Here’s Stewart Thomson’s latest thoughts on gold and gold stocks and their potential impact from tomorrow’s announcements from the US Federal Reserve and Bank of Japan.

He also ponders how the US stock market might perform in the near term…

Rate Hike Implications For Gold Stocks And Dow

Graceland Updates

By Stewart Thomson

- The world is about 24 hours away from key BOJ and Fed meetings that could create a sea change in global markets.

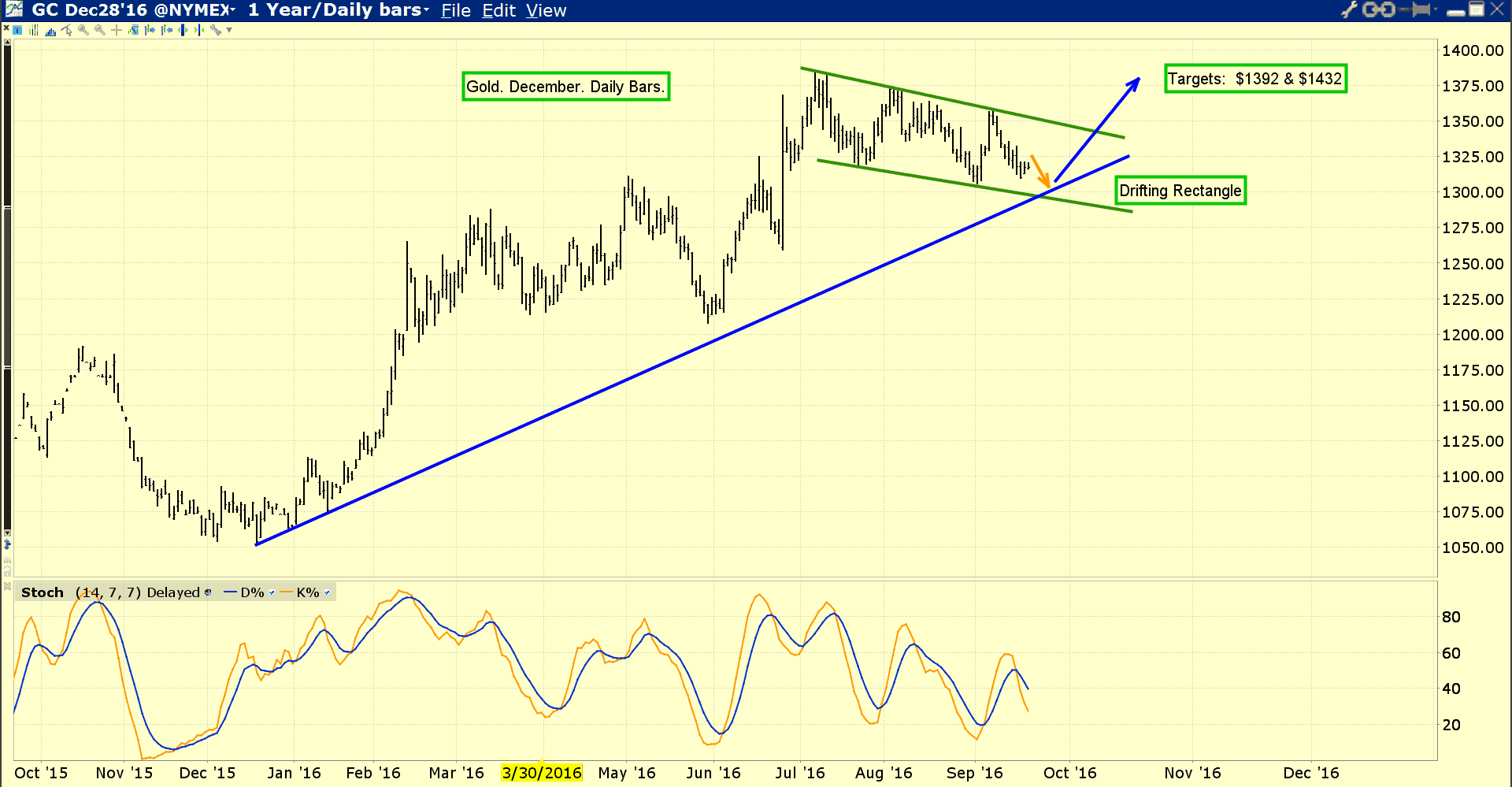

- Please see below now. Double-click to enlarge. This daily bars gold chart shows gold drifting majestically in a rectangular pattern.

