Prices and Charts

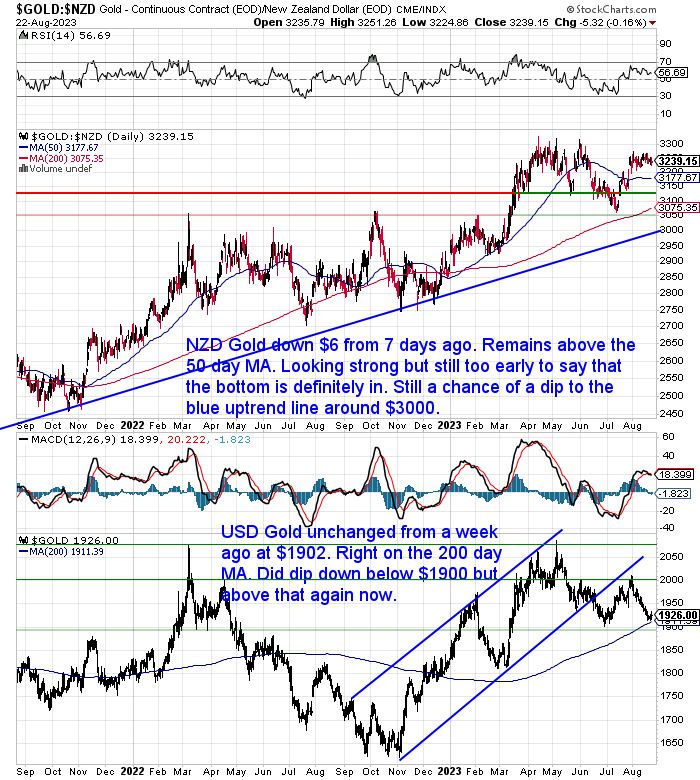

Not Much Change in NZD Gold

Gold in New Zealand dollars has not moved much in the past 7 days. Down just $6 to $3195. It remains above the 50 day moving average. So NZD gold continues to look strong. Still too early to say that the bottom is definitely in. We’ll need to see a clear break above $3300 before we can say that. So there still remains a chance of a dip down to the 200 day MA which is now clearly above the July low at $3050. Or even down to the bleu uptrend line around $3000.

While gold in USD was basically unchanged from a week ago. During the week it did dip down below $1900 but is just above that again now. So we could still see a further drop down to maybe $1875 or even $1850. But the odds favour the bottom being close to hand.

Silver Bounces Back

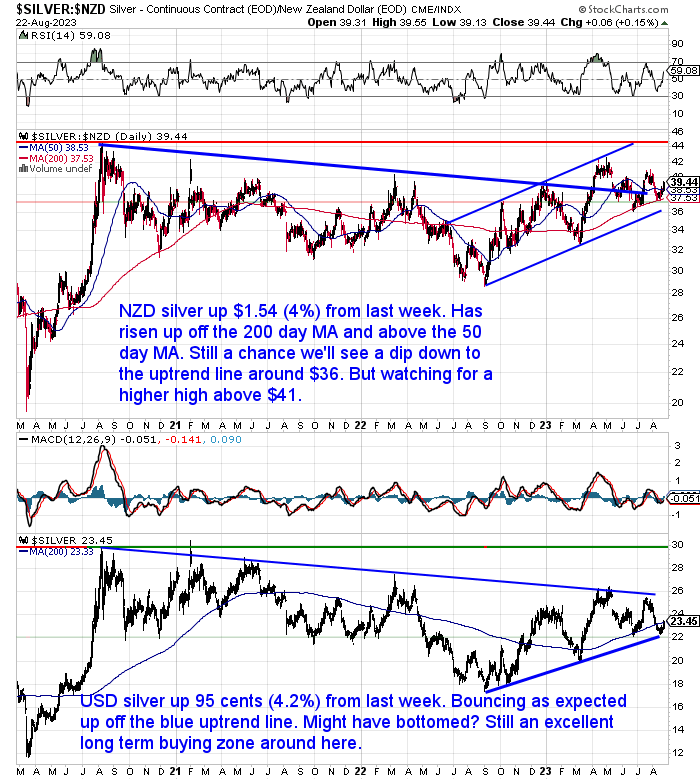

After the recent sharp fall NZD silver has bounced back this week, up $1.54 or 4%. It has risen strongly off the 200 day MA and is now back above the 50 day MA. There remains a chance of a dip down to the blue uptrend line. But right now we are watching for a higher high above $41. Silver is in a clear uptrend channel from September last year. So any dip down close to that trendline is a buying opportunity.

