|

Gold Survival Gold Article Updates:

Jun. 5, 2014

This Week

- Buying a Home Safe for Gold & Silver Storage

- Mining and Environment—Facts vs. Fear

- Special Deal on 30 oz’s NZ Gold

We finally have our long promised article on Buying a Home Safe for Gold & Silver Storage this week. So if you’ve been considering that option we hope it is of some help. As always that and other articles are posted later in this email for you to peruse.

Now – How have the metals performed this week?

Well, it depends on which currency you look at them in.

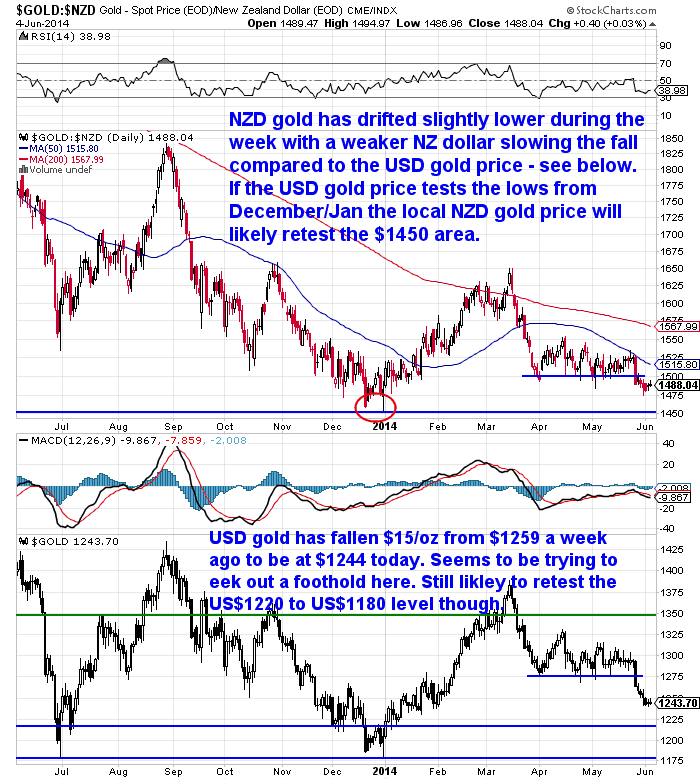

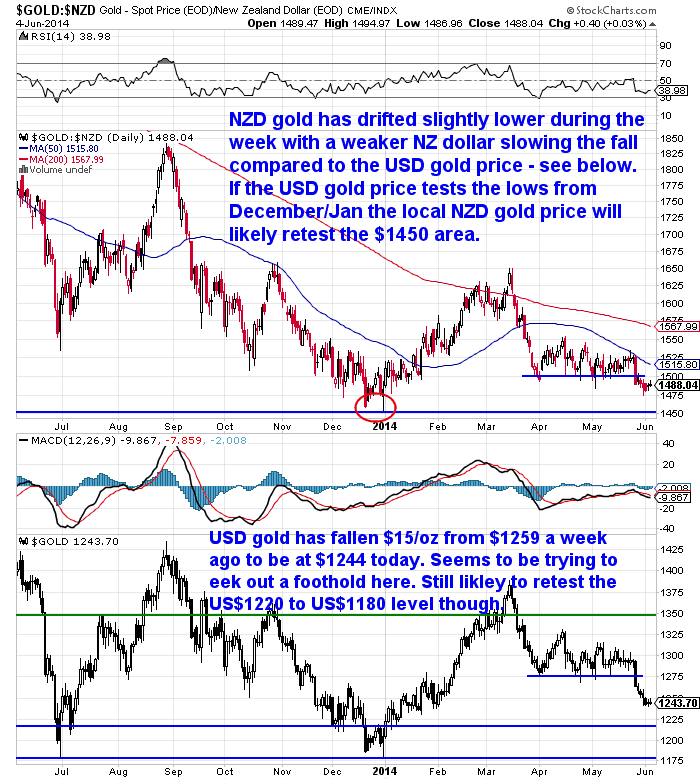

In NZ dollar terms with the NZ dollar continuing to weaken over the past week, gold and silver have not fallen too much further.

