The always informative Darryl Schoon gives an excellent account of monetary history from the 1930’s great depression through until today. You’ll also learn about how gold performed during the deflationary depression…

THE PRICE OF GOLD AND THE ART OF WAR Part III

If you wait by the river long enough, the bodies of your enemies will float by –Sun Tzu, The Art of War, fifth century BC

By Darryl Robert Schoon

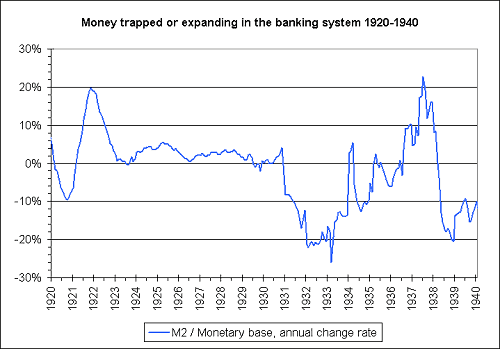

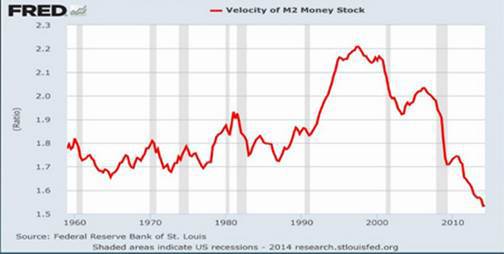

When growth slows in capital markets, the bankers’ daisy-chain of credit and debt breaks down; setting in motion defaulting debt which ends in recession, deflation or, in extreme cases, a deflationary depression.

A deflationary depression is a fatal monetary phenomena where the velocity of money—circulating credit and debt—falls so low capital markets are no longer self-sustaining. This happens after the collapse of massive speculative bubbles such as the collapse of the 1929 US stock market bubble which resulted in the world’s first deflationary depression, the Great Depression of the 1930s.

Throughout history, gold and silver have offered safety in times of economic chaos. Today is no different. What is different is the response of governments and bankers to the collapse of the current economic paradigm—the bankers’ war on gold.

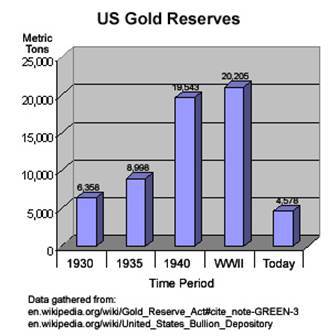

In the midst of the Great Depression, the US passed the 1934 Gold Reserve Act which prohibited the ownership of gold by US citizens, forcing Americans to keep their wealth invested instead in capitalism’s paper assets.

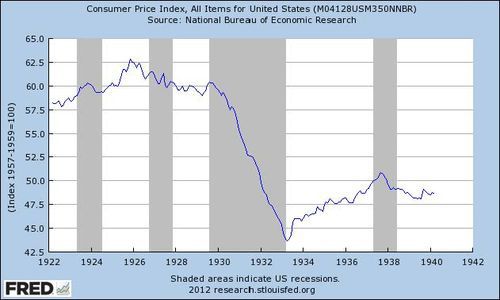

The Gold Reserve Act outlawed most private possession of gold, forcing individuals to sell it to the Treasury, after which it was stored in United States Bullion Depository at Fort Knox and other locations. The act also changed the nominal price of gold from $20.67 per troy ounce to $35. This price change incentivized foreign investors to export their gold to the United States, while simultaneously devaluing the U.S. dollar in an attempt to spark inflation.

http://en.wikipedia.org/wiki/Gold_Reserve_Act#U.S._economic_historical_narrative

The attempt to ‘spark inflation’ in order to overcome a deflationary depression is the 1930s version of today’s similarly futile ‘inflation-targeting’. The resultant rise in the consumer price index from 1934-1937 was only nominal and, by 1938, powerful deflationary pressures had again re-exerted themselves and the US and the world would remain mired in a moribund deflationary depression for the remainder of the decade.

Although the devaluation of the US dollar against gold by the Gold Reserve Act didn’t ‘spark’ the inflation bankers hoped would end the 1930s depression, it would cause large amounts of gold to flow into the US Treasury after 1934 as foreign sellers took advantage of the US Treasury’s offer of a 70% higher price for gold.

In 1944, this unprecedented flow of gold to the US allowed the US to make the dollar fully convertible to gold, officially making the US dollar the world’s reserve currency at Bretton-Woods. However, due to excessive military spending, the US would overspend its entire hoard of gold by 1970, forcing the US to suspend the gold backing of the US dollar in 1971.