- Strong handed gold investors don’t appear to be worried about the BOJ and Fed meetings, and with good reason; a rate hike from the Fed would create panic in the stock market, and investors would flock to gold, just as they did after the first rate hike in December.

- If the BOJ announces deeper negative rates, that’s also good news for gold, from a competitive cost of carry perspective.

- If the BOJ announces “operation twist”, where it buys more short term bonds than long term bonds, institutional money managers will view that as inflationary because it boosts bank lending. That’s more good news for gold.

- Indian festival buying is also now in play, and demand is likely quite a bit higher there than official numbers indicate, due to the rise of the black market’s share of the market.

- That festival demand is likely a big reason why gold feels so firm.

- When the Fed hiked rates last December, gold stocks and the US stock market sold off temporarily, and then a huge rally began.

- If the Fed hikes rates tomorrow, I would suggest that both the stock market and gold stocks will fall again, but it’s likely that only gold stocks recover quickly this time. The bottom line:

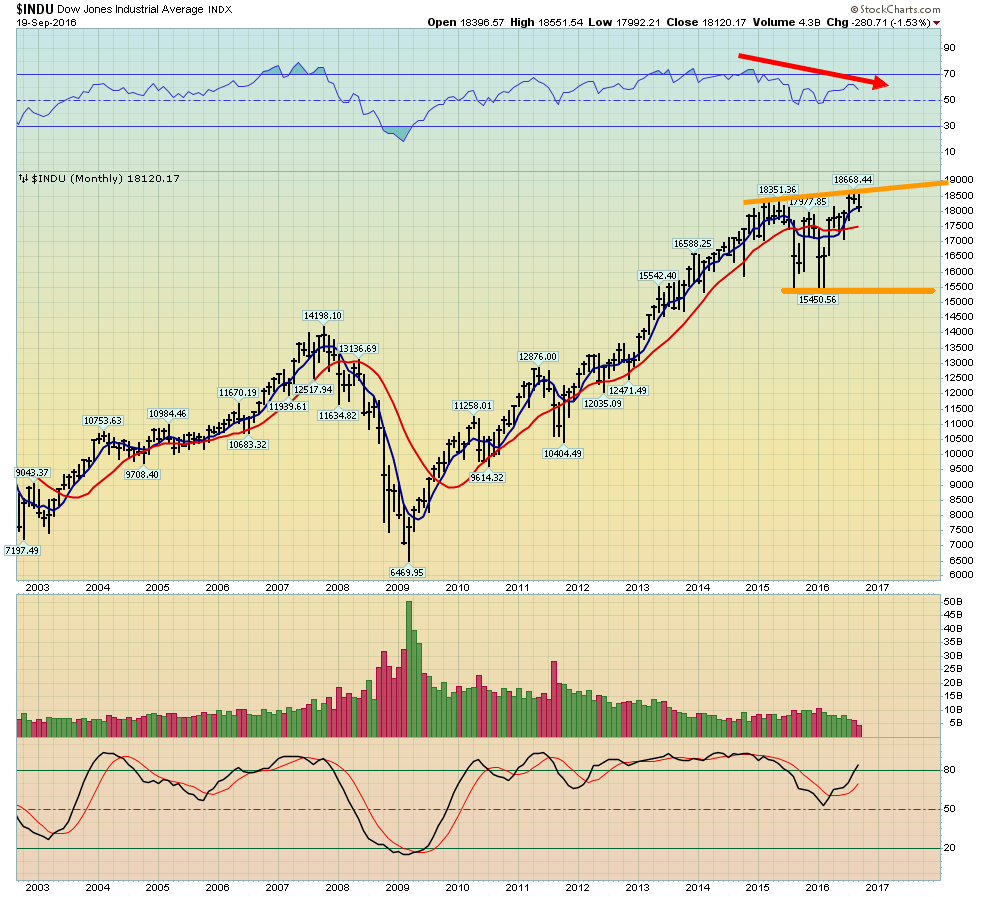

- It’s possible that a rate hike tomorrow marks the end of the US stock market bull cycle. It’s really been treading water since early 2014, when Janet Yellen began tapering QE.

- Please see blow now. Double-click to enlarge. This monthly bars chart of the Dow shows an ominous broadening top formation may be forming, as the RSI oscillator negatively diverges.

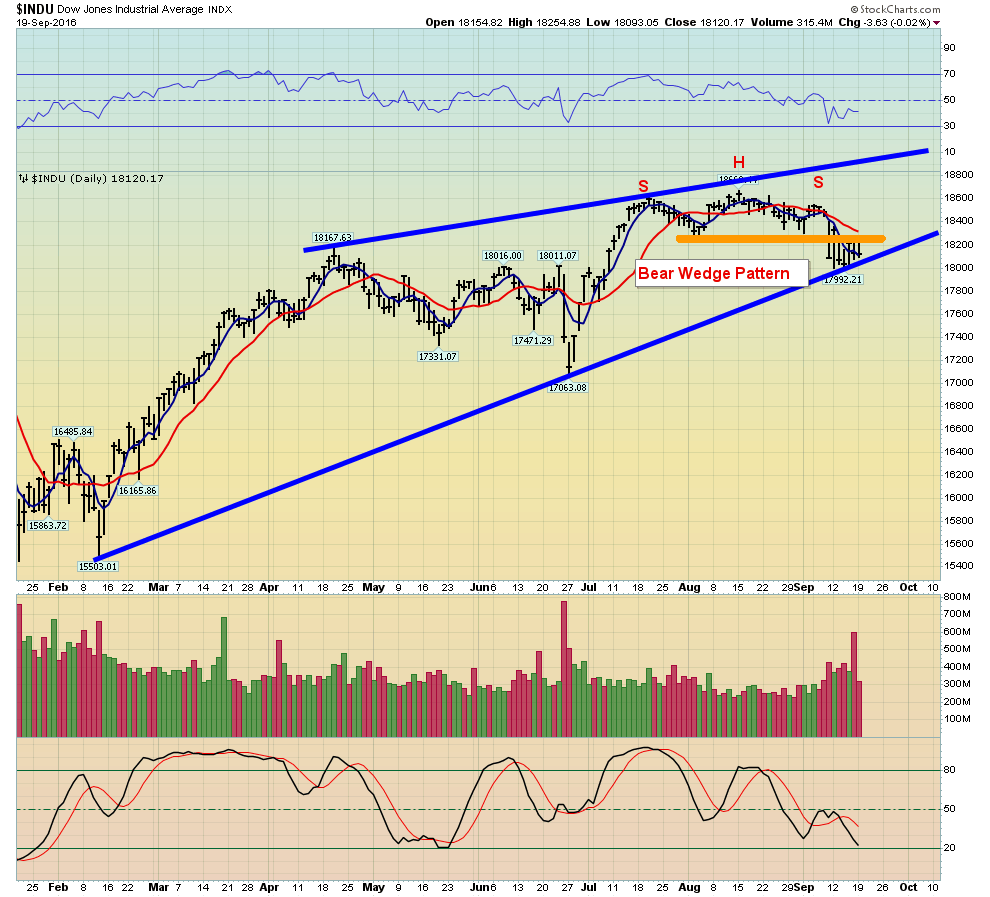

- Next, please see below now. Double-click to enlarge this daily bars chart of the Dow.

- From a technical perspective, it’s a horrific situation. There’s a H&S top pattern in play. It’s similar to the formations on the gold stock ETFs, but it sits within a huge bear wedge formation.

- What about gold stocks? Sadly, Indians don’t buy gold stocks for their festivals. They buy bullion. Gold stocks looked a little shaky recently (with some great exceptions), when global stock markets fell after key Fed representatives spoke.

- I generally mandate myself to a 30% gold stocks limit for my portfolio. I realize that many gold bugs like to hold much higher amounts of capital in their favourite mining stocks.

- Significant intestinal fortitude is required to operate with a “go big or go home” approach to gold stocks, but the potential rewards are gargantuan.

