Prices and Charts

NZD Gold Bounce Back Continues

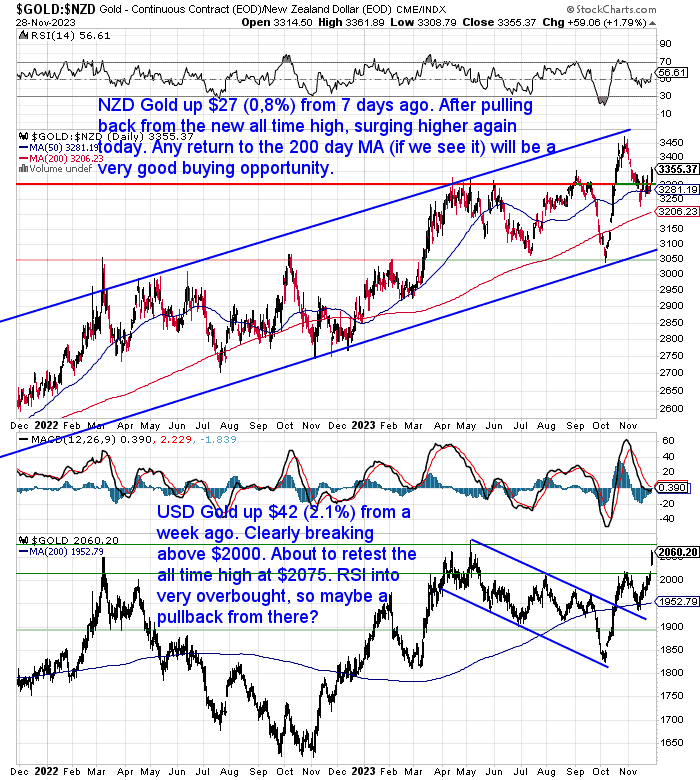

Gold in New Zealand dollars was up $27 from a week ago. The majority of this rise came from the sharp jump overnight. Any return to near the 200 day moving average should be viewed as a very good buying opportunity. But only if we see it.

Because in USD terms gold is really cranking higher. It was up $42 or over 2% this week. It has clearly broken above $2000 and the resistance level just above that and is now very close to retesting the all-time high at $2075. But with the RSI into overbought can it break it on the first attempt? Perhaps we’ll first see a pullback to the horizontal support line at $2007?

But we do get the feeling that new all time highs for USD gold are not that far away.

NZD Silver Surging Almost 4%

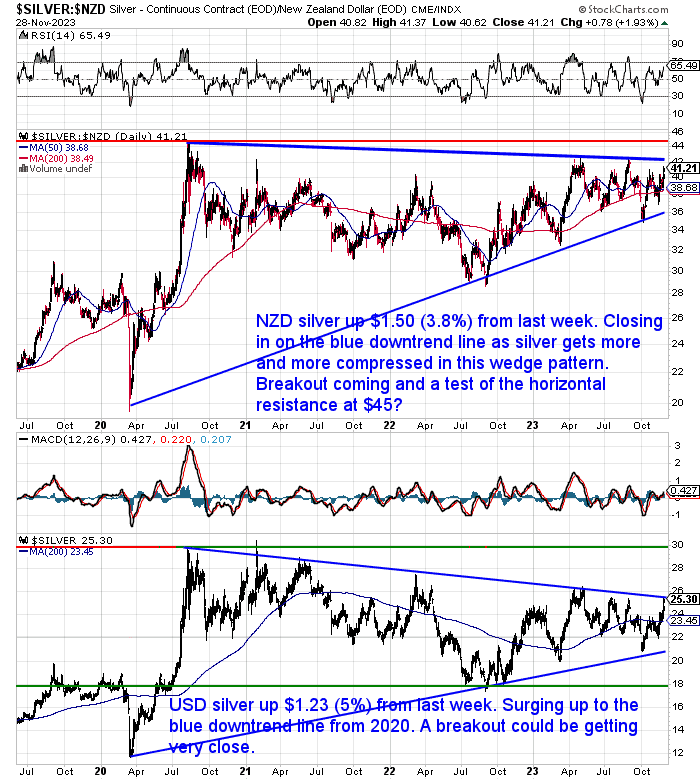

Silver priced in NZ dollars surged $1.50 higher this week. This rise of just under 4% has NZD silver just a hair’s breadth from the blue downtrend line in this wedge or pennant formation. With the RSI not quite into overbought above 70 yet, the odds favour NZD silver heading up to test the downtrend line. Could we then also see a break out of this wedge and a test of the overhead horizontal resistance line at $45?

