Prices and Charts

Gold Pulling Back After Making Multiple New All Time Highs

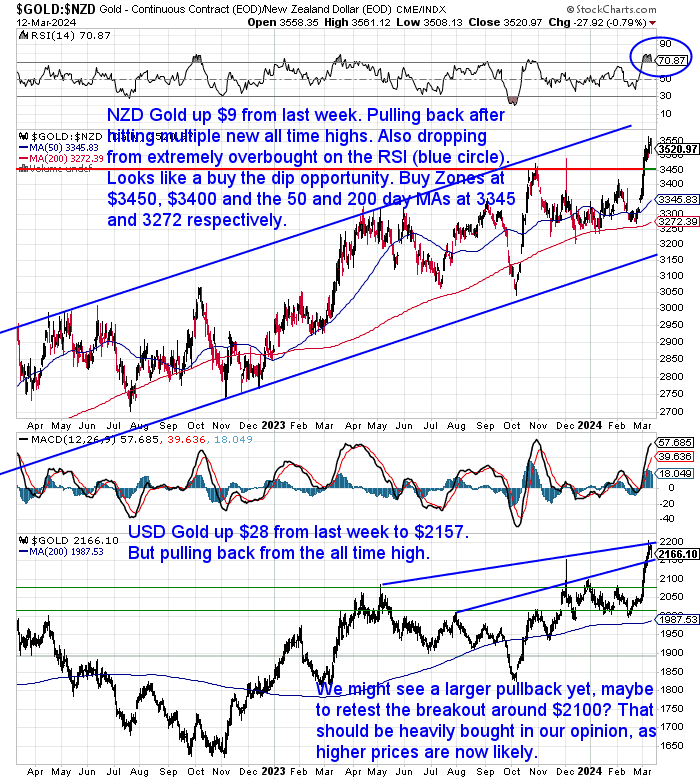

Gold in New Zealand dollars is up $9 from last week. Pulling back after making multiple all time highs on consecutive days. The RSI (Blue circle) has dropped down from extreme overbought, but still remains above 70 so still in overbought territory.

A further pullback wouldn’t be a surprise from here. But to us this looks like a “buy the dip” opportunity. It’s likely gold will retest the breakout around $3450. Other buy zones below that would be $3400 and then the rising 50 and 200 day moving averages (MA) at $3345 and $3272 respectively.

Pretty similar situation for USD gold too. It surged all the way up to touch $2200 but is back down to $2158 today. Looking for a retest of the breakout around $2100. But any dips should be a great buying opportunity.

Silver Still Lagging Gold

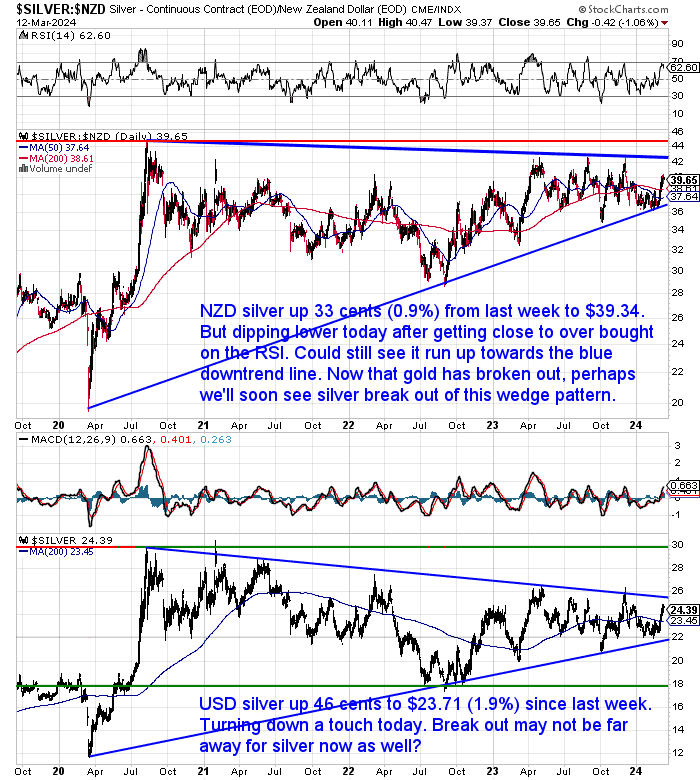

Silver in NZ dollars is up 33 cents from last week to $39.34. It has dipped lower today after getting close to overbought on the RSI indicator. Perhaps we’ll see a brief pullback before it runs up towards the blue downtrend line? But now that gold has broken out, there’s a good chance we’ll soon see silver break out of this multi-year wedge pattern.

In USD terms silver is close to the upper trendline in the wedge pattern. Up 46 cents since last week to US$23.71. We are running out of space in the wedge pattern, getting more and more compressed. So if it does follow gold higher and break out, we could see a pretty fast surge towards US$30. There is a lot of energy coiled up in the “silver spring”.

