|

Gold Survival Gold Article Updates

Jul. 17, 2014

This Week:

- Dairy Prices Plunge – NZ Dollar Follows

- Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?”

- Gold and Silver Technical Indicators Flash “Buy”

- Prof. Antal Fekete: The Banking System – Episode 01/17

Important: Want to make sure you continue to receive our weekly emails?

We are about to change the provider that sends out our emails.

So please look out for our email next week which will be sent through srsend.net our new emailing service. In the meantime may we request that you add info@goldsurvivalguide.co.nz to your Contact List. Unfortunately, due to overzealous spam filtering software, it may not land in your Inbox first time even then. If not please mark the email as important / safe / required, and actually move it to your Inbox if you are able to, all helping to ensure safe delivery in future.

Public service announcement over – back to our regularly scheduled programming!

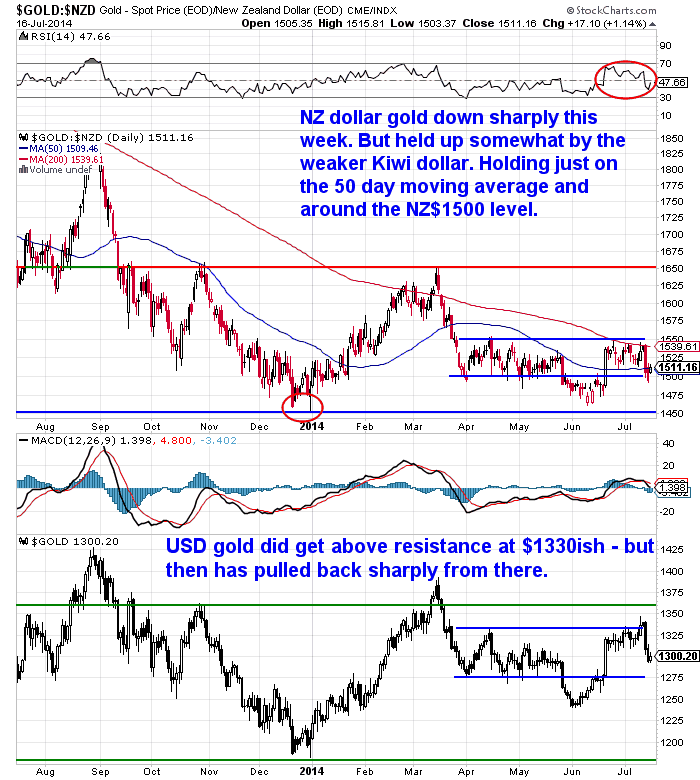

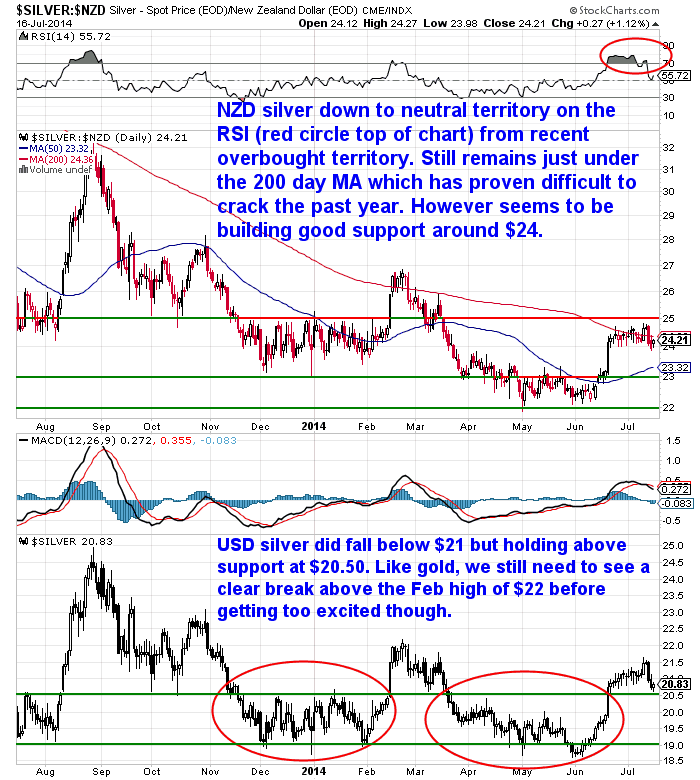

There has been a bit of action in the past week for gold and silver.

