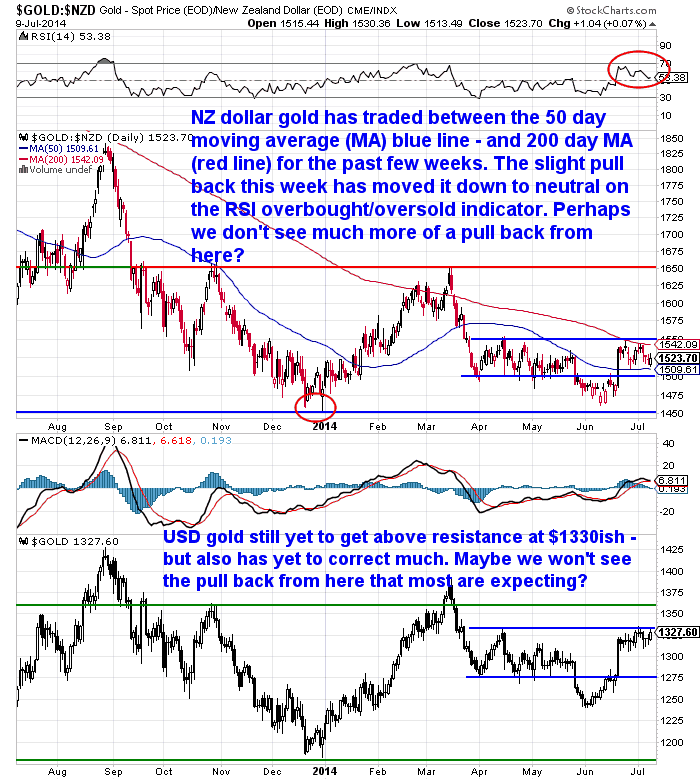

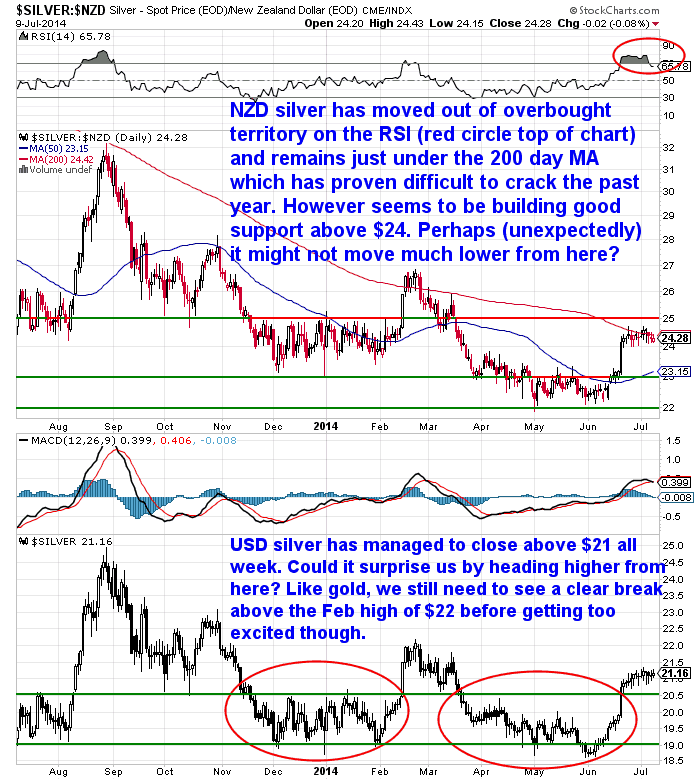

Perhaps surprisingly gold and silver prices have been quite flat since last week. After the strong rise they had both had a decent correction would have been expected.

But from a week ago gold in NZ dollars is only down $7.92 per ounce or 0.52% to $1507.15.

