Weekly Wanderings 24 December 2009

In the final Weekly Wanderings for 2009 we cover….

• Don Coxe on gold – courtesy of Zero Hedge

• Harry Schultz on Deflation

• Chris Martenson to speak at UN

• John Hathaway on whether gold is in a bubble

Don Coxe on Gold – from Zero Hedge

As the only major financial asset that never pays interest or dividends, gold’s performance could be the clearest, purest example of Zero-Based Investing:

With a 25% rise this year, Gold has beaten the S&P roughly 7%. As measured by the XAU, gold mining stocks’ total return is 35%.

But gold’s investment return was exceeded by the amount of publicity and debate it generated. Its late-year blow-off past $1200 briefly made it a Page One story—thereby automatically guaranteeing a sharp correction.

The media were filled with authoritative explanations:

Hyperventilating Commentators’ Explanations:

- the collapse of the dollar;

- the repudiation of Obamanomics;

- a warning of a coming financial collapse, leading to Depression;

- a signal of the runaway inflation to come;

- China has only begun to convert its dollar holdings into bullion: the best is yet to come;

- a short squeeze on gold ETFs which are misrepresenting how much bullion they hold: beware of counterparty risk: buy bullion, not paper;

- a coming Armageddon in the Mideast.

Sophisticated Explanations

- gold is the only asset that is nobody’s liability and is therefore a haven in an increasingly uncertain world;

- capitulation by hedged gold miners, notably Barrick;

- India’s purchase of 203 tonnes from the IMF, removing the overhang in bullion markets;

- China’s announcement that its gold holdings are higher than were previously revealed;

- “Peak gold” discussions, as investors ponder the failure of gold mines to maintain—let alone increase—their production despite record bullion prices. The classic expression for getting rich quick is to find a gold mine—but it takes time, experience and capital to bring on a mine. Reported gold companies’ reserves haven’t been rising, but soaring gold prices will change that: millions of tons of low-grade “resources” that haven’t been booked as ore reserves will be reclassified if gold prices remain near or above current levels;

- recognition of the longer-term implications of central banks’ astounding levels of creation of fiat money at a time they are collectively becoming net buyers of gold—after decades of sustained selling;

- respect for gold’s future because prices have managed the remarkable feat of setting new records at a time jewelry demand—traditionally the main support for gold—is slumping sharply;

- portfolio diversification by sophisticated investors who seek a haven at a time of zero returns on Cash—with no indications that central banks are about to abandon their Zero policies.

Clients can undoubtedly add other justifications and explanations to their lists.

We were in Toronto the week gold prices were setting records daily, and were asked—on TV—to explain the dramatic run-up. Various prominent commentators were falling all over themselves to issue ever-higher targets for bullion prices.

We admitted that we couldn’t explain the sudden rush and the dramatic daily leaps. When asked for our price target, we suggested….

“As an historian, I seek some historic data to assist our predicting. When gold broke through $1,000, we began considering appropriate targets. As every English schoolboy knows, 1066 was the Norman Conquest—the first gold target. The next important date was Magna Carta—1215—and gold has now managed to attain that level. The next big date is the Provisions of Oxford 1258 [when Simon de Montfort forced important constitutional changes on Henry III].

“My one-year target for gold is 1345—the onset of the Black Death.

“Apart from that, I really can’t say how high gold could ultimately go, although longer-term it should reach 1485, when Richard III fell in the Battle of Bosworth, launching the Tudor monarchy, and giving us the enduring quote, “My Kingdom for a horse!” The interviewers laughed, and changed the topic.

Next day, Goldman issued its authoritative target price for next year: 1350.

We were called for comment, and graciously accepted that prediction because it was the end of the Black Death.

The point of these musings is that no one really has any idea of the longer term price of gold that can be justified by sober analysis.

All that we can sensibly say is that gold’s price entered a 20-year Triple Waterfall collapse in 1980, falling from $825 to $250, and has risen every year in this decade. If it can maintain its strength at a time jewelry demand is shrinking, then investors and speculators are in charge; their motivations include momentum and malaise: Gold looks good because it keeps going up, and they’re scared about what the Fed and Obama and other central banks and governments are doing, and have no great confidence that there will be a sustained, noninflationary economic recovery, so gold is a good place to hide.

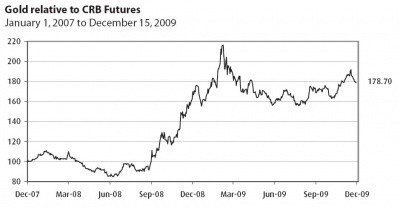

Gold has been the best-performing major commodity since the financial crisis began:

We see no big reason why that outperformance should be over. After its breathless run to $1220, it’s entitled to correct back toward $1,000—or even a bit below that chiliastic level—without ending its bull market.