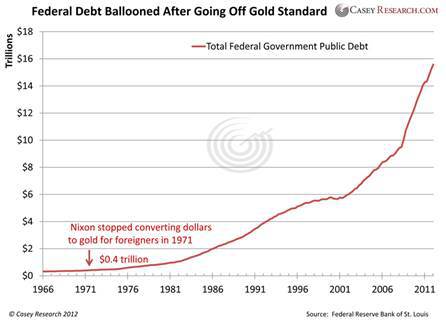

When the US ended the gold convertibility of the US dollar, the US also set in motion capitalism’s end game; as the removal of the bankers’ golden fetters (which previously tied money creation to gold reserves) now allowed governments and banks the fatal freedom to print money and create credit without limits.

http://www.financialsensearchive.com/fsu/editorials/bms/2006/0511.html

The final link between the dollar and gold was broken. The dollar became nothing more than a fiat currency and the Fed was then free to continue monetary expansion at will. The result… was a massive explosion of debt.

John Exter quoted in Gold Wars, Ferdinand Lips, Foundation for the Advancement of Monetary Education, New York, 2001

It was the explosive growth of money and credit after 1971 that would set in motion Ludwig von Mises’ ‘crack-up boom’. Excessive money printing and credit creation would lead to a series of larger and larger speculative bubbles which inevitably would culminate in monetary chaos.

The credit boom is built on the sands of banknotes and deposits. It must collapse… If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders.

Ludwig von Mises, Human Action, 1949

GOLD AND DEFLATIONARY DEPRESSIONS

Although the ownership of gold by US citizens was outlawed in 1934, the shares of Homestake Mining, the world’s largest gold mining company, acted as a proxy for gold during the Great Depression giving investors the same protection gold has given throughout history in times of monetary distress.

[Shares in] Homestake Mining.. rose from $65 per share in 1929 to more than $300 per share in 1933 and then climbed to a $480 bid and $534 ask in December of 1935…During the next six years after the 1929 stock market crash, Homestake Mining paid out a total of $128 in cash dividends. Its dividend in 1929 was $7 per share which then climbed to a staggering 1935 dividend of $56 per share…Homestake Mining earned a compound rate of return of 35% per year from 1929 thru 1935, excluding dividends.[bold, mine]http://www.worststockmarketcrashes.com/featured/homestake-mining-after-the-1929-crash/

Today, the world is on the verge of another, even greater deflationary depression than the 1930s Great Depression. But governments and bankers have pooled their considerable resources to hide that truth from the public in order to protect their vast wealth and power achieved through their use of paper money and leveraged debt.

Nonetheless, powerful deflationary forces unleashed by the collapse of today’s even larger speculative bubbles—the 1990 Nikkei bubble, the 2000 dot.com bubble, the 2008 US real estate bubble and the serial global real estate bubbles—are again moving through global economies; and, just as in the 1930s, the velocity of money is now so low capital markets are no longer self-sustaining.

If today’s investors knew that gold provided not only safety but explosive profits in times of economic chaos, the bankers’ paper markets would have emptied long ago as the majority of investors would have bought gold at the first sign the bankers’ house of cards could go up in flames.

But most investors didn’t know and didn’t buy; and, because of the bankers’ ongoing war on gold, they still haven’t.

This is the time of the vulture, for the vulture feeds neither upon the pastures of the bull nor the stored up wealth of the bear. The vultures feeds instead upon the blind ignorance and denial of the ostrich. The time of the vulture is at hand.

DRSchoon,Time of the Vulture, 3rd ed. 2012

In The Price of Gold and the Art of War, Part I and Part II, I explained how the bankers’ war on gold forced down the price of gold between 1980 and 2000. Next, in The Price of Gold and the Art of War, Part IV, I will explain gold’s price rise after 2000, how the bankers’ responded and how high the price of gold could go in the bankers’ end game.

In my current Dollars & Sense video on youtube, The Economy 2014/2015, I explain the economy in terms that can hopefully be understood by most observers, see below:

As we continue to move deeper into uncharted territory, I believe that good times will succeed the bad times, that love will replace hate and that peace and goodwill towards men and women will prevail.

Buy gold, buy silver, have faith.

Darryl Robert Schoon

P.S. To learn more about the history of the global monetary system over the past century and learn why now is the time you need to invest in gold, along with 9 specific ways to do this you can get access to our free eCourse now.