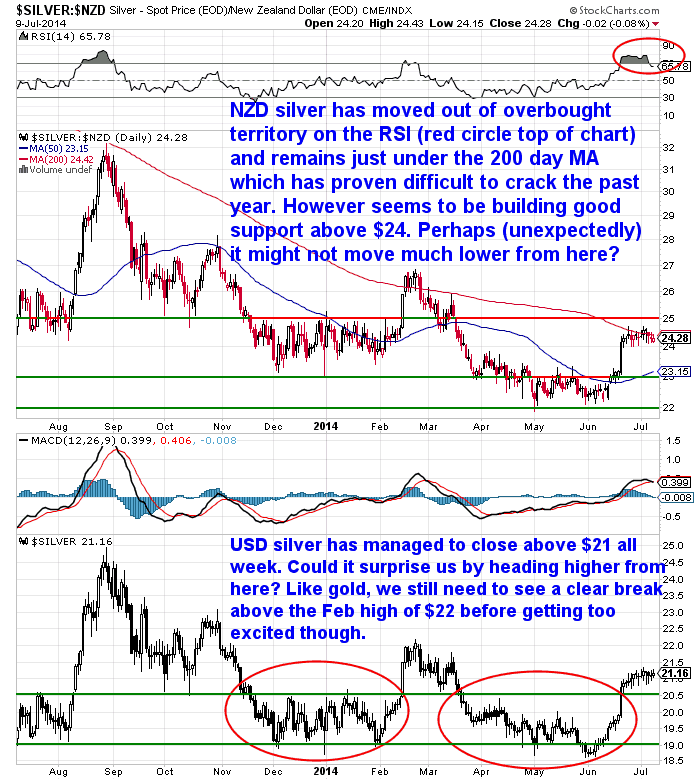

While silver is down just 17 cents per ounce or 0.70% to $24.00.

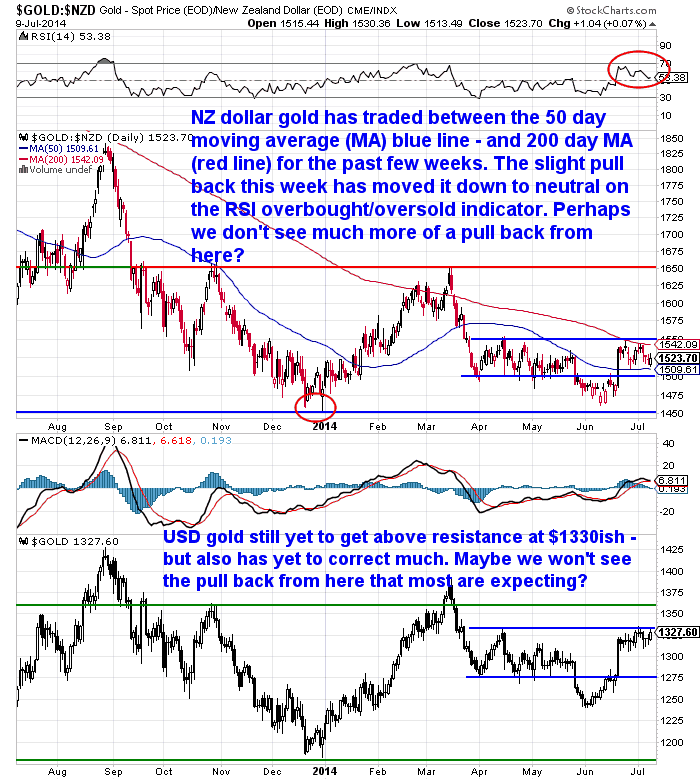

Most (including us) have expected a pull back in metals to occur around here but maybe we have another move higher to come first? Both gold and silver have been consolidating at these levels for over a week now as can be seen in the charts below. And an argument could be made they are building for another move higher.

In fact overnight gold and silver even moved a little higher following the release of the Fed minutes from their June meeting. The minutes showed they expect to end their money printing policy in October.

At first glance this may seem like it should be gold negative. However they also stated they intend to keep interest rates low for a considerable time yet. Also recall that for more than half of this current precious metals bull market there was no QE/Money printing in place. Yet gold climbed from it’s lows around US$250 in 2001 all the way to almost US$1000 in 2008 prior to QE.

