Prices and Charts

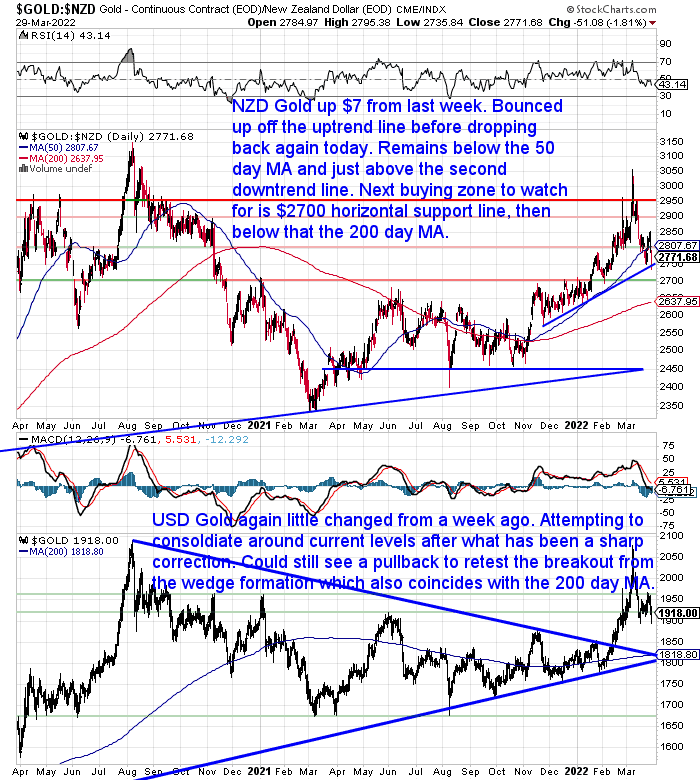

NZD Gold in a Decent Buying Zone

Gold in New Zealand dollars is up just $7 from a week ago. Gold has been trying to consolidate around the $2800 region. It bounced up off the rising blue trendline last week and then today has bounced off that line again.

This is likely a good buying zone to watch for. But it could still head lower as well. Down to the major horizontal support at $2700, or even, perhaps less likely, down as low as the 200 day moving average (MA).

But our guess is that current levels are likely to make for a good long term entry point.

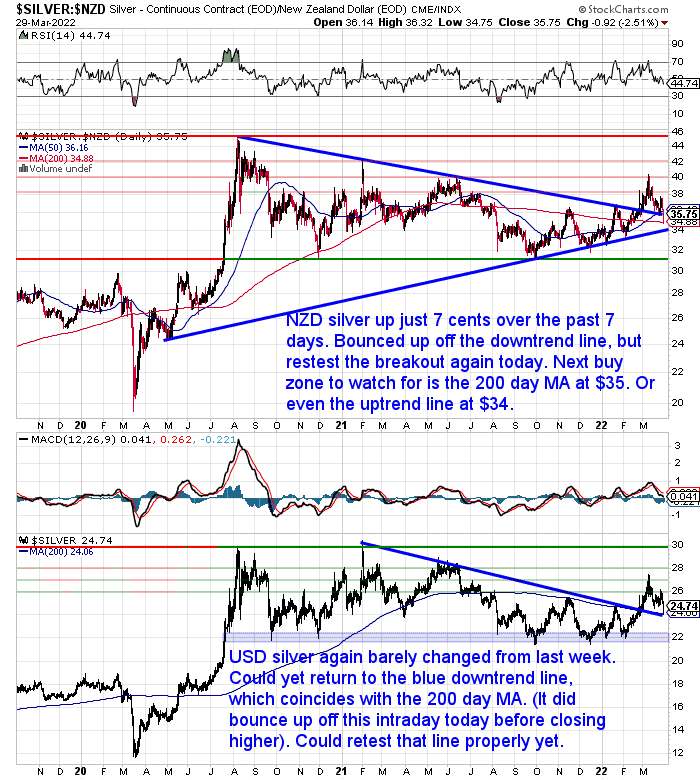

NZD Silver Also Sitting at a Good Long Term Buying Zone

NZD silver is barely changed from 7 days ago. Up just 7 cents. Like gold, silver bounced off the blue downtrend line last week. Today it also closed US trade just above that line. Overnight it even dipped down to touch the 200 day MA. That would be the next buy zone to watch for too. Then below that would be the rising blue trendline at $34.

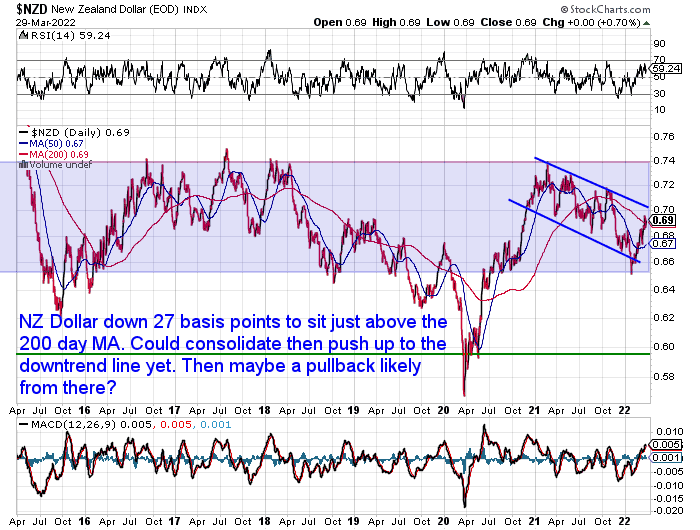

Kiwi Dollar Getting Stretched to the Upside – Correction Coming Soon?