Finally, gold may even be decoupling from the dollar. The sheer scale of foreign exchange reserves in China, Hong Kong, India and other countries whose currencies are pegged, directly or otherwise, to the dollar may be opening a whole new demand for gold. Just to maintain even tiny percentage exposure to gold in forex reserves means these nations must remain on the buy side. The euro was once seen as a worthwhile alternative to the dollar in Asian forex accounts, but the unfolding problems of its Eastern European and Mediterranean members are exposing the euro’s internal contradictions as a viable alternative to the dollar.

In a world in which nearly all paper money has problems, and in which the sheer supply of paper money is expanding far faster than global GDP, gold has its best claim as a constituent of foreign exchange reserves since Bretton Woods booted it out sixty-five years ago. [emphasis Zero Hedge]

Harry Shultz on Deflation

From Rick’s Picks, an excerpt from Harry Shultz’ latest newsletter…

“Deflation suddenly is looming, crowding out the prevalent global view that only higher inflation can possibly be ahead. QE (Quantitative Easing) isn’t working; money pumping, once thought a flawless cure for crises, now falls flat, from lack of confidence. QE is, in fact, having the opposite of the intended effect as it’s obviously a ploy, & QE simply adds to debt, which now chokes the holders. Gold can handle deflation nicely, but not much else can.”

Chris Martenson to Speak at UN…

Chris Martenson whose opinion we follow closely is set to speak at the U.N. Maybe someone who understands the current state of the global economy can get the Bureaucrats to see some sense and see that tax and spend isn’t the answer! Hope springs eternal…

After Copenhagen: Understanding the Energy Trap for Policymakers

Tuesday, February 2, 2010

1:00 to 2:45

United Nations Headquarters

760 United Nations Plaza

New York, NYCo-sponsored by the NGO Sustainability and the Mission of Slovakia to the United Nations

This presentation will discuss the macro trends of our economy, energy structure and environment, as they will affect the decisions we make as individuals and policy-makers. Touching on the outcomes of the Copenhagen Climate Summit, Dr. Chris Martenson will explore why and how a financial system dependent on infinite growth will continue to create disastrous friction with the resources and ecosystems of a finite planet. To enter the solution-space in confronting these timely issues, we will need to understand how these “Three E’s” are inextricably linked, and break apart the myths we tell ourselves as a society to build towards a future of sustainable prosperity.

John Hathaway on gold…

John has been featured in these pages before (see Gold and Central Banks). He is one of the most experienced and knowledgeable commentators on the gold market around. It is worth noting that Mr Gold himself, Jim Sinclair, holds John’s expertise in high esteem. In another recent interview with Eric King, John expresses his views on the gold market, and more.

It is patently false that gold is in a bubble, even though Nouriel Roubini has become the cheerleader for the gold bubble story. However, the gold price we have now is in the context of massive money creation and provision by the Fed of money for speculation at an interest rate of effectively zero.

It’s possible that the current correction in the gold price could see a dip below $1,000, but this would represent a terrific buying opportunity. The sustained break that we have seen above $1, 000 marks a new phase in this gold bull market, one of much increased volatility – both up and down. Jim Sinclair has also expressed this view, by the way.

The opinion that paper currencies are deeply flawed is moving mainstream, and with it the idea of investment in gold. Currently, for example, pension funds, which contain large pools of capital for investment, have virtually zero exposure to precious metals. As investing in gold becomes more fashionable, at least some portion of these pools will stream into the gold market, creating increased buying pressure.

Consider the gold ETF. Currently, it has a value of around $67 billion. Many people view this as high, but John envisages it easily reaching 10 to 15 times this value! From this one perspective, gold is under-owned.

Gold at over $1, 000 seems as undervalued today as it did in 2000 at less than $300. This is the case because of the very different financial environment today, when the measures being taken to reflate assets are so extraordinary, and regard for the integrity of the US dollar is so low. The financial system has been ruptured, and government policies are compounding the damage. The potential pitfalls we face today are demonstrably more dangerous than the ones we faced going into 2008.

Gold shares are currently very undervalued compared to the gold price. Gold mining has been a very tough business over the last few decades, but now, with the gold price over $1, 000, well run mining companies will start to generate significant profits and returns on capital.

Silver remains significantly undervalued, relative to gold. One cautionary note though; if we entered a depression type environment where industrial demand plummeted, then silver might not do so well. However, under the inflationary scenario that the Fed seems determined to engineer, silver should do very well.