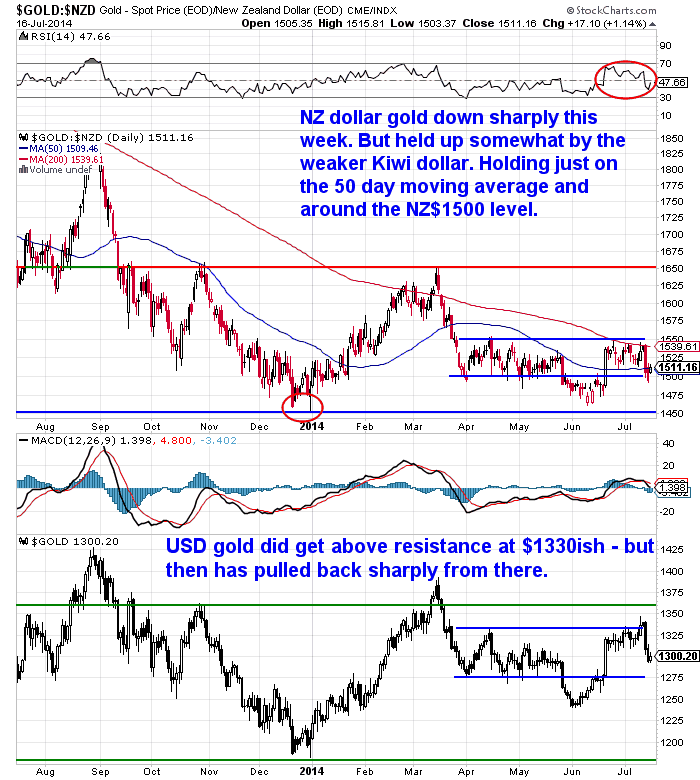

Gold in NZ dollars is down $13.65 or 0.90% from last week to $1493.50.

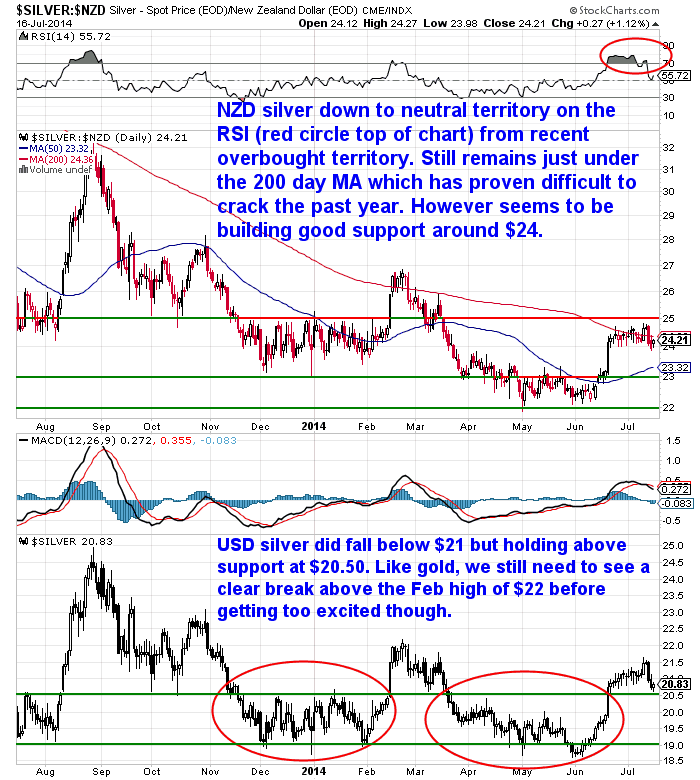

While silver in our local currency is down 11 cents or 0.46% from a week ago to $23.89

Whereas the fall has been much larger in US dollar terms. Gold is down US$28.16 or 2.10% to US$1299.49. While silver in US dollars is down 35 cents or 1.65% to $20.79.

