Simon Black of SovereignMan.com had what turned out to be some controversial thoughts on physical gold demand this week. We’ll reprint his article below. We’ll then include a response from Dave Kranzler at investmentresearchdynamics.com who disagrees with much of Simon Blacks assertions. Then finally we chip in with our 2 cents worth on precious metals demand from a New Zealand Perspective.

First up here’s the piece from Simon Black:

Demand for physical gold is collapsing

I serve on the Board of Directors of a large Singapore-based company that’s in the gold and silver business. And, last night during our quarterly conference call, the management team gave me a lot of intriguing information.Sales of physical gold and silver are collapsing across the entire industry. At the US Mint, for example, sales of US Eagle gold coins fell by 67% between February 2016 versus February 2017. And sales of US Eagle silver coins are down 75% over the same period.

The World Gold Council’s data also shows a substantial decline in physical precious metal demand in 2016, particularly with bars, coins, and jewelry.Suppliers and refiners in the precious metals business are echoing these numbers, lamenting that sales are extremely slow and margins are falling. For our Singapore company, this decline is irrelevant.

They have their own proprietary, state-of-the-art storage facility and a number of cutting-edge service like bullion-backed peer-to-peer loans, so business is great. But I would expect that a number of other bullion dealers will probably go bust if this downturn lasts much longer. The one conundrum is that this trend does NOT correlate with the price of gold.

In US dollar terms, the gold price is up 16% since the beginning of 2016. So it would be reasonable to conclude that sales of physical bars and coins are up as well. But they’re not. The reason is because there’s a HUGE difference between physical gold and “paper” gold.

When people talk about the gold price, they’re really quoting the price of gold contracts at exchanges around the world in London, Shanghai, Chicago, etc. Traders aren’t actually buying and selling physical gold. These gold contracts are merely paper financial instruments, like stocks and bonds, that traders use for speculation.

When some conflict breaks out in Africa, the knee-jerk reaction is for traders to buy gold contracts. And when central bankers announce that the economy is totally awesome, traders dutifully dump their gold contracts. But they’re really just buying and selling highly leveraged paper assets. Nothing physical changes hands. It’s the same with gold ETFs; these are merely financial instruments to gamble on the paper price of gold.

Investors who truly understand the benefits of owning gold, and don’t simply want to speculate on the price, buy physical bars and coins from a dealer. And quite often there’s a massive difference in fundamentals between the demand for physical coins and the paper price.

During the 2008 financial meltdown, the paper price of gold and silver plunged. Speculators and traders were hit by margin calls and forced to sell their contracts. But demand for physical coins was incredibly strong; savvy investors were looking for a safe haven. There was a total disconnect between the paper price and physical demand.

That’s now happening again, but in reverse. The paper price is rising, but physical demand is falling. Management told me last night that they’ve been invited to speak at several investment conferences attended by family offices and high net worth individuals. But they told me that there’s very little interest in owning physical precious metals among these wealthy investors.

Everyone seems to want to dump all of their money in US stocks or real estate, expecting that they’ll easily make 20% despite both markets being at all-time highs. This strikes me as total madness. Few people ever prospered buying what was popular and expensive. There seems to be no fear in the market… no regard for sense or safety. And my contrarian instincts tell me that this complacency is a great reason to own physical gold and silver right now. Remember that gold is primarily a form of savings.

You could hold your savings in a bank account, denominated in paper currency like dollars or euros or renminbi. Or you could hold savings in physical cash. You could even own government bonds. Each of these is a form of savings.But so is gold and silver. (And cryptocurrency, for that matter.) The difference is that gold and silver cannot be conjured out of thin air by a central bank. And unlike cash, or money in a bank, precious metals actually keep pace with inflation over time. I remember having a conversation once with a famous investor who told me that he didn’t know what was going to happen in the future…… and THAT’S why he owned gold– for the “I don’t knows.”

Will there be a trade war with China in the next few years? A shooting war? A major debt crisis? Another terrorist attack? “I don’t know.”Gold and silver are fantastic insurance policies against the “I don’t knows” due to the metals’ 5,000 year history of value and marketability. There’s no need to go overboard and keep 100% of your net worth in precious metals. But given the obvious risks on the horizon that we discuss regularly, and these bizarre demand trends, it’s a great time to consider adding to your physical precious metals savings.

Then here is the response from Dave Kranzler at investmentresearchdynamics.com. He argues that there are other factors at play causing a drop in retail gold and silver buying:

Is Demand For Physical Gold Really Collapsing?

Seriously? “Simon Black” (it’s a nom de plume) wrote an article titled “Demand For Physical Is Collapsing.” He focused on retail bullion demand numbers. The headline and the content is largely fake news as it focuses on the demand for minted coins vs the paper gold market. We’re not really sure about the intent of article, but the content was devoid of any relevance to the actual global demand for physical gold.

While the retail minted coin and small-size bar demand is down from last year’s levels, there’s two factors to explain this. First is price. The price of gold and silver was lower in early 2016 than it is now. The price of gold in February 2017 averaged $1230-$1240 while the price of gold a year ago February averaged $1175. Retail buyers of gold/silver coins are highly sensitive to price and tend to chase the price higher, up to a point. On this basis, it’s not surprising that more minted coins were sold a year ago compared to this year. This “price effect” on the demand for retail gold and silver coins likely explains about 25% of the demand comparison between 2016 and now.