The New Zealand dollar is down 27 basis points from 7 days ago. Sitting just above the 200 day moving average. We could see it move up to test the top of the downtrend channel. If it did that, the RSI would likely be overbought, and so we should see a pullback from there.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – New Stock Finally Here

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

International Reaction to Russian Invasion to Speed Up the End of the US Dollar Reserve Currency System?

The Russian invasion of Ukraine has resulted in reactions from many other countries.

The USA and other countries first blocked Russian use of the SWIFT international payment system. Then went even further. Reuters outlines how they “froze around $300 billion of Russia’s $640-billion gold and forex reserves“.

A recent Wall Street Journal piece looked at how these moves may speed a move away from the US dollar:

If Russian Currency Reserves Aren’t Really Money, the World Is in for a Shock

“Sanctions have shown that currency reserves accumulated by central banks can be taken away. With China taking note, this may reshape geopolitics, economic management and even the international role of the U.S. dollar.”

Source.

The thinking is that this move may prompt many countries, even those which might currently be seen as “friendly”, to also look at how they store their own reserves.

Marketwatch reported yesterday on a mostly overlooked comment from Pavel Zavalny, the head of the Russian parliament:

“If other countries want to buy oil, gas, other resources or anything else from Russia, he said, “let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency.”

In other words, Russia is happy to accept your national currency — yuan, lira, ringgits or whatever — or rubles, or “hard currency,” and for them that no longer means U.S. dollars, it means gold.

“The dollar ceases to be a means of payment for us, it has lost all interest for us,” Zavalny added, calling the greenback no better than “candy wrappers.”

What will this mean? Maybe nothing. Or maybe a lot. Especially if Russia’s lead is followed by countries such as China, India and others — countries that may not welcome Washington’s ability to control the global financial system through its monopoly power over the global reserve currency.”

Source.

An excellent article looking at the impacts of “cancelling” Russian reserves comes to the following conclusion:

“Don’t let anyone paint you as a stark raving Cassandra for taking drastic action to protect your standard of living by saving using different types of monetary hard assets. You cannot cancel the largest energy producer from a monetary system without massive repercussions. If even the bougiest, most establishment, sycophantic media outlets come to the same conclusions as this essay, then it’s only those who refuse to open their eyes and ears who will be left in the dust of history believing nothing is afoot.”

Source.

Covid19 Saw a Huge Increase in Demand for Cash. But Was it the Best Option?

The onset of Covid-19 brought a huge increase in demand for cash.

In a 2020 speech Assistant Reserve Bank of New Zealand Governor Christian Hawkesby commented:

“During the weeks leading up to the March 25 pandemic lockdown, New Zealanders demanded an unprecedented amount of cash, with $800 million of bank notes issued in March alone (compared to $150 million in March 2019).

“These bank notes have not yet returned to the banking system, meaning they are likely still being held by the public.”

Hawkesby said since then, cash in circulation had continued to increase, growing by about 15% year on year during the second quarter of 2020.

“Many other countries have also experienced increased demand for bank notes during the pandemic, as a store of value and a back up method of payment.

So people were worried about how the banking system would operate. They were looking to use cash as a back up payment method.

But if current inflation rates are anything to go by, cash will not be great as a store of value.

This week’s feature article looks at the utility of holding silver coins rather than having cash. It covers…

- If A Currency Collapse Occurs or Even Just a Change to the Monetary System, Would Silver Be Useful?

- New Zealand Has Never Seen a Complete Currency Collapse

- What Has Happened Elsewhere During a Currency Collapse?

- Currency Collapse in New Zealand More Likely to be Result of Global Monetary Breakdown

- What Are the Best Coins to Own?

- Current Best Silver Coin Deal

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Reader Question: “Can You Please Tell Me How to Hedge Against Inflation?”

A reader asks:

“Can you please tell me how to hedge against inflation – I have some very modest savings which I keep in the bank and I believe there is a better way?”

Gold and silver have historically been a good way to protect your purchasing power.

Surprisingly to many people gold and silver are not so correlated to inflation rates. But rather to negative real interest rates.

That is because you could have high inflation but also higher interest rates (such as in 1980) and then precious metals don’t do as well. As the after inflation return is still positive.

Currently the inflation rate (CPI) is much higher than interest rates. Hence we can expect gold and silver to continue to perform well.

See this post for more on that: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand?

Also see this post for interest rate and gold: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

We’d also say that it doesn’t necessarily matter how much cash in the bank someone has. Even if only a modest amount. Everyone can still hedge themselves. After all, a silver coin is only around $45. It is more about looking at the percentage of your overall wealth that might be recommended to hold in precious metals. That varies greatly, as everyone’s situation is different. For example what other assets or investments someone holds? What are their ongoing expenses? What is their income? etc.

See: What Percentage of Gold and Silver Should Be in My Portfolio? [2021 Update]

We also all need some cash in the bank to use for ongoing expenses, but again the amount required varies greatly according to each person’s situation. So that comes down to individual choice as to how much you keep in the bank and how much you place into precious metals.

But just make sure you’ve got enough wealth insurance to protect yourself against ongoing negative real interest rates and the loss of purchasing power they bring with them.

Please get in touch if you’d like a quote.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|