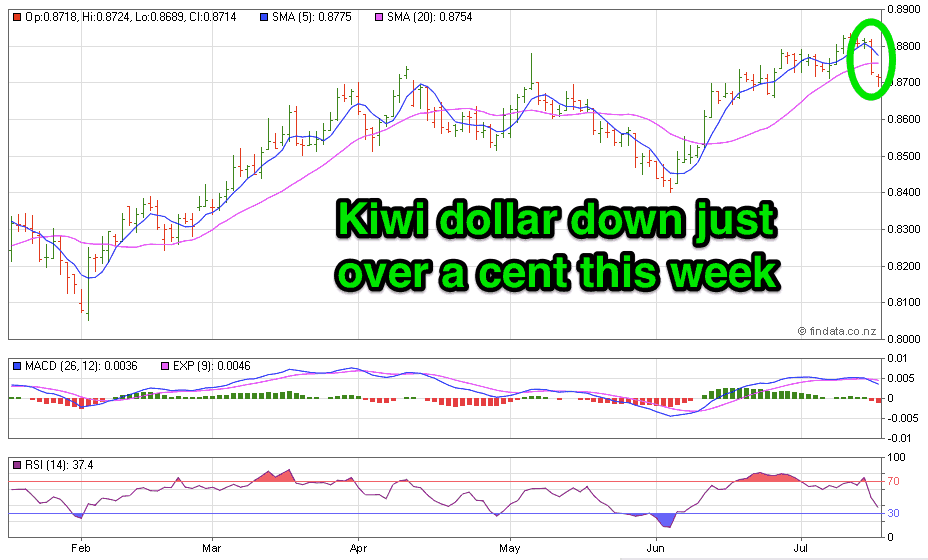

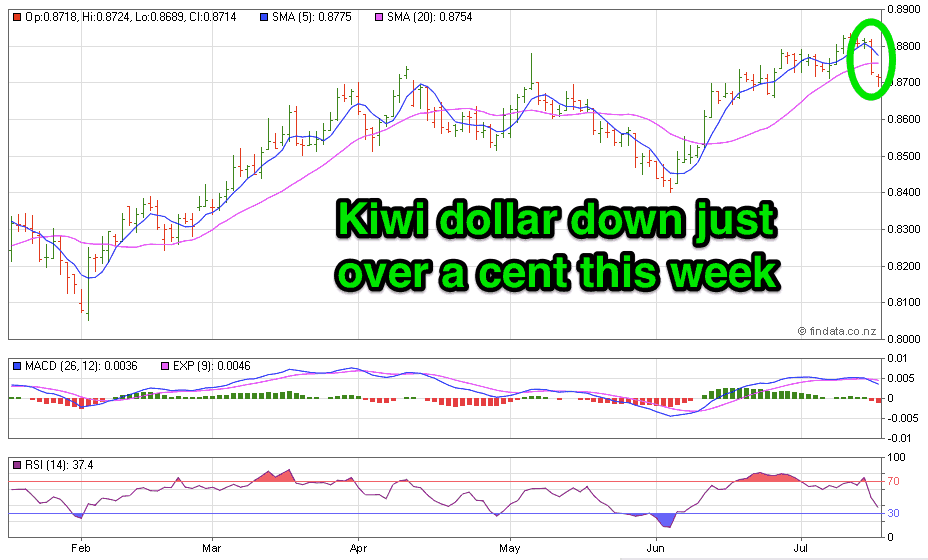

The NZ dollar gold and silver prices have held up better due to the kiwi dollar dropping just over a cent this week from 0.8809 to 0.8701.

