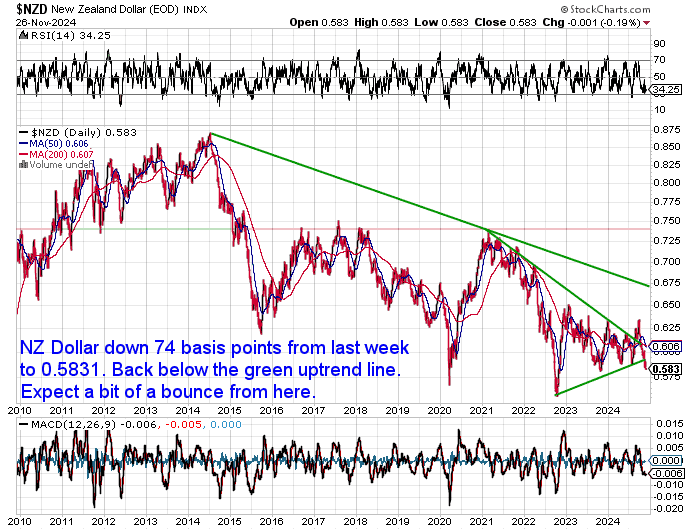

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $4296 |

| Buying Back 1kg NZ Silver 999 Purity |

$1559 |

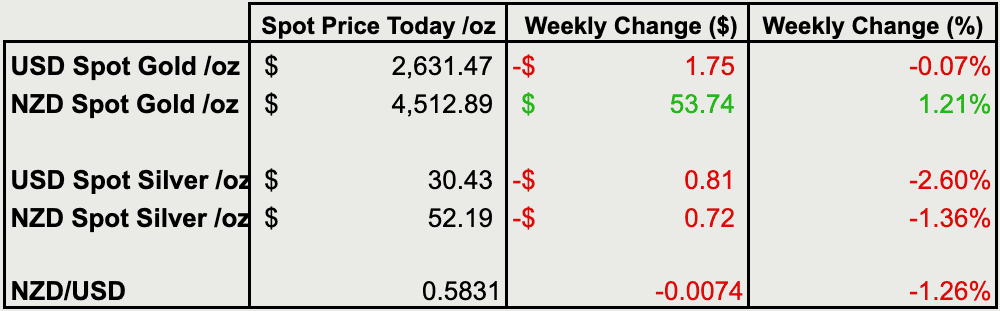

NZD Gold Up 1.2% Care of Weaker Kiwi Dollar

NZD Gold rose back close to the all time highs before dropping sharply yesterday. It ended the week up $54 to $4513, solely due to the weaker Kiwi dollar. The sharp pullback came following the announcement of hedge-fund manager Scott Bessent to lead the US Treasury Department. Tavi Costa pointed out:

“The largest daily gold selloff in four years.

It’s interesting to see this reaction following Scott Bessent’s nomination, considering he’s likely one of the strongest advocates for gold and firmly believes we are on the verge of a major global monetary realignment.”

So we’d say this is to be considered a very good buying opportunity if you didn’t get in a couple weeks ago.

USD Gold was down just $2 from last week to $2631. It dropped down from the resistance line just above $2700. It might have bottomed already at $2550. So this is another chance to buy the dip. Other potential support zones are marked. But don’t count on them being reached.

