This Week:

- Silver Still Surging

- Speaking of Manipulation…

- NZ Dollar in an Uptrend. How Will This Impact Gold & Silver Prices in NZ?

- NZ Dollar Trading Indicates a Coming Fall in US Stock Market?

|

NIFTY HIDING PLACE FOR VALUABLES ***** DICTIONARY HOME DIVERSION BOOK SAFE JUST $39.00 with FREE Shipping This home diversion book safe looks just like a real dictionary. Hide valuables plus important documents like wills and passports |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1785.96 | – $13.75 | – 0.76% |

| USD Gold | $1244.10 | + $1.40 | + 0.11% |

| NZD Silver | $24.34 | + $0.80 | + 3.39% |

| USD Silver | $16.95 | + $0.70 | + 4.30% |

| NZD/USD | 0.6966 | +0.0061 | +0.88% |

Silver Still Surging

Last week’s newsletter was entitled: 5 Reasons to Buy Silver Right Now.

We now think we could have added a sixth reason: Silver will rise another 3.5% in the next week!

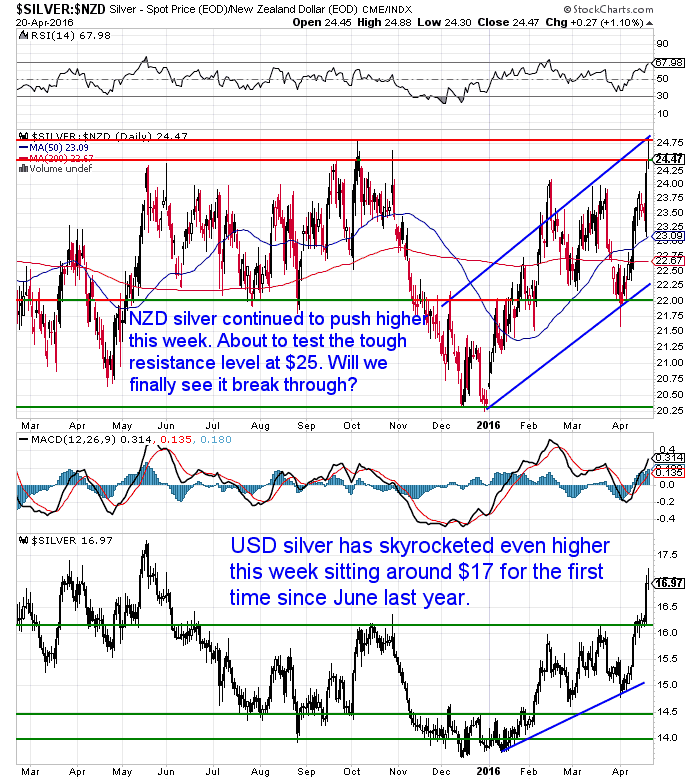

As you can see in the chart below silver has continued to surge higher this week. It is now approaching the key NZ$25 level which it hasn’t managed to get above since early 2014.

Now it is getting close to overbought on the Relative Strength Index. Plus it has risen so sharply in just a couple of days, it is due a breather.

However we just get the impression that maybe this time we could see the breakthrough of the key NZ$25 resistance level. Having bounced off it numerous times in the past 2 years.

We’ll be watching silver closely in the coming days and weeks to see.

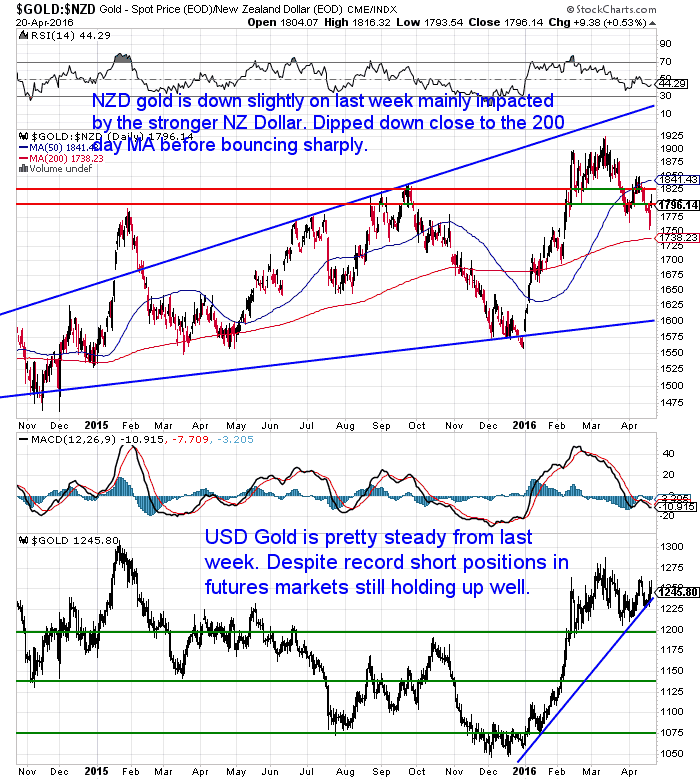

Meanwhile gold has been more lacklustre this week. It actually dipped down close to the 200 day moving average. But finished the week not too far down on where it started it.