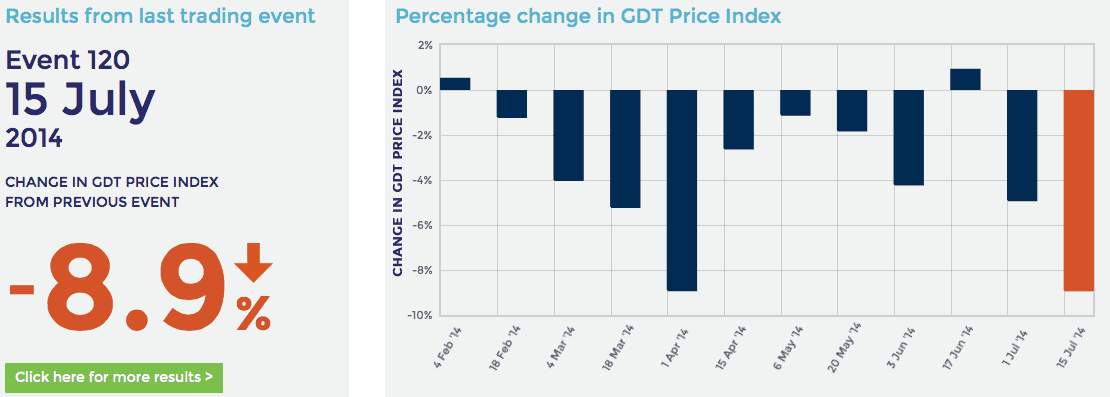

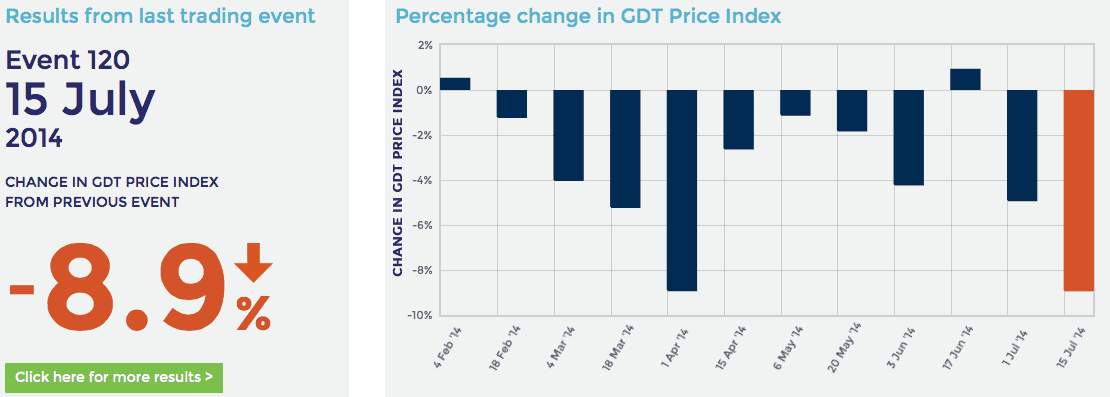

This occurred after the latest Fonterra dairy auction saw an overall 8.9% fall in prices.