In USD terms silver has already reached the downtrend line today with a 5% rise from last week. So a breakout could be close. Or with the RSI hitting overbought we could still see silver bounce up and down for a little longer yet.

But a breakout (whether this happens now or not) in both NZD and USD silver is inevitable. As silver continues to get more and more compressed, in an ever narrower trading range, it is only a matter of time.

NZ Dollar Rises to Downtrend Line

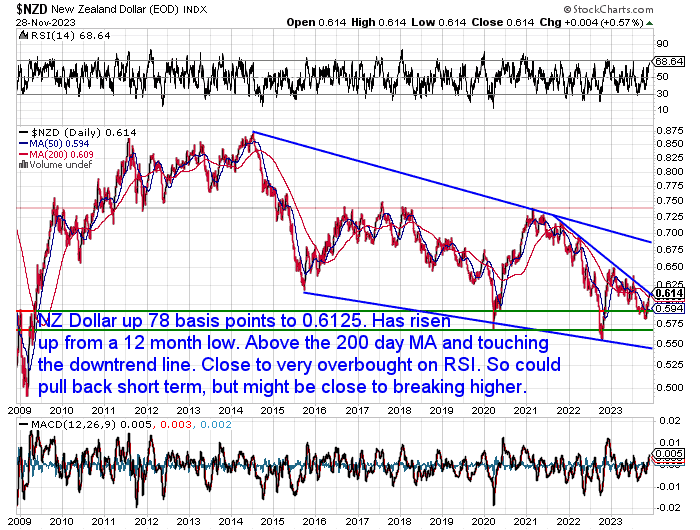

The New Zealand dollar was up 78 basis points this week, a rise of 1.3%. As seen above this did dent the local rises for gold and silver. However they have still risen.

Our guess is this uptrend could continue. But with the RSI close to very overbought we could see a short term pullback in the NZ dollar.

So precious metals prices might rise less in NZD terms than in USD. A reversal of the previous trend where gold hit all time highs in just about every currency except the US dollar.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Gold and Silver Technical Analysis in 2024: The Ultimate Beginners Guide

We get the feeling there are some major moves brewing in both gold and silver next year. In fact, maybe these will start during the remainder of this year. But there is still a chance to buy before these major moves take place. So this week we have our ultimate guide to technical analysis to help time your purchases.

Technical analysis is a method of using charts and indicators to predict the future price movements of an asset based on its past performance.

In this week’s feature article, you will learn the basics of gold and silver technical analysis, and how to use some of the most popular and easy to understand indicators. You will also find out where to get free charts with these indicators built in. Read on to discover how to use technical analysis to buy gold and silver at the best prices.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Alternative to Reading this Week’s Feature Article

The information in this week’s feature article might be quite a lot to digest.

So tomorrow (Thursday) we have our monthly Q&A call and we’ll be covering some of what is contained in the article.

You’ll be able to watch and listen as we show you how to use these simple indicators to improve your timing when purchasing gold and silver.

We’ll also answer your question on this topic or any other question you might have.

Can’t make it live? There will be a recording so sign up to get access to that.

When: Thursday 30 November 2023 01:00 PM NZDT

Where: On your laptop, phone or tablet

Get Free Access Here

USD Precious Metals Breakout Will Attract More Attention

In this week’s charts above we highlighted how gold and silver seem to be getting close to significant break outs, especially in USD terms. We always say to follow the prices of gold and silver in your local currency. However when these breakouts in USD terms take place, we know from experience thai will likely attract much more mainstream interest in gold and silver. So we could see prices jump quite quickly after a breakout.

Also there continues to be low retail demand right now for gold and silver. Likely a contrarian indicator of an impending breakout higher we’d say.

Peter Spina from GoldSeek today stated:

“I believe we see silver prices challenge $30/oz by as soon as year’s end if we see gold prices breakout — and all indications are the gold price is engaged in the stealth bull phase higher, but the stealth phase is fading as it becomes quickly apparent that there is a significant move ahead for Gold and Silver prices as the US Dollar falls further in value.