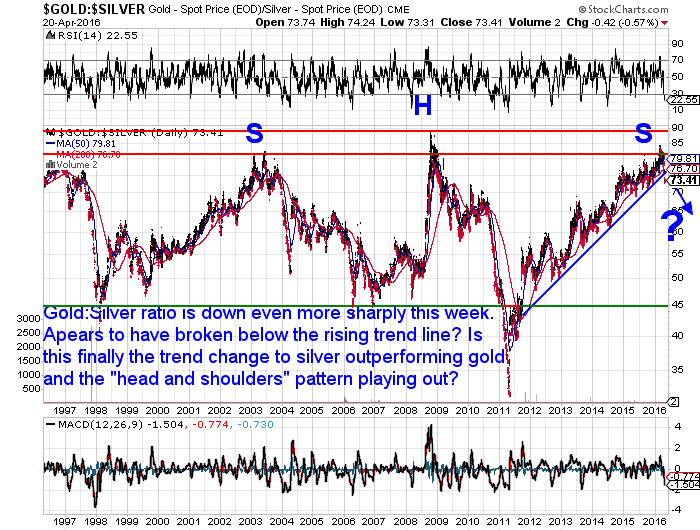

With silver jumping higher the Gold:Silver ratio is down even more sharply this week. It now even appears to have broken below the rising trend line.

Is this finally the trend change to silver outperforming gold?

Is the “head and shoulders” pattern now finally playing out?

If it is this would mean an eventual return to the 45 level, where the formation started.

Is this technical analysis all mumbo jumbo to you?

The head and shoulder pattern simply refers to what looks like a head and 2 shoulders. Where the “left arm” began at 45 and rose up to make the “left shoulder” (the first “S” on the chart). So if this pattern plays out it would imply a return for the gold silver ratio to the 45 level to make the “right arm” to match the “left arm”.

Clear as mud?

Of course in these days of manipulated everything technical analysis has limited value. But it still shows you where the price has been and plenty of traders follow it so has a bit of the “self fulfilling prophecy” about it nonetheless.

Speaking of Manipulation…

The big news this week has been the “confession” of Deutsche Bank that it conspired to manipulate the price of silver with other market making banks.

Mike Maloney does a good job of summarising this in the video below.

“Some big news broke late last week. After mountains of evidence over the last several years had piled up, Deutsche Bank finally admitted in a court of law that the price of silver has been rigged. The significance of this development cannot be overstated because it implies that the gold price has also been manipulated.”

Rightly he gives due credit to the guys at Gold Anti Trust Action Committee (GATA) for helping expose this. Chris Powell, the much maligned secretary of GATA, also had some great posts this week on the topic which are worth a look. Here’s a couple:

Armstrong thinks himself omniscient but knows nothing about anti-trust law

What does Deutsche Bank’s confession mean for gold and silver investors?

“…the focus of the Deutsche Bank class action seems to be narrow; it involves those who traded gold and silver on exchanges like the New York Commodities Exchange. It does not seem to cover trading and valuations that took place outside such exchanges, though of course other gold and silver transactions and the trading of the shares of gold and silver mining companies well may have been heavily influenced by the trading covered in the lawsuit.

For example, shareholders who were wiped out by the bankruptcy of Allied Nevada Gold Corp. a year ago have to be wondering whether the gold and silver market manipulation to which Deutsche Bank has admitted and in which the bank’s associates also may have been involved harmed their investment and entitles them to damages. Indeed, shareholders of anygold or silver mining company must wonder whether Deutsche Bank and the other banks should be liable to them for damages as well.

Those concerns seem to go beyond the scope of the current class-action lawsuit. But once the court in that lawsuit puts substantial evidence on the record or makes a formal finding, all sorts of gold and silver investors and mining companies may do well to engage their own legal counsel to explore their options.”

If you’re unfamiliar with GATA we’d suggest you read the transcript of a speech Chris Powell gave here in Auckland a couple of years back which summarises much of the evidence they have gathered that central banks manipulate the gold price.

If you’re unfamiliar with GATA we’d suggest you read the transcript of a speech Chris Powell gave here in Auckland a couple of years back which summarises much of the evidence they have gathered that central banks manipulate the gold price.

Chris Powell in Auckland: Gold price suppression – why, how, and how long?