So money printing is by no means a prerequisite for a gold bull market. As we’ve said before it is negative interest rates that are a better indicator and it seems that a few more people are worrying about the effects of these currently.

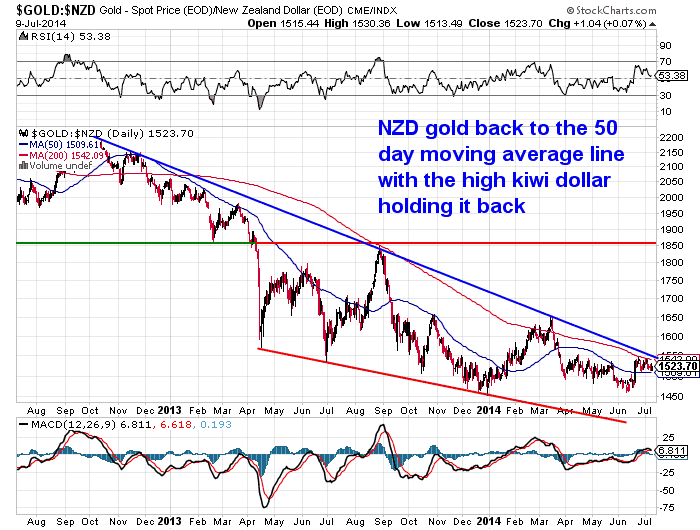

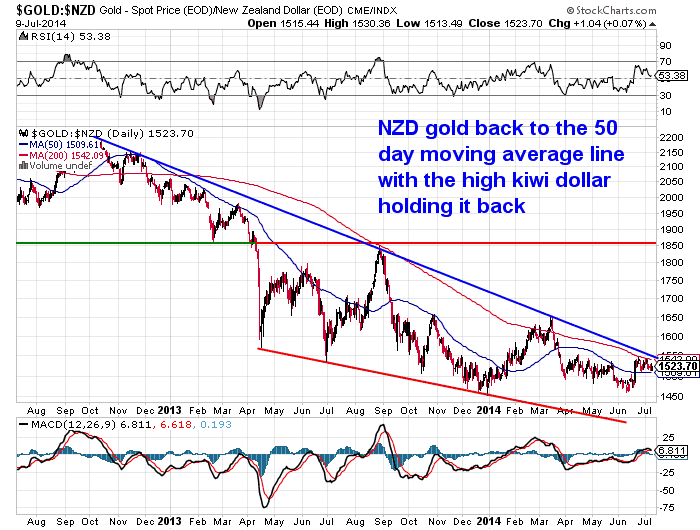

This chart from our daily price alert this morning (you can sign up here if you’re looking at buying and would like to keep a close track of gold and silver price movements) shows we are again very close to the downtrend line of the past couple years. So far NZ dollar gold hasn’t managed to get above it, so it will be interesting to see if this time is different or if the still strengthening kiwi dollar keeps it in check a bit longer yet.