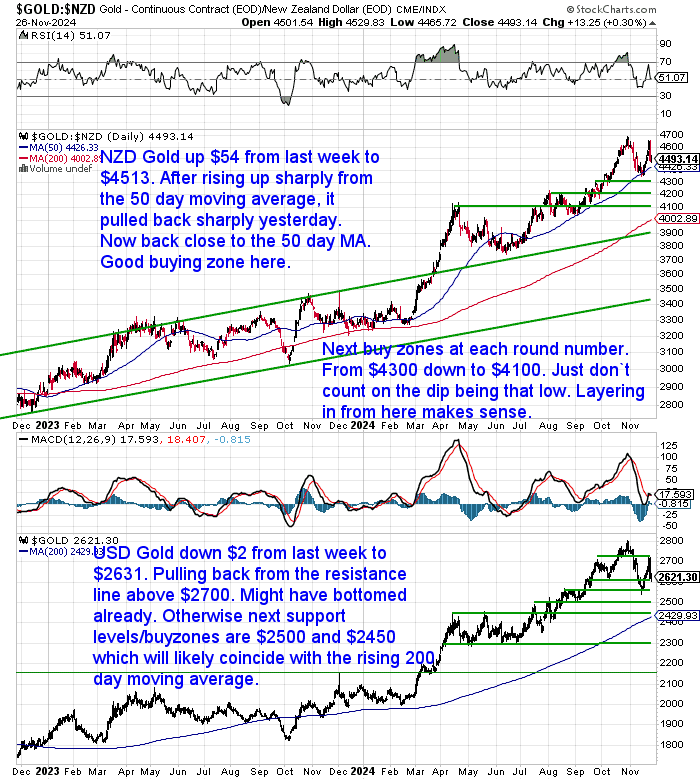

Silver Back Near Recent Lows

NZD silver was down 72 cents or 1.4% to $52.19 from last week. It is back just below the 50 day moving average again. But up from the recent lows. Second bite of the cherry here perhaps? Next buy zones are marked if it was to dip lower.

While USD silver was down 2.6% to $30.43. Again it’s back not far above the 200 day MA ($29.01) which has been a very good place to buy so far this year.

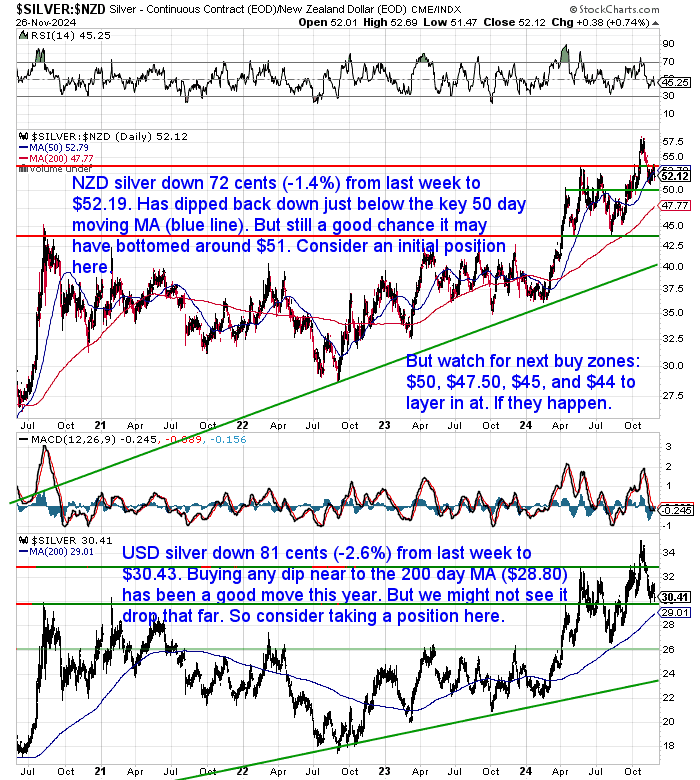

Kiwi Down But For How Long?

As noted already the Kiwi dollar was down 74 basis points from last week to 0.5831. Back close to the lows for the year. But as Jared Dillian pointed out: “if you think Trump, Vance, and Bessent are going to let the dollar stay at these valuations, you got another thing coming.” So expect the USD to weaken next year.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Gold vs. Property: The NZ Housing to Gold Ratio Explained

In our latest article, we delve into the NZ Housing to Gold Ratio, a metric that reveals how many ounces of gold are needed to purchase the median New Zealand house. By analyzing data from 1962 to October 2024, we uncover significant trends and shifts in this ratio between gold prices and the housing market.