20% DISCOUNT ON ALL EMERGENCY FOOD UNTIL 25 APRILAre you prepared for when the shelves are bare?

Beat the price rise.

Until ANZAC Day we have 20% off all emergency food supply packs.

Learn More.

—–

Gold’s Relentless Rally Accelerates

The always entertaining Stewart Thompson this week posted one of his paid daily newsletters in the clear. So we’ve reposted it too.

It gives a few reasons as to why gold is continuing to rise, among them the manipulation lawsuits, China’s new gold fix, and the fact that a number of bank analysts now have become bullish on gold. One even has a gold price target of US$1500! It seems only yesterday they were forecasting $800 gold!

We’d guess this last one is most significant.

Why’s that?

Because the gold price, for now anyway, is still set by the trading in the US and London futures markets. This is where the big money and institutional investors reside. So if the bank analysts are getting bullish this will attract more of this money into gold.

Because the gold price, for now anyway, is still set by the trading in the US and London futures markets. This is where the big money and institutional investors reside. So if the bank analysts are getting bullish this will attract more of this money into gold.

Gold’s Relentless Rally Accelerates

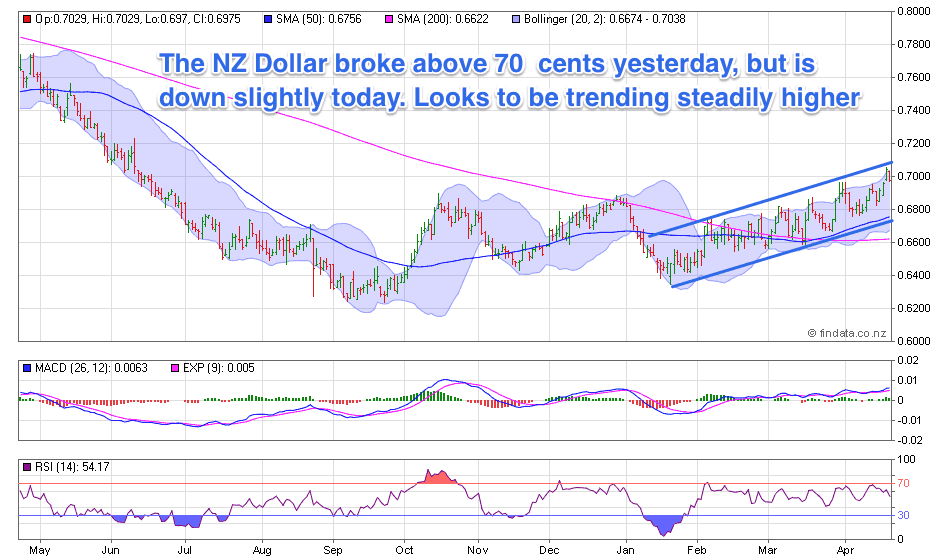

NZ Dollar in an Uptrend. How Will This Impact Gold & Silver Prices in NZ?

The NZ dollar has continued to hold back the price of gold in particular lately.

In the chart below you can see it indeed now looks to be in an uptrend having also broken above the 70 cent mark yesterday for the first time in 10 months.

So the question may then be, how will a strengthening New Zealand Dollar affect local gold and silver prices?

So the question may then be, how will a strengthening New Zealand Dollar affect local gold and silver prices?

We endeavour to answer that in this weeks feature article:

NZ Dollar Outlook + Impact on NZ Gold & Silver Prices

NZ Dollar Trading Indicates a Coming Fall in US Stock Market?

While the NZ Dollar has been strengthening versus the US Dollar, against the Japanese Yen it has been the opposite.

The National Inflation Association (NIA) has noted that this currency pair – New Zealand Dollar (NZD)/Japanese Yen (JPY) – is an accurate indicator of investor risk appetite. But also a good indicator of US share market action. They note that:

“Both New Zealand and Japan have very stable economies and currencies. Out of all countries with stable economies/currencies, New Zealand and Japan have the largest central bank benchmark interest rate differential – making it a popular carry trade.

When investors believe that the global economy will be strong and interest rates will rise, they borrow Japanese Yen at a low interest rate and buy New Zealand Dollars that pay a much higher interest rate – profiting the spread between interest rates plus any appreciation of the currency pair. This causes the NZD/JPY currency pair to rise, indicating that investor risk appetite is high. When the economy weakens and investors fear lower rates, they unwind their carry trade positions – causing the NZD/JPY currency pair to decline.

In mid-2007, the NZD/JPY currency pair peaked and began to collapse two months before the S&P 500. In 2009, the NZD/JPY currency pair bottomed and began to recover a full month ahead of the S&P 500. Over the past decade, the S&P 500 has had a stronger correlation with NZD/JPY than any other currency pair.

