Prices and Charts

NZD Gold Getting Back Close to All Time Highs

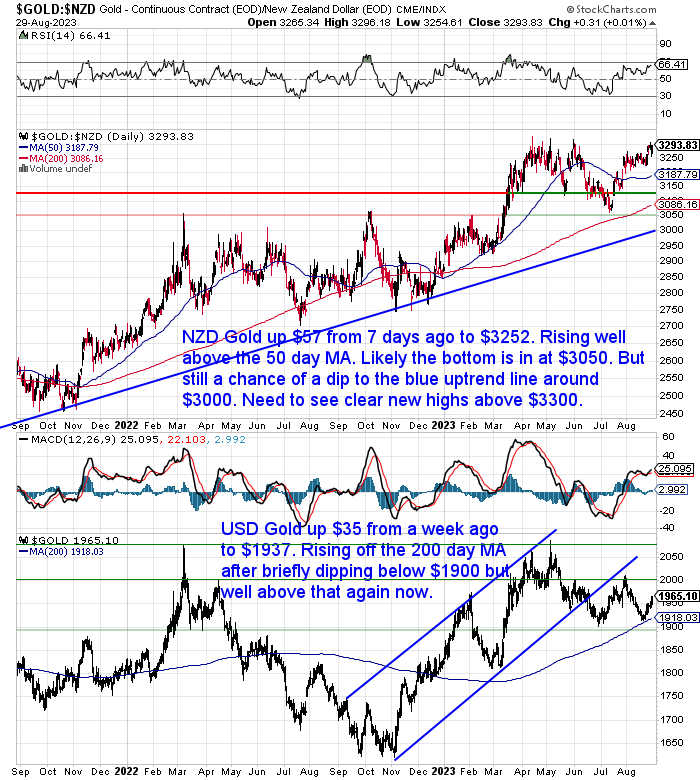

Gold in New Zealand dollars has jumped $35 from 7 days ago. It dipped down close to $3050 (just above the rising 200 day MA at $3039). But from there it bounced back to and is now just under the 50 day MA. Looking good but too early to say that the bottom is definitely in. We won’t really know that for certain until it breaks above $3300. For now we still could see a dip to the blue uptrend line around $2950.

While gold in USD was up nearly 2%. Rising back up towards $2000 after dropping down to touch $1900. Until we see new highs above US$2064, there is still a chance of a dip to the 200 day MA ($1875).

Silver Surging Even Higher

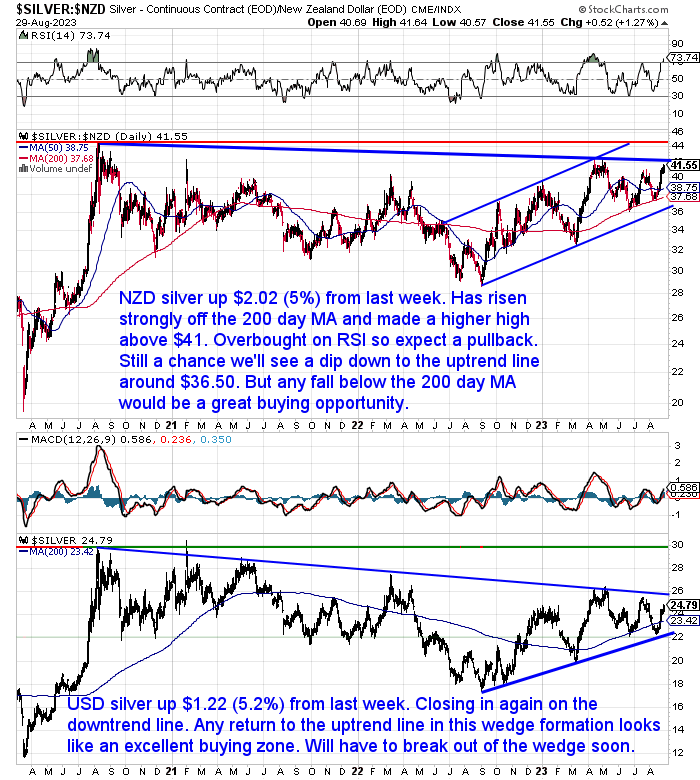

Silver in NZ dollars shot higher again this week. Up over 5% and making a new higher high in the move higher since mid year. Now we need to see it get back above the April highs. But silver is overbought on the RSI indicator (above 70) so we should expect a pullback from here. There’s still a chance we’ll see a dip down to the blue uptrend line – currently around $36.50. But NZD silver is trading in a steadily narrowing range. So we’ll have to see it break out of that pretty soon. In the interim any fall back below the 200 day MA is likely to be a very good buying opportunity. And one that may not last long.

It’s a similar setup in USD silver. It’s also up strongly again this week. But USD silver is even more clearly in a wedge formation shown by the blue lines. So it is running out of space between them and will have to break out soon. Up is looking more likely given the lack of interest in silver currently.