USD silver is looking similar. Although it did actually get down to the uptrend line. It remains in a very good buying zone just on the 200 day MA.

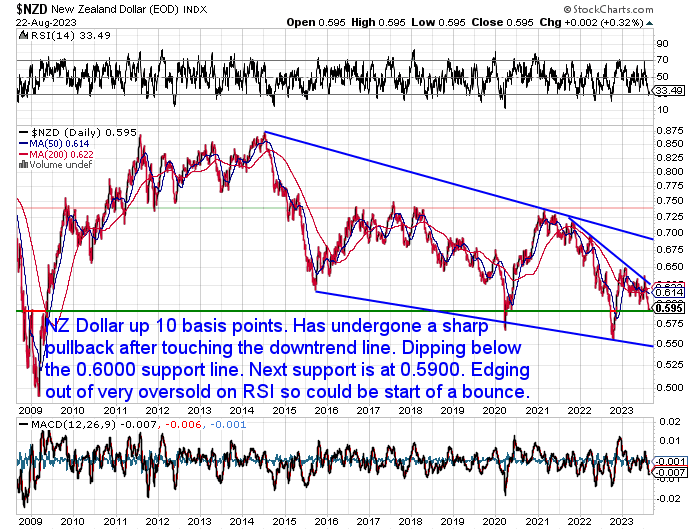

NZ Dollar May Be Bouncing Back

The New Zealand dollar was up 22 basis points. It has undergone a sharp pullback after touching the overhead downtrend line. Having dipped below 0.6000, the next support line is at 0.5900. So far that has held and the RSI is edging out of very oversold so this could be the start of a bounce higher.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

A New Gold Standard or a Free Market For Money: What Comes Next?

In this week’s featured article, we delve into a fascinating topic that might reshape the way we think about money: the evolution beyond the traditional gold standard. Have you ever wondered what a new gold standard might look like, or if we could envision a free market for money?

Our featured article explores the history of gold standards, considers calls for a new gold standard in recent years, and even contemplates alternatives to government-defined monetary systems. We analyse the potential benefits of a classical gold standard and unveil the concept of an “Unadulterated Gold Standard.” You’ll also discover how technology and cryptocurrencies might play pivotal roles in reshaping our monetary landscape.

Join us in “pondering the possibilities” and the path forward for the monetary system…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Inflation: Just Wave 1 of 3?

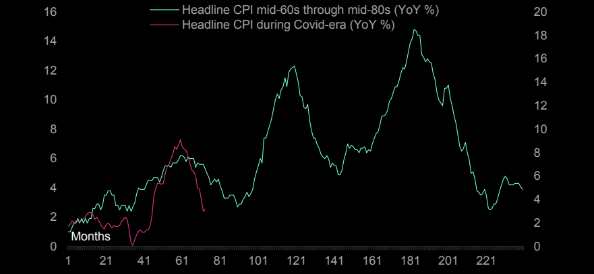

This is a slightly different version of the chart we shared last week.

That chart compared US CPI from 1966 to 1982 with 2013 to 2023. Whereas, the chart below transposes the covid era inflation of the past 5 or 6 years onto the inflation waves that took place from the mid 60s to mid 80s. So if history rhymes, this chart shows we may only be completing the first (and smallest) of 3 waves of inflation.

She moves in mysterious WAVES

Historical patterns indicate that when inflation arrives, it on occasion does so in waves. In particular, this was the case during the most recent extended period of elevated inflation in the US, in the 1970’s. In this instance, headline CPI hit a peak of 6.2% in December 1969, then dipped below 3% by mid-1972, only to surge above 12% to 12.3% in December 1974. Two years later, headline CPI had slowed to below 5% but again a renewed spike followed, with an even higher peak of 14.8% reached in March 1980.

From: Credit Agricole

Source.

Saudi Arabia and UAE to Join BRICS?

Another brick in the wall that is the steady demise of the US dollar…

The BRICS meeting in South Africa kicks off today. There’s still plenty of speculation about what will be discussed, let alone what will be announced.

In Gold We Trust reports:

“BRICS Expansion:

South African Minister of International Relations and Cooperation Naledi Pandor reported on Monday that leaders of 23 countries from around the world officially expressed their desire to join BRICS.

“We have received official expressions of interest from the leaders of 23 countries to join BRICS, and further informal consultations on membership possibilities”

Source.

This is more evidence of the end of the dominance of the petrodollar, as Saudi Arabia and UAE are among the 23 countries. Jim Rickards who was one of the first to discuss this meeting has an update on it here.

So we wait to see if anything significant is announced at the end of this week.