Major Slump in Dairy Prices

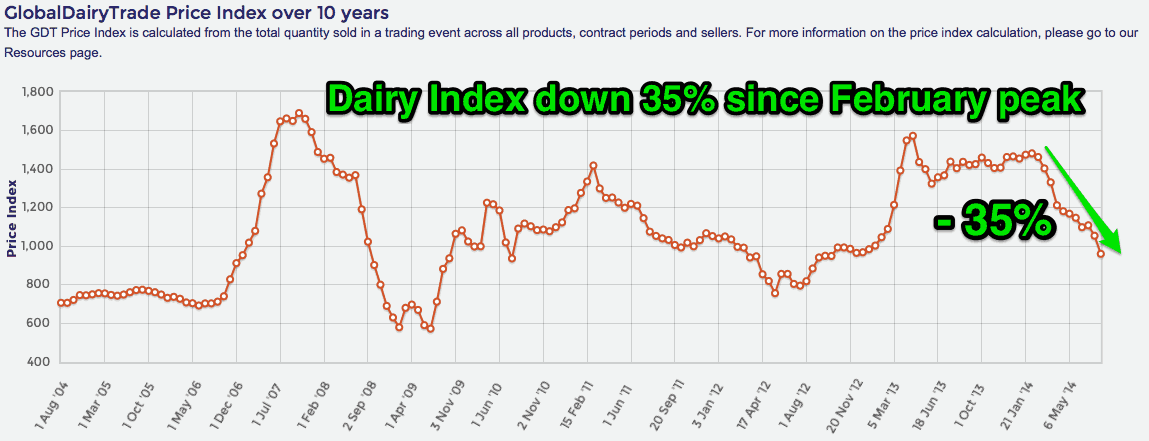

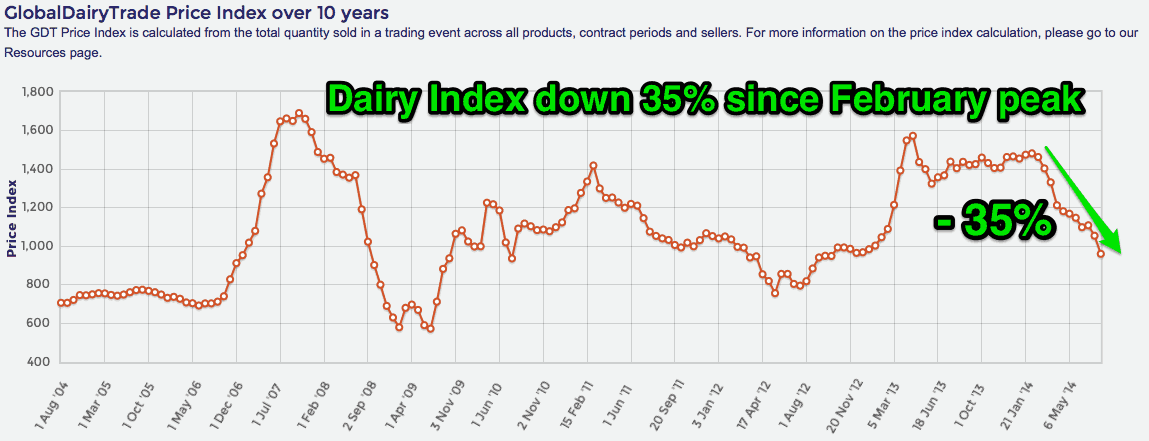

As you can see from the chart above there has been a fall in every auction bar two since February. Overall the GlobalDairyTrade index is down 35% from its peak in February (the index is made up of 9 products including the likes of Whole Milk Powder, Skim Milk Powder and Butter).

Quite a significant fall in just under half a year. And currency markets have reacted accordingly. High US and international grain crop forecasts, and lower grain prices might be leading buyers to expect cheaper dairy prices ahead (grain being the main food source internationally for cows, means lower production costs). We’ve seen a few downgrades for expected whole milk powder payout prices too from bank analysts since the fall.

Last week we mentioned the price of timber has dropped sharply in recent months, so perhaps things aren’t quite as rosy as some would have us believe?

There seems to be a bit of a stalemate of sorts caused by this less rosy trade data versus the higher interest rate differential we have. So far the interest rate differential hasn’t been enough to get the kiwi dollar to new highs.

The retail investors expecting a weaker NZ dollar we mentioned last week seem to be right -well so far anyway.

Inflation data was weaker than expected yesterday too.

It will be interesting to see how the RBNZ reacts to these factors next week and whether the expected rate rise goes ahead. Perhaps they will but will hold at that level for a while?

To us there still seems more downside risk than upside potential with the Kiwi dollar, but comparatively we are doing better than many here.

Wrong on India – so far

Well we along with many others were wrong (so far anyway) last week on the India budget likely containing news of a reduction in duties. The end result rather was – no change.

An article on Mineweb speculates this is due to surging gold imports in new Prime Minister Modi’s home state of Gujarat. And we guess the fear that lower duties/prices will send these even higher?