NZD Unchanged

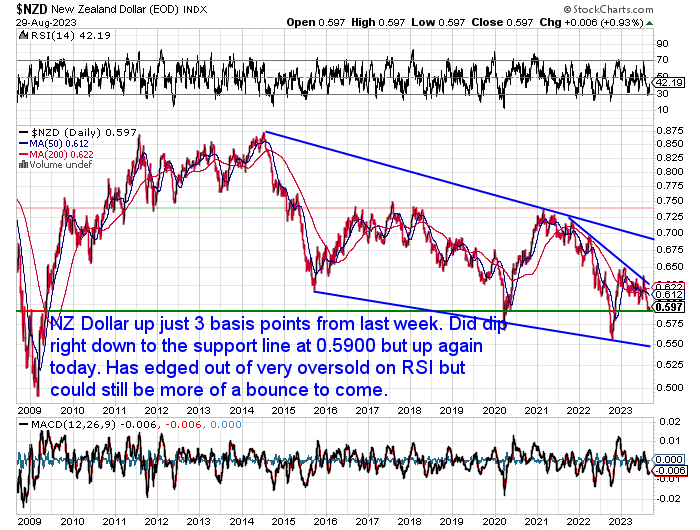

The New Zealand dollar is pretty well unchanged from a week ago. Up just 3 basis points. During the weekend the Kiwi did dip down to the horizontal support line at 0.59, even getting slightly below it. But it is up again today edging out of oversold on the RSI. But we could still see more of a bounce back to come yet. Downtrend remains in play.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

The “Time Price” – Why Gold is Money and Will Continue to Be

Last week we discussed the history of the gold standard, along with the issues a gold standard set by governments has.

But the reason gold has been used as money is more than just because it is a shiny metal. It is a measure of time and human productivity. In this week’s feature article, you will discover how the time-price of gold reveals its true value as money and why it will continue to be the ultimate store of wealth in the future. You will also learn how to use gold as a hedge against inflation, currency devaluation, and economic crises. Read on to find out why gold is money and will continue to be…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Reality Check Radio Interview – Up Your Brave Show

Gold Survival Guide Co-Founder Glenn Thomas was a guest last week on the Up Your Brave show on Reality Check Radio. Discussing Gold, Silver and being prepared.

You can listen to the replay here.

Inflation – Why it Pays to Own a Business

Inflation is a very good reason to be a business owner. Why? Because you can somewhat shield yourself from inflation as you can raise your prices much earlier compared to when a wage worker gets an increase in their wages.

Businesses have been returning record profits while inflation surges during the cost of living crisis, new research shows. The study was designed to emulate analysis done overseas by the European Central Bank and a number of other research institutes, and was carried out by FIRST Union, the Council of Trade Unions and the lobby group Action Station.

Read more

The report author concluded with “monetary policy needed fiscal friends to appropriately distribute the rising costs that come from inflation and the rising benefits to certain parties.

Measures could include windfall taxes, levies on bank profits and fiscal engagement to distribute the costs and benefits of inflation more equitably.”

But of course these studies are not looking at the root cause of inflation and that isn’t businesses is it. Businesses don’t create the extra currency units chasing the goods and services. That is done by the central bank. Seems like a useful scapegoat to us.

St Louis Fed: US Govt Deficits Likely to Lead to Currency Printing!

Speaking of currency printing, a surprising report from the St Louis Federal Reserve bank (care of Ronnie Stoeferle) highlights that when governments run large deficits this leads to currency printing:

“Historically, high inflation is produced by growth in the supply of money that reflects the pressures of fiscal dominance. Every major inflation in world history is a fiscal phenomenon before it is a monetary phenomenon.”

The translation of this banker speak is, when governments run large deficits (i.e. spend much more than they collect in taxes), this historically has led to central banks printing currency to fund the deficit which in turns leads to high inflation.

This of course is not a surprise to us. What is a surprise is that a bank in the US federal reserve system is highlighting it! It is also a surprise that they say such a situation befalling the USA looks very likely:

“This problem seems likely, given the way [the US] Congress has behaved in recent years. A significant rise in long-run real interest rates also seems quite possible, given that the three decades of decline in real interest rates are poorly understood and may reflect temporary demographic influences. Such an environment would hasten the triggering of a fiscal dominance problem, leading to a messy monetization in the US, with ramifications worldwide.”

Source.

Monetization of course just means funding the debt through currency printing.

so yes, it is very surprising to see them highlighting this as a very, very real risk to the US and the world.

BRICS Currency – the Announcement That Wasn’t

Not surprisingly, last week’s BRICS conference in South Africa ended without any official announcement of plans for a new BRICS currency.

We did see announcements from the Chinese and Brazilian leaders on the topic of monetary reform though.

Brazil’s President, Luiz Inacio Lula da Silva, called for:

“…the BRICS nations to create a common currency for trade and investment between each other, as a means of reducing their vulnerability to dollar exchange rate fluctuations.”

Source.

While..

“Chinese leader Xi Jinping says it is necessary for BRICS countries to promote a reform of the international monetary and financial system.

In other words,

Monetary reset.”

Source.

The main announcement from the BRICS meeting was the decision to invite six new countries to become members of the group: Saudi Arabia, Iran, Ethiopia, Egypt, Argentina and the United Arab Emirates. With the aim of growing the bloc’s clout.

“The new bloc will represent roughly 46 percent of the world population, account for 29 percent of the world’s gross domestic product in nominal terms and 37 percent of global GDP at purchasing power parity.”

Source.

While recent news out of Saudi Arabia shows that they are already pivoting towards China…

“Saudi Arabia’s Ministry of Education has instructed all public and private secondary schools in the Kingdom to implement the program of teaching Mandarin Chinese language at the rate of two classes per week.”

Source.

However it is not actually necessary for the BRICS to launch their own currency to transact with one another. A recently released statistic shows that one of these new additions to the BRICS, the United Arab Emirates (U.A.E.), has likely been transacting significantly with Russia in gold.

“The U.A.E. imported $4 billion worth of Russian gold between Feb. 24, 2022 and March 3 this year, up from $61 million during 2021, according to customs data”

Source.

In fact this is likely to be much more feasible than constructing a new currency and then trying to link it to gold. As each country involved will still have to trust the other one. Better instead to just move gold to settle the balance of payments.

So regardless of whether we see any gold backed or linked currency, or a return to some sort of gold standard, it’s likely gold is going to play a much larger role in international finance.

Make sure you are prepared to take advantage of this yourself with sufficient reserves.

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|