Discover how historical events have influenced this ratio and what it might indicate for future investment opportunities. Whether you’re interested in precious metals, real estate, or economic trends, this analysis provides valuable insights into the interplay between gold and housing prices in New Zealand.

Spoiler Alert: Even though gold has risen a lot in the past year, the ratio shows it has quite a bit further to rise compared to property yet.

Check out the full article below.

NZ Housing to Gold Ratio 1962 – Oct 2024: Measuring House Prices in Gold

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Inflation Fears Haunt Markets: Short-Term Rates Down, Long-Term Rates Up

By the time you read this there will likely have been a 50 basis points cut to the OCR by the NZ reserve bank. Most economists are calling for this and the market is also anticipating it.

However don’t count on it making a big difference to the mortgage rates for 2 years or more.

“Infometrics chief forecaster Gareth Kiernan said a 50bp cut had already been priced in by financial markets.

…But he said the complicating factor was that wholesale swap rates for terms of two years or more had increased a lot in the last two months.

“It looks like a definite shift in sentiment from the downward trend we’ve seen since the end of May.

“It appears to be partly driven by international factors, with the re-election of Donald Trump raising concerns about stimulatory or inflationary fiscal policy in the US, and partly by domestic factors as markets see signs of the NZ economy starting to emerge from the zero growth of the last 24 months.

“This shift in wholesale markets is thus placing some upward pressure on retail rates for two-plus years, which mostly hasn’t been passed on by the banks yet.

“The upshot is that, unless there is another change in the trend in wholesale markets, the lift in wholesale rates over the last couple of months is likely to limit the pass-through of any OCR cut – even a larger-than-expected one – into longer-term mortgage rates.”

Jeremy Andrews, a mortgage adviser at Key Mortgages sounds like he is on the money with this assessment:

“We haven’t seen much movement in the mid-term rates, and the long-term rates have remained at similar levels for many months – which might also indicate uncertainty about foreign growth and inflation along with geopolitical risks too.”

This backs our thesis that we are likely to see a comeback for inflation in the next few years. While central banks can control short term rates, they can’t control the long term end of the bond market.

So be warned.

Ray Dalio – What’s Coming: The Changing Domestic and World Orders Under the Trump Administration

Ray Dalio, founder of massive hedge fund Bridgewater Associates, this week has a very interesting article on his LinkedIn page. He outlines what he believes will take place under the Trump administration.

It’s not a massive read but we have also summarised it below for you. Full article linked at the end.

Overview

Ray Dalio analyzes the potential domestic and global changes under Donald Trump’s new administration following a decisive election victory. He outlines a sweeping reorganization of government operations, significant shifts in domestic and foreign policy, and implications for the economy and global order. Dalio draws parallels to the 1930s to contextualize the scale and style of these changes.

Domestic Policy Changes

- Government Overhaul: Trump’s administration plans to reorganize the federal government like a corporate takeover, prioritizing efficiency and cost-cutting. This includes replacing civil service protections with loyalty-based appointments.

- Deregulation: A massive deregulatory push will ease constraints on businesses, especially in tech and energy.

- Economic Focus: Policies favor Wall Street, pro-Trump tech companies, and businesses hampered by regulations. AI will remain largely unregulated, and tariffs will support domestic production.

- Healthcare Reform: Radical changes to the healthcare system are anticipated, led by RFK Jr.

- Immigration and Trade: Stricter border controls and deportations, along with a reevaluation of tariffs and trade relationships.

- Military and Security: Increased emphasis on domestic production of essential technologies, steel, autos, and advanced semiconductors to reduce dependency on foreign adversaries.

Foreign Policy Changes

- America First Approach: A shift from a cooperative post-WWII world order to a fragmented system where the U.S. pursues its interests aggressively.

- Focus on China: China is viewed as the U.S.’s primary geopolitical and economic rival. Other adversaries include Russia, Iran, and North Korea.

- Stronger Alliances: Strengthening ties with allies like Japan, the U.K., and Australia while facing challenges in Europe and the Global South.