Gold in NZ dollars is currently $1479.31 per ounce. Down $5.18 or 0.35% since a week ago.

However in USD terms the fall has been more marked. Down $14.90 or 1.18% in a week to $1244.10. You can see this clearly in the chart below with NZD gold price in the top half and USD gold price below.

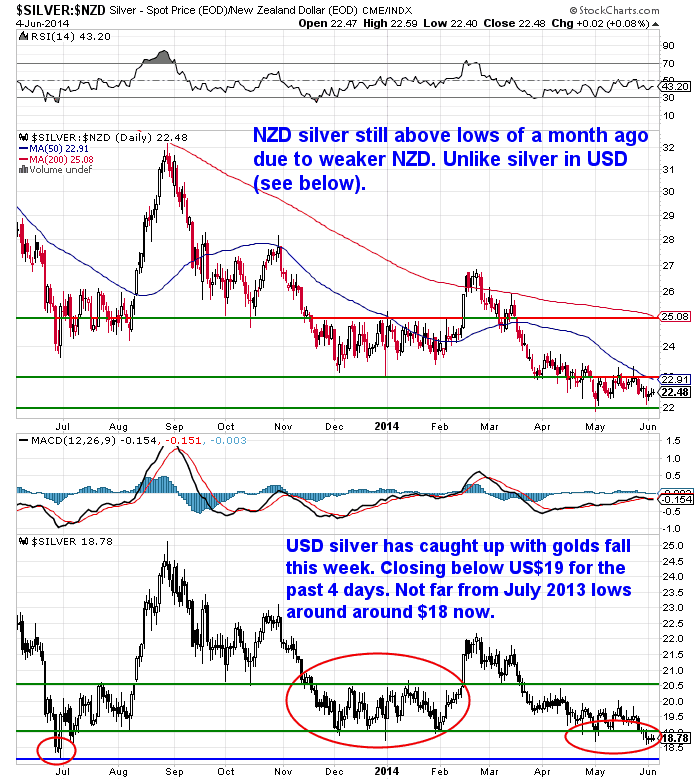

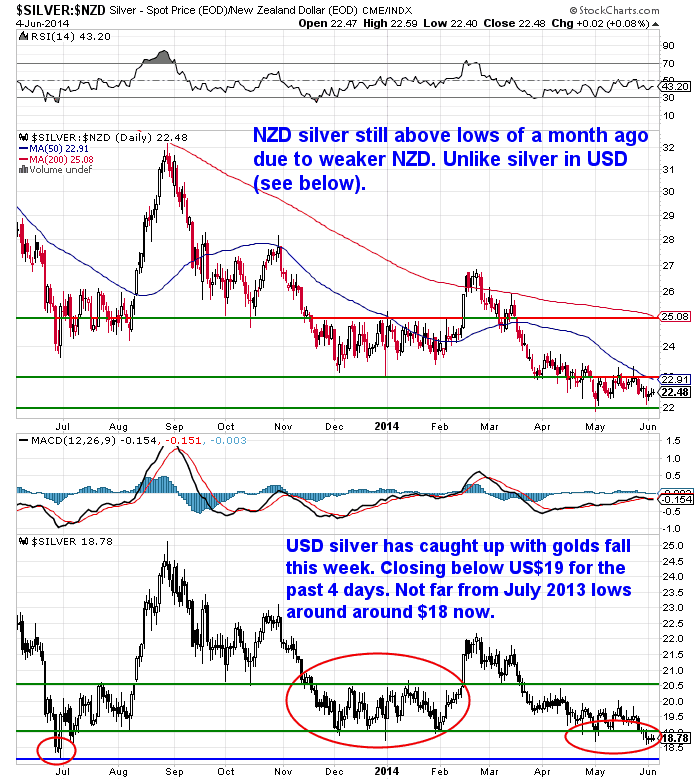

It has been much the same with silver. In NZ dollar terms silver has fallen 7 cents or 0.31% from last week down to $22.40. While in US dollars it has dropped 12 cents or 1.15% to US$18.84.