Most recently, the NZD/JPY currency pair peaked on December 29, 2014 – five months ahead of the S&P 500 peaking on May 21, 2015. Although the S&P 500 has bounced from its 2016 lows due to a massive short squeeze, there has been absolutely no follow through by NZD/JPY. In fact, the NZD/JPY currency pair is getting ready to decline below a major support level, which could trigger a short-term collapse similar to late-2008 when the S&P 500 crashed.

Clearly, the S&P 500’s recent short squeeze/bounce has taken the stock market up to unsustainable levels – with its next major downward leg now imminent. If NZD/JPY falls below its recent short-term support level of 73.85, look for the S&P 500 to collapse to a new 2016 low within the following 3-4 months. Click here to check out exclusive must see NIA charts of NZD/JPY vs. the S&P 500!”

This was indeed the case as:

“On Thursday, NIA’s ultimate risk on/off indicator, the NZD/JPY currency pair – collapsed to below its key 7 1/2 year support level! This means that risk is now officially off and the stock market will soon crash to new 2016 lows, as gold breaks out big to new 2016 highs of above $1,300 per oz! Click here to see for yourself!

On Thursday, the NZD/JPY currency pair declined by -2% to a new three-year low of 73! It is now down -6.25% from one week ago, its largest one week decline in over four years. In August 2015, when NZD/JPY declined by -6.1% in a single week – the S&P 500 collapsed by 11.1% to a new 52-week low of 1,868. In January 2016, when NZD/JPY declined by -6.15% in a single week – the S&P 500 collapsed by 10.5% to a new 52-week low of 1,859. Click here to see for yourself!

Already, the S&P 500 is showing major renewed weakness – after it fell on Thursday by -1.2%, its largest single day decline since February. As investors once again rush to dump stocks, gold will benefit the most. Gold prices soared on Thursday by $13.70 to settle at $1,236.20 per oz!

The NZD/JPY currency pair last declined below its current level of 73 back on September 5th, 2008. Over the following six months, the S&P 500 lost 45.5% of its value – crashing from 1,242.31 down to 676.53. Ultimately, the NZD/JPY currency pair bottomed at 45.16 – one full month ahead of the S&P 500.

Check out NIA’s brand new must see charts of everything discussed in this alert by clicking here!”

Well be watching the US and global stock markets closely the next few weeks/months to see if this “risk off” indicator plays out.

Smart Money Negative on Gold and Silver – Does it Matter?

Richard Smith of Trade Stops points out that the “smart money” in gold and silver are continuing to add to their short positions in gold and silver. So he expects a decent correction to occur before too long.

“Commercial interests in the gold markets are selling into this rally like nobody’s business. Every time these market participants have reached a negative sentiment extreme (when the black CCoT line crosses the bottom red line) in the past 4 years, prices have declined significantly.

We’re seeing the exact same pattern in the silver futures markets as well.”

It makes sense. A correction appears to be overdue. However…

He looks at what has happened with gold futures over the past 4 years. This has obviously been a bear market in gold and silver.

But it seems to us that the tables have turned and we are back into a bull market. This looks to have been driven of late by big money, institutional investment. Evidenced by the rise in holdings in the gold ETF GLD.

So perhaps the same rules may not apply and it might be this new money that decides the trend, rather than the commercial traders this time?

A correction looks overdue and would be expected. But maybe that is just it. It is expected by many people. We may instead see the opposite occur with an ongoing consolidation instead.

What to do?

Perhaps the smart thing to do, if you are looking to buy currently, is to take an initial position. This way you have a foot in the door at least.

Then you could look to try and average down in a few more purchases if we do see a correction.

On the flipside if we don’t see much of a correction, at least you already have a tranche locked in. Otherwise you risk sitting on the sidelines as the price continues to rise. Then jumping in at higher prices. What happens then? Yep, you guessed it the price falls!

So if you’d like a quote even just to get a feel for how the purchasing process works then simply reply to this email or give David a call on 0800 888 465.

Free delivery anywhere in New Zealand

Todays price for a box of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured is $14,575. Delivery is now about 7-10 business days.

[New] Credit Card Knife (2 pack)

Check out this cool new survival gadget.

This amazing little knife in just seconds transforms from an unassuming card in your wallet into a fully functional knife.

The Insta-Knife folds down to the same size as a credit card. And at just 2 mm thin it is 1/10th the thickness of your standard utility knife!

FREE Shipping – Shop Now

This Weeks Articles: |

|

|

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices Spot Gold |

|

| NZ $ 1785.96 / oz | US $ 1244.10 / oz |

| Spot Silver | |

| NZ $ 24.34 / oz NZ $ 782.53 / kg |

US $ 16.95 / oz US $ 545.11 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Gold Survival Guide

PO Box 74437

Greenlane Auckland 1546

New Zealand

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |