- What Does Short Covering Mean for the Price of Silver?

- Canary In The Silver Mine

- Doug Casey’s Top Two Ways to Store Wealth Abroad

- RBNZ Deputy Confirms Our Thoughts: Any Bank Depositor Bail-In Exemption Likely Minimal

TWO SILVER COIN SPECIALS TODAY

OPTION 1:

Sold 1500 this week, but still 6500 x 1oz Perth Mint Silver Kangaroos 2015 BU (Brilliant Uncirculated) Left

Minimum order 500 coins

500 x 1oz Perth Mint Silver Kangaroos 2015 are $14,500 ($29 per coin)

1000 x 1oz Perth Mint 2015 Silver Kangaroos are $28,700 ($28.70 per coin)

Fully insured and couriered via Fed Ex directly to you anywhere in New Zealand or Australia.

—–

OPTION 2: EXPIRES TODAY

Canadian Silver Maples Monster Box – Bonus Deal

$14,680 for 500 x 1oz Canadian Silver Maples fully insured via Fed Ex directly to you anywhere in New Zealand or Australia.

+ Free Glove Box Survival Kit valued at $69 with any order of 500 or more 1oz silver coins.

Looking like an excellent time to buy today as silver looks set to move higher.

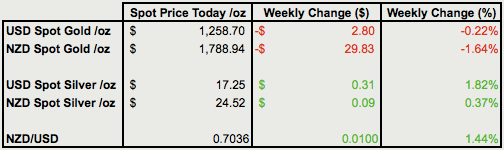

Prices and Charts

| Looking to sell your gold and silver? Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1715 |

| Buying Back 1kg NZ Silver 999 Purity | $745 |

Silver Up Gold Down

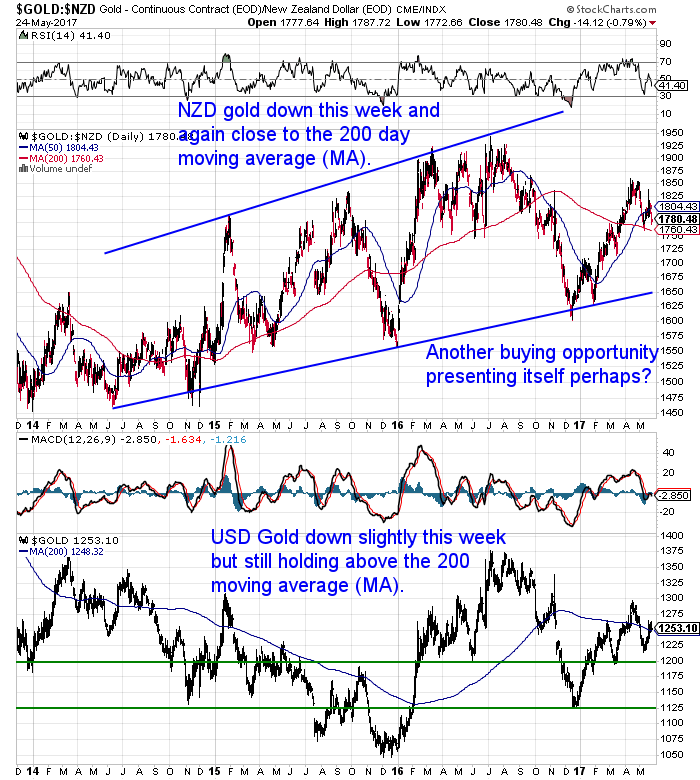

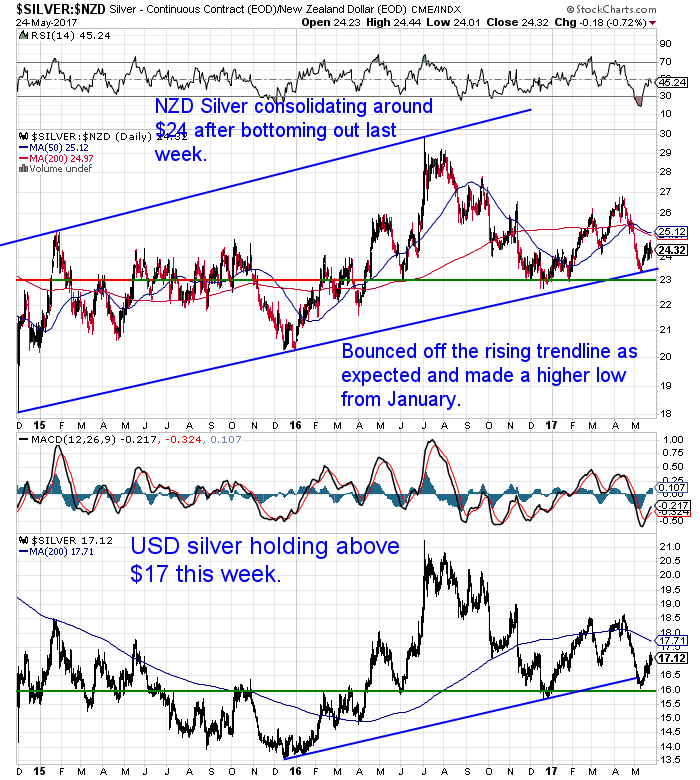

Both precious metals have paused this week after their strong bounces from what look like being bottoms.

NZD gold is down just over 1.5% and once again not too far above the 200 day moving average (MA) line. Another buying opportunity in gold could be presenting itself.

Meanwhile silver is holding up well even in the face of a stronger Kiwi dollar. Looking to consolidate the recent sharp rise and holding above $24.

The Kiwi dollar did manage to break above the 50 day moving average this week. But it is now looking a bit over extended. It is approaching overhead resistance at 0.71. The RSI is also now overbought at 70 and the price is above the upper Bollinger band (the shaded blue area on the chart below).

So odds favour a pull back in the NZ dollar from here. This could help boost the local prices of gold and silver higher.

Would you like some assistance with timing your entry into and your eventual exit from gold and silver? Then you may want to meet our “secret” investment advisor. You can learn more about who he is… And how you could benefit from his uncanny ability to enter and exit not just the precious metals markets but many other markets too, at just the right time. So go here to learn more now.

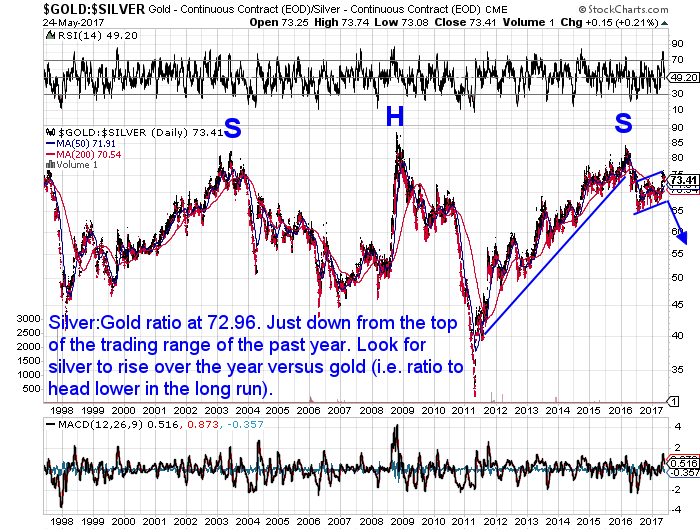

Gold/Silver Ratio Ready to Resume it’s Fall?

In our daily price alert lately we’ve been showing how the gold/silver ratio looks ready to begin falling again.

(Learn more about our daily price alert why you might want to sign up here, especially if you’re looking to buy and want to keep a close eye on the daily movements).

The ratio recently poked its nose above 76, reaching the top of the trading range the ratio has been in over the past year. (Note: The ratio measures how many ozs of silver it takes to buy an oz of gold).

But with things looking in silvers favour (more on that in one of our feature articles below), we think this ratio is likely to head lower again now. Meaning silver will outperform gold in the coming months.

If it does watch for the key level around 65. The ratio hasn’t been below that since 2014. So we’d be in new territory and that would be very bullish for silver.

What Does Short Covering Mean for the Price of Silver?

In last weeks feature article, NZD Silver Bottom is Here – Technical and Sentiment Analysis, one topic we touched on was how the silver futures Commitment of Traders (COT) report data was turning bullish.

“Last month speculative traders had become incredibly bullish on silver especially. But the silver sell off has caused many to reverse their position.”

There has been much more coverage of the COT data this week and so we’ve pulled much of that together.

We summarise:

- What’s been going on in the silver futures market,

- What short covering means, and

- What it could do to the price of silver.

So if you don’t understand the futures market at all, but would like to learn how you can use it to determine likely market bottoms and buying opportunities this one is for you.

What Does Short Covering Mean for the Price of Silver?

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

<

Never worry about safe drinking water for yourself or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions and has time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

RBNZ Deputy Confirms Our Thoughts: Any Bank Depositor Bail-In Exemption Likely Minimal

Two weeks ago we discussed how the IMF has:

“…recommended the government implement a $10,000 “de minimis” exemption to the current Open Bank Resolution (OBR) scheme (a.k.a. bank depositor haircut scheme).

This would mean that each bank depositor would get $10,000 exempt from the Reserve Bank of New Zealand’s (RBNZ) depositor “haircut” policy if a bank were to fail.”

But we wrote that a $10,000 “de minimis” exemption looked unlikely:

“…Finance Minister Steven Joyce said the government is looking at making some “tweaks” to the current OBR set up. But given the RBNZ has consulted on only a $500 exemption these tweaks may not be that significant.

Significant however is that New Zealand is the only OECD country to not have bank deposit insurance. For example Australia has coverage up to AU$250,000. In the US it is up to US$100,000.

So in the event of a bank failure all your bank deposits are at risk currently. In the future this may change to a small amount not being subjected to a hair cut.”

Source.

This week you can read how the Reserve Bank Deputy Governor as good as confirmed our thoughts on this in a recent interview.

RBNZ Deputy Confirms Our Thoughts: Any Bank Depositor Bail-In Exemption Likely Minimal

Silver in particular looks in a good buying zone currently. So a good chance to take advantage of one of the 2 silver coin deals going currently and remove some of your wealth from the reaches of a bank bail-in.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

—–

This Weeks Articles: |

|||

|

|||

|

|||

|

|||

|

|||

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

Copyright © 2017 Gold Survival Guide. All Rights Reserved.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

In last weeks feature article, NZD Silver Bottom is Here – Technical and Sentiment Analysis, one topic we touched on was how the silver futures Commitment of Traders (COT) report data was turning bullish. “Last month speculative traders had become incredibly bullish on silver especially. But the silver sell off has caused many to reverse […]

In last weeks feature article, NZD Silver Bottom is Here – Technical and Sentiment Analysis, one topic we touched on was how the silver futures Commitment of Traders (COT) report data was turning bullish. “Last month speculative traders had become incredibly bullish on silver especially. But the silver sell off has caused many to reverse […]

One of these wealth storage options is portable and one is not. Both likely have their place. If you’re looking for some offshore wealth storage options then get in touch as we have a new option in place for holding wealth outside of New Zealand… Doug Casey’s Top Two Ways to Store Wealth Abroad By […]

One of these wealth storage options is portable and one is not. Both likely have their place. If you’re looking for some offshore wealth storage options then get in touch as we have a new option in place for holding wealth outside of New Zealand… Doug Casey’s Top Two Ways to Store Wealth Abroad By […]

Stewart Thomson thinks we are seeing the early signs of rising global inflation. And that this will lead to higher silver prices in particular. Check out why he believes this is a very good place to be buying right now. Canary In The Silver Mine Graceland Updates: By Stewart Thomson The average gold market investor […]

Stewart Thomson thinks we are seeing the early signs of rising global inflation. And that this will lead to higher silver prices in particular. Check out why he believes this is a very good place to be buying right now. Canary In The Silver Mine Graceland Updates: By Stewart Thomson The average gold market investor […]

This Week: NZD Silver Bottom is Here – Technical and Sentiment Analysis Freegold and the Mechanism of the Gold Reset Tax Freedom Day Falls Later Again This Year in New Zealand Zimbabwe Contemplates Restoring its Own Currency with Gold Backing SPECIAL EXPIRES THURSDAY 25 MAY Canadian Silver Maples Monster Box – Bonus Deal $14,680 for […]

This Week: NZD Silver Bottom is Here – Technical and Sentiment Analysis Freegold and the Mechanism of the Gold Reset Tax Freedom Day Falls Later Again This Year in New Zealand Zimbabwe Contemplates Restoring its Own Currency with Gold Backing SPECIAL EXPIRES THURSDAY 25 MAY Canadian Silver Maples Monster Box – Bonus Deal $14,680 for […]