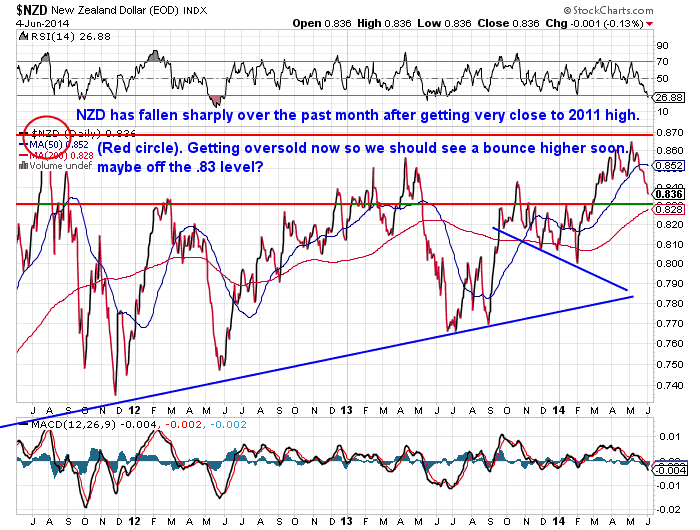

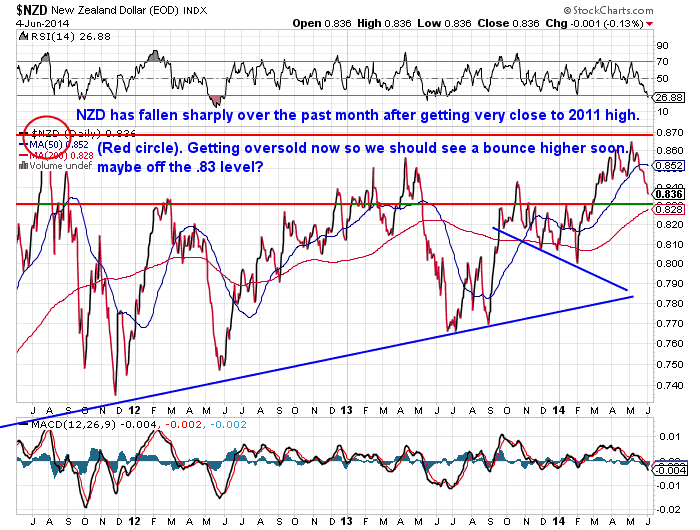

So both metals have only fallen just over a quarter as far in NZ dollars compared to in US dollar terms, due to the weakening kiwi dollar. This is clearly shown in the below chart. You can see the NZ dollar has fallen quite sharply over the past month after getting close to the highs from 2011.

Possibly the impact of weaker Whole Milk Powder (WMP) prices at recent Fonterra auctions having been priced in a bit more now?

However the kiwi dollar looks to be getting a bit oversold now so a bounce would not be a surprise from here. Although maybe just a short term one?

Where to from here?

You’d think it likely that US dollar gold should come close to retesting the lows around $1180 to $1200 – now only about $50 per ounce away.

However gold does seem to be trying to eek out a foothold at current levels. Also we haven’t seen a plummeting price like the falls of last year.