—–

In Modi’s home state, gold imports surge

“Could the Indian government’s decision to ignore the cries of the bullion industry to lower duty cuts on gold have anything to do with the fact that gold imports crossed double digit figures for the first time in Gujarat, the home town of the current Prime Minister Narendra Modi?”

—–

So we’ll have to wait and see what happens now. But it is interesting that gold imports into Gujarat have soared on only the slightest of relaxation in import rules that has occurred so far. You can’t keep an Indian from his gold it would seem.

Yet More Suspicious Sell Orders

Meanwhile western based speculative money has quickly pulled out of gold and silver futures markets following yet another suspiciously large sale at an illiquid time of day.

Lawrie Williams on Mineweb has an excellent run down on this and whether there could still be more to come yet that is worth a quick read too: Gold and silver smashdown: More to come?

This large sale dovetails nicely into the 2nd question we got from a reader recently as to why to bother with technical analysis (as in reading and analysing pricing charts).

Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?”

“With all the evidence emerging of active manipulation of ALL markets, including precious metals, why would one bother with technical analysis at all? Doesn’t effective technical analysis rely on a market where buyers and sellers are rational participants? Participants that wouldn’t do things like sell 400 tons of gold contracts all in one go at times of the lowest market activity to obtain the worst possible price?”

So given the above mentioned large but very suspicious gold futures sale, it was quite timely that we got round to answering that in our feature article this week: So given the above mentioned large but very suspicious gold futures sale, it was quite timely that we got round to answering that in our feature article this week:

Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?”

Also on the topic of technical analysis this week we put together an article featuring a couple of short videos which look at some technical signals which have recently flashed buy for gold and even more so for silver: Also on the topic of technical analysis this week we put together an article featuring a couple of short videos which look at some technical signals which have recently flashed buy for gold and even more so for silver:

Gold and Silver Technical Indicators Flash “Buy”

We won’t get too excited until the recent highs in March for gold and silver are taken out, but we are more confident that the lows of the past 6 months may well hold. Also it’s not very often we see these significant technical indicators flash a buy. So if you are yet to take positions in gold and silver any dips we see are likely to be good buying opportunities in the long run. Get in touch if you would like a quote or have any questions. We’re always happy to help out first time buyers.

This Weeks Articles:

| India and Modi: A possible positive factor for gold |

2014-07-10 01:26:17-04Gold Survival Gold Article Updates: Jul 9, 2014 This Week: What Would Happen to the NZ Dollar When the US Dollar Collapses?: Reader Question Gold Rises on Fed Minutes Stating QE ends in October NZ Dollar Could Strengthen But What About Gold and Silver? India and Modi: A possible positive factor for gold NZ govt […] 2014-07-10 01:26:17-04Gold Survival Gold Article Updates: Jul 9, 2014 This Week: What Would Happen to the NZ Dollar When the US Dollar Collapses?: Reader Question Gold Rises on Fed Minutes Stating QE ends in October NZ Dollar Could Strengthen But What About Gold and Silver? India and Modi: A possible positive factor for gold NZ govt […]