- Economic Competition: Increased emphasis on economic self-reliance and strategic alliances to mitigate reliance on foreign production.

Overall Conclusions

Dalio concludes that Trump’s administration will bring dramatic domestic and international changes, akin to the 1930s, with a nationalistic and protectionist approach. The short-term impact is likely to favor businesses and markets aligned with the administration’s goals, but long-term consequences for global stability and alliances remain uncertain. The new order prioritizes strength and loyalty, both domestically and abroad, while creating risks for those unwilling to align with U.S. priorities.

Dalio emphasizes the urgency and challenges of implementing these sweeping changes within a short political window, leaving much dependent on the administration’s ability to execute its vision.

Source: Full Article on LinkedIn.

For more on Ray Dalio see this article we wrote last month:

Why Ray Dalio Recommends Gold as Protection Against Inflation and Global Economic Crises

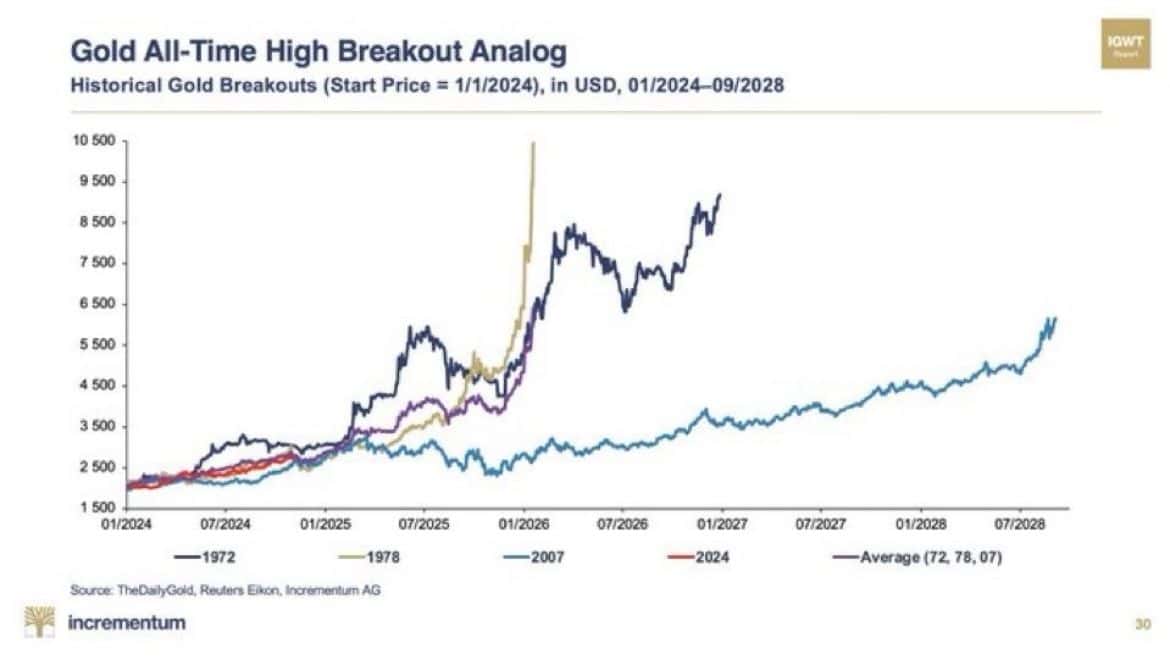

Current Gold Breakout Historical Comparison

This week’s feature article shows that gold is still undervalued compared to property. Here’s another chart comparing the current run up in gold to previous historical breakouts. Still along way to go…

“Putting the current pullback in gold🏅prices into perspective

Love the charts that Incrementum AG’s In Gold We Trust Report regularly publishes.

This one is particularly useful for anyone looking for clues how the gold price could move from here, if historical breakouts for gold are any guide.”

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

This Weeks Articles: |

|||||||||||||||||

|

|||||||||||||||||

|