Kiwi Dollar Still in the Downtrend

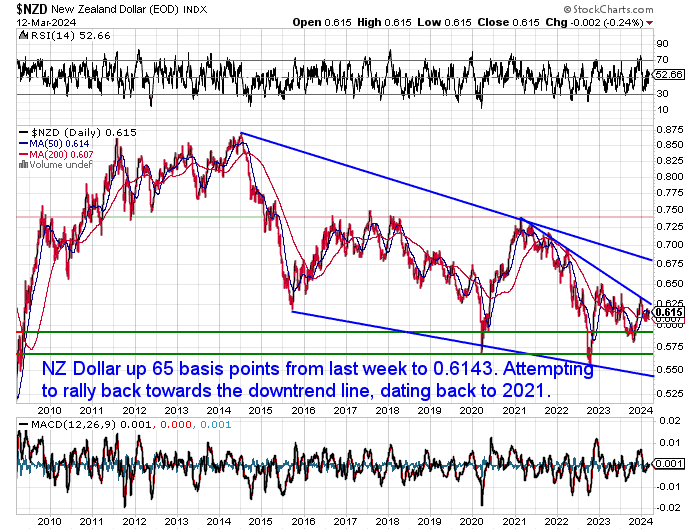

The Kiwi dollar was up 65 basis points from last week. Still attempting to rally back towards the downtrend line dating back to 2021.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Inflationary Enigma: Can You Outpace the Printing Press with Property or Gold?

This week’s feature article dives into the fascinating world of money supply and its influence on investments like property and gold. You’ll discover:

- How central banks printing money can impact the value of your assets

- Why understanding the “money multiplier” is crucial for informed investment decisions

- Whether a surge in money printing might benefit property prices or lead to inflation

Intrigued by the connection between central bank actions and your investment portfolio? This week’s article sheds light on this complex relationship and gives you valuable insights for navigating the current economic climate.

P.S. Want to know how much new money is being created and how it could potentially impact your investments? Read the full article to find out!

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Rise from 5000 Year Low in Interest Rates Over Already?

A headline this week somewhat confusingly read:

Interest rate expectations: It’s not over yet. Most Kiwis think interest rate increases have peaked.

Source.

From what we gather 31% of respondents to an ASB survey think interest rates will stay the same.

However, 15% are still expecting an increase, although that is down from 28% in October last year. The data highlights more people are starting to think a peak in rates might just be around the corner.

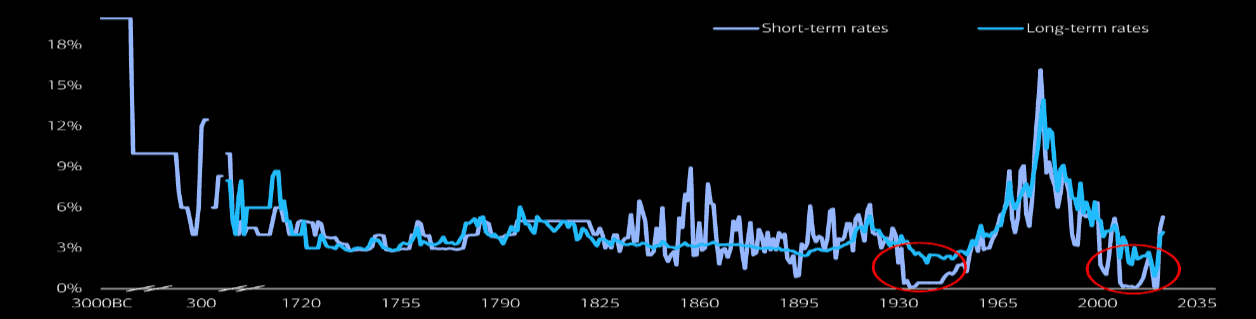

But then on our trusty laptop we spotted this chart we saved some months back from the Bank of America Quant team.

Source.

This chart got us wondering, after hitting a 5000 year low a couple years back, can the rise in interest rates be over already? Or are we perhaps just at a pause in a run up like we saw in the 1970’s?

Why the East is Driving this Current Gold Price Rise

Despite gold hitting an all time high, the gold holdings at the GLD exchange traded fund (ETF) continue to fall. The assertion being that it is the east (China) that is buying…

The East is driving this rise ????#gold #silver (or a big whale)

Gold pushing new all time highs despite broad hatred in the US, higher dollar, and tighter dollar US monetary policy expectations suggests the surge in demand is from abroad, particularly China.

Gold price is rising even as US ETF assets keep falling:

Source.