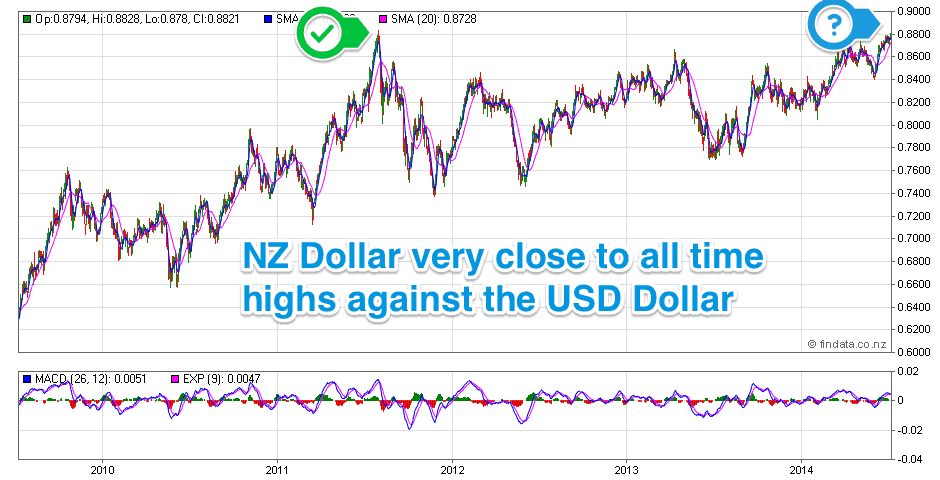

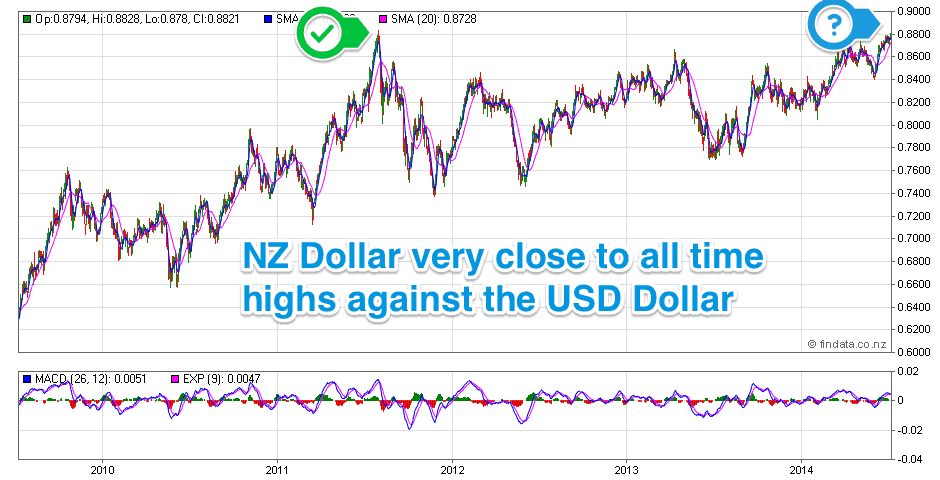

NZ Dollar Even Closer to All time Highs

But for now the NZ dollar continues to slowly close in on all time highs against the US dollar and according to some is poised to break them soon.

While as we noted last week this could make now a good time to be hedging yourself with gold and silver, the kiwi dollar could continue higher for a bit yet.

A potential indicator of this is that according to CMC Markets 80-90% of their Forex retail traders expect the kiwi to fall “a number that had increased over the past six months as the New Zealand dollar continued to climb.”

Retail investors seem to get things wrong more often than not so perhaps this is an indicator that new highs are indeed coming for the kiwi?

Meanwhile the same article noted that while institutional investors expect the NZ dollar to keep rising yet…

—–

“Westpac senior market strategist Imre Speizer said institutional speculators expected the kiwi to rise against the US dollar.

Speizer said a group of speculators lost money by predicting a fall ahead of the Reserve Bank’s June monetary policy statement, in which it forecast a higher interest rate track than the speculators expected.

“If anything I would say over the last few weeks the speculative institutional set has been buying the kiwi.”

Speizer predicted the kiwi would hit a new post-float high in the next month or two, continuing its upward trend against the US dollar since it was floated in 1985.

A peak of about US89c would be a “sensible number”, he said.

Smith said the recent movements in the kiwi had caused a spike in interest and trading activity from its New Zealand clients, who trade between $400 million to $500m in currency per day in notional terms.

This was in contrast to many other countries, where CMC had seen a decline in currency trading.

“The New Zealand dollar is one of the few currencies actually moving,” he said.

“Over the last six months we’ve had some of our lowest foreign exchange volume ever.”

—–

Then again there is no guarantee that institutional investors are always the “smart money”.