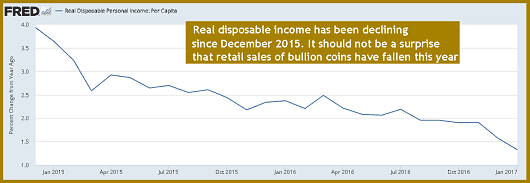

The second factor is the economy. Remember, the end user of minted bullion products is largely the retail buyer. In the first two months of 2017, real wages have declined. Even more negative for retail sales of any sort is the fact that real disposable income has been declining on a year over basis since December 2015:

While we at the Shadow of Truth do not consider buying and owning bullion to be “discretionary,” retail sales, including sales of bullion coins, is highly dependent on the relative level of real disposable income. Thus once again it should not surprise, based on just looking at retail demand for physical bullion, that retail bullion sales are falling.

On the other hand, the Black article purports the idea that retail bullion sales represents global demand for gold and silver. Nothing could be further from the truth. Retail demand at the margin has no affect on price other than maybe the price premiums in the coin market based on mint supply and retail demand.

The majority of gold bullion demand comes from the jewelry industry, eastern hemisphere Central Banks and sophisticated wealthy and institutional investors. India and China alone import more gold than is produced from mines globally. This is why Black’s “paper gold” price is rising. It’s why the BIS and western Central Banks have failed to eliminate the significance of gold in the global monetary system.

Gold imports into India jumped 175% in February from February 2016 to 96.4 tonnes (LINK). In fact, official gold imports into India have been rising since December. And that does not include dore bars or smuggled gold. 179 tonnes of gold was withdrawn from the Shanghai Gold Exchange in February. This is 60% higher than February 2016. The Russian Central Bank gold reserves have been rising almost monthly since mid-2007.

To claim that the global demand for physical gold is collapsing is seeded in either ignorance or mal-intent. But either way, the assertion is outright idiotic when the facts are examined, which we do in today’s episode of the Shadow of Truth:

Our Take on Physical Gold Demand in New Zealand

We’re not sure that Black and Kranzler are necessarily poles apart in what they have written. Perhaps it is more a case of arguing about what the “paper” price is doing versus physical? And what the west is doing versus the east?

So what’s our view on this gold demand situation?

Well, here in New Zealand our numbers also show a drop like those reported by the US Mint and elsewhere. (Of course our volume is pretty small compared to the US Mint, but still enough to warrant a comparison in overall trend!)

Comparing February of 2016 to this year, we saw a drop of 36% in total purchase volume. But the really interesting statistic is a fall of 76% in the number of actual transactions from the same month last year.

(The much greater fall in transaction numbers compared to the volume of sales, shows that fewer people were buying but those that bought, on average, bought significantly more than in February 2016. Maybe these will people will prove to be the “smart money” as the year progresses?)

What to make of this fall in volume and transaction numbers?

Our take would be that the price of gold has been the main factor in sales volumes.

Dave Kranzler theorises that sales for the US Mint are down this February as the gold price was lower in the same month last year. So this prompted more people to buy last year as they got more gold – due to the lower price.

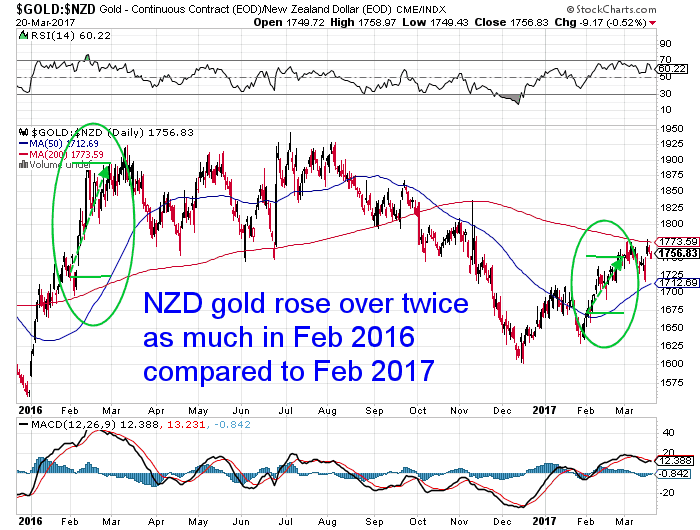

However here in New Zealand the opposite was true. The NZD gold price was lower at the start of February this year compared to last February. The price also moved up over twice as much last February as in February 2017.

This last point gels with what we often see. And we’d say it is likely a significant factor in western retail gold demand. That is, more people buy when the gold price is rising sharply that when it is stagnant, not rising much, or bottoming out.

This seems to be more of a western phenomenon. Whereas in China and India, purchases seem to increase when the gold price is down.

So overall we’d say Western retail gold demand is certainly down on year ago.

This doesn’t really surprise us given the difference in how the gold price has moved between those two periods. With the price shooting higher in February 2016 this saw a surge in western buying compared to the much slower rise this February. We reckon the direction and pace of the price is actually more of a factor in western hemisphere purchasing than how high or low the gold price is.

We also think the lower demand in the West may also be indicative of doubts in the gold bull market having actually returned. Perhaps the majority still think this is just a bounce higher in an overall bear market?

Global demand overall looks to be picking up again, as the numbers outlined by Kranzler for India attest.

Our guess is the price will again head higher this year and that is likely when western retail demand will pick up again. Along with Institutional buying in the form of exchange traded funds (ETF’s).

So any pull back we experience towards the NZ$1700 level is likely to be an excellent place to take a position in gold over the along run.

>> Related: Paper Gold vs Physical Gold – What Should You Buy?

Pingback: Ronni Stoeferle: Retail Bullion Demand is Collapsing - What About in New Zealand? - Gold Survival Guide

Pingback: 2017 Global Physical Gold and Silver Demand: A Fact Vs. Propaganda Update - Gold Survival Guide