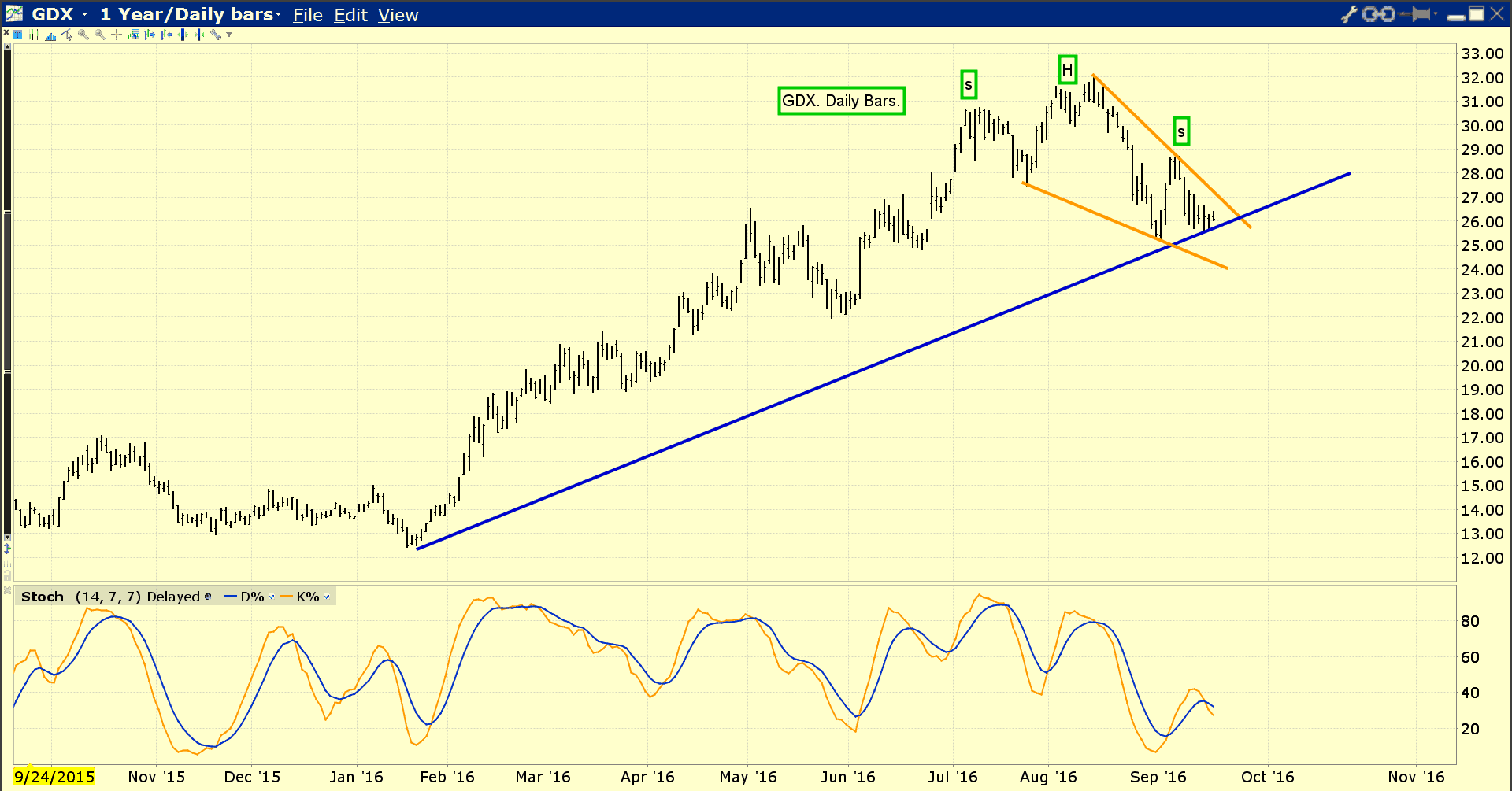

- Please see below now. Double-click to enlarge this daily bars GDX chart.

- Technically, GDX has a head and shoulders top pattern like the Dow, and the same pattern has appeared on the GDXJ and SIL entities.

- Gold stocks can be viewed as a canary in the Fed’s coal mine, and it makes sense that a rate hike could bring some pain to gold stock enthusiasts around the world.

- Regardless, I think that pain would be very temporary, and I’m in some great company in my view.

- On that note, please see below now. This is a truly spectacular summation of the gold stocks sector in the “here and now” time frame, and it comes from Goldman Sachs’ highly influential research team.

- The bottom line is this: Fundamentally-oriented liquidity flows from institutional money managers create the chart patterns that technicians see on their charts, and one rate hike from the Fed cannot undo all of the balance sheet repair work that gold mining companies have achieved.

- While the H&S top patterns and infrequent rate hikes from the Fed need to be respected, the ability of most productive gold mining companies to generate 5% – 8% free cash flow yields for many years is something that commands vastly more respect.

- It’s going to be an action-packed day tomorrow. I invite all gold stock and silver stock enthusiasts to cast fear aside now, and join myself and top Goldman analysts in placing buy orders slightly below the current market prices, in preparation for tomorrow’s BOJ and Fed announcements!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

https://www.gracelandupdates.com

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?