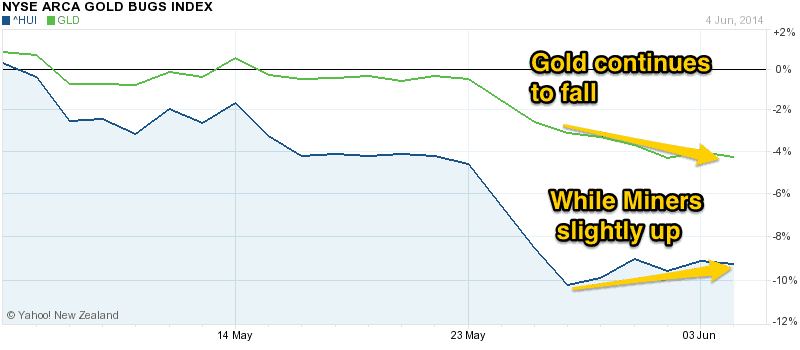

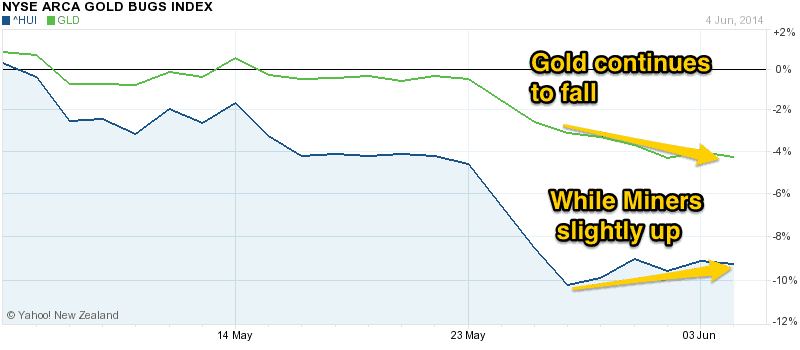

And on top of this mining shares have been edging up over the past week while gold itself has continued to fall. As we’ve mentioned before the price action in mining shares is often forward looking. You can see this divergence clearly in the chart below.

So never say never, but we think the odds favour the previous lows in gold holding (around US$1180), if we get that low that is. But we did point out in this article way back in September 2011 that there is a precedent for gold falling 50% in the mid 1970’s: Just how low could gold fall?

Time has really gotten away on us this week sorry so that will have to do for today if we are going to get this out before nightfall!

New Website

We’re busying finishing up our new website which is hopefully not too many days away now. It will be “responsive” so will adjust to the size of the screen you are viewing it on. So this should make for a much better experience reading our articles on your tablet or smartphone. Also the menus should be a lot easier to find your way around than the current one.

Long Life Emergency Foods

We mentioned we’ll have a supply of long life emergency foods coming soon a few weeks ago. The website for this is still quite a few weeks away yet but thought we’d mention it again anyway as there seems to be some interest in this.

We’ve found those getting prepared for a natural disaster are also those who want to be prepared for a financial or monetary shock. So we’ll have more to come on this topic in the future too. Keep your eyes peeled.

As we mentioned already check out this weeks feature article on buying a safe if you’ve ever considered that. And the other one on Mining and the Environment is a really interesting piece that fits in well with this previous article we wrote 2 years ago: Oceania Gold Mine Expansion: Why the Greens Should be Embracing Gold

And if you’d like to have something to fill a safe with, we can think of nothing better than some shiny yellow and/or grey metals! You know where to find us if you’d like a quote. On that topic we have a limited time deal on gold for the next few days from a local NZ supplier:

Special Gold Deal

For 30 oz NZ gold 99.99% or more. Available in 1oz, 5oz or 10oz bullion bars. For 30 oz NZ gold 99.99% or more. Available in 1oz, 5oz or 10oz bullion bars.

Spot plus 2.25% picked up in Auckland or delivered and insured throughout New Zealand for an additional .3% (2.55% above spot).

Special expires Tuesday 10th June at 4pm.

This Weeks Articles:

| Price Drop! Where to now for both metals? |

2014-05-29 01:25:30-04Gold Survival Gold Article Updates: May. 29, 2014 This week: – Where to now for both metals? – Shanghai Gold Exchange Considers International Exchange – Barclays fined $44 Million for Suppressing Gold Prices – NZIER chief economist agrees: Rents not rising in line with house prices in Auckland – GST On Platinum? […] 2014-05-29 01:25:30-04Gold Survival Gold Article Updates: May. 29, 2014 This week: – Where to now for both metals? – Shanghai Gold Exchange Considers International Exchange – Barclays fined $44 Million for Suppressing Gold Prices – NZIER chief economist agrees: Rents not rising in line with house prices in Auckland – GST On Platinum? […]

