We’ve pointed out as far back as last August that silver was looking overdue to outperform gold.

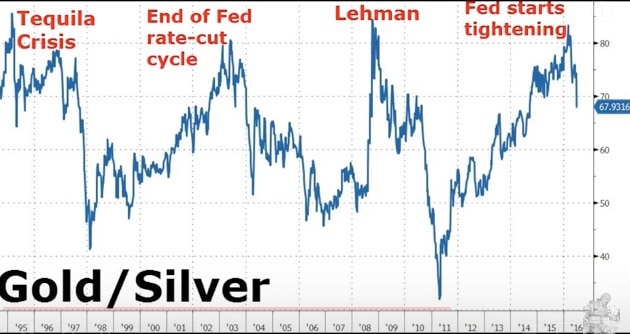

In an article back then we discussed the Gold/Silver ratio (the number of ounces of silver it takes to buy one ounce of gold) and the fact it was getting pretty high historically:

As it happens we were a bit early as the Gold/Silver ratio actually rose higher until earlier this year. Silver fell a bit while gold not so much.

However the ratio has recently moved sharply lower indicating that silver has been sharply outperforming gold lately.

Chris Duane in the video below discusses the sharp rise in silver particularly earlier this week. Here in New Zealand we’ve at times seen even greater volatility as the New Zealand Dollar has also been moving up and down in quite large moves the past week or so since the Brexit vote outcome.

Duane makes some good points especially about the timing of these latest big jumps in the silver price. The full video is below. Here’s a summary of what is covered:

- How there is a limit up in the silver futures market where they cap the rises in silver. While there is no limit down in silver and it can drop $6 at a time. But even with this “limit up” cap we have seen some big jumps lately.

- The significance of these large moves in silver happening over a Holiday weekend in the USA and the weekend in China.

- How he believes there could be a quick US$6 move up to around $26.

- How he is more confident that a silver bull has returned compared to earlier this year given that silver has now spiked higher and made a catch up run with gold.

- Why “when you consider how undervalued silver is in the grand scheme of things you can’t worry about trying to time your lows.”

- Why it is so significant that this sharp rise is occurring over a holiday weekend; post Brexit in China; during the (northern hemisphere) summer which is usually a time precious metals historically don’t perform so well; and without any mainstream media coverage.

- Why he buys on a weekly basis out of habit.

- Why premiums are likely to rise and delivery times will get extended too.

- How the ratio of gold to silver in the ground is 1 to 9. Versus the above ground ratio of gold to silver where gold is actually much higher than silver.

- How the Gold/Silver ratio rises during a crisis but then usually drops sharply in the aftermath (see the chart below).

- How he expects a definite return to the 30 to 1 ratio, before an eventually return to 9 to 1. His ultimate goal is a 1 to 1 ratio.

- Finally: If you’ve been on the sidelines waiting for a pullback, stop pricing your silver in dollars and buy on a consistent basis.

Pingback: Gold and Silver ChartFest - Update for 2016 - Gold Survival Guide - Gold Survival Guide