What Would Happen to the NZ Dollar When the US Dollar Collapses?: Reader Question

Speaking of the kiwi dollar, our feature article this week is an answer to a reader question on how a US dollar collapse would impact the NZ dollar. As we mentioned last week our answer is perhaps somewhat counter intuitive to what many would expect. So while it’s all about Kiwi dollar strength at the moment, we look at how in the long run a higher kiwi dollar versus the US is possibly not a one way bet. Speaking of the kiwi dollar, our feature article this week is an answer to a reader question on how a US dollar collapse would impact the NZ dollar. As we mentioned last week our answer is perhaps somewhat counter intuitive to what many would expect. So while it’s all about Kiwi dollar strength at the moment, we look at how in the long run a higher kiwi dollar versus the US is possibly not a one way bet.

What Would Happen to the NZ Dollar When the US Dollar Collapses?: Reader Question

NZ Dollar Could Strengthen But What About Gold and Silver?

So while many factors seem to point to the NZ dollar continuing to strengthen, the flip side to consider if you’re looking at buying gold and silver, is how strong (or weak) gold and silver prices themselves may be in the coming months. As if they continue to rise they may well outpace any rise in the kiwi dollar exchange rate.

India and Modi: A possible positive factor for gold

One possible positive factor for gold is that the new Modi government in India may be about to cut their gold import duties from 10% to 6%.

India may cut gold import duty at budget – industry official

Modi intends to crack down on corruption and lowering import duties will likely reduce smuggling. As may reducing the 80:20 rule which required 20% of all gold imports to be re-exported.

The Reserve Bank of India says it may sell old bars from its reserves to become jewellery, and then use the cash to buy Good Delivery gold held at the Bank of England in London.

With the idea being it would give more supply to the local jewellery market without affecting India’s current account.

A Mineweb article points out they are also looking at how to “mobilise” the gold they already have in India. A couple of state owned banks have broached the idea that if gold is deposited by their customers they should be allowed to count it as part of their required reserve ratios. An interesting development which mimics what Turkey has allowed for some time.

We recall reading somewhere a while back that India could “solve” its current account problem simply by re-categorising how gold is treated on its books. Something along the lines of if they treated gold imports as financial reserves rather than as consumer goods then they would not be included in the current account and India wouldn’t have a deficit due to gold imports.

A simple solution that perhaps is where this idea of banks being allowed to treat customer gold deposits as reserves is heading? We could also argue perhaps this is some sketchy evidence that the import duties etc were as much about putting a stop to the rising gold price as they were about “solving” India’s current account deficit?

Is Modi all he’s cracked up to be?

Sticking to the topic of India and the new Modi government. We posted an article by Stewart Thompsom back in November as it discussed Modi in ways we hadn’t seen elsewhere. As it turns out that article has so far been right on the money and it could well be that his election has an impact on the gold price as per the reductions in import duties discussed earlier.

At a dinner back at the start of June we questioned an Indian gentleman who works for a timber company on what he thought the impact of Modi being elected was.

Much to our surprise he said he had actually met Modi in his business dealings! He had been to Modi’s office (back when he was the head of Gujarat state) to ask him to stop the corruption at one of the ports they dealt with. (They were having to pay bribes in order to get their logs through the port). Anyway Modi got the job done there and their logs then went smoothly through the port from there on. So he thought Modi will have a large impact and what is being said about him is not overblown.

On a side note it was Interesting that he also said the demand for timber has fallen massively in China of late – prices were down about 25% in recent weeks.

This was later confirmed by an ASB commodities report we read on 27 June 2014.

—–

“Since peaking in April, the ASB Forestry Index has fallen nearly 6% in USD terms. Most of the fall in the overall index is due to falling log prices; these are down around 13% over the same period. The falls since April come after a sustained period of prices increases, with the ASB Forestry Index increasing almost 13% over the year to April 2014.

Recent slowing in the Chinese housing market is driving most of the fall in forestry prices; in the same way that an expansion in the Chinese housing market drove the increase. The Chinese house price index for May fell 6.7% compared to May 2013.

With log imports into China continuing at a rapid pace, according to Agrifax Chinese log inventory levels have climbed to very high levels. As this wood stockpile has grown, demand for logs has fallen and put downward pressure on export log prices. Until both the Chinese housing market recovers and this stockpile is cleared, the downward pressure on export log prices will continue, likely through the remainder of 2014.”