Silver is lagging, but it has everything going for it, fundamentally and soon technically speaking! A big move is brewing and with a strong structural supply deficit underpinning falling inventories, a rush into monetary safehavens will initiate bidding wars for remaining inventories on lower prices.

The big move in Silver appears to also have initiated its stealth bull move higher…”

Source.

Also here’s a chart from Peter that smooths out the noise in USD gold. It seems to show that after a couple of years of building a base, we are at the start of the next move higher:

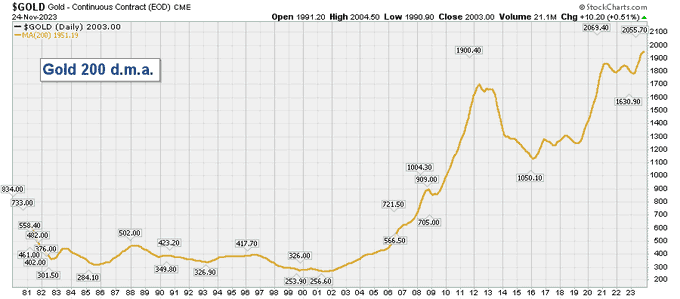

Gold 200 Daily Moving Average Chart / NOISE Reduction Update

(daily closing Highs Peaks .. and Lows shown)

Source.

Are Gold Mining Shares Indicating a Larger Rise in Gold?

We’ve been keeping an eye on the prices of precious metals mining companies lately. These have been performing terribly for much of this year. However recently they have started to show some life.

Today, the “world’s largest gold producer is the leading performer in the S&P 500 in Tuesday afternoon trading...”

Then here’s a chart of the Vaneck Gold Miners ETF GDX surging higher today:

“I’ve posted this $GDX chart multiple times over the past two weeks.

It’s difficult to overstate how bullish it appears.

Note the double bottom with an island reversal in March.

It has a reverse H&S with an island reversal now.

Target is $33, then $36. Higher toward $46 in 2024.”

Source.

Then we have a former chief investment strategist at hedge fund Bridgewater Associates, highlighting a number of reasons why ”Falling inflation might not dent gold’s rally”:

“Precious metal can gain even if the US economy heads to a soft landing

…Looking at the year ahead, however, there are at least three factors that could help gold keep its lustre, even if hopes of a soft landing are realised. Central banks suggest they intend to add more gold to their reserves, and China’s central bank in particular has room to do so. In addition, the ongoing property deleveraging in China, weighing down on the country’s economy and domestic assets, may keep Chinese households looking to gold as a preferred store of wealth. Finally, investors broadly may want to increase gold allocations as a hedge against an unusually busy political calendar that could exacerbate an already unsettled geopolitical backdrop.”

Source.

More Warnings Signs For Global Banking System

Last week we covered how US Banks are still sitting on $650 billion of unrealized losses. Plus how the Feds Bank Term Funding Program spiked by 3.9 billion to a new record high $112.9 billion.

Jeff Snider in this short 2 minute video snippet highlights a number of warning signs that Banks around the world are preparing for something.

Then we have this warning of financial contagion due to Chinese unsecured commercial property loans…

“Financial contagion warning as HSBC is told to brace for ‘catastrophic’ £6.3billion hit

HSBC is facing a “hit” of more than £6.3billion as a result of unsecured commercial property loans into China, a UK-based tax consultant has warned.

Bob Lyddon branded the situation a ‘disaster’ – and warned of a “financial contagion” risk which could have a knock-on effect on Britain’s economy.”

Source.

Do You Know Someone Under 35?

We read this interesting post about the Shenzhen’s Shuibei area, which has become China’s premier gold capital:

In Shuibei, all that glitters is gold

“…a sizable amount of these [gold] transactions are linked to the younger Chinese demographic, particularly those under the age of 35”

Source.

This got us thinking about our demographics where most of our customers are more likely over 40.

So do you know anyone under 35 that might need some protection from the likely troubles ahead? These are the children and grandchildren who likely are having trouble affording to purchase a home, but still might have some savings that are being ravaged by the recent inflation. So they could well benefit from the purchasing power protection of precious metals.

They might not have had any exposure to gold or silver thus far, but we find that when you experience it in your hand, regardless of your age, you’ll likely want to own some.

Please get in contact for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|