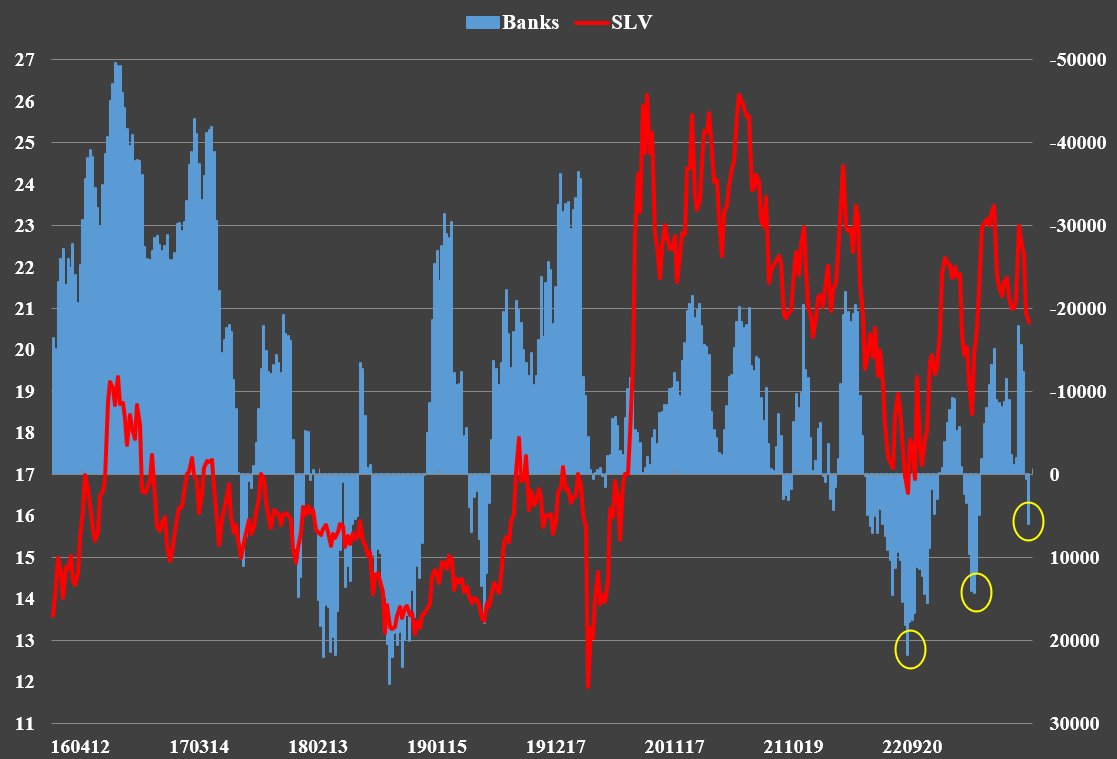

Positive Sign: Silver Short Positions Dropping

A recent tweet from Peter Spina at Goldseek noted:

“Specs getting shaken out, banks covering shorts… heavily so in silver.

Silver looking really good at first glance!”

Source.

Meanwhile David Brady pointed out:

#SILVER

Banks add to their net long position ‘again’.

Funds add to their net short position ‘again’.

The data is telling you we’re close to the bottom.”

Source.

At the same time Ted Butler in his weekly precious metals report noted the following:

“The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, 08 August, was everything that both Ted and I were hoping it would be…plus more.

In silver, the Commercial net short position dropped by 13,663 COMEX contracts, or 68.315 million troy ounces of the stuff.

…The Big 8 shorts in total decreased their net short position from 62,700 contracts, down to 54,226 COMEX contracts week-over-week…a drop of 8,474 contracts. But you have to subtract out the short position of that Managed Money trader…now down to 5,000 contracts…so the Big 8 commercial short position, in reality, is likely a bit under the 50,000 contract mark…which is the lowest its been like forever.

…On top of that, the commercial traders of whatever stripe have set three tiny and consecutive new intraday lows in silver since the Tuesday cut-off, so we’re back to being wildly bullish in silver from a COMEX futures market perspective.”

Source.

In simple terms the “commercials” are the likes of the bullion banks and miners and those in the industry actively hedging their physical positions. History shows they are right at the extremes more than not.

While the “funds” are those more just betting on the price of silver, hedge funds etc. They are generally wrong at the extremes.

So the commercials are expecting silver to rise (they are reducing their short positions). The funds are expecting silver to fall (increasing their shorts.

This data is always in the past but it looks to have been proven correct again as silver staged a decent bounce following this.

In short, it’s more evidence that anywhere around these levels should make for a good buying opportunity in silver.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: St Louis Fed: US Govt Deficits Likely to Lead to Currency Printing - Gold Survival Guide