—–

So it’s not all good news for NZ exports currently with dairy prices resuming their fall recently as well.

This week also saw a bigger NZ government operating deficit than expected due to company tax and GST takes being lower than expected.

—–

NZ govt operating deficit bigger than expected as tax take lags

The New Zealand government posted a bigger operating deficit than forecasts in the May Budget, as company tax and GST again lagged expectations.

The Crown’s operating balance before gains and losses (obegal) was a deficit of $1.1 billion in the 11 months ended May 31, smaller than the $3.27 billion shortfall a year earlier, though more than the $767 million deficit forecast in the Budget economist and fiscal update. Core tax revenue was up 4.6 percent from a year earlier, though $459 million short of expectations at $56.5 billion, with goods and services tax was lower than forecast on more subdued domestic consumption. The company tax take was below forecast due to some large downward adjustments in end of financial year assessments.

“It is too early to determine the likely impact of these results on the current and future financial years as both downside and upside risks exist,” acting chief government accountant Fergus Welsh said in a statement.”

Source.

—–

So while the NZ dollar is (possibly) reaching new highs there are a few concerns to keep an eye on still. And with things looking a bit brighter in the gold and silver sector (but sentiment remaining low) this could still be a good time to get some financial insurance in the form of “no counterparty risk” precious metals.

This Weeks Articles:

Gold Survival Gold Article Updates: Jul. 3, 2014 This Week: Gold and silver remain near last weeks prices NZ Dollar close to all time highs Loan to Income Ratios or Loan to Value Ratios Won’t “Fix” the Problem Smart Money, Dumb Money & Your Money Just a short email this week as we are […]

read more…

What Would Happen to the NZ Dollar When the US Dollar Collapses?: Reader Question |

Speaking of the kiwi dollar, our feature article this week is an answer to a reader question on how a US dollar collapse would impact the NZ dollar. As we mentioned last week our answer is perhaps somewhat counter intuitive to what many would expect. So while it’s all about Kiwi dollar strength at the moment, we look at how in the long run a higher kiwi dollar versus the US is possibly not a one way bet.

Speaking of the kiwi dollar, our feature article this week is an answer to a reader question on how a US dollar collapse would impact the NZ dollar. As we mentioned last week our answer is perhaps somewhat counter intuitive to what many would expect. So while it’s all about Kiwi dollar strength at the moment, we look at how in the long run a higher kiwi dollar versus the US is possibly not a one way bet. 2014-07-03 04:22:48-04

2014-07-03 04:22:48-04 2014-07-07 21:44:34-04Doug Casey: “America Has Ceased to Exist” By Doug Casey, Chairman “America is a marvelous idea, a unique idea, fantastic idea. I’m extremely pro-American. But America has ceased to exist,” says Doug Casey. Watch him in this fascinating interview with Reason TV’s Nick Gillespie discuss the political, social, and economic challenges the US must conquer as well […]

2014-07-07 21:44:34-04Doug Casey: “America Has Ceased to Exist” By Doug Casey, Chairman “America is a marvelous idea, a unique idea, fantastic idea. I’m extremely pro-American. But America has ceased to exist,” says Doug Casey. Watch him in this fascinating interview with Reason TV’s Nick Gillespie discuss the political, social, and economic challenges the US must conquer as well […]

2014-07-08 00:45:00-04Darryl Schoon is back with a follow on from last weeks SMART MONEY, DUMB MONEY & YOUR MONEY. This week looking at inflation, including how inflation figures are “massaged”, and how food and fuel prices head up first. While we may currently be shielded from some of the price rises here in New Zealand by […]

2014-07-08 00:45:00-04Darryl Schoon is back with a follow on from last weeks SMART MONEY, DUMB MONEY & YOUR MONEY. This week looking at inflation, including how inflation figures are “massaged”, and how food and fuel prices head up first. While we may currently be shielded from some of the price rises here in New Zealand by […]

Pingback: Gold Prices | Gold Investing Guide Dairy prices plunge - NZ dollar follows - Gold Prices | Gold Investing Guide