|

2014-06-03 22:49:46-04There are many gold and silver storage options available. From private vaulting and storage companies to “midnight gardening”. We go through the main ones in module 7 of our free Gold Ecourse: Module 7 of 8 – How and where to store it. A home safe is one storage option for precious metals and one that definitely fulfils the preference for keeping gold and silver “in your physical possession” […]read more… 2014-06-03 22:49:46-04There are many gold and silver storage options available. From private vaulting and storage companies to “midnight gardening”. We go through the main ones in module 7 of our free Gold Ecourse: Module 7 of 8 – How and where to store it. A home safe is one storage option for precious metals and one that definitely fulfils the preference for keeping gold and silver “in your physical possession” […]read more…

Mining and Environment—Facts vs. Fear

|

2014-06-04 17:48:24-04A couple of years ago we gave or thoughts on why the “Greens” should be embracing gold here in New Zealand. While we touched on mining it was more about gold in general. This very informative article is of a similar vein although deals with the facts and details about mining itself. It busts a few myths about how destructive mining supposedly is, even going as far as arguing why you can be an environmentalist and pro-mining at the same time. 2014-06-04 17:48:24-04A couple of years ago we gave or thoughts on why the “Greens” should be embracing gold here in New Zealand. While we touched on mining it was more about gold in general. This very informative article is of a similar vein although deals with the facts and details about mining itself. It busts a few myths about how destructive mining supposedly is, even going as far as arguing why you can be an environmentalist and pro-mining at the same time. |

|

For 30 oz NZ gold 99.99% or more. Available in 1oz, 5oz or 10oz bullion bars.

For 30 oz NZ gold 99.99% or more. Available in 1oz, 5oz or 10oz bullion bars. 2014-05-29 01:25:30-04Gold Survival Gold Article Updates: May. 29, 2014 This week: – Where to now for both metals? – Shanghai Gold Exchange Considers International Exchange – Barclays fined $44 Million for Suppressing Gold Prices – NZIER chief economist agrees: Rents not rising in line with house prices in Auckland – GST On Platinum? […]

2014-05-29 01:25:30-04Gold Survival Gold Article Updates: May. 29, 2014 This week: – Where to now for both metals? – Shanghai Gold Exchange Considers International Exchange – Barclays fined $44 Million for Suppressing Gold Prices – NZIER chief economist agrees: Rents not rising in line with house prices in Auckland – GST On Platinum? […]

2014-06-03 22:49:46-04There are many gold and silver storage options available. From private vaulting and storage companies to “midnight gardening”. We go through the main ones in module 7 of our free Gold Ecourse: Module 7 of 8 – How and where to store it. A home safe is one storage option for precious metals and one that definitely fulfils the preference for keeping gold and silver “in your physical possession” […]

2014-06-03 22:49:46-04There are many gold and silver storage options available. From private vaulting and storage companies to “midnight gardening”. We go through the main ones in module 7 of our free Gold Ecourse: Module 7 of 8 – How and where to store it. A home safe is one storage option for precious metals and one that definitely fulfils the preference for keeping gold and silver “in your physical possession” […] 2014-06-04 17:48:24-04A couple of years ago we gave or thoughts on why the “Greens” should be embracing gold here in New Zealand. While we touched on mining it was more about gold in general. This very informative article is of a similar vein although deals with the facts and details about mining itself. It busts a few myths about how destructive mining supposedly is, even going as far as arguing why you can be an environmentalist and pro-mining at the same time.

2014-06-04 17:48:24-04A couple of years ago we gave or thoughts on why the “Greens” should be embracing gold here in New Zealand. While we touched on mining it was more about gold in general. This very informative article is of a similar vein although deals with the facts and details about mining itself. It busts a few myths about how destructive mining supposedly is, even going as far as arguing why you can be an environmentalist and pro-mining at the same time.