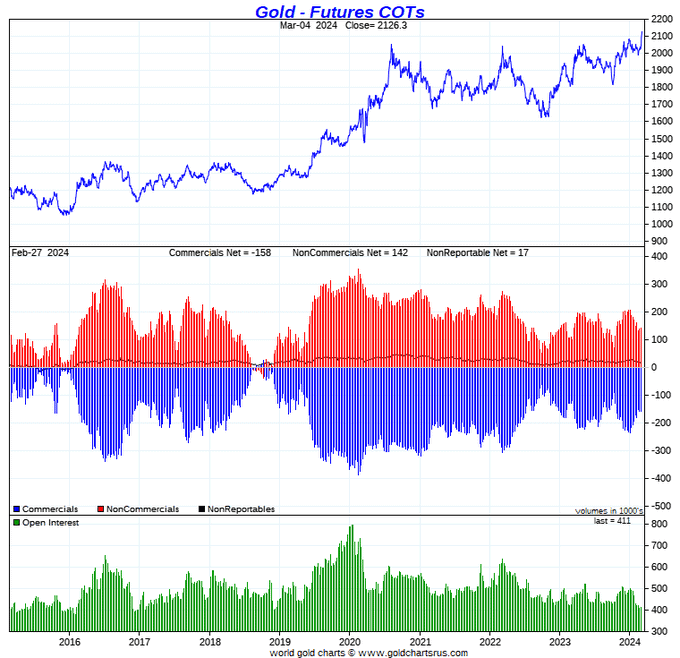

Also backed up by the lack of open interest in the gold futures market. (as we discussed a few weeks ago.)

Looks like Comex is not driving this rise #gold #openinterest #comex

what is remarkable: #Gold is at an all-time high and the open interest is at a 10-year low…

$GLD

Source.

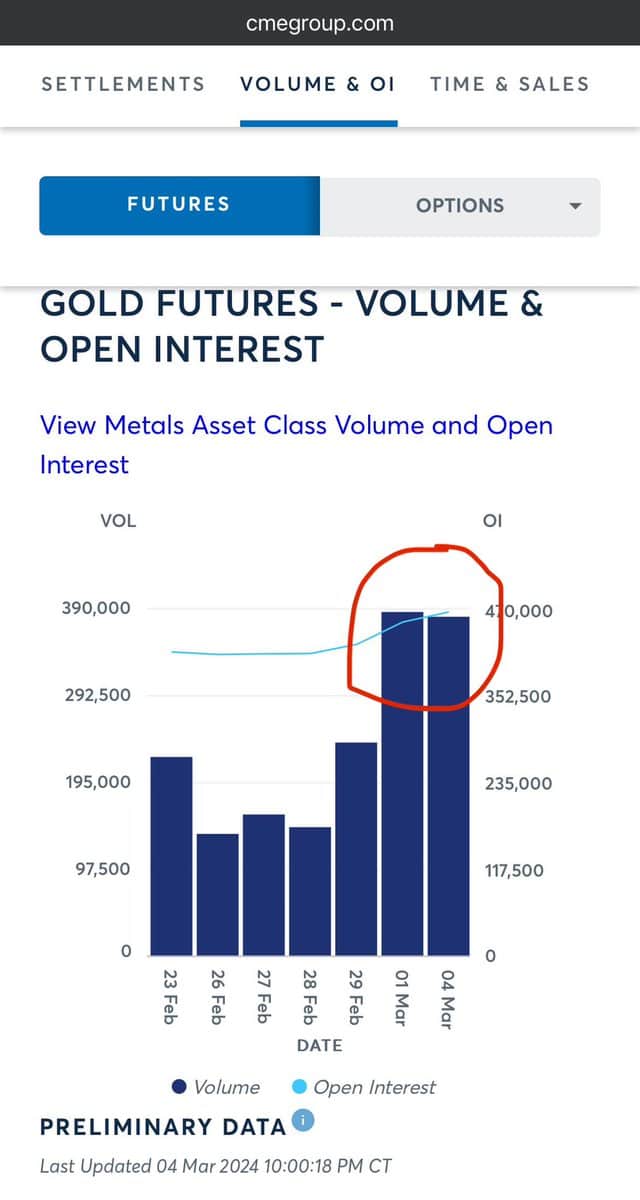

Although maybe this next chart shows that the west is now joining in too?

Gold futures volume and open interest is rising in the past days. Seems to me COMEX traders are driving the gold price up since Friday.

If the West is really joining China in the gold buying spree we’ll see in the coming weeks. If both sides keep on buying that could be very explosive.

Source.

We said last week that this breakout in gold has been totally ignored. We have seen very few no positive gold articles in the mainstream. Even those writing about the recent rally are finding ways to “trash talk” gold.

When CNBC misleads its audience by cautioning them against buying gold it’s time to actually pay attention.Contrary to what they suggest, the fact is that Gold has outperformed both stocks & bonds since the turn of the century

@GoldTelegraph_

Don’t be enticed by the gold rally, expert says: Investors ‘buy gold and hope it doesn’t go up’

Argument: “Indeed, over the last century, gold has risen around just 1% a year, on average.”

One needs to start from 1971, when the fiat money printing orgy truly began.

Source.

So in summary:

- The East continues to buy gold. Both their central banks and also consumers with reports of long lines of people buying gold in china following the Chinese new year in February. See this youtube video: 800,000 Chinese Rush to Buy Gold in Malls at New Year, With Worsening Politico-Economic Environment.

- The West so far remains absent but perhaps in the very early stages of showing more interest.

- Mainstream media has had a few more articles on gold but by and large these continue to be very disparaging towards gold, despite a new all-time high.

To us this looks like the perfect setup for the next bull run. As the bull runs with the fewest number of people on board. This week’s charts show gold in particular may be dipping lower. So we’d say this will be a “buy the dip” opportunity as these new highs are likely just the very early stages of a large run higher.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost-effective.

Shop the Range…

—–

|