read more…

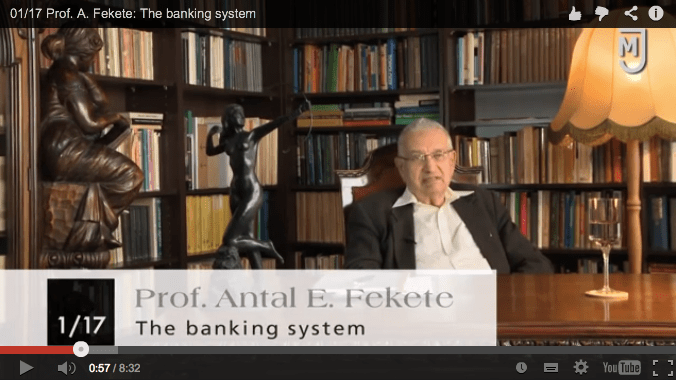

Prof. Antal Fekete: The Banking System – Episode 01/17 |

2014-07-15 17:59:47-04This is the first video (just 8 minutes long) from Professor Fekete in a series of 17 short videos. We’ve featured much of the Professors writings, theories and interviews over the years. Sometimes his more “scholarly” work can be a bit hard to digest for the lay person. But these short videos are likely the most […] 2014-07-15 17:59:47-04This is the first video (just 8 minutes long) from Professor Fekete in a series of 17 short videos. We’ve featured much of the Professors writings, theories and interviews over the years. Sometimes his more “scholarly” work can be a bit hard to digest for the lay person. But these short videos are likely the most […]

read more…

Gold and Silver Technical Indicators Flash “Buy” |

2014-07-16 00:56:20-04Silver’s Monthly MACD (Moving Average Convergence Divergence) crosses over to diverge for only the 5th time this decade, potentially leading to the next bull run in silver. This very brief video from Silver Bullet Silver Shield explains the possible significance of this technical indicator right now. (See below for an full explanation on the MACD […] 2014-07-16 00:56:20-04Silver’s Monthly MACD (Moving Average Convergence Divergence) crosses over to diverge for only the 5th time this decade, potentially leading to the next bull run in silver. This very brief video from Silver Bullet Silver Shield explains the possible significance of this technical indicator right now. (See below for an full explanation on the MACD […]

read more…

Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?” |

2014-07-16 17:32:40-04We received the below question from a reader a couple of weeks ago: “With all the evidence emerging of active manipulation of ALL markets, including precious metals, why would one bother with technical analysis at all? Doesn’t effective technical analysis rely on a market where buyers and sellers are rational participants? Participants that wouldn’t do […] 2014-07-16 17:32:40-04We received the below question from a reader a couple of weeks ago: “With all the evidence emerging of active manipulation of ALL markets, including precious metals, why would one bother with technical analysis at all? Doesn’t effective technical analysis rely on a market where buyers and sellers are rational participants? Participants that wouldn’t do […]

read more…

|

|

So given the above mentioned large but very suspicious gold futures sale, it was quite timely that we got round to answering that in our feature article this week:

So given the above mentioned large but very suspicious gold futures sale, it was quite timely that we got round to answering that in our feature article this week: Also on the topic of technical analysis this week we put together an article featuring a couple of short videos which look at some technical signals which have recently flashed buy for gold and even more so for silver:

Also on the topic of technical analysis this week we put together an article featuring a couple of short videos which look at some technical signals which have recently flashed buy for gold and even more so for silver: 2014-07-10 01:26:17-04Gold Survival Gold Article Updates: Jul 9, 2014 This Week: What Would Happen to the NZ Dollar When the US Dollar Collapses?: Reader Question Gold Rises on Fed Minutes Stating QE ends in October NZ Dollar Could Strengthen But What About Gold and Silver? India and Modi: A possible positive factor for gold NZ govt […]

2014-07-10 01:26:17-04Gold Survival Gold Article Updates: Jul 9, 2014 This Week: What Would Happen to the NZ Dollar When the US Dollar Collapses?: Reader Question Gold Rises on Fed Minutes Stating QE ends in October NZ Dollar Could Strengthen But What About Gold and Silver? India and Modi: A possible positive factor for gold NZ govt […]

2014-07-15 17:59:47-04This is the first video (just 8 minutes long) from Professor Fekete in a series of 17 short videos. We’ve featured much of the Professors writings, theories and interviews over the years. Sometimes his more “scholarly” work can be a bit hard to digest for the lay person. But these short videos are likely the most […]

2014-07-15 17:59:47-04This is the first video (just 8 minutes long) from Professor Fekete in a series of 17 short videos. We’ve featured much of the Professors writings, theories and interviews over the years. Sometimes his more “scholarly” work can be a bit hard to digest for the lay person. But these short videos are likely the most […]

Pingback: Gold Prices | Gold Investing Guide RBNZ Lifts Interest Rates - NZD Falls - Gold Prices | Gold Investing Guide